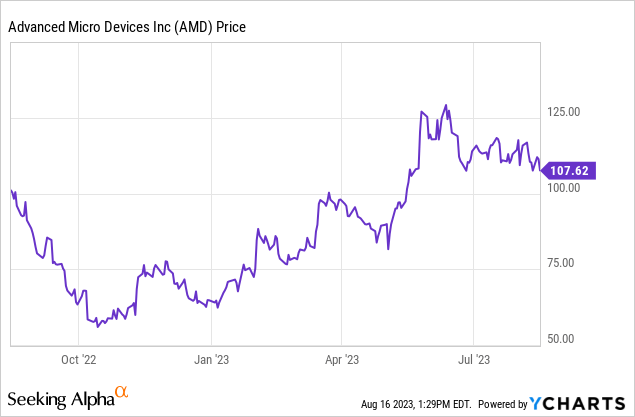

Advanced Micro Devices, Inc. (NASDAQ:AMD) stock has given up 19% of its value since peaking in June of this year at $132.83. Make no mistake, the chip sector, and tech more broadly, has been under pressure for a few weeks. After a massive run higher, we are in the middle of a correction.

But AMD stock is at a crossroads here. The so-called 20% decline in a stock marks it entering a bear market. But it does not mean you have to bail on shares, or go net short. Shorts have made some money here, and may continue to do so in coming weeks. We are in a seasonally weak period, and as our members know, we have been preparing for a sizable correction since the start of summer. We rallied a bit market-wise in July, but have been in a downtrend the last few weeks.

So what to do with AMD? We believe a trade can be executed here, but it will require a touch of patience in coming weeks as the stock consolidates further. Here is how we suggest playing it:

The play

Target entry 1: $106-$107 (25% of position).

Target entry 2: $101-$102 (35% of position).

Target entry 3: $96-$97 (40% of position).

Stop loss: $88.

Target exit: $118.

Options consideration: Option considerations are reserved for members of our investing group, but there are a number of call and put options/spreads that can be considered here.

Note: This trade is an example of what members receive along with the research at our investing group.

Discussion

So we are looking to start scaling in for a medium-term trade. One question we receive often is “what happens if the stock rallies from your first buy?” Well this is a high quality problem. While we intend to build a position, sometimes the stock rallies from the initial buy. This simply means you made money. Albeit, less than if you bought all at once. But if you buy all at once, and shares fall to $101, then to $96 let’s say, instead of legging in and having a more reasonable average around $101, where you would need just over a 5% move to be even, you would instead need a near 12% rally just to be even. We embrace scaling in.

With that said, the earnings performance in Q2 supports a buy on this large pull back, in our opinion. The future is bright.

Performance was strong in Q2, though sales decline as expected

The AMD Q2 earnings were overall strong. The headline results were above consensus. We think that operations have or are close to troughing, and that bodes well. The AI revolution is only a boon to operations, even if it will take many quarters to really ramp up here, as competition is further along and dominating market share, for now. That said, in Q2, revenue was $5.36 billion and actually decreased 18.2% year-over-year. Sequentially we were effectively flat from Q1. There was mixed performance in most segments from last year.

One item we watch closely is gross margins, and these have been under some pressure. AMD’s GAAP gross margins were 46%, flat year-over-year, but rising from 44% in Q1. It was also up from Q4 2022’s 43%, and up from Q3 2022’s 42%. So, we are seeing progress here. Adjusted gross margins were, however, down to 50%. This was flat from the sequential quarter’s 50%, and down from 54% a year ago. Margin pressure persists, but we still believe margins have bottomed out.

Operating income declines following a revenue decline

As the revenues and adjusted margins were down from last year, AMD saw an unsurprising decline in gross profit. The one negative we saw was that operating expenses were high, nearly flat on a GAAP basis from a year ago but rising on an adjusted basis. This led to operating income declines and is a short-term bearish point. It is rarely a good combination to have revenues decline but operating expenses increase. Labor costs, and other investments for growth are weighing near-term. We do see demand accelerating toward the end of the year into next year, barring a severe recession, and AI engagements are increasing.

AMD Chair and CEO Dr. Lisa Su stated:

“Our AI engagements increased by more than seven times in the quarter as multiple customers initiated or expanded programs supporting future deployments of Instinct accelerators at scale. We made strong progress meeting key hardware and software milestones to address the growing customer pull for our data center AI solutions and are on track to launch and ramp production of MI300 accelerators in the fourth quarter.”

We view this commentary positively. Of course, operating income, and earnings, were hit hard. In Q2, AMD’s operating income, as adjusted, fell and was $1.07 billion, or down 46% from $1.98 billion a year ago. We would prefer more focus on controlling operating expenses in an environment where sales are declining.

Putting it altogether, AMD’s net income fell to under $1 billion again, hitting $948 million from a year ago. Earnings per share fell, however, to $0.58 vs. $1.05 last year, but did beat by $0.01. We believe this is the bottom for earnings near-term. The company has a great balance sheet, and issued a positive outlook in our estimation.

AMD has a strong balance sheet

The AMD balance sheet is quite healthy. At the end of Q2, cash was $3.8 billion. Cash from operations was $379 million compared to $1.03 billion a year ago, while free cash flow was $254 million compared to $906 million a year ago. Free cash flow was also down from Q1’s $328 million. Total debt stood at $2.46 billion, so net cash is a very strong $1.3 billion.

Outlook

So, our thesis is that we have seen a bottoming in performance and that AMD stock is revaluing lower on uncertainty and in a seasonal correction. As we look ahead, we still see ongoing weakness for PCs and client revenue. We continue to think that data center leads the way, along with gaming and then embedded revenue. On this selloff, we would look to see if repurchases are resumed in coming weeks.

For Q3, we believe AMD starts to see a performance ramp-up after the Q2 trough. That is our thesis here. AMD guided for revenue to be approximately $5.4-$6.0 billion, while gross margin will be around 51%, a notable improvement from Q2.

Our view for the year on revenues is $21.5-$24.5 billion. We see revenue strength ramping later this year, and into 2024. Assuming at least a 50% margin, and even roughly comparable capex and opex, we see EPS of $2.80-$3.00 for 2023 as likely. Assuming the midpoint, AMD shares are trading at about 37X FWD earnings. AMD stock is not cheap, but on a pullback below $100, this gets attractive once again and would encourage new money to re-enter. However, we think starting that position over $100 is acceptable, but scale in.

Take-home

Advanced Micro Devices, Inc. stock is on the verge of bear territory, but we want to get in down a good 20%. We expect market weakness continues in coming weeks in this seasonally weak period for stocks. Let the stock come down and do some buying for a trade.

Read the full article here