Dear readers/followers,

It shouldn’t surprise you at this point that I favor investing in quality dividend stocks that have through-cyclic safety. While I do invest in cyclical companies, I try to make sure that these companies come at very high cyclical safeties, meaning that you have some sort of a baseline dividend. Aside from this, credit ratings should be high, and you should feel safe, based on the asset quality, that you’re not exposed to anything that’s likely to massively plummet in value.

While Hydro (OTCQX:NHYDY) is certainly a volatile business because it’s exposed to the ups and downs of the sector, it’s far from any sort of bad company. I have made returns in the triple digits, as you can see here (Source) with this investment, though I don’t believe that the company has a really massive upside from the current valuation.

Let’s see what we have going for us as we move into 3Q23, and what we could expect from Hydro on a forward basis.

Norsk Hydro – Plenty to like about Aluminum, just not the valuation

2Q23 results are the latest set of results we have. This quarter saw, as before, cash flow in the billions of NOK, and an adjusted RoACE on a good level – above 13.5%. Given the cyclicality we’re going into, this is good.

Hydro’s appeal overall has been its entry into “green” aluminum coupled with legacy operations. Green aluminum not necessarily because I am an ESG investor, but for the same reason I believe green investments in Europe are actually not a bad idea. Because the EU is already taxing non-ESG-adjusted resources and basic materials at a high level, this makes it “easy” to choose suppliers like Hydro, which in turn enjoy significant sales upsides over time in home markets.

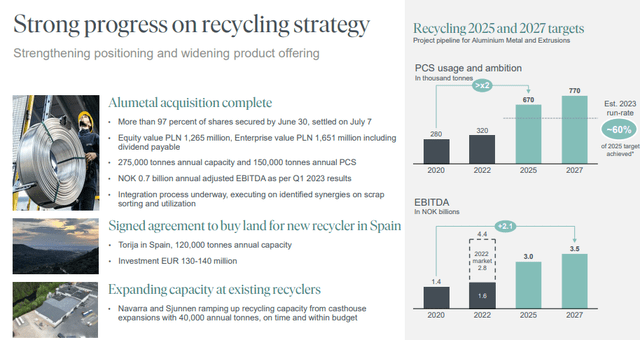

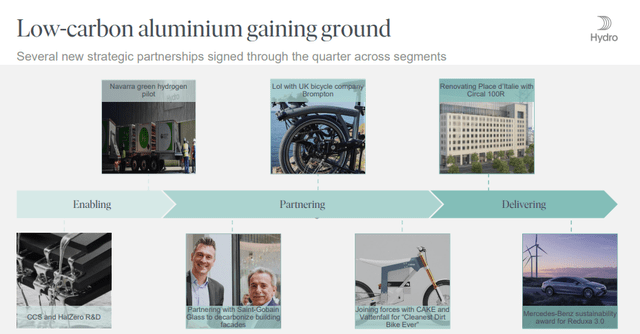

Hydro has delivered good progress in this quarter on its low-carbon aluminum alternatives, and its M&A of Alumetal significantly strengthens its position in aluminum recycling. Plenty to like there.

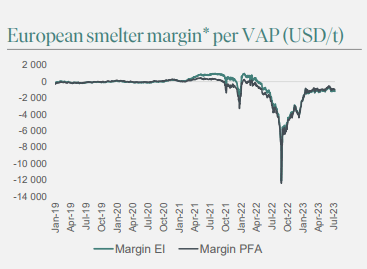

The company also increased, on the negative side, its CapEx estimate, due to investments, FX, and inflation, which are heavily impacting things. The market balance overall, especially smelter margins, is preparing to decline due to weaker demand in most Western markets.

Hydro IR (Hydro IR)

Hydro, to remind you, has been selling a lot of aluminum to China. The Chinese market, due to the decline in property, has gone down. There is also Russian metal inventories, where availability is growing leading to a current supply/demand imbalance on the negative side. Since May of 2022, for about a year, this has seen declining Aluminum prices. We’re not down to a 2020 level just yet – not at this time, at least. But we’re certainly down from previous high levels. And with the Geopolitical macro, we seem to be seeing an increase in Russian primary aluminum export.

