Editor’s note: Seeking Alpha is proud to welcome Gems Capital as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

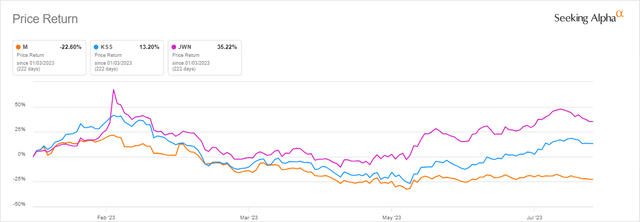

Unlike its closest two peers (Kohl’s (KSS) and Nordstrom (JWN)), Macy’s (NYSE:M) stock has been trading down for quite some time now and rather precipitously. Year-to-date, it is down ~23%.

Seeking Alpha (8-14-2023)

As detailed later in the article, Macy’s financial performance is superior to that of Kohl’s and Nordstrom. Macy’s market cap is currently ~$4.26 billion. Just the real estate assets of Macy’s, are likely worth more than the entire market cap of the Company, probably significantly more. Macy’s stock is trading very cheaply at a TTM P/E ratio of 4.09 (source: Yahoo Finance) and a forward P/E ratio of 5.28 (based on the mid-range of Macy’s revised guidance for 2023 of $2.70 to $3.20 adjusted EPS), both as of the stock’s closing price on August 11, 2023. There are some consistent encouraging signs that inflation is considerably easing and a recession now seems much less likely than previously anticipated. I expect the back half of the year to look better than its first and 2024 to be even better. In addition, Macy’s financial position is very strong with no significant maturities until 2027 and an untapped credit line of $3 billion. I rate Macy’s a buy.

The Real Estate Portfolio

It is nothing new that the value of Macy’s real estate assets is not appropriately reflected in its stock price. Seeing that locked value, in 2016 the activist fund Starboard Value tried to persuade Macy’s to engage in a series of well-thought-of transactions aiming to unlock it. Eventually, Macy’s did not engage in these proposed transactions but amid pressures to spin-off its real estate assets Macy’s named two executives to its board and management team, both with strong real estate background: in March 2016 it added William Lenehan, an expert in REITs, to its board and in May 2016 it named Douglas Sesler, a real estate investment banker, as its executive vice president for real estate. In the last 10 years, the biggest gains, by far, that were realized from Macy’s real estate portfolio were in 2017 and 2018 ($544 million and $389 million, respectively), the two years immediately following the year during which Starboard Value was active in trying to get Macy’s to unlock value from its real estate assets. Could that be just by chance? I doubt it. Those high gains from real estate sales in 2017 and 2018, years where sales fell sharply compared to the preceding two years, made a meaningful, much-needed, contribution to Macy’s bottom line.

|

Year |

Gains on sale of real estate |

|

2013 |

$79,000,000 |

|

2014 |

$92,000,000 |

|

2015 |

$212,000,000 |

|

2016 |

$209,000,000 |

|

2017 |

$544,000,000 |

|

2018 |

$389,000,000 |

|

2019 |

$162,000,000 |

|

2020 |

$60,000,000 |

|

2021 |

$91,000,000 |

|

2022 |

$89,000,000 |

|

Source: Macy’s 10-K filings |

In May 2021, Macy’s revealed a plan to revitalize its flagship location in Herald Square, Manhattan and was reportedly in talks to build a tower atop that store. Macy’s even has a website which sets forth the details of this proposed project, which can be found here. I did not find information, however, regarding any progress with respect to that plan.

In the Q1 2021 earnings call, responding to a question by an analyst, the Company spoke in some detail about its real estate initiatives. Since then, I found very little information with respect to the progress the Company made with respect to such initiatives. Given the significant drop in real estate gains realized in 2020, 2021, 2022 and Q1 of 2023 it will be interesting to have the Company discuss any progress made with the initiatives mentioned on the Q1 2021 earnings call, any new initiatives and to get some estimated timeline as to when it expects any such initiatives to be realized or start to bear fruit.

As the value of Macy’s real estate portfolio is far from being reflected in its stock price, in my opinion, extracting value from these assets should be a top priority. Whether it be (1) a straight sale (or partial sale) of such assets in their current condition, (2) a redevelopment plan that would (i) increase their value before they are sold (or partially sold); or (ii) create a new source of income to the Company from rent for many years to come, (3) a size reduction of stores enabling to sell or rent out the remaining space, and any other creative idea that could increase gains from sales of real estate, generate new sources of income from rent or bring to light the actual market value of its real estate assets, such as partial sales of its real estate, as proposed at the time by Starboard Value, that would convincingly and unequivocally expose the real market value of these assets.

