There can be little doubt that one of the biggest problems facing the average American today is the incredibly high rate of inflation that has been driving up the cost of living. This is clearly showcased by the consumer price index, which claims to measure the price of a basket of goods that is regularly purchased by the average American. This chart shows the year-over-year rate of change in this index during every month of the past twenty-five years:

Trading Economics

As we can see, the consumer price index’s annual rate of change increased dramatically following the economic lockdowns in the Spring of 2020. This is because the Federal government and the Federal Reserve increased the money supply by approximately 41% to finance a number of economic support programs intended to help the economy through the shutdowns. When things started reopening again, people began spending all of the money that they had saved while stuck at home, pushing up the price of everything. After all, the actual productive output of the economy did not grow by anywhere close to 40% during that period.

While the annual rate of increase has seemingly moderated, the most recent number was still a 3.2% year-over-year increase, which is well above the average that most of us are accustomed to and above the Federal Reserve’s target level of 2% annually. Perhaps the biggest reason that inflation is a problem though is that wages have not grown nearly as rapidly as the cost of living. As of May 2023, real wage growth was negative for 26 months in a row. This means that the number of goods and services that people could purchase with the paychecks that they receive from their jobs was much less than it had been two years prior, despite the fact that their nominal earnings were actually up.

This situation has been forcing people to engage in desperate measures to support themselves, including dumpster diving for food and pawning their possessions. There has also been an increase in the number of people taking on second jobs, which could be one reason why the employment reports have not exhibited the signs of economic weakness as many other economic indicators.

As investors, we are certainly not immune to this. After all, we require food for sustenance and energy to heat our homes and businesses, just like anyone else. We may also want to enjoy some luxuries from time to time. All of these things have gotten considerably more expensive over the past two years. Fortunately, we do not have to resort to desperate measures to obtain the extra money that we need to cover these costs. After all, we have the ability to put our money to work for us to earn an income.

One of the best ways to do this is to purchase shares of a closed-end fund, or CEF, that specializes in the generation of income. These funds are unfortunately not very well-followed in the financial media and many investment advisors are unfamiliar with them so it can be difficult to obtain the information that we would really like to have to make an informed investment decision. This is a shame because closed-end funds offer a few advantages over ordinary open-ended and exchange-traded funds. In particular, a closed-end fund is able to employ certain strategies that have the effect of boosting its effective yields well above that of any of the underlying assets or indeed just about anything else in the market.

In this article, we will discuss the BlackRock Floating Rate Income Strategies Fund Inc (NYSE:FRA), which is one fund that investors can use to earn an income from their portfolios today. As of the time of writing, this fund yields 11.29%, which is certainly enough to turn the eye of any income-hungry investor. I have discussed this fund before, but a few months have passed since that time so naturally a few things have changed. This article will therefore focus specifically on those changes as well as provide an updated analysis of the fund’s financial condition. Let us investigate and see if this fund could be a good addition to your portfolio today.

About The Fund

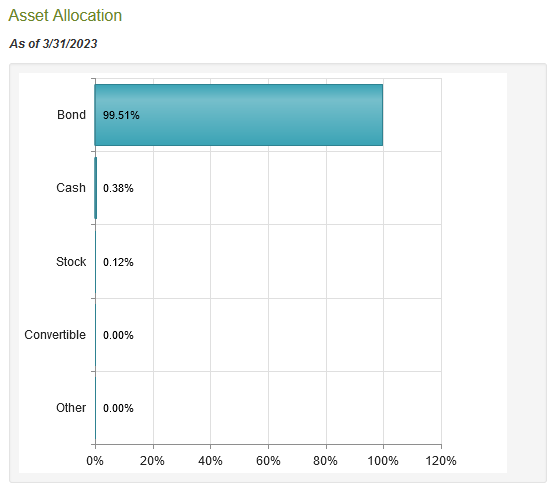

According to the fund’s webpage, the BlackRock Floating Income Strategies Fund has the objective of providing its investors with a high level of income while still ensuring the preservation of capital. This is certainly not surprising, as the name of this fund suggests that it invests primarily in debt securities and most debt funds have an objective that is quite similar to this. A look at the fund’s portfolio confirms this assumption, as 99.51% of its assets are invested in bonds alongside very small allocations to cash and common stock:

CEF Connect

The reason that the fund’s objective makes sense when we consider this is that debt securities in general are income securities by their very nature. In fact, they have no potential for net capital gains over their lifetime. This is very easy to visualize. After all, an investor purchases a bond at face value, receives a stream of coupon payments over the life of the bond, and receives the face value back from the issuer when the bond matures. There are no net capital gains paid out over the life of the bond because bonds have no inherent link to the growth and prosperity of the issuing company. After all, a company will not pay its creditors a higher rate of interest just because its profits have increased during a given period. It will instead pay its excess profits out to the common shareholders who took on more investment risk.

One thing that is very important to keep in mind with this fund is that it is not investing in traditional fixed-rate bonds. The fund describes its strategy on its webpage:

“BlackRock Floating Rate Income Strategies Fund, Inc.’s investment objective is to provide shareholders with high current income and such preservation of capital as is consistent with investment in a diversified, leveraged portfolio consisting primarily of floating rate debt securities and instruments. The fund seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its assets in floating rate debt securities, including floating or variable rate debt securities that pay interest at rates that adjust whenever a specified interest rate changes and/or which reset on pre-determined dates (such as the last date of a month or calendar quarter). The fund invests a substantial portion of its investments in floating rate debt securities consisting of secured or unsecured senior floating rate loans that are rated below investment grade.”

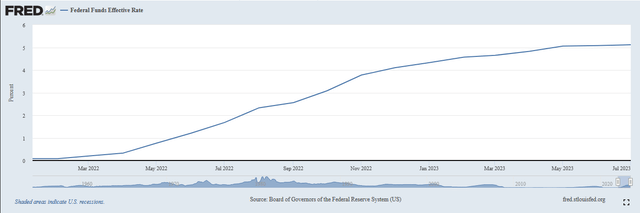

The major takeaway here is that this fund is investing in floating-rate debt securities, not traditional fixed-rate bonds. This means that one of the defining characteristics of bond investing is not relevant here. This is because fixed-rate bond prices vary inversely with interest rates. Basically, when interest rates go up, bond prices go down. The Federal Reserve has been aggressively raising interest rates over the past eighteen months in an effort to bring down the incredibly high rate of inflation plaguing the economy. We can see this by looking at the effective federal funds rate, which went from 0.08% in January 2022 to 5.08% today:

Federal Reserve Bank of St. Louis

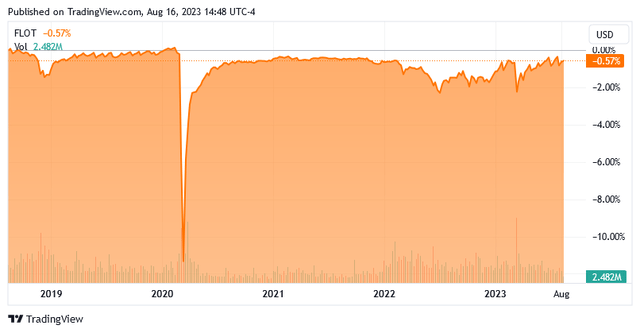

This is the reason why bond prices crashed last year. As I have noted in various previous articles, the Bloomberg U.S. Aggregate Bond Index (AGG) delivered a –13.01% total return in 2022. It is a different story with floating-rate securities, however. This is because the coupon that they pay their investors adjusts with the market interest rate in an economy. As such, floating-rate debt instruments will always deliver a competitive interest rate when they are trading at face value, so the price does not need to adjust so that older securities will deliver the same effective yield to maturity as a brand-new security. This means that the price of floating-rate securities tends to be more stable with the passage of time. For example, let us take a look at the iShares Floating Rate Bond ETF (FLOT), which tracks the Bloomberg U.S. Floating Rate Note Index. As we can see here, the price of the index fund has been almost perfectly flat over the past five years:

Seeking Alpha

There were quite a few interest rate changes over the trailing five-year period, both positive and negative. Yet, none of them had any real effect on the index. In fact, the only thing that has seemingly had an impact on it was the outbreak of the COVID-19 pandemic. That was a once-in-a-lifetime event that saw investors liquidate pretty much everything just to get cash. The takeaway here is that the securities that are held by this fund should be quite stable over time with respect to their price.

