Warren Buffett’s Berkshire Hathaway (BRK.A) recently revealed that it has been building a position in homebuilders such as D.R. Horton (DHI), NVR (NVR), and Lennar (LEN.B), signaling a significant bet on the housing sector.

In this article, we will look at Buffett’s bet on the housing sector, the outlook for housing, and then share our top housing stock of the moment.

Buffett’s Bet On Housing

This investment is particularly interesting given that Berkshire already owns several businesses in the housing industry such as Clayton Homes, Johns Manville insulation, and Benjamin Moore paint, all of which experienced weaker performance during Q2 due to a slowdown in the housing sector.

What this seems to imply is that Buffett believes that the long-term outlook for the housing sector is better than the market’s current sentiment is giving it credit for. While high mortgage rates and a slowing economy are weighing on housing right now, there is a very low inventory of homes for sale, providing opportunity for homebuilders to potentially profit, especially if/when mortgage rates decline again.

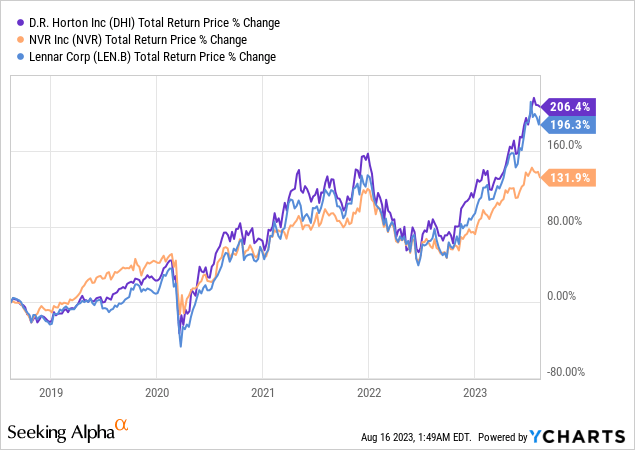

It is also interesting to note that Buffett has clearly been buying these stocks ever after them experiencing a strong run-up in price in recent years, implying that he clearly does not think a housing downturn is coming anytime soon:

Housing Sector Outlook

The outlook for housing obviously varies widely, but overall there is a generally positive outlook for the sector. Norada Real Estate Investments expects housing prices to continue rising over the next five years, albeit at a meaningfully slower pace than has been seen in recent years. While there is a shortage of inventory at the moment, new construction is expected to pick up and help increase supply in the coming years, hence Buffett’s bullishness on the sector.

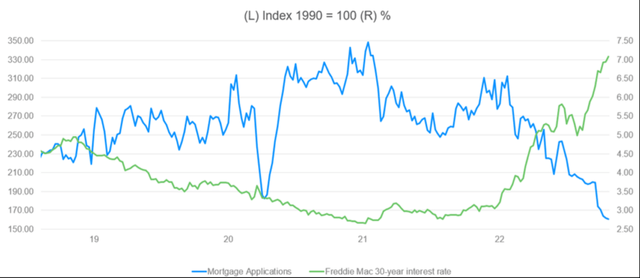

One of the most dominant factors for the housing sector is the direction that interest rates will take. Given that mortgage rates have rapidly risen over the past year and a half to above 7%, the supply of housing is being crimped due to existing mortgage holders not wanting to lose their existing mortgages at much lower rates. At the same time, demand is also being blunted due to the sky-high mortgage rates combining with housing prices that are still near all-time highs to make housing historically unaffordable. Moreover, an expected slowdown, if not recession could weigh further on housing demand in the near future, though the current strong employment and wage numbers is keeping housing demand at sufficiently high levels to keep home prices elevated near record levels. Longer-term, the growing trend of remote work should also support demand for the single-family home industry.

Ramsey Solutions echoes many of these same sentiments, predicting a more stable and balanced 2023 housing market compared to the frenzied activity seen in recent years. The extreme highs in housing prices and multiple offers seem to be subsiding, indicating a return to a more normal state. Meanwhile, the likelihood of a crash similar to the housing crisis of 2007-09 is low due to stricter lending rules and a shortage of housing supply.

