Investment Thesis

AAON, Inc.’s ( NASDAQ:AAON) revenue growth should benefit from a good backlog level of $526 million, price increases, and good end-market demand supported by multi-year secular trends from decarbonization, electrification, energy transition, and improved air quality. However, as backlog levels have started seeing some softening, revenue growth should start to normalize. Moreover, revenue comparisons are also getting tougher in the back of 2023, which should also impact revenue growth in the coming quarters.

On the margin front, the company should see margin expansion as it benefits from a high-priced backlog, a favorable cost environment due to easing supply chain issues and moderating inflation, and productivity gains. However, margin expansion is also expected to slow down in the coming quarters due to tough comparisons, and the impact of the price increases should also soften. I believe normalizing growth should result in contraction of the company’s P/E multiple and, as a result, I am moving to the sidelines and rating the stock neutral.

Q2 2023 Earnings

Recently, AAON reported better-than-expected results for its second quarter of 2023. Net revenue increased by 36% Y/Y to $283.9 million, beating the consensus estimate by $7.8 million. EPS increased significantly by 173.3% Y/Y to $0.82, beating the consensus estimate by $0.17. Gross margin was up 1040 basis points (bps) Y/Y to 33.1% and operating margin increased 950 bps to 19.3%. The growth in revenue was due to increased production, and price increases. EPS and Margins benefited from easing supply chain conditions, price increases, and easier comparisons from the previous year’s quarter.

Revenue Analysis and Outlook

In my previous article, I talked about the company’s good growth prospects ahead as it should benefit from a healthy backlog, price increases, good end-market demand, and improved backlog execution. The company has reported its second quarter of 2023 since then.

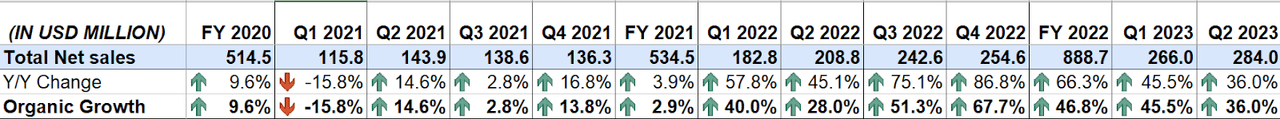

In the second quarter of 2023, the company’s sales growth benefited from improving backlog execution as supply chain conditions continued to ease and AAON increased production capacity with an increased headcount. This resulted in a 16% Y/Y increase in organic volume. In addition, price increases also contribute to sales growth by 20%. This resulted in a 36% Y/Y increase in sales growth organically as well as on a reported basis to $284 million.

AAON’s Historical Net Sales (Company Data, GS Analytics Research)

Looking forward, while the company is well-placed to deliver sales growth, its rate of growth is expected to normalize as the impact of carryover pricing is decreasing, and backlog growth is also expected to normalize.

While the company has seen good price increases over the last few quarters, management does not want to lose market share in an inflationary environment where consumer behavior becomes value-seeking. So, the company is expected to implement a much more normalized pace of price increases looking forward, compared to what it has done in the recent past. This means that the impact of price increases should start to decrease in the coming quarters and contribute less to the topline.

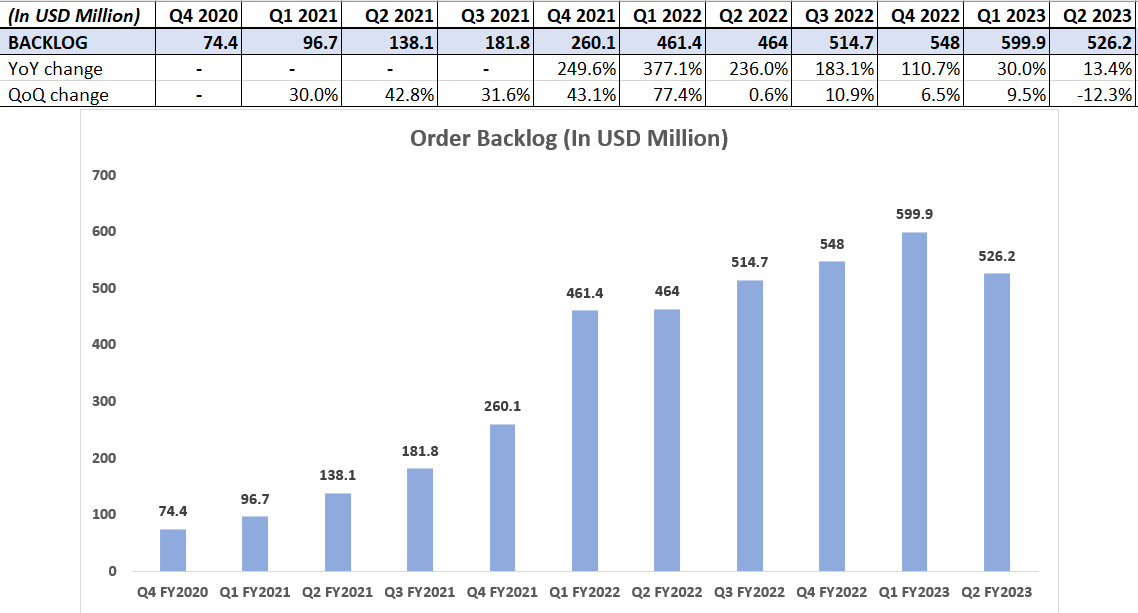

Moreover, in the past couple of years, the company’s backlog benefited from supply chain disruptions. Since the pandemic, supply chain networks have faced long lead times for manufacturing as well as material availability. As a result, a lot of orders got built up in the backlog, and backlog growth exceeded the production levels. Additionally, customers also started ordering way in advance, given the long lead times for order delivery. Now supply chain disruptions are easing, availability of raw materials has become easier, and lead times have also fallen compared to the previous year. In addition, the company has also improved its backlog execution by increasing production capacity and expanding the labor base. This also has increased production levels and reduced the overall lead time of AAON’s products and has resulted in production levels outpacing backlog growth.