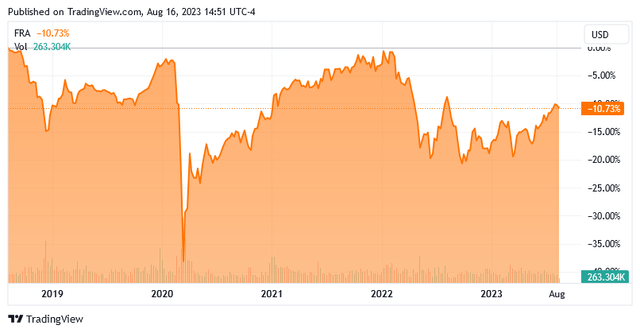

For its part, the fund has been more stable than most debt funds. Over the past five years, the share price is down 10.73%:

Seeking Alpha

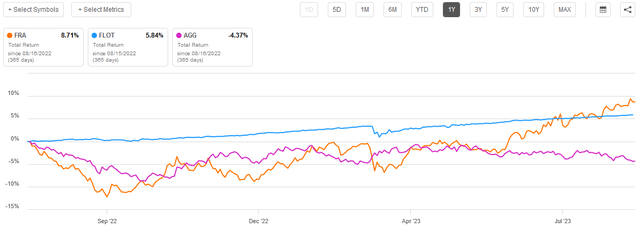

The fund’s share price is only down 1.82% over the past twelve months. As the fund’s yield more than offsets these declines, it had a positive total return over both of these periods. In fact, this fund outperformed both the Bloomberg U.S. Aggregate Bond Index and the Bloomberg U.S. Floating Rate Index over time. This chart shows the total return of the fund against both of the indices over the past twelve months:

Seeking Alpha

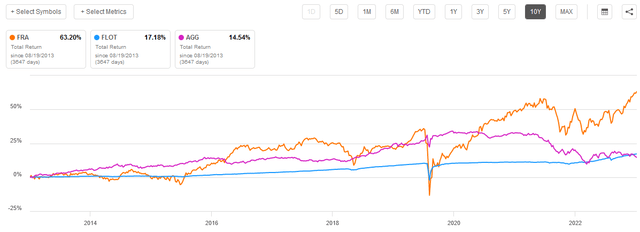

Here is the same comparison over the past ten years:

Seeking Alpha

As can be clearly seen, the BlackRock Floating Rate Income Strategies Fund consistently managed to beat both of the indices. This is due mostly to its use of leverage, which allows it to artificially boost the effective yield of the portfolio. This leverage is also the reason why this fund’s share price declined in early 2022 once the Federal Reserve started its monetary tightening campaign. After all, a rising interest rate means that it is more expensive for the fund to borrow money than it used to be. It also made the yield of safer investments, like money market funds, more attractive and dropped the fund’s price so that it offered a sufficient premium to a risk-free asset to justify taking on the extra risk of owning a leveraged debt fund. We will discuss the fund’s use of leverage in greater detail later in this article.

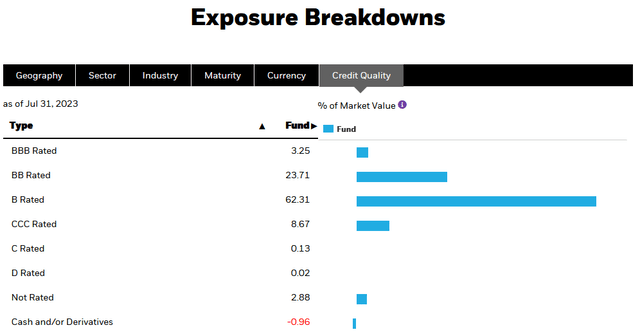

In the fund’s description of its strategy, it was pointed out that the fund is investing a significant proportion of its assets in debt securities that are rated below investment grade. These are what are termed “leveraged loans,” as they refer to bank loans that are made to companies that already have a significant amount of debt. As such, there is a much higher risk of default than we would find with typical investment-grade bonds. That is something that could be concerning to conservative risk-averse investors. However, we can alleviate some of those concerns by looking at the credit ratings of the securities that are actually contained in the fund’s portfolio. Here is a summary:

