Investment thesis

Camtek Ltd. (NASDAQ:CAMT) is one of the hottest stocks of the past decade, with above 2,500% stock price appreciation. Indeed, it is a high-quality business with solid revenue growth and margin expansion. The company fuels its impressive growth with constant innovation, a must-do in the highly competitive industry CAMT operates. The management looks strong and conservative, maintaining solid profitability despite the current temporary revenue dynamic weakness. The company’s balance sheet is a fortress and ensures that CAMT has sufficient resources to weather the storm over multiple quarters. But the valuation also looks too generous after a massive year-to-date rally. The stock now trades very close to all-time highs, and I would not recommend investing at this price since my analysis suggests a substantial overvaluation. That said, I assign CAMT a “Hold” rating.

Company information

Camtek is a developer and manufacturer of high-end inspection and metrology equipment for the semiconductor industry. The company’s systems inspect and measure integrated circuit [IC] features on wafers throughout the production process of semiconductor devices, covering the front and mid-end and up to the beginning of assembly. Camtek’s systems inspect wafers for the most demanding semiconductor market segments.

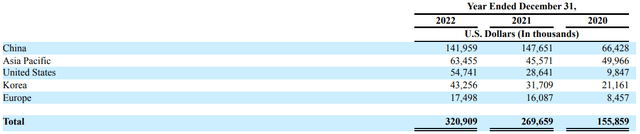

The company’s fiscal year ends on December 31. CMAT is incorporated in Israel. According to the latest 10-K report, 44% of the total sales were generated in China in FY 2022.

CAMT’s latest annual SEC filing

Financials

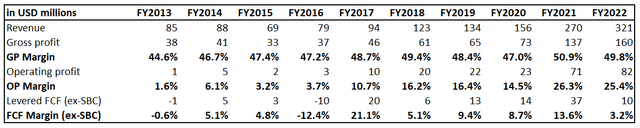

The company demonstrated stellar 16% revenue CAGR over the past decade, with profitability metrics expanding notably.

Author’s calculations

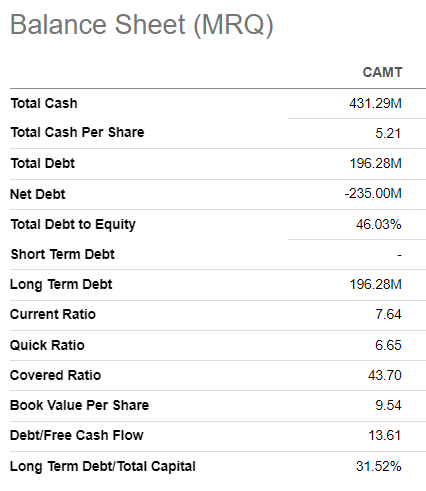

The gross margin has been stable and close to 50%, while the operating margin expanded from almost zero to an impressive 25%. The FCF margin has been volatile over the decade, though consistently positive in the last six years. Strong profitability metrics enable the company to sustain a strong balance sheet. As of the latest reporting date, CAMT had a substantial net cash position of above $200 million and wide liquidity metrics. Leverage ratios also look prudent, as well as the covered ratio.

Seeking Alpha

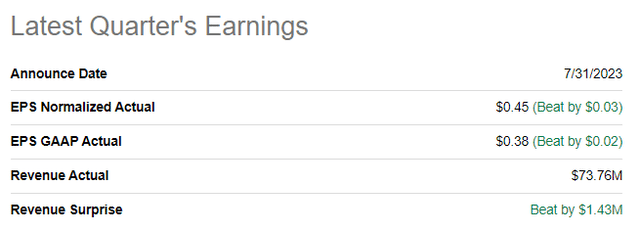

The latest quarterly earnings were released on July 31, when CAMT topped consensus estimates. Despite a 7.3% YoY revenue decline, the bottom line demonstrated resilience as the adjusted EPS declined by just a cent. Though the sequential dynamic was positive, the gross and operating margins shrank YoY.

Seeking Alpha

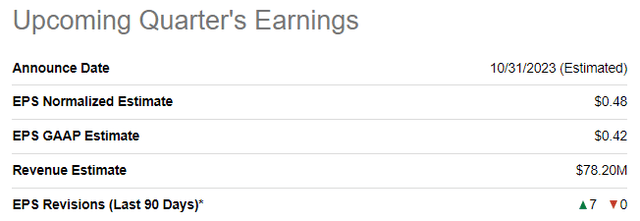

The upcoming quarter’s release is scheduled on October 31. Quarterly revenue is expected at $78.2 million, meaning a 5% YoY decline due to macro headwinds. Despite the expected revenue drop, the adjusted EPS will stay flat YoY.

