Recently, I downgraded the ProShares Ultra Bloomberg Natural Gas ETF (BOIL), as I believe the BOIL ETF may face heightened headwinds from futures roll decay. Does this mean that the ProShares UltraShort Bloomberg Natural Gas ETF (NYSEARCA:KOLD), the corollary to the BOIL ETF, is a buy?

Unfortunately, being cautious on the BOIL ETF does not mean one should be bullish on the KOLD ETF. Fundamentals are still supportive of natural gas prices and natural gas prices tend to rally into the Fall. For speculators looking to bet on KOLD, I recommend they wait until year-end.

Brief Fund Overview

The ProShares UltraShort Bloomberg Natural Gas ETF seeks to provide daily returns that are -2x the return of the Bloomberg Natural Gas Subindex (“Index”), an index that reflects the daily performance of a rolling position in front-month natural gas futures. As future contracts expire, the index replaces expiring futures with contracts having later expirations.

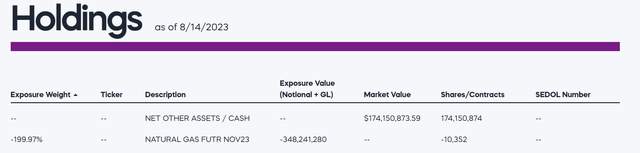

Figure 1 shows the current holdings of the KOLD ETF, which consists of cash plus short futures positions.

Figure 1 – KOLD ETF holdings (proshares.com)

The KOLD ETF has $174 million in assets and charges an expense ratio of 0.95%.

KOLD Is Not A Long-Term Investment

Similar to the BOIL ETF, the KOLD ETF suffers from ‘volatility decay’ due to its leverage. Volatility decay is best explained with a numerical example. Assume an investor started with $100 invested in KOLD. If the underlying index returns -5% on day 1, the investor’s holding will grow to $110 (-2 times -5% return). However, if the index returns 5% the next day, investors end up with $99.00, instead of a 2-day compounded loss of 0.25% or $99.50. The slippage between actual vs. theoretical return is called ‘volatility decay’.

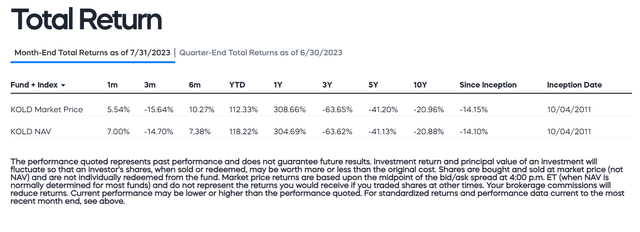

Natural gas is an extremely volatile asset class, with daily +/- 5% moves being fairly common. Hence both the BOIL and the KOLD ETF suffer from large volatility decays, leading to poor long-term performance. The KOLD ETF has compounded at a -14.1% average annual return since inception (Figure 2).

Figure 2 – KOLD suffers from large volatility decays over time (proshares.com)

So investors should definitely not hold leveraged funds like the KOLD ETF for the long-term.