Capital Expenditures & Financial Position

In the Q4 2022 earnings call, it was said that:

Over the next 3 years through 2025, we expect to spend up to $3 billion in total capital expenditures focused on digital and technology investments, data and analytics, supply chain modernization and omni-channel capabilities, including our growth vectors.

$3 billion of capital expenditures over 3 years is a hefty amount, although the Company said “up to $3 billion” so that leaves a room for lower expenses. The Company suffered from a decline in sales in Q1 of 2023, a considerable part of which could probably be attributed to the recent high inflation rates which had not been seen in the US in decades. Due to this and other macroeconomic pressures, Macy’s concluded Q1 of 2023 with negative free cash flow and I suspect would probably conclude Q2 of 2023 the same way. Should significant growth in sales not be evident starting from Q3 of 2023, Macy’s would not be able to continue financing its ambitious capital expenditures from its own sources without taking out additional loans or drawing down on its asset-backed line of credit. There are reasons for optimism though that the back half of 2023 will look nothing like its first half as inflation rates are continuously showing signs of slowing down meaningfully and a recession today seems far less probable than it did just up until a short while ago.

Macy’s financial position, albeit the recent weakness from top to bottom in its financial results, is still very strong. It has no significant maturities until 2027 and it has an untapped $3 billion line of credit it may draw down upon. Also, according to Macy’s latest 10-K, “At January 28, 2023, no notes or debentures contained provisions requiring acceleration of payment upon a debt rating downgrade.” This adds another layer of comfort to its financial resilience.

The Retail Operations

Macy’s business is susceptible to high inflationary environment and inflation in 2022 went through the roof. It is likely that the COVID stimulus checks provided some counter weight against the negative effects of the extremely high inflation rates – to what extent? I really cannot tell. And still, since inflation rates reached levels that had not been seen in decades and coincided with other macroeconomic headwinds, I would not look at 2022 and the first half of 2023 as a period fairly representing Macy’s ability to grow its overall business in general and its digital business in particular.

Macy’s has been in the forefront of digital innovation for years. Macy’s told investors in August 2021 that it expects its digital sales for 2021 to be between $8.35 billion and $8.45 billion, after increasing almost twofold in the past four years and, as it seems, it aims to keep pushing hard in this direction. Only time will tell whether these efforts will pan out. Although some benefits from the (up to) $3 billion of capital expenditures over the years 2023 to 2025 may be realized along the way, I believe that only in 2026-2027 the market will be in position to fully evaluate the outcome of that investment. 2026-2027 is a long time from now and I think it’s imperative that steps will be taken in other directions as well to reduce the effects of the ambitious capital expenditures on the Company’s free cash flow and to support long-term value creation.

Macy’s executive team seems energetic and creative. They always seem to be on the lookout for opportunities to add popular brands, customize offerings, improve inventory and supply chain management, enhance its digital capabilities and cut costs wherever possible. To that effect, it was mentioned in the Q1 2023 earnings call that the Company sees an incremental $200 million of cost savings for 2023 versus its prior outlook and that for 2024 it estimates the savings to be between $300 million and $350 million. It is encouraging to learn that along the way, the Company manages to find pockets of expenses that could and would be meaningfully reduced.

Stock Repurchases

The stock trades very cheaply in the market at a current TTM P/E ratio of 4.09 (source: Yahoo Finance) and a forward P/E ratio of 5.28 (based on the mid-range of Macy’s revised guidance for 2023 of $2.70 to $3.20 adjusted EPS), both as of the stock’s closing price on August 11, 2023. It should also be taken into consideration that such forward P/E ratio is based on the expected results of a particularly bad year caused by abnormal inflationary pressures along with other macroeconomic headwinds. As there are some consistent signs that inflation is considerably easing and that a recession is much less likely than previously anticipated, I think it makes a lot of sense for the Company to start drawing down on its credit line as soon as possible in order to commence accumulation of its own shares by executing buybacks and keep doing so for as long as the stock price remains depressed.

The Company mentioned in its latest quarterly report that during that quarter it repurchased ~1.4 million shares for a total of ~$25 million. As of the end of its latest reported quarter, the Company had $1,375 million available for repurchases under its share repurchase program.

$25 million of stock buybacks represents approximately 0.5% of the Company’s outstanding shares. Such rate of quarterly repurchases reflects an extremely slow pace, which would have very little impact on the earnings per share and could hardly, if at all, provide a tailwind to the stock price in the market, given the extraordinarily high tradability of Macy’s shares. There is no information about the exact timing of the buybacks, but even if the entire 1.4M shares were bought back in a single trading day these would have been quite easily absorbed by the massive average trading volume in the Company’s stock leaving little room, if any, to create an upward pressure.