Average home prices have risen to $424,495, and while experts predict some minor fluctuations, drastic changes are unlikely. The market experienced a housing recession in terms of declining home sales, but this was due to a return to pre-pandemic levels and is not indicative of a broader economic or housing sector crisis. Despite concerns of a housing bubble, home values are showing signs of stabilizing, with single-digit annual growth and even slight declines in some areas. Forecasts indicate that home prices may go up slightly or decrease by a small amount, but they are not expected to plummet.

Moody’s Analytics says that rising interest rates as reflected in rising mortgage rates have combined with sustained elevated prices to send housing affordability plummeting, leading to fewer people applying for mortgages.

Mortgage Bankers Association, Freddie Mac, Moody’s Analytics

As a result, new and existing home sales are dropping and home builders are pulling back on construction. That said, despite the correction, the demand for housing remains strong, driven by demographics and housing deficits.

Finally, Forbes thinks that despite high mortgage rates, strong demand and limited inventory are contributing to a competitive market, causing an affordability crisis for aspiring homeowners. Moreover, Forbes expects weak housing market activity to persist due to high mortgage rates, elevated home prices, and constrained housing inventory, with mortgage rates likely remaining above 6% for the rest of the year.

That said, builders are feeling cautiously optimistic due to rising builder confidence, but headwinds such as higher supply costs, construction labor shortages, and tighter credit conditions continue to affect the market. Moreover, foreclosure activity is trending up, with increased activity potentially approaching pre-pandemic levels.

What all this means is that – while the financial benefits of property ownership are likely to be rather poor in the coming years – the outlook for homebuilders as essential providers of badly needed housing market supply as well as rental landlords is quite strong. Home affordability may be at all-time lows, but that renting a single-family home much more attractive by comparison.

Our Top Pick

As a result, while we certainly agree with Buffett that home builders have a promising outlook ahead of them, we are somewhat less excited about the valuations currently being demanded for these stocks. Instead, we see significant opportunity among single-family REITs (VNQ). Invitation Homes (INVH) and American Homes 4 Rent (AMH) are both decent values at the moment. INVH is trading at 0.91x its NAV, trading at 22x NTM AFFO compared to its historic average of 25x, and combining a 3.1% dividend yield with an expected ~7% dividend per share CAGR through 2025. AMH meanwhile is trading at 0.93x its NAV, trading at 23.8x NTM AFFO compared to its historic average of 25.4x, and combining a 2.5% dividend yield with an expected ~9% dividend per share CAGR through 2025.

However, our top pick in the sector is the smaller and lesser well-known stock Tricon Residential (TCN), which is trading at 0.66x its NAV, trading at 18x NTM AFFO compared to its historic average of 22.6x, and combining a 2.8% dividend yield with an expected ~18% AFFO per share CAGR through 2025. TCN enjoys very attractive economics on its rentals because it combines an asset management business with its own equity ownership stakes in its properties, leading to high returns on investment and a strong growth profile. Moreover, its rental properties are largely concentrated in sunbelt markets where population growth and rental property demand are very strong.

Overall, we see TCN as combining both deep value – providing a margin of safety against a steep decline in housing prices – with robust growth potential due to the very bullish outlook for the rental market in TCN’s core markets. As a result, we rate it a Strong Buy and consider it to be our top pick in the housing sector.

Investor Takeaway

Warren Buffett has an impressive track record, and we certainly share his bullish outlook for homebuilders given the glaring lack of supply in the housing sector at present. Moreover, given that it appears that interest rates are near or at their peak right now, the sector could enjoy a strong tailwind from declining interest rates in the coming years that would improve home affordability and boost demand for housing. Meanwhile, the typical interest rate on most existing mortgages today remains so far below where mortgage rates are today that even if mortgage interest rates were to fall by a few hundred basis points, it likely would not significantly boost the supply of existing homes for sale on the market. As a result, much of the incremental demand will likely go towards new housing that home builders will profit from.

With all of that said, however, there is not much margin of safety built into the home builders in our view as their valuations are at fairly elevated levels right now in anticipation of this bullish future. In contrast, rental property owners have somewhat of a margin of safety built into their valuations right now and also enjoy strong growth tailwinds which should should persist at least somewhat in the coming years. In TCN, investors can enjoy a deep discount to NAV along with attractive growth economics due to its concentration in sunbelt markets and asset management business, making it our top pick of the moment.

Read the full article here