Fundamentals Still Favour Higher Natural Gas Prices

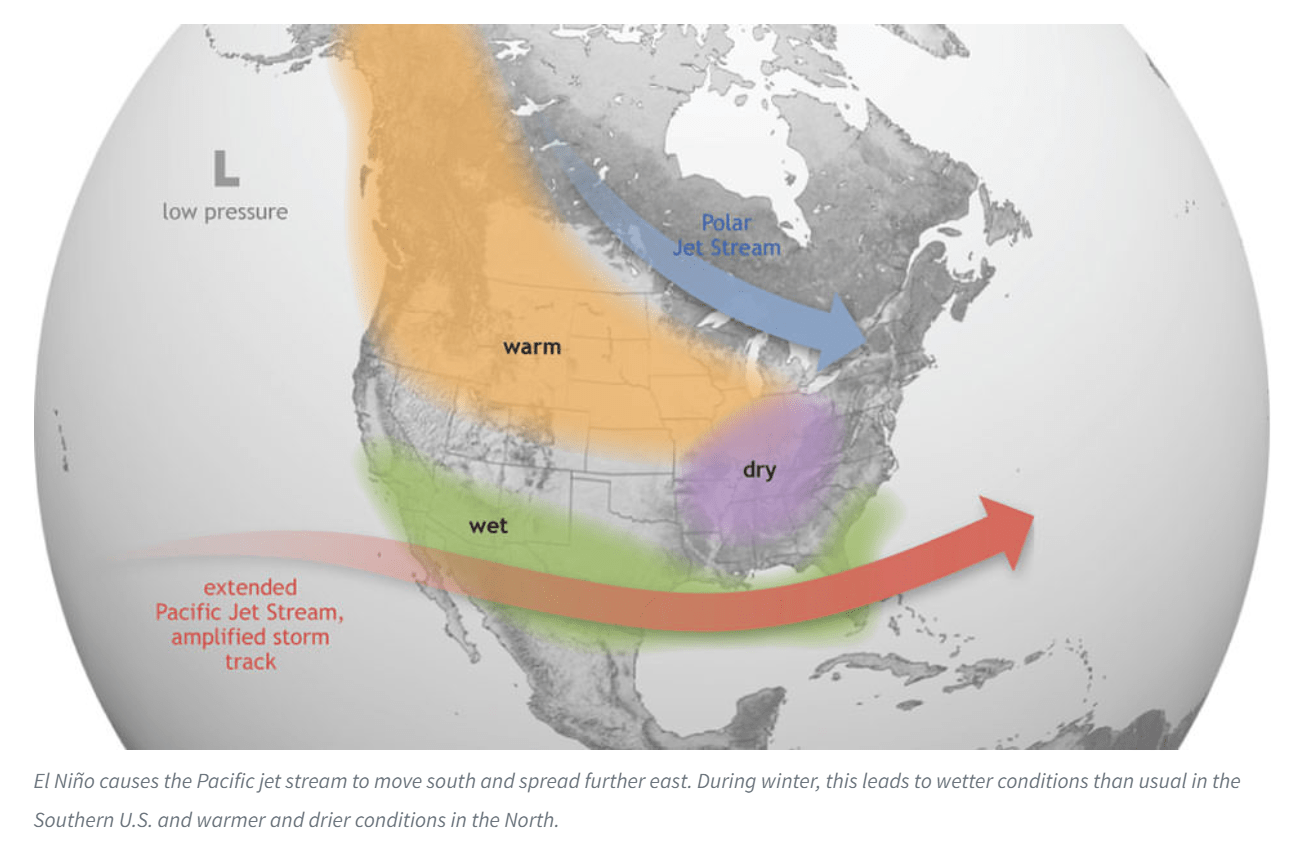

As I wrote in my June article on the BOIL ETF, the primary reason for my bullish stance on the BOIL ETF was because I believe we were going to experience an exceptionally hot summer due to a developing El Niño. El Niño tends to cause hot and dry weather across the U.S. and Canada (Figure 3).

Figure 3 – El Niño could bring dryer and warmer weather (NOAA)

So far, my fundamental prediction has proven correct as July was the ‘hottest month ever recorded on Earth’, with record-breaking heatwaves across the U.S. The temperatures were so high that in parts of Arizona, people were being treated for burns from falling down onto the hot pavement.

Due to the sweltering summer heat, electricity demand has been extremely strong, as air conditioners have been running non-stop. As a large percentage of electricity is generated from natural gas power plants, this leads to above normal natural gas demand.