The market gains very little from knowing that the Company has a repurchase program in place and/or how much is still available under such program if no indication when and to what extent the Company expects to execute on this program. Companies could go on for years with a repurchase program authorizing it to buyback a large chunk of shares without utilizing it or just making a marginal use of it. Kohl’s, perhaps Macy’s closest peer, for instance, provides in its annual reports expectations as to the value of buybacks it intends to execute in the coming year.

In April 2021 Kohl’s entered into a settlement agreement with an activist investor – Macellum Advisors (and certain other investors), which included an expansion of Kohl’s repurchase program to $2 billion. Kohl’s 2021 annual report revealed that it bought back an astounding number of shares for a total value of $1.4 billion that year. In February 2022, Kohl’s board of directors increased the remaining share repurchase authorization under its existing share repurchase program to $3 billion. Kohl’s 2022 annual report revealed that it repurchased shares worth $658 million that year.

I assume the much greater scope of repurchases by Kohl’s in 2021 and 2022 was a result of pressures by investors. The outstanding number of Kohl’s shares decreased by a staggering ~30% from March 10, 2021 to March 8, 2023. Should Kohl’s find ways to unlock value from its real estate portfolio and improve its operational performance, that sharp decrease in the outstanding number of shares could contribute immensely to value creation for its long-term shareholders.

I cannot overstate the importance of Macy’s finding ways to (1) extract meaningful cash flows from its real estate portfolio while capital expenditures keep piling up until the end of 2025, and (2) engage in redevelopment plans, such as the one envisioned for Herald Square (as described above), to enhance the value of its crown jewel real estate assets and potentially create meaningful sources of ongoing rent income for many years to come. If both the planned capital expenditures and comprehensive redevelopment plans for its most valuable real estate assets, which I hope Macy’s will engage in, bear fruit then the reward to patient long-term shareholders could be substantial. Meaningful buybacks of its shares in the meantime could make it tremendous.

Macy’s Is Greatly Undervalued

Sophisticated investors are well-aware of the continuous discrepancy between Macy’s depressed stock price and the Company’s intrinsic value. Over the years, there have been numerous attempts by activist investors to buy blocks of Macy’s shares with the aim to push the Company to implement plans that would unlock significant value for the benefit of Macy’s shareholders. Thus far, it seems as if such efforts yielded limited results, except the substantial rise in real estate gains in 2017 and 2018 that could perhaps be attributed to Starboard Value’s moves in 2016.

In 2017, Macy’s was reportedly in talks with Hudson Bay regarding a possible takeover. As mentioned earlier in this article, a year earlier it was the activist investor Starboard Value which tried to get Macy’s to spin off its real estate assets. In Q3 of 2021 activist investor Jana Partners built a position in Macy’s and tried to push Macy’s to spin off its e-commerce business into a standalone company. That move came after earlier that year Saks Fifth Avenue spun off its digital business at a valuation equal to ~2X sales.

Interest rates are still high, and that, too, weights heavy on consumer discretionary retailers, such as Macy’s, but I believe the considerable inflationary decline (provided that inflation would not abruptly change course) will support Macy’s financial performance starting in Q3 2023 and that performance would be further boosted by a decline in interest rates, which I believe would start taking place somewhere in the first half of 2024 (assuming inflation does not get out of hand again).

The speed at which inflationary pressures have eased and other macroeconomic concerns have subsided in the first half of 2023 would hopefully allow Macy’s to meaningfully beat its guidance for 2023, particularly since Macy’s decided it would be appropriate to take a conservative stance by revising its 2023 guidance, as announced in its Q1 2023 earnings call. That revised guidance weighs heavy on Macy’s stock price, as it considerably lags its closest peers since then, as demonstrated in the chart below.

Seeking Alpha (8-14-2023)

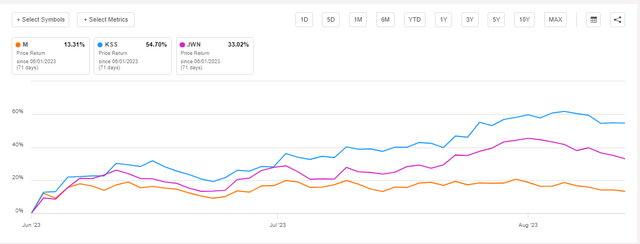

The flip side of Macy’s conservatism, however, is that it has a spectacular record beating its quarterly EPS consensus estimates and EPS surprises would likely provide a tailwind to its stock price. Macy’s beat all its quarterly EPS consensus estimates since Q2 2019. That means that it did that 15 times in a row. None of its peers listed above has such a stellar record. I like Macy’s management’s transparency, even in hard times, and its conservative approach. I always prefer managements to under promise and over deliver than the other way around.

