JPMorgan Chase (NYSE:JPM) reported a strong set of Q2 2023 results, easily topping consensus estimates on both topline and earnings. JPM’s results were supported by a strong performance across business divisions, with a favorable net interest income tailwind pushing JPM’s adjusted return on tangible equity (ROTE) to a close record-high, industry-leading 23%. Moreover, JPMorgan’s Q2 results gave a clear indication that the First Republic acquisition will likely be highly value accretive for JPM shareholders.

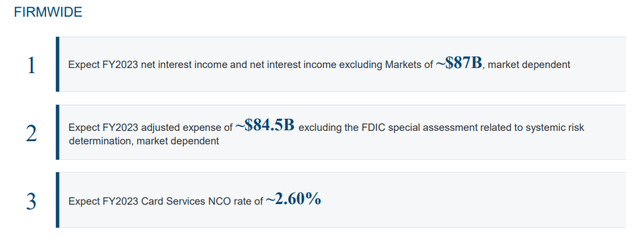

Going into 2H 2023, JPMorgan is in an excellent position to continue generating a ROTE in the low 20%, as the bank revised the NII guidance for 2023 upwards, to $87 billion. According to management commentary, this upward revision is supported by both a slower than expected repricing of deposit costs, as well as higher than expected Fed interest rate benchmarks.

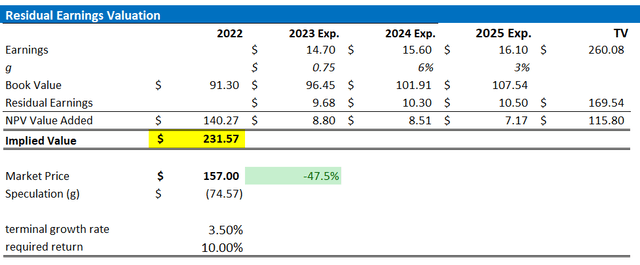

Reflecting on JPM’s Q2 results, I update my EPS projections for the bank through 2025; And, anchored on these adjustments, I raise my fair-value target price for JPM stock to $231.57/ share. Reiterate “Buy/ Overweight” rating.

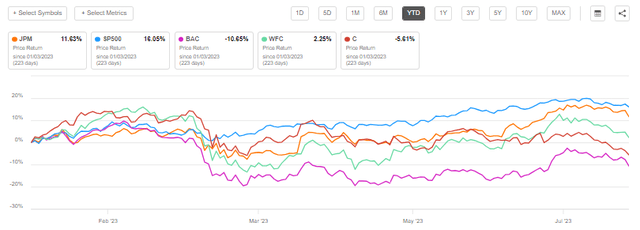

For reference, JPMorgan stock has underperformed the broad U.S equity market YTD, but outperformed key competitors, respectively. Since the start of 2023, JPM shares are up approximately 12%, as compared to a gain of about 16% for the S&P 500 (SP500). Notably, shares of BAC and C are down YTD, while WFC trades with only 2.3% gain.

Seeking Alpha

Strong Q2 Supports Value Thesis

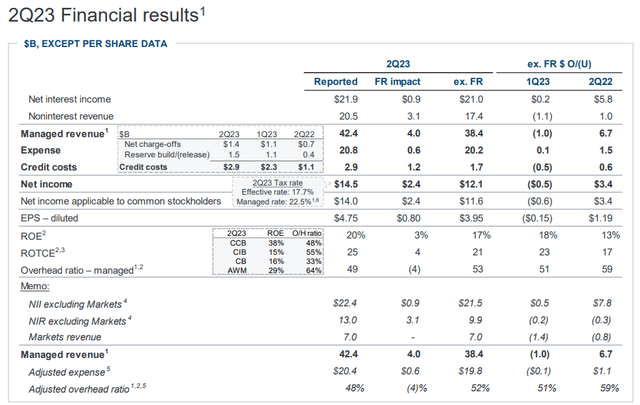

After multiple quarters of strong profitability, JPMorgan delivered another strong quarter, with Q2 2023 beating analyst consensus Refinitiv estimates on multiple dimensions, including topline, NII and earnings. During the period from April to end of June, JPM generated $42.4 billion of revenues, which compares very favorably to approximately $31.6 billion for the same period one year earlier (up 34% YoY), and to $41.2 billion estimated by analysts at consensus midpoint (a strong $1.2 billion beat, according to data collected by Refintiv). Admittedly, on an ex. First Republic benchmark, JPMorgan’s Q2 topline would have been $38.4 billion, a 22% YoY growth.

With regards to profitability, JPM’s quarterly net income jumped to $14.5 billion, vs. $8.6 billion of the same period in 2022 (up 69% YoY). According to data collected by Refintiv, analysts have estimated Q2 2023 net income at around $11.3 billion ($3.2 billion earnings beat).

JPM Q2 2023 results

JPM’s strong earnings beat was supported by a better than expected net interest income, which was $21.9 billion, vs. $15.2 billion for Q2 2022. However, JPM also benefited from a strong fee performance in FICC and equities trading, supportive OPEX discipline and good credit quality.

