Introduction

Aya Gold & Silver (OTCQX:AYASF) is small silver producer in Morocco. However, they are ramping up production to become a mid-tier producer. Plus, they are drilling a second project (Boumadine) that appears to be another large silver discovery.

Some investors are leery of Northern Africa, where Morocco is located. However, after speaking with management, I am confident in this location and consider it to be one of the more safer jurisdictions in Africa. However, this is Africa and has to be considered a high-risk location for that reason. Political stability and Africa are not generally statements you put in the same sentence.

I’m excited to hold Aya for several reasons. First, I love their first mine (Zgounder) which has had one good drill hole after another. It’s a 100M oz deposit at 300 gpt AG, and is increasing is size. Those types of large high-grade silver deposits have become rare. Second, they have second potential large mine (Boumadine). Third, I like their management team, which seems to be really solid. Fourth, they have a high number of insiders and are not for sale. Fifth, they are cheap. That’s a lot of good reasons to like it.

I’m bullish silver and want to own as many silver producers as I can. When I find one like this that I really like, I can’t wait to buy shares and own it. I never take large positions and bet on a few plays, instead I take small position and wait to see which ones are the winners.

I’m not a believer that you can pick winners in PM miners because so many things can go wrong. These investments are never slam dunks and go according to plan. That said, I think you can find PM miners with strong risk-reward profiles. Aya is one of those.

One thing I always like to point out is that investing in PM miners is speculating. We are gambling, since so many things can go wrong. Keep your allocations low and expect to lose money on some of your PM mining stocks. What we are really betting on is PM prices going higher. If silver prices rise, then Aya will be in a strong position. If silver prices languish, then bad things can happen.

|

Stock Name |

Symbol (US) |

Type |

Category |

Share Price (US) |

FD Shares |

FD Mkt Cap (8/14/2023) |

|

Aya Gold & Silver |

OTCQX:AYASF |

Silver |

Emerging Mid-Tier Producer |

$5.65 |

128M |

$724M |

Company Overview

Aya Gold & Silver is an emerging mid-tier silver producer in Morocco. Zgounder is a large silver project (100 million oz at 300 gpt) producing about 2 million oz a year. They plan to increase production to 8 million oz in Q2 2024 at Zgounder. The capex was $140 million, and construction began in 2022 (about 50% completed).

The Zgounder deposit is growing in size from high-grade drill results. They have released one good drill hole after another. They plan to continue drilling aggressively at Zgounder (26,000 meters planned for 2023). They will likely expand production at least one more time at Zgounder.

Aya is generating FCF (free cash flow), with a breakeven cost per oz at around $18. The projected AISC for the production expansion is $10 per oz. I expect their breakeven costs to remain around $18 per oz in 2024. They have 96 million oz of M&I at 300 gpt, and 70 million oz of reserves. They have $49 million in cash and $100 million in debt.

They can use their cash flow to expand the resource at Zgounder and focus on Boumadine and Amizmiz (gold) for production growth. Amizmiz (100%), their gold project, also has significant potential. It is a 350,000 oz resource at 13 gpt. That is a very good grade, and they think they can find a lot more. Plus, they have another gold project in Mauritania (Tijirit), although it currently is only 200,000 oz.

Boumadine (85% ownership) is a past producing mine (1992) with 25 million oz of silver, and growing in size. They think Boumadine could be as large as Zgounder. A PEA was recently completed that was very favorable. The PEA had an IRR of over 100%. It has a low capex of under $50 million to produce around 3 million oz AG per year. They plan to drill 36,000 meters in 2023 at Boumadine. The 2022 drill results were very good (32 meters at 1039 AGEQ).

Currently, Morocco is mining-friendly and stable, but it is in North Africa, a place of political turmoil. I’m not highly concerned about the potential political risk because, right now, it appears to be a mining-friendly location.

