Investment thesis

I initiate my coverage of the Monster Beverage Corporation (NASDAQ:MNST) and rate it a Hold following my research into the company and the underlying market, and the company’s strong Q2 results. Overall, I initiate a bullish view of the company but believe its valuation is too demanding today.

I view the company’s competitive position as incredibly strong and believe the Monster beverage corporation and all brands under its umbrella should be able to take more market share in the energy drinks market. This belief is driven by the company’s very strong and broad offering, including zero-sugar, low-calorie, and health-focused products. Furthermore, the company’s branding is impressive, which should strengthen its brand as a whole. The company’s competitive strength is already highlighted by the market share gains it has made over recent years.

The company can also leverage this brand strength to expand into new beverage verticals like alcoholic beverages, which is driving growth over recent quarters and already accounts for 3.3% of its Q2 revenue. I believe alcoholic beverages could continue to drive growth, but this will largely depend on the company’s ability to develop original products and launch and market these correctly. Considering the company’s history with these aspects, I see no reason to doubt these efforts and remain bullish.

Finally, the company’s sublime balance sheet with no debt and over $3 billion in cash should allow for continued M&A activity after already acquiring Bang Energy’s assets following this company’s bankruptcy. Also, this strong balance sheet allows for continued share repurchases and potentially a dividend in the next couple of years, which would further fuel the bullish case for Monster.

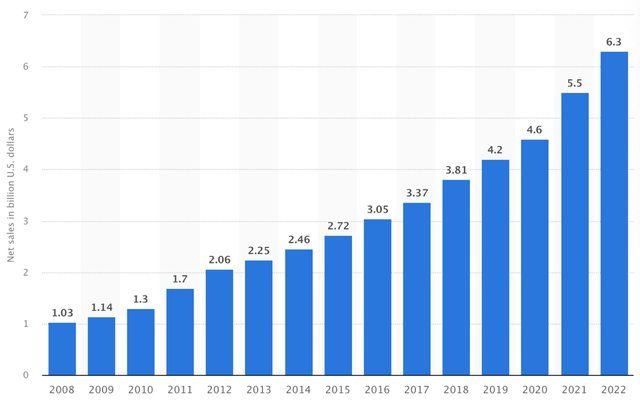

As a result of all these aspects, I believe the company should be able to continue its excellent growth streak to keep reporting sales growth in the low-double digits after growing sales at a CAGR of 12% over the last decade. The recent Bang Energy acquisition and management’s increased focus on international expansion could also be excellent growth drivers over the next few years.

However, while I am very bullish on the company, as explained above, its valuation is very demanding today, making it hard to award it a buy rating. Based on my findings, I believe it is best to stay on the sidelines for now, closely monitor the company’s performance, and wait for a more favorable entry point.

In this article, I will take you through my analysis of the company and the underlying industry, as well as the latest developments and financial projections.

General company introduction

Monster Beverage Corporation, founded in 1992 and headquartered in Corona, California, is a global leader in the production and distribution of energy drinks and other beverages through brands like Monster Energy and other smaller brands like Burn, Nos, Full Throttle, Mother, and Reign. Monster’s diverse product portfolio includes a wide range of energy drinks, flavored teas, fruit drinks, and other refreshments that cater to different consumer preferences and lifestyles, although most of its product portfolio is aimed at the energy drinks market.

Renowned for its iconic Monster Energy brand, the company has successfully captured the attention of the youth market with its edgy branding and bold flavors. Monster Beverage Corporation has achieved widespread international recognition through strategic partnerships, effective marketing campaigns, and extensive distribution networks. Its products are available in 157 countries, making it a truly global player.

This strong global presence of the company in the very lucrative energy drink industry, in combination with its impressive global brand strength, broad product offering, and ability to attract younger generations through promotional activities has allowed it to show incredible sales growth over the last decade, growing at a CAGR of close to 12%.

Monster Beverage revenue (Statista)

This stellar growth has earned the company the number-one spot in the energy drinks industry, overtaking Red Bull, and has earned it a market cap of $61 billion after growing the share price by 500% over the last ten years.