AAON’s Order Backlog (Company Data, GS Analytics Research)

The company’s backlog level saw a sequential decline in the second quarter and decreased by 12.3% quarter-over-quarter to $526 million from $599 million in Q1 2023. The company did see backlog growth from the previous year’s same quarter by 13.4% Y/Y, however, this growth is much less than the triple-digit Y/Y backlog growth the company experienced in 2022. This implies backlog growth has started normalizing, and the benefits derived from supply chain issues over the past years have dissipated significantly. As a result, I anticipate the backlog to continue returning to normalized levels moving forward.

The revenue growth should also normalize as the benefits derived from strong backlog growth goes away. Furthermore, revenue growth comparisons are also getting tougher in the back half of 2023. This should also impact revenue growth in the coming quarters. While Q3 2023’s revenue growth is expected to be solid still at 21.45% Y/Y, if we look at the current consensus estimate, the company’s revenue growth is expected to slow to a high single-digit range in Q4 2023. Hence, we should see a much-normalized level of sales growth a couple of quarters down the road.

Margin Analysis and Outlook

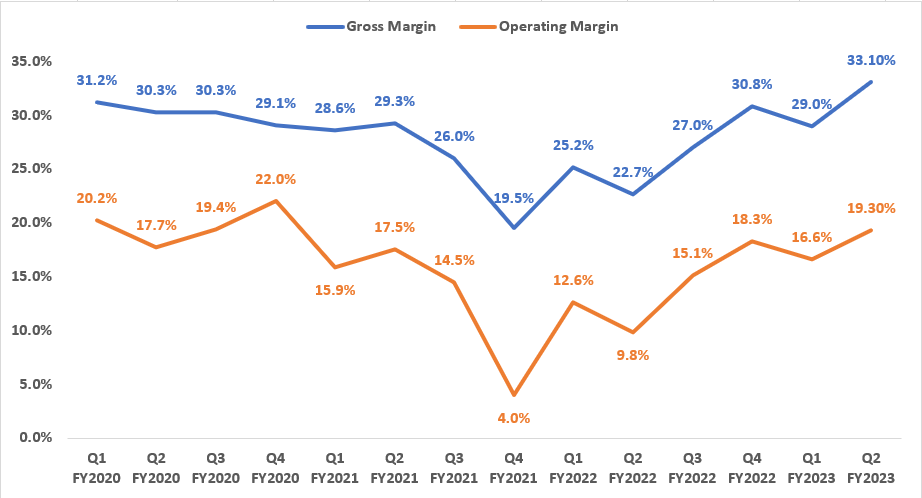

In the second quarter of 2023, the company saw benefits from moderating inflation as compared to the previous year’s quarters. In addition, price increases and productivity gains also helped the company in expanding its margin and more than offset some remaining challenges from the supply chain and elevated labor costs. Further, easier comparisons also boosted the margin growth. This resulted in a 1040 bps Y/Y increase in gross margin to 33.1% and a 950 bps Y/Y increase in operating margin to 19.3%.

AAON’s Historical Gross Margin and Operating Margin (Company Data, GS Analytics Research)

Looking forward, I believe the company should be able to continue its margin expansion. The company has high prices in its current backlog as a result of price increases over the past year, which should continue to support margin growth. Moreover, the company also has completed the majority of new employee onboarding. So moving forward, costs associated with hiring and training new staff should decrease, supporting margin growth. Further, the company is also investing in new equipment to support the increased production as old equipment was not efficient enough for the increased capacity. So this should also increase efficiency and productivity. In addition, easing supply chain challenges and moderating inflation should also result in a favorable cost environment. Hence, margin growth should continue moving forward.

However, management is anticipating the rate of margin growth in the second half of 2023 to slow down as compared to the first half of 2023 due to the diminishing impact of carryover price increases in the coming quarters. Moreover, comparisons are getting tough in the second half of 2023. This should also slow down the margin growth rate. So, margins should continue to increase, but at a slower pace.

Valuation and Conclusion

The company is trading at a 31.14x FY23 consensus EPS estimate of $3.04. The company has enjoyed a premium multiple over the past few years as it has seen strong growth driven by demand for customized HVAC offerings. While the longer-term growth story is still there, the growth rate is expected to normalize looking forward. This can lead to a contraction in the valuation multiple that investors are willing to pay for the stock. I first covered the stock in September of last year and gave it a buy rating. The stock has given a solid ~75% return since then, massively outperforming the broader market. I believe it is prudent to move on the sidelines after this run-up and given the company’s slowing growth rate. Hence, I am downgrading my rating on the stock to neutral.

Read the full article here