It is a tightly held stock, with only 116 million shares and about 50% insiders. They won’t give it away for a low premium. In fact, I don’t think the company is for sale. I’ve spoken to them, and they recognize the huge upside potential of silver and their properties.

If they keep finding high-grade silver, I think it will do well as silver prices trend. I met with the management team in 2022 at Beaver Creek and was impressed. They have a solid team. I got the impression the company was not for sale, and they plan to build a large company. I find it interesting that they are drilling a gold project in Mauritania. They might have a strategic plan to diversify outside of Morocco.

Company Info

Cash: $49 million

Debt: $100 million

Current Silver Resources: 125 million oz at 300 gpt (AG)

Current Silver Production: 1.8 million oz. (AG)

Current All-in Costs (breakeven): $18 per oz

Current FCF multiple: 90

Estimated Future Silver Reserves: 150 million oz. (AG)

Estimated Future Silver Production: 10 million oz. (AG)

Estimated Future Silver All-in Costs (breakeven): $23 per oz

Estimated Future FCF Multiple: 15

Scorecard (1 to 10)

Properties/Projects: 8

Costs/Grade/Economics: 8

People/Management: 8

Cash/Debt: 7

Location Risk: 7

Risk-Reward: 8

Upside Potential: 8

Production Growth Potential/Exploration: 8

Overall Rating: 8

Strengths/Positives

Large deposit / long mine life

Good grade

Good economics

Significant upside potential

Strong management

Pure silver play

Good location

Risks/Red Flags

Dependence on higher PM prices (for large returns)

Location risk

Could be acquired

Speculation stock (high risk)

Estimated Future Valuation ($75 Silver)

Silver production estimate for the long term: 10 million oz.

Silver All-In Costs (break-even): $23 per oz.

10M oz. x ($75 – $23) = $520 million annual FCF (free cash flow).

$520 million x 15 (FCF multiplier) = $7.8 billion.

Current FD market cap: $724 million.

Upside potential: 970%.

Future Valuation Explained

This is an estimated return and will only occur if all assumptions are correct. A more likely outcome will be something less than this amount, although it is not crazy talk to expect silver to exceed $75 or the FCF multiple to reach 15.

My All-In Costs are the expected costs that will generate FCF.

I used a future FCF multiplier of 15, which I think is conservative for my expectations. I expect them to receive at least a 15 multiple.

I used a future PM price of $75 silver because I am a long-term investor who plans to wait for higher silver prices. I expect to see this level reached within 3-5 years. In fact, I use $100 silver for valuations on my website since that is my expected future price. I tone it down a bit to $75 on Seeking Alpha, which I think is more reasonable.

It is my opinion that gold drives the silver price and that macroeconomics drives the gold price. The only reason I expect to see $100 in silver is that I expect to see at least $3,000 in gold.

A $75 or $100 silver price may seem like a pie-in-the-sky fantasy, but silver traded at $49 in 2011 when gold was at $1,935. If gold rises 50% from its current level, there is a good chance that silver will rise 150%. This is usually what happens as the GSR gets squeezed. Of course, this is an assumption.

Balance Sheet/Share Dilution

They currently have a weak balance sheet with $49 million in cash and $100 million in long-term debt. Plus, their cash balance will drop to complete their current expansion project. However, once they expand to 8M oz of annual production in 2024, I expect them to pay off their debt quickly and build their cash balance.

Risk/Reward

As I mentioned at the beginning, investing in PM miners is speculating. Why? Because one of your assumptions is bound to get flipped. The biggest risk is that PM prices won’t rise, or inflation will cause costs to rise significantly, reducing expected margins. Many things can go wrong.

One thing that could go wrong is our expectation of margins. I’m expecting large margins as silver prices rise, which will drive up their FCF. Several things could hinder large margins, one of which is politics. Morocco could raise taxes or even do some type of nationalization, such as requiring partial government ownership of all silver mines.