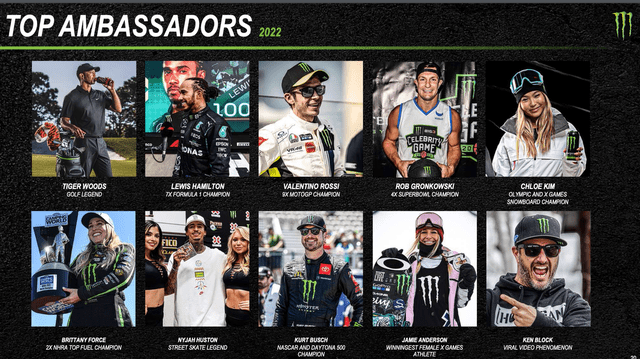

A big strength of the company over the last decade, and driving this growth, was its exceptional ability to promote its products. As, for example, Nike (NKE) has shown in the past, there is little more powerful than strong product and brand promotion through athletes.

Monster has shown that it understands this mechanism and is a key sponsor for some of the most watched sports worldwide, like NASCAR and UFC, but also championship-winning athletes are often seen with the company’s branding on their sports gear. This has given the company excellent visibility and has strengthened its bond with the younger audience to which these athletes are often examples, and this has massively worked in the company’s favor.

Monster partnerships (Monster beverage corporation)

Monster beverage corporation

Today, the company remains a leader in the energy drinks market and is further exploring other verticals of the beverage industry to boost growth while expanding its international presence. For the next several years, I see a clear growth runway for the company driven by a number of factors, making it an attractive stock pick.

Focus on faster-growing market verticals

One of the most important factors driving the bullish case for Monster is its exposure to fast-growing verticals of the beverage industry. The company focuses primarily on verticals like energy drinks and alcoholic beverages and an overall focus on ready-to-drink products.

Traditionally, the company focused primarily on the energy drinks market and competed with Red Bull for industry leadership. This strategy has worked well for the company over the last decade as the energy drinks market has appeared as one of the fast-growing beverage markets, driving strong growth for Monster. Today, not much has changed and this particular industry remains one of the most promising ones.

According to Grand View Research, the energy drinks market is poised to keep growing strongly at an estimated CAGR of 8.3% through 2030, which is almost twice the pace of the overall beverage industry at a CAGR of 4.7%. This is driven by the increasing demand for energy-boosting drinks that are free from sugar and glucose and industry leaders that aggressively market these drinks as functional beverages that uplift energy and alertness as well as provide a physical boost. This creates for strong demand, especially among younger generations.

The latest Nielsen data shows a strong performance in the energy drinks industry as this was up 13.1% in June after recording 12.5% growth in the period April – June, showing a growth acceleration. Most of this growth continued to be driven by price increases, though. But still, volumes also held up much better than recorded for other beverage categories.

According to the same Nielsen data, Monster held a market share in the energy drinks industry of around 36.1%, up ten basis points YoY (including the Bang brand, this came in at 37.9%). This market share expansion was primarily driven by the incredible performance of the Reign brand, which grew its share in the global energy drinks industry from 0.8% last year to 3.1% in Q2. This compensated for the market share loss of the Monster brand from 30.4% to 29.8%.

Overall, Monster remained the global energy drinks leader as Red Bull lost 1.6 percentage points of market share and accounted for 34.7% of the global energy drinks sales, making Monster best positioned to benefit from the continued strong growth in the energy drinks market. I believe Monster’s energy drinks segments should be able to deliver growth at a similar pace to the overall industry as I continue to see the potential for market share gains.

Yet, today, there is more to the company than just energy drinks. Whereas energy drinks still account for close to 90% of the company’s revenues, revenues derived from the company’s alcoholic beverages as of Q2 also account for 3.3% of the company’s total revenues. While this might not sound very meaningful, this segment did meaningfully outgrow the energy drinks segment over the last year as its share of revenue one year ago stood at just below 2%. Just last quarter, the alcoholic beverages segment grew by a staggering 88%.