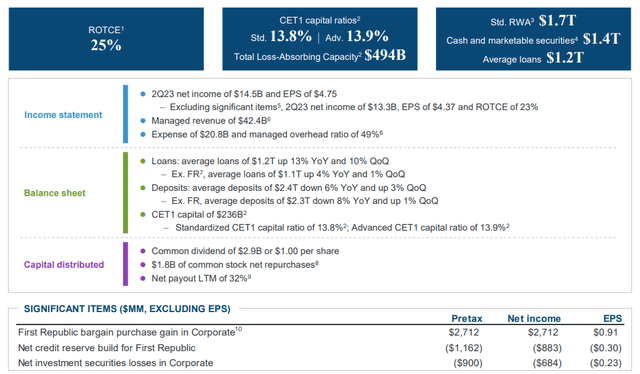

Overall, JPMorgan continues to post best in class metrics on both profitability and solvency: For Q2 2023, JPMorgan’s adjusted post-tax return on tangible equity was 23%, vs. range of 6-10% for most key competitors; the bank’s cost-to-income ratio was 48%. With regard to balance sheet strength, I would like to point out a 13.8% CET1 ratio, $2.4 trillion in deposits and $494 billion of loss-absorbing capital buffer.

JPM Q2 2023 results

On the First Republic takeover: The deal is already yielding positive results for JPMorgan’s top-and bottom-line, with approximately $4 billion in revenue, and a gain of $2.7 billion on the “bargain purchase”. For the 2 months leading up to June 30th, FRC accounted for $897 of net interest income and $436 million of fee income.

Not a One-Time Pump – Strong Outlook

Reflecting on JPM’s bumper Q2 2023, I would be reasonable to ask if the bank’s profitability is sustainable. In that context, I would argue that JPMorgan is currently overearning on credit, but deposit repricing will likely take longer than initially expected, supporting a strong NII through 2H 2023 and 1H 2024. Then, NIM pressure will likely build on downtrending Fed funds rate, and uptrending deposit rates. With that frame of reference, it is worth highlighting that JPMorgan has not updated its medium-term net interest income projections, which continue to hover around the “mid-70s” range. However, once NIM compression gains momentum, activity in capital markets, including ECM and DCM, will likely pick up, as well as merger and acquisition (M&A) deal marking — which should largely offset ROTCE compression from lower interest income.

Investors should also consider that JPMorgan continues to skillfully manage balance sheet positioning on rate dynamics: As a percentage of equity, the bank has suffered much less “paper losses” on fixed-income securities repricing that major competitors, including WFC, C, and BAC.

For FY 2023, JPMorgan management now expects net interest income of approximately $87 billion, up from $84 billion estimated previously; Adj. expenses will likely be around $84.5 billion; Card service NCO now estimated at 2.6%.

JPM Q2 2023 results

Valuation Update: Raise To Target Price

Following JPMorgan’s strong Q2 2023 results and supportive outlook, I update my EPS expectations for the bank through 2025: I now estimate that JPM’s EPS in 2023 will likely expand to somewhere between $14.5 and $15.0. Moreover, I also raise my EPS expectations for 2024 and 2025, to $15.6 and $16.1 respectively.

I continue to anchor on a 3.5% terminal growth rate (approximately one percentage point higher than estimated nominal global GDP growth), as well as a 10.0% cost of equity.

Given the EPS update as highlighted below, I now calculate a fair implied share price for JPM equal to $231.57, seeing almost 50% upside vs. $157/ share as of mid August 2023.

Company Financials; Author’s EPS Estimates; Author’s Calculation

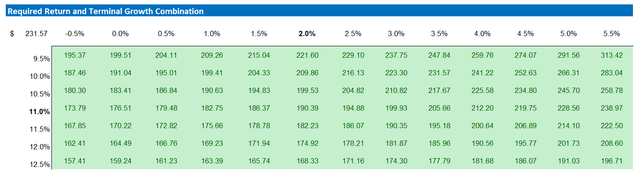

Below also the updated sensitivity table:

Company Financials; Author’s EPS Estimates; Author’s Calculation

Risk Update

JPM’s strong Q2 is clouded by Basel III uncertainty. In July 2023, the Federal Reserve, OCC, and FDIC proposed changes to the risk-based capital framework for large banking organizations. In its essence, the proposal aims to revise capital requirements for banks with assets over $100 billion, including JPM and other U.S. GSIBs. The proposed effective date is July 1, 2025, with a three-year transition for the expanded risk-based approach.

More recently, in an interview with CNBC Fitch analyst Chris Wolfe warned about a potential downgrade of banks’ credit ratings across the industry. While there is not specific to JPMorgan, analyst Wolfe cites a challenging operating environment for the US banking sector as the main reason for a bearish view. However, the argument of a challenging environment clearly contrasts with JPM’s strong Q2 results. And in any case, the bank’s strong balance sheet with $494 billion of loss-absorbing capital buffer should definitely support stability even in times of market duress.

Conclusion

For the fourth consecutive quarter, JPM delivered a consensus earnings beat, with the better than expected results being driven not only by net interest income, but also fee income, as well as the value accretive FRC takeover. On the backdrop of a supportive rate environment and slower than anticipated deposit repricing, JPM raised its net interest income guidance to $87 billion for 2023. Even if NIM would compress in FY 2024, the headwind is likely offset by a pick-up in capital markets and deal making activity. Overall, I remain confident in wide-moated JPMorgan’s ability to generate a 18-22% ROTCE through 2025.

Read the full article here