Datadog (NASDAQ:DDOG) provides the observability and security platform for cloud applications used by IT engineers. They were initially founded as an IT infrastructure monitoring company and later expanded into application performance monitoring, log management, and cloud security under a unified platform. In Q1 FY23, their total annual revenue run rate exceeded $2 billion for the first time, making them one of the fastest-growing SaaS companies.

I believe that AI adoption can accelerate the demand for Datadog’s solutions. More importantly, I anticipate that AI will transform Datadog’s platform from observability to automated remediation. Although it’s still in the early stages, AI technology’s rapid evolution positions Datadog to leverage their vast data sets across every layer of the stack, propelling their platform to the next level of automation.

What is an Observability Platform?

Observability is a software platform that helps developers and IT operations understand the internal state or condition of a complex system solely based on knowledge of its external outputs. Observability systems commonly utilize three types of telemetry data: metrics, logs, and traces. These provide visibility for distributed systems and enable the IT department to pinpoint the root cause of technical issues. Think of observability as a surveillance system equipped with various sensors.

For example, consider an e-commerce company receiving multiple complaints from customers about their website’s inability to process online orders. Without an observability system, IT developers and operations would struggle to collaborate and resolve the issue efficiently. However, with such a platform, they gain an overview of all systems, recent software upgrades, and more. This enhances productivity and customer satisfaction.

Over the past decade, enterprises have rapidly migrated their workloads to the cloud, utilizing microservices, serverless architectures, and container technologies. Traditional IT monitoring or observability platforms, such as IBM (IBM) and Cisco Systems (CSCO), face challenges in tracing origins within these complex distributed systems.

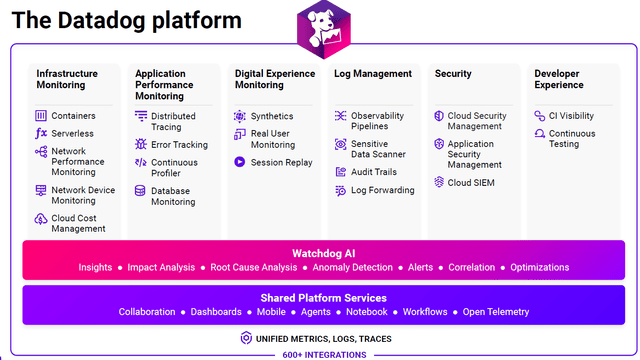

In my opinion, Datadog, along with Dynatrace (DT) and New Relic (NEWR), is leading the charge with the new generation of observability platforms tailored for the cloud. Datadog is the largest vendor among these three, providing infrastructure monitoring, application performance monitoring, logs, and cloud security systems, all integrated into a unified platform. Their platform supports major cloud infrastructures like AWS, Azure, and Google.

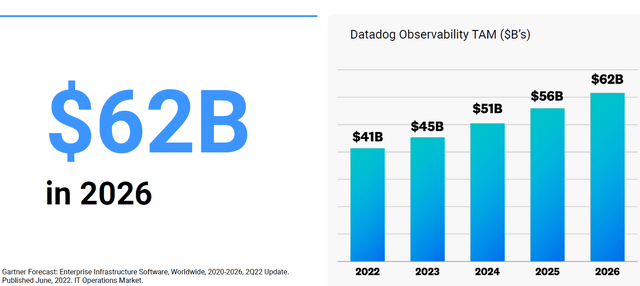

Potential Market Size

During the Datadog Investor Meeting at Dash in October 2022, it was indicated that the IT Operations Management market could reach $62 billion by 2026. This estimate largely encompasses legacy on-premises and private cloud environments, not fully accounting for the potential in modern multi-cloud and hybrid cloud setups.

Datadog Investor Meeting at Dash in October 2022

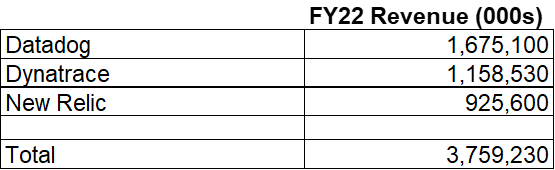

As shown in the table below, the combined revenue from the three major cloud-based IT Operations Management vendors reached $3.7 billion in 2022, representing less than 10% of the total market size. Traditional vendors continue to dominate IT operations management, especially in on-premise scenarios. As digital transformation and cloud migration continue, a significant growth opportunity emerges for innovative cloud-based operations management vendors.