Furthermore, the outlook for the alcoholic beverages industry is even more impressive as this one is projected to grow at a CAGR of 10.3% through 2030. This makes me quite bullish on the company’s opportunities in this market. The company already has a strong presence among the younger generations and a strong brand appeal, which it should be able to leverage.

As a result, this segment could become a growth driver for the company over the next several years, driving overall sales growth likely to be in the double digits.

Growing its product offering and international expansion allow it to grow its TAM

Apart from the company’s already great product portfolio, it is also heavily focused on further expanding its product offering to new regions and is actively acquiring other brands that fit its product offering to boost growth and grow the TAM.

Monster has recently acquired Bang Energy’s assets after the energy drink brand filed for bankruptcy last year. This includes Monster taking control of the state-of-the-art beverage production facility located in Phoenix. Monster plans to fully benefit from the facility and will be using it for both Bang Energy products as well as other products in its portfolio.

Furthermore, the acquisition should help Monster fight for the top market share position in the energy drinks industry against Red Bull. The Bang brand is currently good for a 1.8% market share in the energy drinks industry after it fell from 3% prior to the bankruptcy filing. There clearly is much potential in the Bang Energy brand as both a sport and lifestyle energy drink. This seems like a great move from Monster.

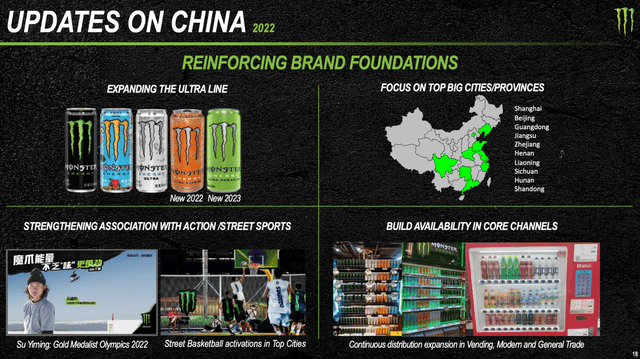

As for international expansion, the company continues to launch new products across regions and countries to gain market share. China, in particular, is a region for which Monster continues to see a lot of growth potential through expanding its operations in the country. So, while it is active in over 150 countries already, new product launches and operation expansion across key regions should boost growth for the company as well.

Monster beverage corporation

According to analysts at HSBC, the company’s acquisition of the Bang energy brand and the focus on continued international expansion should be the missing growth drivers for the company.

Furthermore, whereas the company’s brands and products are currently skewed toward addressing the male population, the recent launch of a more health-focused energy drink with Reign Storm and the acquisition of Bang Energy should position it more favorably to also win share among the female population, which should help Monster further pull ahead of Red Bull in the race for US energy beverage leadership. Of course, this will also boost growth as we can see this in the company’s latest quarterly results.

A solid Q2 performance and excellent financial health

The company reported a solid second fiscal quarter when it reported a couple of weeks ago. It delivered net sales growth of 12.1% to $1.85 billion, which sat roughly in line with the Wall Street consensus. Growth was driven by both the North American segment and international, although growth from North America was somewhat stronger at 16.1% against 10.2% growth in regions outside of North America.

The two energy drink segments reported growth of 10.5%, while, according to data from Nielsen, the global energy drink market saw sales increase by 12.2% in Q2. This means Monster grew slightly below the overall industry, but still outgrew its main rival, Red Bull, which reported sales growth of 10.2% YoY in Q2. More impressive was the performance of the alcoholic beverage segment as this was up 88.2% YoY, largely driven by the continued rollout of the first flavored malt beverage alcohol product, The Beast Unleashed™, launched by the company in the US.

Overall, the company reported strong top-line growth, driven by price increases, new product launches, and resilient volumes. The overall performance remains very resilient and a standout in the beverage industry. Furthermore, with more price increases coming over the next couple of months and consumer spending power expected to remain resilient in the second half of the year, I expect sales growth to accelerate in the second half as well.