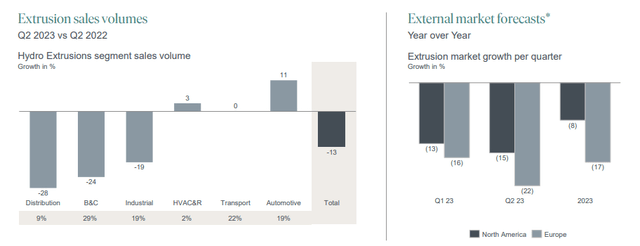

For Hydro-specific segments, there are improvements and positives worth noting. First among them is the improvements in Automotive in the extrusion segment – though the segment is still up, market down for other demand forecast declines, from the industrial B&C, and Distribution sectors. So automotive is almost the only thing that’s “up”.

NHY IR (NHY IR)

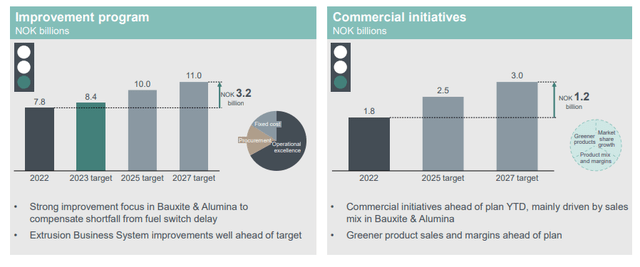

The important thing, if you’re looking to invest in Hydro, remains to keep your eye on the “ball” here, in this case, the company’s long-term 2025E goals. These goals include diversification and leadership/strong market position in both low carbon alu and new energies.

The improvements to these goals, that’s working out. The company’s improvement programs are above expectations, and overall it’s just very impressive how quickly Norsk Hydro has turned this “ship” around. I say that because I remember not that many years ago when the company was being discussed by analysts of being “done”, due to the scandal with Alunorte. This has obviously not become the case.

Norsk Hydro IR (Norsk Hydro IR)

This has also driven improvements in the extrusion segment, despite lower demand, due to the company introducing segment improvements on the margin side. The greener product offering is also a net positive here due to better sales. Improvements have come from restructuring, better SG&A, procurement improvements, and operational improvements.

Recycling is another segment I really want to highlight for the company because it’s working so well.

NHY IR (NHY IR)

I expect the recycling segment to become a major contributor to overall company profit on the longer term – and one of the recycling plants is actually less than 15 minutes away from where I grew up.

Meanwhile, when I started reviewing Norsk Hydro, low-carbon alu was still very much in its infancy. In the course of only a few years, it’s become one of the hottest things in the entire industry – and partners seem to be lining up for the company.

NHY IR (NHY IR)

The company also still has ongoing renewable segments with its Hydro Rein segment. The long-term plan is a solid portfolio of renewable generating assets, both on the offshore wind (potentially), onshore wind and solar. The company has already acquired four solar projects across Scandinavian with a combined capacity when finished of upwards of 800 Mw.

On a high level, results were good, despite lower prices, higher fixed costs, higher debt costs, and FX not being able to weigh up the positives from energy pricing, improving margins, and efficiency gains. The company is lifting its guidance, and the plans going forward remain the same. Working capital/operating capital is also seeing improvements, and though the company’s net debt/EBITDA actually increased both due to dividends (almost 11.5B NOK) and adjustments of around 4.6B NOK, it’s still not at anything close to a worrying level.

Instead, what I would keep an eye on is to see if those extrusion margins and income levels are actually sustainable. That was a big surprise for me in this quarter, as I expected them to be worse. However, due to strong efficiency and strong savings, the company actually did very well here.