Datadog, Dynatrace, New Relic 10Ks

Digital Transformation and Cloud Migration’s Ongoing Contribution

Global end-user spending on public cloud services is projected to grow by 21.7% to reach $597.3 billion in 2023, up from $491 billion in 2022, according to Gartner’s latest forecast. Cloud computing remains a driving force in the digital business landscape as organizations embrace emerging technologies like generative AI, Web3, and the metaverse. I firmly believe that digital transformation and cloud migration are still in their early stages, indicating substantial growth potential in the foreseeable future.

Historically, Datadog’s growth rate has exceeded that of cloud providers, thanks to their expanding product range under a unified platform and broader distribution channels. As revealed by the company, Datadog’s platform has evolved from initial infrastructure offerings to 17 SKUs at present. This expansion in products has led to higher growth rates compared to Hyperscalers. Additionally, Datadog’s focus on modern development workloads aligns with the higher growth rate of such workloads compared to the broader cloud workflow.

I foresee the rise of AI further accelerating digital transformation and cloud migration. Cloud adoption becomes a necessity for AI implementation, making it difficult to envision effective on-premises AI strategies for enterprises.

Unified Platform and Growing Attach Rate

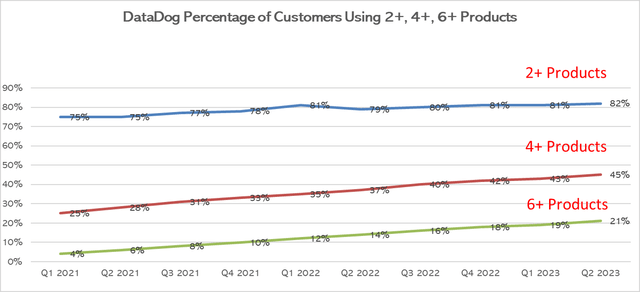

Datadog’s journey began with infrastructure monitoring and extended to application performance monitoring (APM), log management, and cloud security. As disclosed, over 80% of their customers use more than one product, combining infrastructure with logs or APM. An increasing trend shows customers adopting four to six products. Datadog’s trailing 12-month dollar-based net retention rate has consistently exceeded 130%, a robust figure for a SaaS company.

Datadog Quarterly Results

Investment in R&D and New Products Launches

Datadog’s commitment to innovation is evident through their product launches. They introduced APM in 2017, followed by Log Management in 2018, User Experience Monitoring and Network Performance Monitoring in 2019, Continuous Profiler and Incident Management in 2020, and Cloud Security in 2021. Additionally, Application and Cloud Security Management were introduced in 2022.

In August 2023, they unveiled “Bits,” an AI Assistant designed to aid engineers in rapidly resolving application issues. During Q2 FY23 earnings call, Datadog announced 15 new integrations across the next-generation AI stack, encompassing GPU infrastructure providers, Vector databases model vendors, and AI orchestration frameworks.

In my view, Datadog’s consistent investment in R&D and new product launches sets them apart from legacy infrastructure monitoring vendors. These new products under the unified platform are poised to enhance sales productivity and increase product attach rates.

Datadog August 2023 Investor Presentation

Diversified End-Markets

While Datadog does not publicly disclose specific end-market exposure details, they emphasize that their markets are well-diversified without a dominant sector. As they disclosed, financial services constitute a significant sector, including insurance, credit card, and payment companies. The travel sector accounts for around 10% of sales, and crypto represents a small single-digit portion. In addition, Datadog’s customer base includes a third that employs 1,000 employees or fewer.

In theory, I think Datadog’s platform could cater to various industries, given that infrastructure and applications monitoring is a necessity for IT departments across sectors.

Machine Learning’s Role for Datadog

Datadog incorporates several machine learning-based features for application and infrastructure observation. Their machine-learning capabilities enable the identification of anomalies and outliers that might elude manual detection.