Also worth noting is Macy’s stability in being profitable. Macy’s has been profitable since Q4 2020, following the initial shock of the pandemic. Kohl’s, in contrast, had a massive loss of $2.49 per share in Q4 2022 while missing consensus estimates by a whopping $3.47 per share. In addition, Kohl’s ended full year 2022 with a slump of nearly 7% in revenues compared to 2021 while Macy’s revenues remained nearly unchanged. Kohl’s is likely the closest peer to Macy’s as it, too, has a very valuable portfolio of real estate assets.

As of the close of trading on August 11, 2023 Kohl’s traded at a forward P/E of 11.6 (based on the mid-range of Kohl’s guidance for 2023 of $2.10 to $2.70 adjusted EPS) – more than double that of Macy’s. Kohl’s real estate value was estimated in 2022 to be worth $6.2 billion. Cowen, the investment banking and research firm, estimated Macy’s real estate value in 2022 to be between $6 billion and $8 billion.

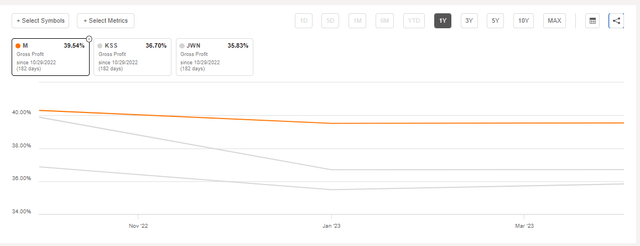

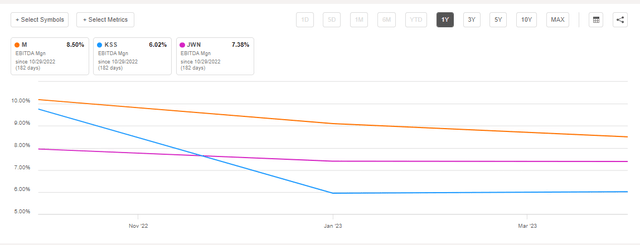

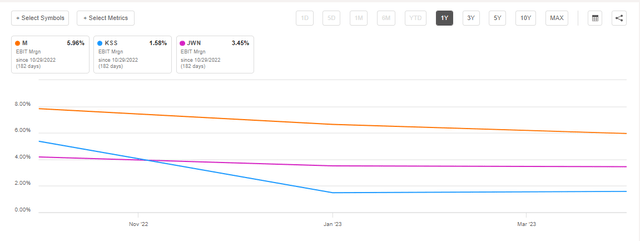

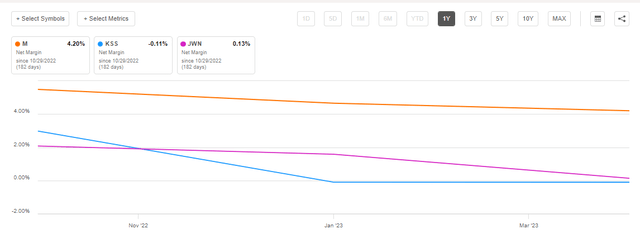

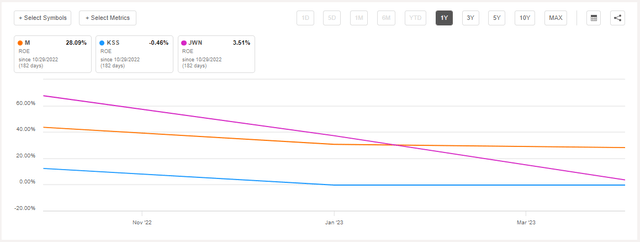

It seems rational that Kohl’s would have a high forward P/E relative to its sector’s growth prospects given the substantial value of its rich real estate portfolio. It seems irrational, however, that Macy’s would have a much lower forward P/E than Kohl’s has, since Macy’s real estate portfolio appears to be at least as valuable as that of Kohl’s and Macy’s financial performance is superior, as demonstrated in the charts below. If anything, Macy’s is the one which should have a higher forward P/E.

Nordstrom, which is probably the second closest peer to Macy’s, as of the close of trading on August 11, 2023 had a forward P/E of 10.66 (based on the mid-range of Nordstrom’s guidance for 2023 of $1.80 to $2.20 adjusted EPS) – again, more than twice that of Macy’s. Macy’s financial performance is superior to that of Nordstrom, as displayed in the charts below, and Nordstrom does not seem to have a real estate portfolio as valuable as the one Macy’s possesses.