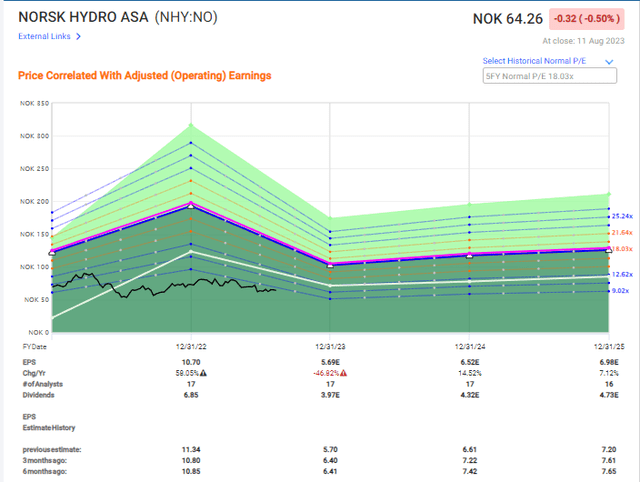

We need to be clear that we’re going into a “downcycle” with the company actually going down in terms of earnings here. The forecasts currently confirm this (if you believe them). The 2023E EPS on an adjusted basis is set to decline by more than 45% (Source: FactSet). What happens beyond this is then a question of your outlook. The average estimate from the same analyst is an average reversal of around 7-8% per year until 2025E. Me, I say that’s only likely in part – and I derive this from the fact that Hydro almost can’t be accurately forecast at any historical point in time.

Let me show you what I mean in the valuation section.

Hydro – Valuation remains high for what’s ahead, but I still say “BUY” on the long-term upside.

If you recall my last article on the company, I did call it attractive and gave it a 68 NOK share price. I just didn’t call it “cheap”. I’m not shifting my price target in this article, despite the outlook for what can only be considered a rather significant drop in income.

What I mean when the company isn’t forecastable is that only 6-17% of the time, analysts are able to accurately forecast this company with any sort of accuracy even with a 10-20% margin of error. At other times, we have misses close to the triple digits both on the negative and the positive side. Such beats are not necessarily a positive to me, it just implies that the company is hard to forecast – as this one actually is.

To put this into context, NHY is expecting a -13% average EPS growth rate until 2025E – though that’s from a current level of nearly 11 NOK/share on an adjusted basis.

NHY Valuation (F.A.S.T graphs)

As you can also see, the company hasn’t really seen any sort of growth inv valuation due to its 2022A results. Most of those came well ahead of the record results, only to drop down. I, therefore, believe that it would be exuberant to expect the company to significantly go upward to normalize at 15-18x from here on in terms of P/E.

Instead, I would forecast it closer to 10-12x P/E. 12x P/E would be the most I would see as realistic here, and that upside implies annualized RoR of just above 15%, with a PT of around 79 NOK based on a 2025E 12x P/E.

S&P Global analysts give the company an average share price of 55 NOK on the low side and 100 NOK on the high side. I remind you at this point, that I invested in Hydro at below 27 NOK and held to a return above 170% of that valuation before I sold the lion’s share of my investment. Compared to the over 6% I held at the time, I’m currently below 1.5%, and I have no intention of massively increasing my stake here.

Out of 14 analysts, only 4 give the company a “BUY” – most are at “HOLD” or similar. That’s not to say Hydro isn’t massively overvalued here – if it was, I wouldn’t have my “BUY” target or my “BUY” Rating.

But it’s far from the most appealing, or even any significantly appealing investment here at this time.

At above 68 NOK, the thesis with a double-digit upside falls clearly apart as I see it. You just can’t easily make that upside there if you buy at 70 NOK, even if the company realizes the current forecast.

If you invest in Hydro, you should focus on the fundamentals and the valuation of the company. Going by DCF or other forecast methods really doesn’t work, especially once you start ratcheting up that share price. For guidance as to what can happen in negative times, just look at how deeply the company fell during “bad” times. It could do so again.

That’s why I focus very clearly on buying this company only at cheap pricing – and if I can’t, I’m willing to wait.

So while I do say “BUY” here – and I do – I also say to look at other alternatives.

Thesis

- Norsk Hydro is currently close to fairly valued to normalized future earnings and my new improved price target going into 2Q23.

- The potential returns from today’s levels are now acceptable compared to what other investment alternatives in the market offer us.

- At its current valuation, Norsk Hydro is a bare-bones “BUY” with at least the beginnings of what I consider to be an attractive upside. The price target is 68 NOK.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I can’t call Hydro “cheap”, but I am calling it “attractive” here even after a slight drop after my last articles.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here