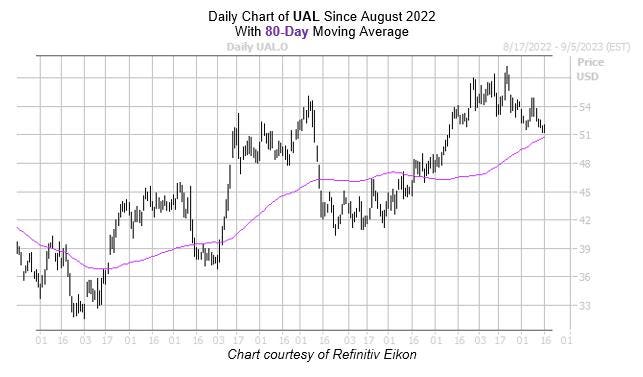

United Airlines (UAL) just came within one standard deviation of its 80-day moving average for the fifth time in the past three years. According to Schaeffer’s Senior Quantitative Analyst Rocky White, UAL was higher one month later after every signal, averaging a 14.2% gain.

United Airlines stock sports a marginal midday loss and was last seen trading at $51.33, meaning a similar move would place the equity at a more than two-year high above the $58.60 level. Peer Southwest Airlines (LUV) yesterday reached a tentative agreement with union representatives that will see certain workers earn more than United Airlines and Delta Air Lines (DAL) employees, which is likely weighing on the shares today. And while UAL is down 6.5% this quarter, it’s still outperforming the SPDR S&P 500 ETF Trust (SPY) with a more than 36% year-to-date lead.

An upgrade or two could help the shares, too. At the moment, four of 16 covering brokerages rate United Airlines stock a “hold” or worse. Plus, now looks like a good time to weigh in with options. The stock is seeing attractively priced premiums at the moment, per UAL’s Schaeffer’s Volatility Index (SVI) of 35%, which sits in the low 6th percentile of its annual range.

Read the full article here