Investment Thesis

Rumble Inc. (NASDAQ:RUM) has been on a roll during the pandemic and the very obvious censorship of other opinions. I also once wrote that a YouTube alternative is urgently needed. And still, the company offers exactly that, but now the growth of the company has slowed down considerably or even completely reversed. Given the company’s still-meager revenue, an investment in RUM stock seems too risky at the moment.

The two same problems remain

In February 2022, I wrote an article where I tried to estimate the revenue potential for Rumble. In May 2023, I wrote a bearish one that shows the two problems of Rumble: slowing growth and monetization of users.

These are still the points where investors should focus their attention. For the stock market, this is a growth story; if the growth stops, the market will punish it accordingly. That is what has happened now. Growth slowed down, or rather, there is even shrinkage. In Q2, the average global monthly active users were 44 million, which is about the same as in Q2 2022. In my last article about Q1, I wrote the following:

And this is despite Monthly Active Users increasing by 17% year-on-year to 48M. However, according to the company, there were even 80M in Q4 2022, which they attribute to the U.S. midterm election cycle

Rumble Has 2 Problems.

YoY, users have remained constant, which is disappointing, but even worse is that the user numbers have been falling for at least two quarters. Also, please note that these numbers are monthly active users, not daily. So if someone mainly uses YouTube and Rumble only occasionally to watch channels that have been deleted there, they fall into this statistic. I’m also part of the 44M monthly active users, or MAUs, although I do not particularly like the Rumble app, and the app’s algorithm can not keep up with YouTube, which already knows my preferences for many years. Even if you look at the home page without being logged in, you’ll notice that Rumble focuses heavily on conservative American politics and former President Donald Trump. This might be ok for Americans who are very interested in this area, but it is rather uninteresting for most other global users. The result is that even I stay on YouTube, although I would belong to the perfect target group of Rumble.

However, things look better regarding the total number of minutes viewed on the platform. Here, there are improvements compared to both the previous quarter and the previous year.

Strong consumption with average estimated Minutes Watched Per Month (“MWPM”) increasing by 46% to 11.8 billion in the second quarter of 2023, compared to 8.1 billion in the second quarter of 2022, and 10.8 billion in the first quarter of 2023.

Rumble Q2 2023.

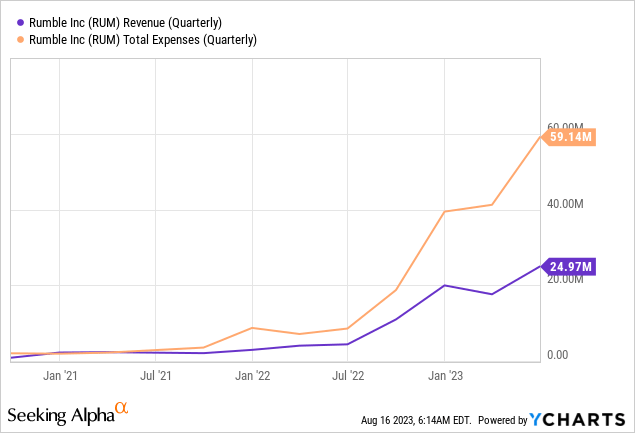

Revenue of approximately $25M has been achieved but remains at a very low level. Also, costs continue to rise significantly faster than sales.

What’s Next?

In the second quarter press release, there was a detailed summary of personalities now publishing or streaming exclusively on Rumble. For example:

Strategically diversified Rumble’s content library with the addition of an exclusive joint live stream show by Kai Cenat, the #1 most-subscribed streamer in the history of Twitch, and IShowSpeed, the #1 U.S.-based gaming streamer on YouTube. The show debuted on Rumble with over 200,000 concurrent viewers and over 6,500,000 million total views in their first livestream.

Rumble Q2 2023.

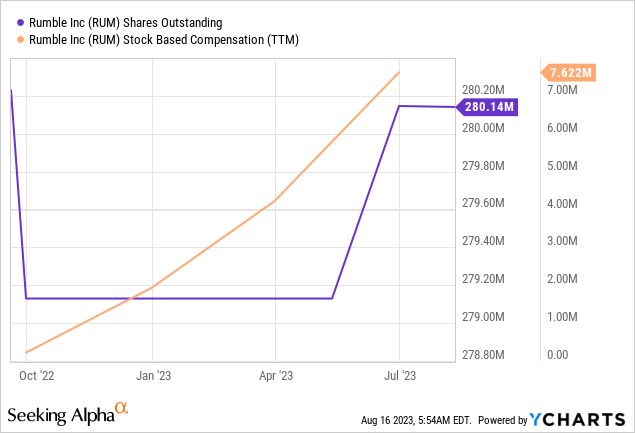

Such exclusive agreements cost the platform money, and how much it yields is unclear. I am not a fan of this. A good platform should grow organically without paying large sums to a few selected streamers. As long as there is enough cash left, they can do something like that, but at some point, the cash will be depleted, and then we will probably see share dilutions. Extrapolating the Q2 loss ($29.4M), cash should last another ten quarters, but probably less as expenses will likely continue to grow faster than revenues. So money may last another two years or less.

Further news indicates that Rumble Cloud will go into beta at the end of 2023, more emphasis will be placed on livestreaming, and “with the strategic acquisition of Callin,” content creators will be given new tools.

Share dilution and insider selling

The company currently has enough cash left (about $297M), so there was no further stock dilution. The stock-based compensations, or SBCs, are still relatively low but rising, and there was also no insider selling in the past six months.

Conclusion

Overall, this is a worrying development. Rumble Inc.’s market capitalization of $2.3B implies an assumption of further growth. This does not seem to be the case, and whether all future initiatives will be effective remains to be seen. With better numbers in the next few quarters, an upward turnaround could come quickly, but I expect the stock to remain very volatile for the next few months or quarters. I consider an investment too risky.

Read the full article here