Acknowledging these capabilities, Datadog earned recognition as a Leader in The Forrester Wave™: Artificial Intelligence For IT Operations, alongside Dynatrace (DT). Although AIOps technology is still in its early stages, Datadog’s substantial investment in this area positions them for continued growth, facilitating quicker resolution of DevOps issues for their clients.

Leveraging their extensive datasets, spanning every layer of infrastructure and application stacks, Datadog holds potential for robust machine learning applications. Through machine learning, Datadog’s platform could proactively identify technical issues and provide automated solutions, in my opinion.

Datadog’s Standing in Cloud Security

Datadog’s management clarifies that their focus is on cloud security rather than endpoint, network security, or email security. Their suite of products includes container security, security posture management, security for the cloud, security cluster management, and application security. In Q2 FY23, over 5,000 customers adopted their security platform, constituting around 20% of their client base. Furthermore, in the Q2 earning call, they disclosed that 79 customers spent over $100,000 on Datadog Security, with a handful surpassing $1 million.

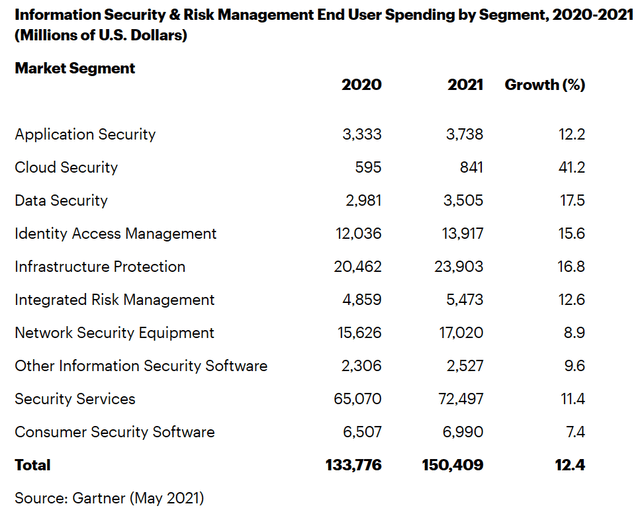

Cloud security is a relatively nascent market for most players. For example, Palo Alto Networks launched the Prisma suite in 2019, delivering cloud security services to enterprises. In the 2021 Gartner report, cloud security and remote worker technologies were forecasted to experience strong growth. Despite this, the total cloud security market in 2021 was valued at only $841 million, representing less than 1% of the total security market.

Gartner Report: https://www.gartner.com/en/newsroom/press-releases/2021-05-17-gartner-forecasts-worldwide-security-and-risk-managem

I believe that Datadog’s advantage stems from their substantial data on infrastructure and application levels. Leveraging this data could provide powerful inputs for effective cloud security, capitalizing on their unified platform. Cloud security is a sizable market, and while still in its infancy, it holds significant potential.

AI’s Impact on Datadog’s Growth in the Near Term

I am convinced that AI will profoundly transform Datadog over the coming decade, with substantial benefits to be reaped in the next 2-3 years. Firstly, AI technologies can enhance the efficiency of code writing for IT engineers, potentially leading to the creation of more applications with the same human resources. The increased adoption of AI-assisted coding could, in turn, drive demand for observability products as more cloud-based applications come into play.

Secondly, AI implementation will expedite digital transformation and cloud migration. The shift to the cloud becomes essential for machine learning implementations, making Datadog’s cloud-focused products increasingly valuable.

Lastly, Datadog’s introduction of more AI-related products under their unified platform can assist enterprises in their AI-related IT projects. For example, Datadog Watchdog serves as the AI layer for data analytics, enabling enterprises to troubleshoot AI projects and enhance observability.

Long-Term Transformation Through AI

While AI is still in its early stages, it has already commoditized conventional models and chatbots. Integrating AI technologies, like those from OpenAI, into existing applications or platforms has become relatively straightforward through API calls. However, the true value of AI lies in large language models and deep machine learning, necessitating extensive data sets from each layer of IT stacks. Datadog’s solutions serve as a crucial resource for gathering relevant data for effective machine learning.

As AI technology matures, I believe Datadog can transition their platform from observation to a fully automated remediation ecosystem. In the long term, AI-powered automation will be key to swift issue resolution without significant human intervention. The platform should be intelligent enough to identify the root causes of IT incidents, ensuring that full automation doesn’t exacerbate problems. Large model machine learning is pivotal in enhancing accuracy and achieving this goal.