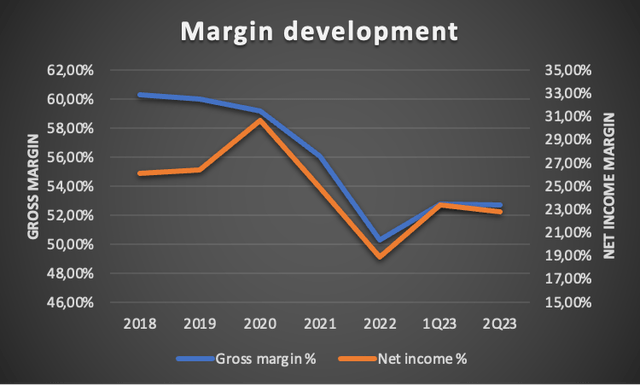

Moving to the bottom line, the gross margin in Q2 increased to 52.5%, up 540 basis points YoY, but down slightly from a 52.8% reported gross margin in Q1 as aluminum can costs increased. Still, the YoY improvement is very impressive and was driven by the company’s price increases and lower operating expenses as a percentage of revenue, down 20 basis points.

Promotional allowances were up slightly YoY and sequentially as expected, but operating expenses as a percentage of sales were down 30 basis points YoY. Lower freight costs helped the company in Q2 as these caused lower distribution expenses, which, as a percentage of sales, decreased by 90 basis points.

However, these efforts were offset slightly by rapid growth in the alcohol segment, which carries lower margins overall, which is something that could become a longer-term drag on the company’s margins as it increases its effort in alcoholic beverages.

While lower-priced energy drinks are driving continued growth for Monster, even as the economic macro environment deteriorates, this is having a negative impact on the company’s margin profile and outlook. These lower-margin drinks and the company’s increased focus on alcoholic beverages, which generally carry lower margins as well, are having a negative impact on its reported margins and margin outlook. Meanwhile, the easing inflation and expected further price increases by the company across several regions in the coming months should help offset this impact somewhat.

Net income in Q2 surged by 51.4% to $413.9 million as the net income margin improved by 490 basis points. This led to an EPS of $0.39, up 52.8% as the share count also decreased slightly.

Diving a bit deeper into the company’s margin profile, we can see that Monster has seen its gross margin fall by ten percentage points from 60% in 2018 to 50% in 2022 over the last several years. Meanwhile, the net income margin also decreased by 6.2 percentage points over the same period of time to just 18.9% in 2022.

Of course, much of this is due to a very challenging macro environment seen over the last several years with the COVID-19 pandemic and incredibly high inflation. While the company’s top line wasn’t impacted as such, other aspects of the business were. Furthermore, the company has also been diversifying into different beverage industry verticals like alcoholic beverages, which have seen explosive growth but generally carry lower margins, as indicated before. Also, the lower-priced products of the company have been outgrowing the premium brands, leading to lower margins.

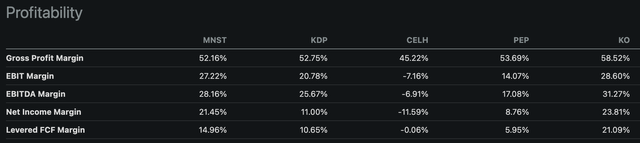

Still, margins seem to be recovering over the last several quarters, driven by the price increases and a healthier operating environment, which allows for lower freight costs, less raw material cost inflation, and increased demand for higher-priced products. Also, margins still sit at the mid-range of the peer average and remain very healthy. The company has the clear potential to drive the margins above most of its peers, but this might require time.

Margin peer comparison (Seeking Alpha)

While returning to a 60% gross margin is still possible, the new product mix will complicate this, and I do not expect this to happen anytime soon. A margin in the range of 54%-56% would already be a meaningful accomplishment, as well as a net income margin of closer to 24%-25%.

Still, with management indicating that there are still more price increases ahead to compensate for raw material inflation, I expect the company to keep improving its margins and reach a gross margin of around 53.5% to 54% by the end of the year.