While the risk is high, the reward for Aya is enticing if silver prices rise substantially. Plus, if Aya finds a way to grow production beyond 10M oz annually, the reward could be even higher than I anticipate with my estimated future valuation.

I think Boumadine will add more than 2M oz to the 8M oz from Zgounder. My target of 10M oz of annual production is quite conservative. My breakeven cost target of $23 could be a bit aggressive if inflation is high.

Investment Thesis

Aya appears to be well-positioned and well-leveraged for higher silver prices. They are somewhat unique in holding very strong factors, such as high-grade, moderate costs, a good location, and a tight share structure. These factors make it very attractive, and why it is on my favorites list.

Ironically, the location actually adds to its value in my opinion. Most large silver projects are in Mexico, which has become a mining-unfriendly country. Aya provides an opportunity to diversify out of Mexico.

In the introduction, I listed my investment thesis, listing five reasons why I like Aya. You can refer to that for a review.

Strategy to Manage Risk

www.goldstockdata.com

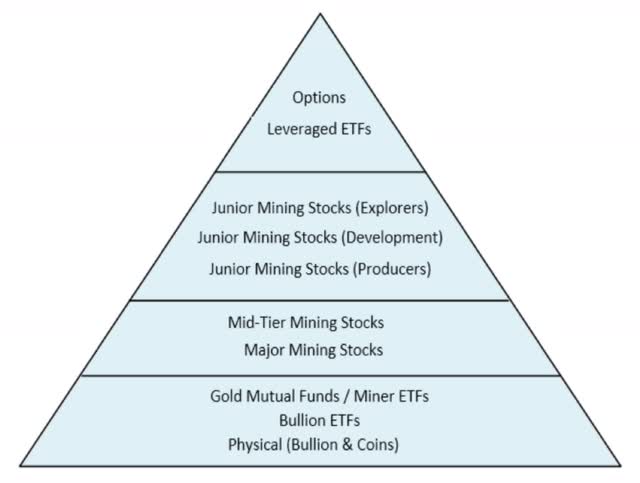

I use a pyramid approach (as discussed in my book) to manage risk, along with low allocations (normally less than 1% per individual stock), whereby I use less risky assets at the base of the pyramid and riskier stocks as I move up the pyramid.

As the shape of a pyramid implies, the bulk of my portfolio is on the lower half. This means that I hold fewer riskier stocks as a portion of my cost basis. Also, the base of the pyramid should be strong enough to withstand major corrections when the riskier stocks (exploration and development) higher up on the pyramid get obliterated (sometimes down 70% or more).

Aya fits in the lower half of the pyramid, where I accumulate quality mid-tier producers. Ironically, it is also a high-upside stock because of its moderate costs and large resources. In many respects, I think it is an ideal stock to own. Many are fortunate it is this cheap. I don’t think it will be once silver reaches $35, when it will likely double in value.

I don’t trade. Instead, I use a buy-and-hold strategy of accumulating stocks (expanding my portfolio). Sometimes I think I am more of a stock collector than an investor.

While I am constantly accumulating stocks (I currently hold over 150 stocks), I also have an exit strategy. In fact, I have an exit strategy for each stock. I often add to stocks that crash more than 50% if I still like the story, thereby reducing my cost basis.

I rarely add to stocks that fall less than 50%, unless I think I am underweight on an exceptional stock. Moreover, I always buy big stock market corrections to improve my portfolio (this is usually the best time to buy).

I currently have a list of about 10 stocks that I want to buy in the coming correction. Of these 10 stocks, about half I already own. This will improve my portfolio.

My New Investing Group is Coming this Month!

I am pleased to announce that my Investing Group, “Gold Silver Mining Ideas” will be launching on Tuesday, August 29th. This is your opportunity to interact with me directly and join my community, so save the date to sign up.

I’m creating this Investing Group to have more flexibility on what I can post. It will add a lot more value than my current posts in Seeking Alpha. It will also include an ideal portfolio using my investing strategy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here