Leveraging their extensive data sets across all layers of the stack, I envision Datadog elevating their platform to an advanced automation level. In the future, they won’t just be an observability company; they will emerge as a sophisticated automation platform capable of rapid issue response and situational awareness. It’s my belief that Datadog’s potential in the AI space remains largely undiscovered, as the company maintains a low profile on AI-related topics.

Datadog introduced Workflow Automation in June 2023 to expedite application issue resolution. This feature enables organizations to trigger responses swiftly, automate intricate processes, and incorporate human-in-the-loop workflows.

Workflow Automation represents a surface-level application of AI. Over time, as AI evolves, workflow automation will become smarter, involving fewer human interventions and providing more accurate solutions for technical or application issues. While today’s AI technology might not fully address complex IT problems, I believe the field will progress in the years to come.

Investment Risks

Competition Landscape: The competition landscape poses challenges for Datadog, as their unified platform competes against vendors from various traditional product categories. Legacy vendors like IBM dominate traditional infrastructure monitoring, while companies like Cisco, New Relic, and Dynatrace provide competition in APM. Additionally, Datadog faces rivals like Splunk in the realm of Log Management, and there’s a plethora of existing cybersecurity companies in the cloud security space.

Datadog combats these challenges through robust product investment and innovation. Their R&D investment stands out as an outlier compared to competitors. Furthermore, Datadog’s unique advantage lies in designing solutions on a unified platform, fostering widespread deployment and collaboration among customers. These factors position Datadog to thrive in the competitive landscape.

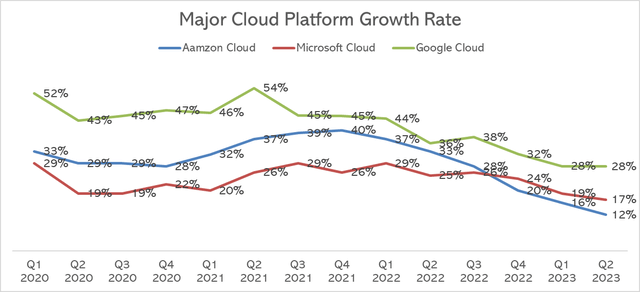

Cloud Optimization Headwinds: AWS and Azure previously experienced growth rates of 30% to 40% year over year. However, amid a weaker macroeconomic environment, some enterprises are postponing cloud migration projects and reducing cloud consumption. This trend is evident across major cloud platforms, as growth deceleration becomes apparent.

Amazon, Microsoft, Alphabet Quarterly Earnings

Datadog’s products and platforms rely on these cloud infrastructures, exposing them to potential financial impacts stemming from reduced cloud migration projects. Nonetheless, I believe that Datadog’s growth rate should outpace that of Hyperscalers.

Simultaneously, numerous cloud optimization projects are underway to reduce operational costs for enterprises. Although many of these projects initiated about a year ago, Datadog noted signs of subsiding cloud optimization in Q2 FY23 earnings call, with usage growth rebounding in July. While it’s too early to declare the end of cloud optimization, I anticipate that once this cycle concludes (likely within the next two to three quarters, based on my estimates), cloud spending will experience renewed acceleration.

Datadog continues to observe slower growth among larger spending customers compared to their smaller counterparts. Among industries, the consumer discretionary vertical, especially e-commerce and food delivery, shows the slowest growth.

High R&D and Stock Based Compensation: Datadog’s commitment to R&D is evident in their spending, surpassing 40% of total revenue, making them one of the industry’s highest investors in this area. As they disclosed in their annual report in FY22, 33% of their employees are located in France. They don’t disclose the cost difference between US and France; however, I don’t expect France to be a low-cost region for IT engineers. In addition, Datadog spent $363 million in stock-based compensation in FY22, and $163 million in in FY21. The SBC is quite high compared to their $1.67 billion in revenue. I usually don’t view the high R&D and SBC spending as a big concern for a high growth software company. When Datadog grows their revenue, these ratios will come down, just as other high growth companies.