By Author

Finally, at the end of Q2, it is safe to say that the company is in excellent financial health as it has a total cash position of $3.29 billion on the balance sheet against pretty much no debt. This is an especially strong benefit for the company in the current high-interest rate environment. Also, the company does not pay a dividend yet, which means it has no financial obligations and can use the cash to further strengthen its competitive position, look for attractive M&A opportunities, or use the cash to buy back its own shares to reward shareholders, as it has been doing over the last decade as well.

Outlook & MNST stock valuation

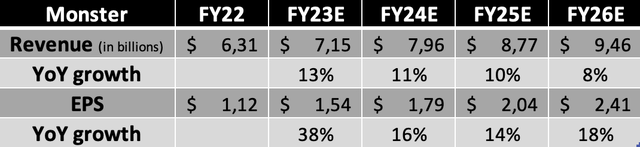

Considering everything discussed above, it is easy to see this company grow sales at double digits for many years to come. It is the largest player in the very promising energy drink industry and through M&A, new product launches, and international expansion, it should be able to maintain its market lead. In addition, its expansion into the alcoholic beverages industry and focus on easy-to-drink beverages should drive even more meaningful and above-industry growth. Also, I want to add that Monster seems especially strong among younger generations, even more so than Red Bull, which could give the company an additional edge against the competition, especially in combination with its superior marketing.

Furthermore, as there is clearly a lot of margin improvement potential, with margins sitting far below their highs, we should see EPS grow even faster, also driven by continued share repurchases. However, investors should closely monitor these margin developments. I see no easy way back to the once far higher gross and net income margins as there are several fundamental headwinds the company will face, like the growing lower-margin alcoholic beverages segment.

Currently, Wall Street analysts expect the following financial results through 2026. I believe these estimates by analysts are fair and represent a strong sales and EPS outlook.

Financial estimates from Wall Street analysts (Made by Author based on data from Seeking Alpha)

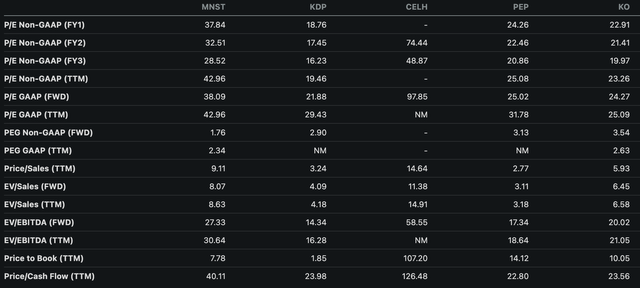

Moving to the valuation, I believe a significant premium over its already richly priced peers is justified. The generally resilient beverages industry already causes the largest players to trade at a premium, but these generally tend to grow their revenue and EPS at much lower rates as are currently expected for Monster, as shown above.

This is nicely highlighted by the earnings multiples as on a 1-year forward P/E, Monster trades at a 72% premium, but this falls to 50% on a 3-year basis. A 50% premium seems largely justified, considering the company’s growth history, excellent market position, and clean balance sheet. Still, shares are currently valued at a forward P/E of close to 38x, which sits 12% above its 5-year average.

Valuation peer comparison (Seeking Alpha)

Overall, the company is quite expensive but for good reasons. Still, I believe paying over 35x earnings creates a limited margin of safety. Based on a 35x P/E, which I believe is fair for this high-quality business, I calculate a target price of $63 per share, leaving an upside of 7.7%.

Conclusion

My analysis of Monster Beverage Corporation reveals a company with strong competitive positioning and robust growth potential. Its diverse product portfolio, strategic branding, and market share gains reflect its ability to capture a significant share of the energy drinks market. Additionally, the company’s expansion into the alcoholic beverages segment offers promising growth prospects, supported by its strong brand appeal among younger generations.

However, while I am very bullish on the company, as explained above, I believe its valuation today is somewhat stretched, leading to a very thin margin of safety. Based on my target price of $63 and an annual return of approximately 9.5%, I believe a current fair share price sits around $55 per share, or 6% below its current share price of $58.50.

Therefore, I rate shares a Hold today and recommend investors to wait for a share price dip and to start buying at a share price below $55 per share.

Read the full article here