Seeking Alpha

Overall, I think the company operates in an industry expected to grow double digits over the long term. Fortunebusinessinsights.com projects that the industry will compound at 12.2% annually up to 2029, a favorable secular tailwind for CAMT. It is also important to emphasize that CAMT has solid room for profitability improvement as revenue costs are only partially affected by sales volume. The business will likely enjoy the economies of scale effect as revenue expands. According to the latest annual SEC filing, CAMT’s market is highly competitive. Still, I think the management understands the importance of innovating and allocates substantial resources to R&D. The solid track record of revenue growth and wide operating margin suggests that the company is on the right path of competing effectively. That said, the business is well-positioned to capture the broad semiconductor market’s growth.

Valuation

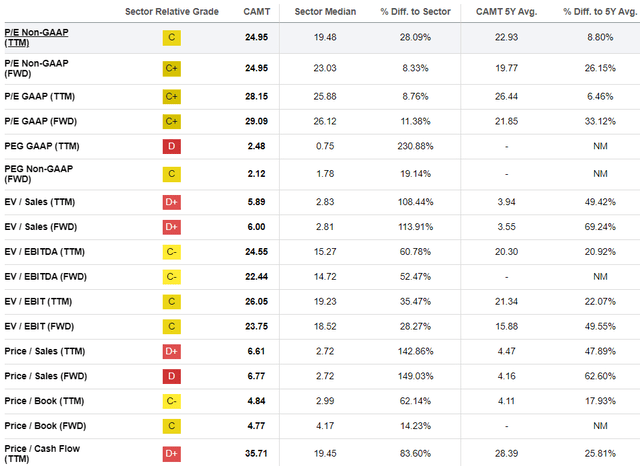

The stock more than doubled in price year-to-date, meaning significant outperformance of the broad market. Seeking Alpha Quant assigns the stock a relatively low “C-” valuation grade. Indeed, multiples are substantially higher than the sector median and historical averages. The stock currently trades close to late 2021 all-time highs.

Seeking Alpha

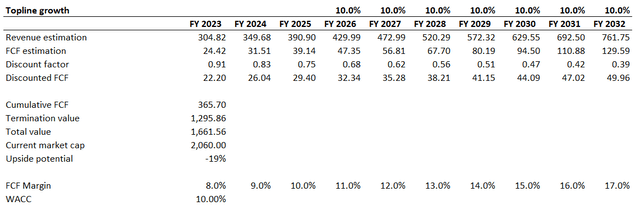

Discounted cash flow [DCF] valuation approach is the most appropriate for growth companies like CAMT. I use a 10% WACC as a discount rate. I have revenue consensus estimates available up to FY 2025 and incorporate a 10% CAGR for the years beyond. I use the past five-year average for the base year FCF margin and expect it to expand by one percentage point yearly.

Author’s calculations

According to the DCF model, the stock is about 20% overvalued, given the approximately 11% revenue CAGR assumption for the next decade. The company’s net cash position of $235 million makes the fair value closer to the current market cap. Still, the business’s fair value will be lower than the market cap.

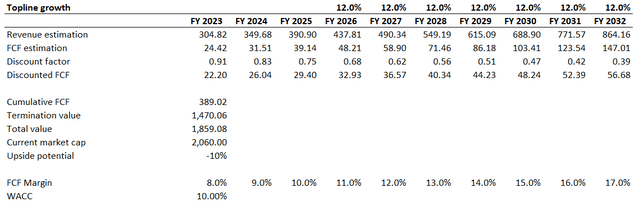

The DCF template is very vulnerable to changes in revenue growth rate. If I implement a more aggressive 12% revenue CAGR between FY 2026-2032, the upside potential would still be limited, if any. That said, the stock does not look attractive at the current price.

Author’s calculations

Risks to consider

As a growth company, CAMT faces the risk of underperforming the expected revenue and profitability growth, priced into its current market cap. Any signs of revenue growth pace deceleration or profitability metrics decline will lead to investors’ disappointment and can lead to a massive stock sell-off. As a small-cap growth stock, CAMT is vulnerable to the overall market sentiment. For example, despite solid revenue growth and profitability metrics expansion in FY 2022, the stock experienced a massive sell-off due to the broader U.S. stock market weakness. The share price halved from its late 2021 peak by the end of 2022. That said, CMAT investors should be ready to tolerate the short-term volatility inherent to this stock.

Having a substantial portion of the revenue generated in China also looks risky to me. While China has no geopolitical tensions with Israel, there is an apparent “cold war” between China and the U.S. Being one of the closest U.S. allies, there is a risk that some geopolitical tensions between China and Israel might eventually arise. While I consider this a remote risk, the adverse impact of this risk will be massive as the company generates almost half of its revenues in China.

Bottom line

To conclude, Camtek stock is a “Hold” for me at this share price level. My DCF analysis suggests the stock is about 20% overvalued, even with optimistic assumptions priced in. I like this business and the management’s prudent approach with steady revenue growth, constant innovation, and a clean balance sheet. Secular trends are also favorable for the company, but I have a high conviction that there will be more attractive entry points, therefore, I prefer to wait on the sidelines.

Read the full article here