BlackRock

An investment-grade debt security is anything rated BBB or higher. As we can clearly see, that only represents 3.25% of the portfolio’s assets. The remainder are speculative-grade securities (“junk bonds”), which carry a higher risk of default. However, we can see that 86.02% of the securities carry either a BB or a B rating. These are the two highest possible ratings for junk debt.

According to the official bond ratings scale, companies whose securities carry a BB or a B rating have sufficient financial capacity to carry their debt at the time of issuance even in the event of a short-term economic shock. While they are not as financially strong as investment-grade rated companies, the risk of default losses should not be too great here. In addition, the fund has 436 positions, so each individual company’s securities should only account for a very small proportion of the portfolio. Thus, the impact of a single default should be negligible.

Overall, we should not have to worry too much about the risk of losses due to a default. In fact, the real risk here is an interest rate cut as that would result in traditional fixed-rate bonds outperforming floating-rate securities.

Leverage

In the introduction to this article, I noted that closed-end funds such as the BlackRock Floating Rate Income Strategies Fund have the ability to employ certain strategies that allow them to artificially boost the effective yields of their portfolios. One of these strategies is the use of leverage. In short, the fund is borrowing money and then using that borrowed money to purchase floating-rate debt securities. As long as the purchased assets have a higher yield than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio.

As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, that will usually be the case. It is important to note though that this strategy is not as effective today at boosting the portfolio yield as it was eighteen months ago. This is because the difference between the borrowing rate and the yield of the purchased assets is much narrower than it was back when the borrowing rate was basically zero.

Unfortunately, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. This is undoubtedly one reason why this fund’s share price has been much more volatile than the floating rate index. As such, we want to ensure that the fund is not employing too much leverage because that would expose us to an excessive amount of risk. I generally do not like any fund to have leverage above a third as a percentage of its assets for this reason. Fortunately, the BlackRock Floating Rate Income Strategies Fund looks pretty good in this respect, as its levered assets only comprise 24.10% of the portfolio today. As such, it appears that this fund is striking an acceptable balance between risk and reward.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the BlackRock Floating Rate Income Strategies Fund is to provide its investors with a high level of current income. In order to achieve this objective, the fund invests primarily in speculative-grade floating-rate debt securities, which will naturally have much higher yields than investment-grade securities. It then applies a layer of leverage to artificially boost the yield of the portfolio beyond that of any of the underlying assets. Finally, the fund pays out a significant portion of its investment returns to the shareholders.

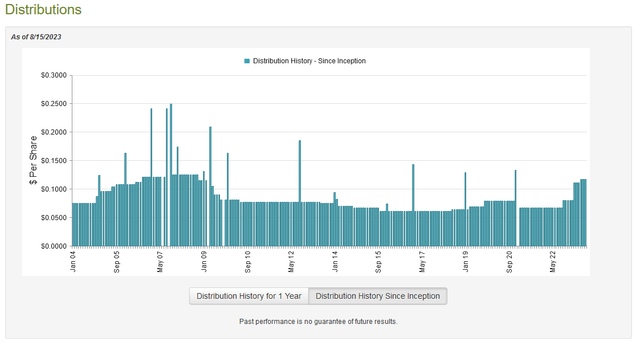

We can therefore assume that BlackRock Floating Rate Income Strategies Fund will have a very high yield itself. That is certainly the case as the fund currently pays a monthly distribution of $0.1170 per share ($1.404 per share annually), which gives it an 11.29% yield at the current price. Unfortunately, this fund has not been consistent with its distribution and has changed it quite a bit over the years:

CEF Connect

This is something that will probably reduce the appeal of the fund in the eyes of any investor that is seeking a safe and secure source of income to use to pay their bills or finance their lifestyles. However, the fact that the fund has increased its distribution three times in the past year is rather nice. While this variation might be a bit of a turn-off to some investors, it is quite understandable. After all, this fund is investing primarily in floating-rate securities, which as we have already seen tend to be very stable in terms of price.

