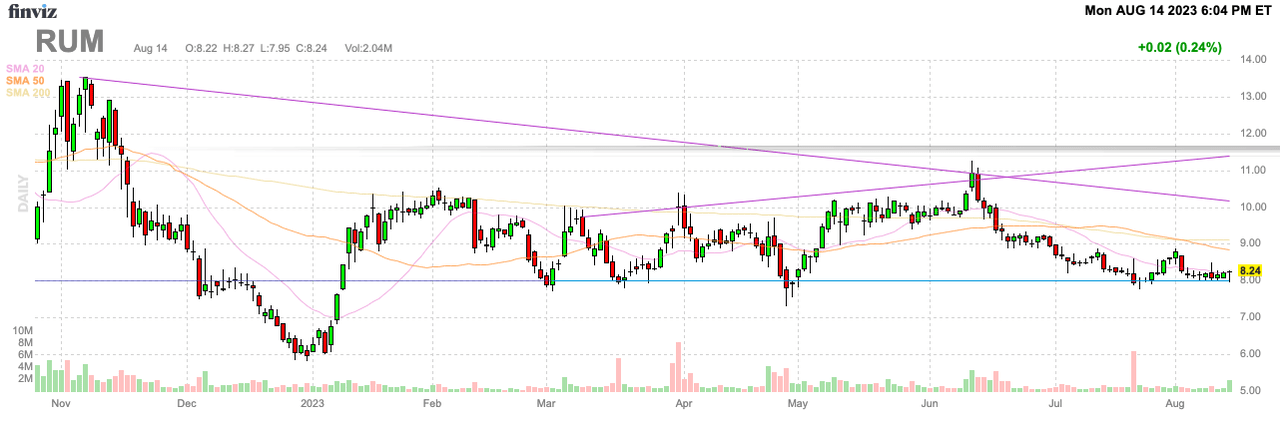

Rumble Inc. (NASDAQ:RUM) continues to offer a lot of promise as a free speech platform and YouTube competitor, but the company is now running into massive growing pains. The user base continues to collapse and content costs are spiraling higher. My investment thesis remains Bearish on the stock up above $8.

Finviz

Mixed Results

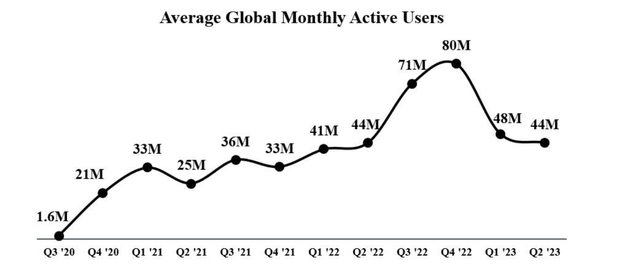

Rumble continues to report very negative user numbers, with monthly active users (MAUs) down 4 million from the prior quarter. The video streaming site peaked at 80 million MAUs back in Q4’22 and only reported 44 million MAUs in Q2.

Rumble 10-Q

On the flip side, Rumble reported usage metrics suggesting a hardcore user base is even more active. The Minutes Watched Per Month grew by 46% to 11.8 billion. The hours of video uploaded grew by 48% to 13,229. Both metrics reported solid growth from Q1.

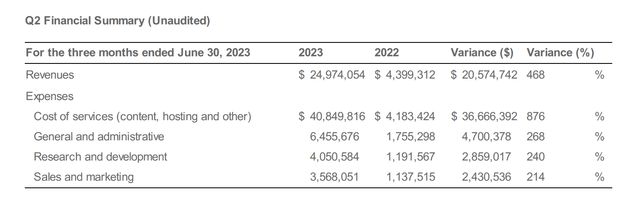

The higher usage and better monetization led to Rumble reporting record revenues of $25.0 million. The company jumped substantially above the $17.6 million reported in Q1.

Rumble Q2’23 earnings release

Ultimately, the business will grow based on usage metrics, but Rumble has capped upside without MAU growth. The U.S. and Canada MAUs are stuck at only 28 million during a period where other social media players were still growing much larger user bases.

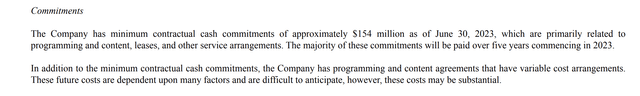

If the flat-to-down MAUs weren’t bad enough, the weakness comes during a period where Rumble has aggressively added new content creators. The company has now committed $154 million in cash via contractual deals, up nearly $100 million from just $68 million in Q1.

Rumble Q2’23 10-Q

Management continues to push how Rumble doesn’t have to invest a substantial amount of capital to build the platform and the benefits of free speech, but the company is still aggressively paying for programming. The original premise of the platform was that creators would flock to Rumble, but the reality appears they only show up when the company makes huge cash commitments.

The costs have soared in the quarter. Whether or not Rumble has huge capital commitments, the company has seen expenses soar from just over $8 million last Q2 to over $54 million in the last quarter. Rumble added about $20 million in revenues YoY, while the costs grew twice as fast.

The cost of services actually grew 10x in the quarter to nearly $41 million. All of these additional costs weren’t due to higher MAUs flooding to the video streaming service, with user flat YoY to only 44 million.

In the last quarter, Rumble announced the following content creators:

- Bare Knuckle Fighting

- JiDion

- Kai Cenat and iShowSpeed

- Mizkif

- Robert F. Kennedy Jr.

The company is spending double on costs in comparison to additional revenues. The cash balance has slipped below $300 million after Rumble burned $30 million during the quarter, highlighting one of the primary concerns of competing with a platform like YouTube with a parent like Alphabet (GOOG, GOOGL) with over $100 billion in cash.

Stretched Valuation

The major problem with the stock all along was the relatively high valuation for the expected revenue base. The Q2 results reinforce this situation.

The stock is worth $2.3 billion now, and the company has shown no ability to scale the platform outside of buying programming. The prime point to the business doesn’t appear to exist. The goal was for content creators to flood the platform for the free speech aspect, when the reality is that they are only showing up for the cash commitments.

Rumble reported a massive loss when analysts were only forecasting a $0.02 loss in the quarter. Revenues actually smashed analyst estimates at only $20 million, but this amount isn’t going to matter with the cash position and burn rate.

The video streaming platform now needs to prove the ability to add low-cost programming to drive user growth. The addition of overnight sensation Oliver Anthony is the prime example of the opportunity ahead, but Rumble needs homegrown talents that don’t come with huge price tags.

Takeaway

The key investor takeaway is that investors should work for a better value on Rumble Inc. The video streaming platform still offers a lot of potential, but the financials are very upside down and the company has a big user problem to justify a premium valuation.

Read the full article here