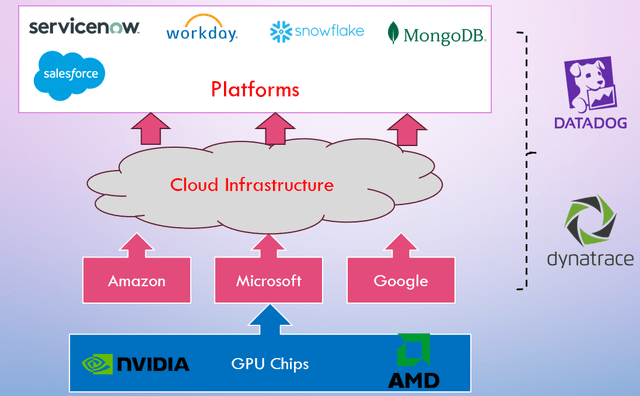

Why do I think Datadog is One of the Best AI Plays?

Considering the AI investment value chain, GPU players form the core hardware, followed by cloud infrastructure vendors, and platforms like Datadog serving atop these infrastructures. In the realm of infrastructure and applications, Datadog and Dynatrace lead the way in IT monitoring. To include the best AI play in your investment portfolio, the company should possess massive datasets suitable for large language model machine learning.

Author’s Research

Among the companies illustrated in the chart above, Datadog stands out as relatively lesser-known to investors. However, I firmly believe that their cloud-based observability and security platform stands to gain significantly from AI technology. Moreover, their products hold the potential to evolve from current observability functions to a fully automated remediation system, thanks to the influence of AI technology.

Recent Result Review and Outlook

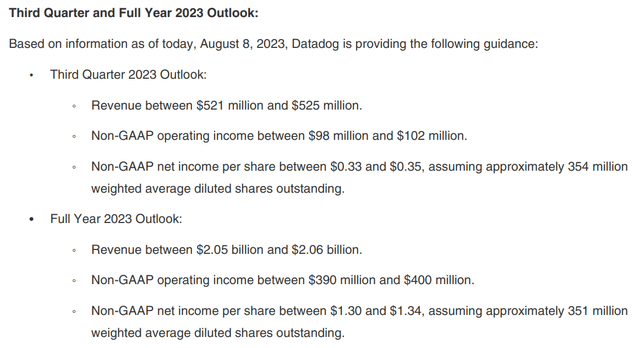

In Q2 FY23, Datadog achieved a 25% growth in sales and a 25.7% increase in adjusted operating income. In the earning call, they expressed that Q2 usage growth for existing customers was a bit lower than previous quarters due to the cloud optimizations. As they disclosed, trailing 12-month dollar-based net retention rate was over 120% in Q2, a robust figure for a SaaS company.

Turning to FY23 guidance, Datadog lowered revenue forecasts but raised operating income and EPS guidance. The mid-point revenue guidance is $2.055 billion, down from the previous $2.09 billion. Non-GAAP operating income at the mid-point is expected to reach $395 million, up from the earlier $350 million projection.

Datadog Q2 FY23 Earning Report

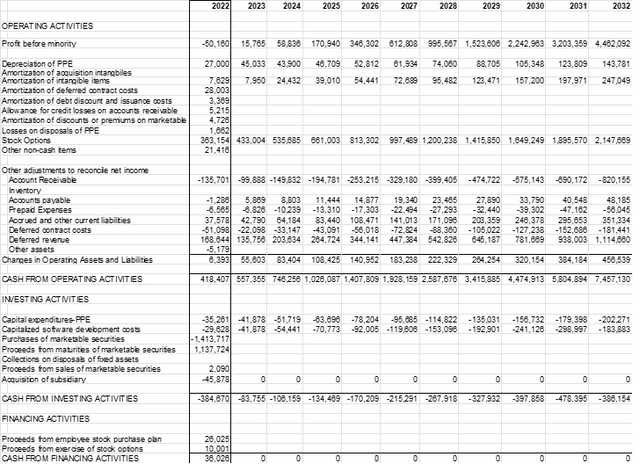

In terms of cash flow, Q2 FY23 witnessed $141 million in free cash flow, constituting 28% of the free cash flow margin. This margin marked a significant increase from the 15% of the previous year. Capital expenditures and capitalized software are anticipated to comprise approximately 4% of revenues in FY23, according to the company’s guidance.