Seeking Alpha (8-14-2023) Seeking Alpha (8-14-2023) Seeking Alpha (8-14-2023) Seeking Alpha (8-14-2023) Seeking Alpha (8-14-2023)

Based on the above, I conservatively assign a value of $32.83 for Macy’s stock. I reached that value by multiplying the mid-range of Macy’s revised guidance for 2023 (which is $2.95 adjusted EPS) by the average of the forward P/E multiples of Kohl’s and Nordstrom (which is 11.13). Using Cowen’s 2022 low end of the range for Macy’s real estate ($6 billion), these assets contribute ~$22 per share (based on the number of Macy’s outstanding shares as reported in its latest 10-Q filing), which provide a decent margin of safety.

Potential Catalysts

Kohl’s has been courted by numerous suitors for a while now. Should it strike a deal to be taken over or to spin off its real estate portfolio (or some of it), most likely much greater value will be assigned to that portfolio than the value currently given to it by the market. Any such transaction would almost inevitably positively affect the value attributed by the market to Macy’s real estate assets which will likely lead to a spike in Macy’s stock price. The courting of Kohl’s by various large investors further proves the same point with respect to Macy’s undervalued real estate as Kohl’s, too, has a rich portfolio of real estate assets. Kohl’s was pursued by numerous investors in 2022 but thus far none of these have come to fruition. Activist investor, Macellum Advisors has been a long-time suitor of Kohl’s and even launched in 2022 a proxy contest aiming to replace board members with its proposed slate of directors. It was not successful but Macellum still holds a large chunk in Kohl’s shares (close to 5%) as of its latest 13F filing.

A boost to Macy’s stock could also come from a spin off of Macy’s crown jewel assets and/or partial sales of these assets and/or comprehensive redevelopment plans with respect to these assets that would generate a meaningful stream of income from rent for many years to come.

Some other trigger to a spike in Macy’s stock may originate from campaigns by activist investors that see the discrepancy between Macy’s depressed market value and its intrinsic value and believe they could come up with a formula that would close, or at least minimize, the gap between the two.

Another scenario that may cause Macy’s stock to soar, although currently it may seem quite remote, is that Macy’s may be taken over by one of the biggest e-commerce players in the market as part of a consolidation of the so-called bricks and clicks. That possibility was rumored in 2020. I believe, such scenario could become more realistic should Macy’s manage to increase its digital sales so that they would comprise at least 50% of its overall sales while its total annual sales be beyond $25 billion.

Risks To My Thesis

Although the current trend indicates a significant decline in inflation, it is still possible that inflation will change course and get out of hand again. That by itself would likely lead to softer consumer demand for many of the products Macy’s sells. In addition, a probable result of an unexpected hike in inflation would be that interest rates will remain elevated longer. That, as well, would have a negative effect on Macy’s. Another risk is that the ambitious capital expenditures plan for 2023 to 2025 will likely not yield meaningful improvement in financial performance. In the short term (circa 1 to 1.5 years) I would consider re-rating Macy’s should a clear trend develop in an improved macroeconomic environment indicating lower gross margin, lower adjusted EBITDA margin and lower adjusted EPS, all compared to 2022. In the longer term (circa 3 to 5 years), I would consider re-rating Macy’s should by that time there should be no substantial reduction in the outstanding number of shares (unless by that time Macy’s would trade at a much higher P/E ratio) and should no meaningful plans to extract substantial value from its real estate portfolio be realized.

Conclusion

I think the back half of 2023 will likely look nothing like its first half and that Macy’s will beat its revised guidance for 2023 with flying colors. I believe at least one of the potential catalysts I described may pan out in the next 2 to 3 years. Now that the stock price is still greatly depressed while most of the macroeconomic dark clouds seem to have dissipated with a clearer view of the others probably dissipating in the foreseeable future, there is a fertile ground for activist investors to pick up large chunks of stock in the market. In addition, I believe that should Macy’s engage in an extensive buyback, such as the one Kohl’s engaged in, where over a period of 2 years it reduced its outstanding shares by roughly 30%, long-term shareholders would benefit immensely. In my opinion, drawing down on Macy’s $3 billion credit line in order to advance repurchases on a massive scale for as long as the Company’s stock price remains depressed would be a proper use of that credit line, given Macy’s financial resilience. Last, but definitely not least, Macy’s real estate portfolio provides a margin of safety. I rate Macy’s a buy.

Read the full article here