Thus, the fund’s investment returns will consist almost entirely of the coupon payments that it receives from the securities in its portfolio. These coupon payments will be a lot higher during periods of high-interest rates than during periods of low-interest rates. The bond needs to adjust its distribution to correspond to its income in order to ensure that it is sustainable over the long term. After all, it does not want to deplete its assets as that will make it progressively more difficult to earn the necessary return to sustain a certain distribution.

As I have pointed out numerous times in the past, the fund’s distribution history is not necessarily the most important thing for anyone purchasing the shares today. This is because a buyer today will receive the current distribution at the current yield and does not need to be particularly concerned about the fund’s past. The most important thing for anyone buying today is the fund’s ability to sustain its distribution going forward. Let us investigate that.

Unfortunately, we do not have a relatively recent document that we can consult for that purpose. The fund’s most recent financial report corresponds to the six-month period that ended on December 31, 2022. This is a bit of a shame because the market has been much stronger year-to-date than it was last year. However, that is not as important for this fund as it would be for most others due to the incredible stability of floating-rate assets, as we discussed earlier in this article. It will, unfortunately, not provide us with as much insight into the fund’s ability to sustain its current distribution as we would like, as the fund has raised its distribution twice since this report was published. Nevertheless, it is the best that we have as of the time of writing.

During the six-month period, the BlackRock Floating Rate Income Strategies Fund received $75,134 in dividends along with $38,919,929 in interest from the assets in its portfolio. When we combine this with a small amount of income from other sources, we see that the fund had a total investment income of $39,520,644 during the period. It paid its expenses out of this amount, which left it with $29,462,918 available for shareholders. This was sufficient to cover the $27,297,906 that the fund paid out in distributions during the period.

Overall, this is quite nice to see as the fund is simply paying out its net investment income. If we assume that it is going to be consistent about this, which is reasonable, then it should have no real problems sustaining its current distribution as long as interest rates remain at their current levels. With the recent uptick in inflation, that is a very reasonable assumption as some Federal Reserve officials have started to get more hawkish and have suggested that rates could even be increased further. There seems to be very limited support among officials for a rate cut, suggesting that this fund could be a pretty good way to hide out and generate a high level of income for now.

Valuation

It is always critical that we do not overpay for any assets in our portfolios. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of a closed-end fund like the BlackRock Floating Rate Income Strategies Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all of the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to buy shares of a fund when we can obtain them at a price that is less than the net asset value. This is because such a scenario implies that we are purchasing the fund’s assets for less than they are actually worth. This is, fortunately, the case with this fund today. As of August 15, 2023 (the most recent date for which data is currently available as of the time of writing), the BlackRock Floating Rate Income Strategies Fund has a net asset value of $13.14 per share but the shares only trade for $12.35 each. This gives the fund’s shares a 6.01% discount on net asset value at the current price. This is slightly better than the 5.68% discount that the shares have averaged over the past month, and it is overall a very reasonable price to pay for the fund. Overall, this fund may be worth picking up today.

Conclusion

In conclusion, there are a lot of reasons to like the BlackRock Floating Rate Income Strategies Fund as a way to earn a high income today. The fund’s assets should prove reasonably stable regardless of interest rates and its distribution should increase if the Federal Reserve does increase rates further. That is a very realistic possibility right now considering that the latest inflation report went in the wrong direction for the doves, and rising energy prices could very easily start reversing the “progress” against inflation so far.

BlackRock Floating Rate Income Strategies Fund is simply paying out its net investment income, which will increase along with interest rates. The fact that it is trading at a discount is nice to see, too, as it tells us that right now is a good time to buy.

Read the full article here