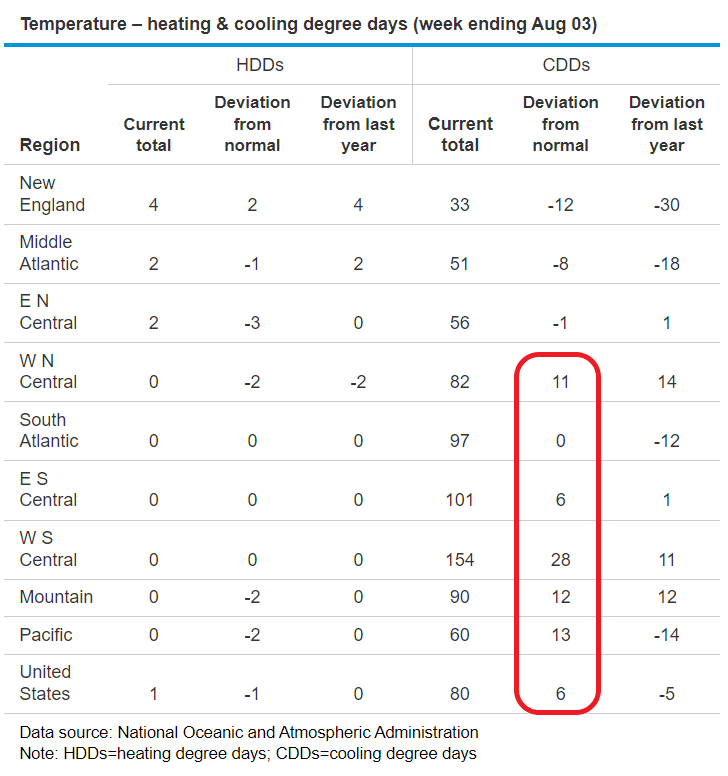

Investors can keep track of the weather’s impact on natural gas demand by tracking cooling degree days (“CDDs”). in the week ended August 3rd, many parts of the U.S. have seen much higher than normal CDDs (Figure 4).

Figure 4 – Extreme heat has led to higher gas demand (EIA)

Natural Gas Seasonality About To Turn Bullish

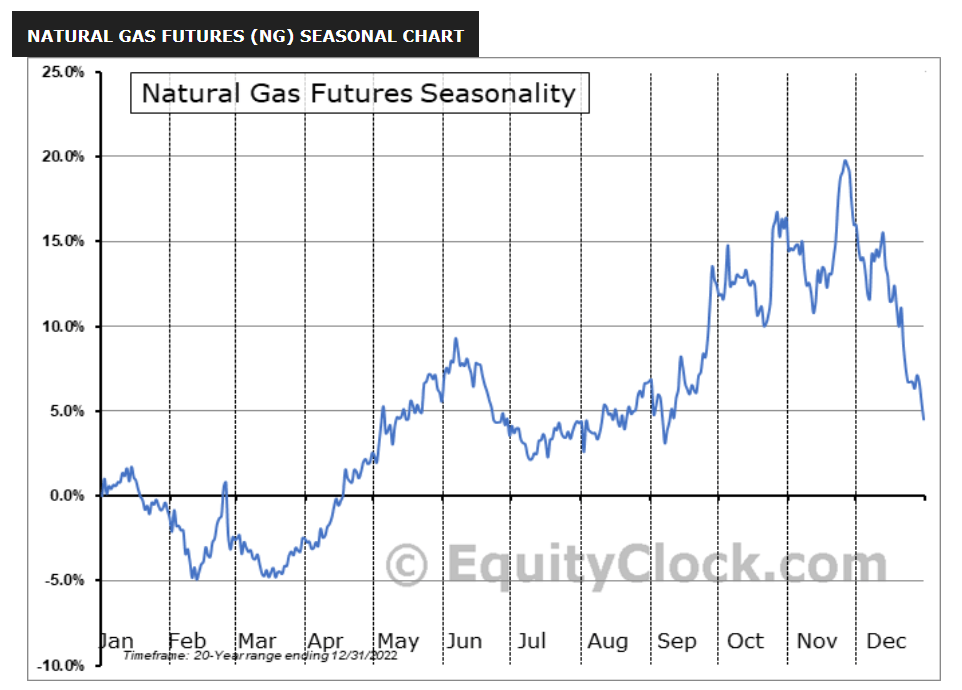

Furthermore, natural gas prices also exhibit strong seasonality, with prices bottoming in August and rallying into the Fall as speculators bet on winter heating demand (Figure 5).

Figure 5 – Natural gas exhibit strong seasonality into the Fall (equityclock.com)

Therefore, from a fundamental and seasonality perspective, I believe spot natural gas prices still have an upside bias, so I would not bet on shorting natural gas futures at this time.

Wait For End Of The Year For A Shot At KOLD

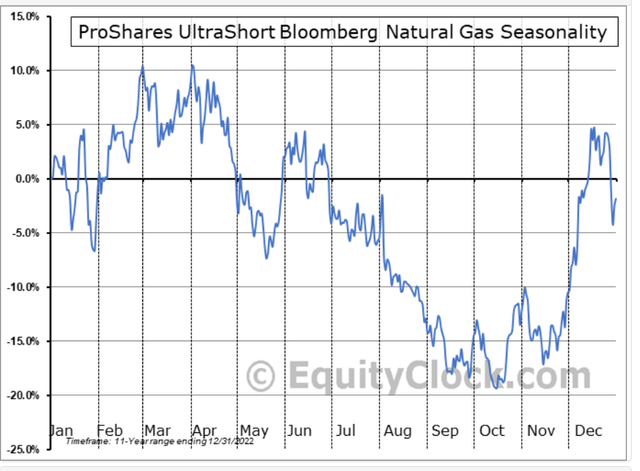

In fact, if we study the seasonality on the KOLD ETF, we can see there is a pronounced seasonality that coincides with the typical year-end decline in natural gas prices (Figure 6).

Figure 6 – KOLD has pronounced year-end seasonality (equityclock.com)

KOLD’s November-December seasonality makes fundamental sense as speculators typically bet on winter gas demand through the Fall and by late November, actual winter weather is more or less known, so the speculative fever subsides and natural gas prices tend to decline.

If speculators want to take a shot at the KOLD ETF, I would suggest waiting for the November/December time window, and if the winter is warm (less heating demand), then KOLD should do well for a trade.

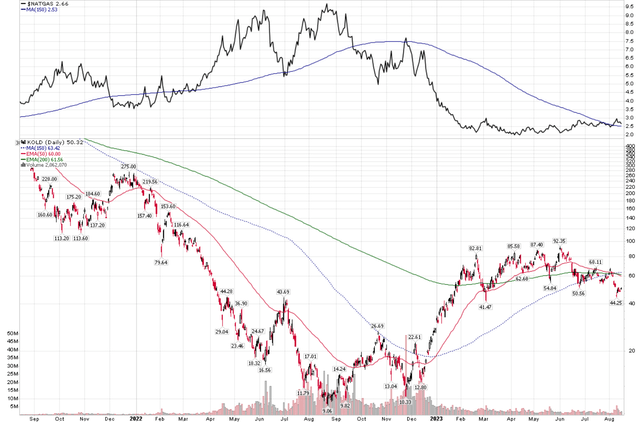

For example, in the most recent 2022/2023 winter season, weather was extremely mild, which led to a collapse of natural gas prices from over $9.00 / mmbtu to ~$2.00 / mmbtu, and the KOLD ETF rallied 8x from ~$10 to over $80 / share (Figure 7).

Figure 2 – KOLD vs. natural gas prices (Author created with price chart from stockcharts.com)

Conclusion

The KOLD ETF is a short-term trading vehicle for speculators betting on a decline in front-month natural gas futures prices. Although I am cautious on the BOIL ETF due to a steep futures roll decay in the coming few weeks, that does not mean I am bullish on the corollary, the KOLD ETF. Fundamentals and seasonality are both supportive of natural gas prices into the Fall.

For speculators looking to bet on the KOLD ETF, they should wait for the end of the year when natural gas prices tend to decline as winter weather is realized.

Read the full article here