With a robust balance sheet, Datadog holds over $2 billion in cash and market securities, counterbalanced by $740 million in convertible debts, yielding a net positive cash position.

Valuation

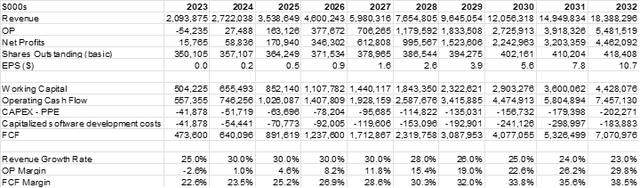

The valuation model applies the following key assumptions:

Normalized Organic Sales Growth: 25% for FY23 and 30% for normalized growth. The FY23 figure in the model leans towards the high end of the guidance.

Margin Expansion: I think when Datadog scales, their operating margin could gradually expand to 30%, a normal SaaS company margin.

Capex on PPE and Capitalized R&D: the model assumes capital expenditures and capitalized software together to be about 4%, in line with the company’s guidance.

M&A: Assume no M&A activities in the future.

Tax Rate: Assume $15 million tax expenses in FY23, the mid-point of the company’s guidance. Going forward, the model is using 25% of tax rate.

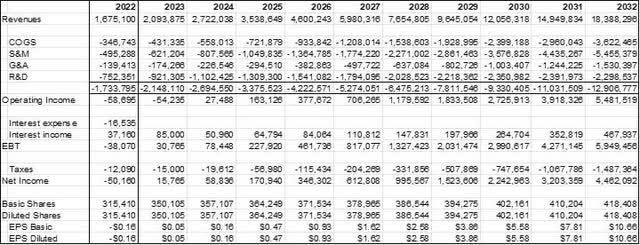

Using these inputs, the projected financial statements are as follows:

Income Statement Pro forma:

Datadog DCF Model, Author’s Calculation

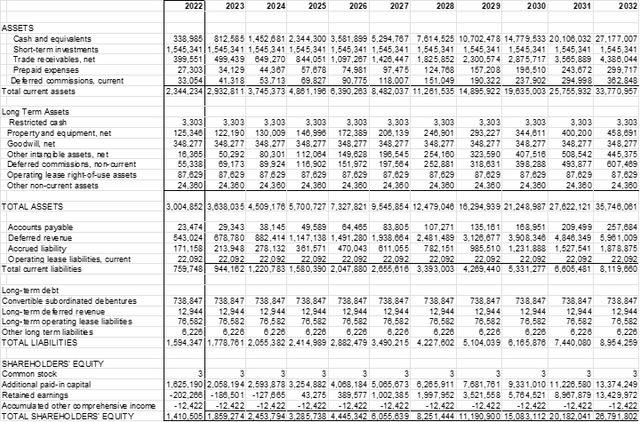

Balance Sheet Pro forma:

Datadog DCF Model-Author’s calculation

Cash Flow Statement Pro forma:

Datadog DCF Model-Author’s calculation

For the weighted average cost of capital, I am using the following assumptions to calculate:

Beta: 0.94. Data Source: Yahoo Finance five-year monthly beta.

Risk-Free Rate of Return: 4.2%. I am using 10-year US government bond yield.

Expected Market Return Premium: 7%. I am using the same assumption across my models.

Cost of debt: 10%. I am using the same assumption across my models.

With these inputs, the cost of equity stands at 10.8%, and the WACC is estimated at 9.8% in the model.

Datadog DCF Model, Author’s Calculation

Discounting all free cash flows from the firm to present value using a 9.8% discount rate, the enterprise value is estimated at $42 billion. Thus, my valuation indicates a fair value of $124 per share for Datadog.

Conclusion

In summary, I firmly believe that AI adoption can accelerate cloud migration and digital transformation. AI’s increased value highlights the potential of Datadog’s existing products, especially with the increased migration to the cloud. Moreover, I see AI as a catalyst that can facilitate Datadog’s evolution from a platform focused on observability to one centered on automated remediation. In my assessment, Datadog stands out as a premier AI play, earning a “Strong Buy” rating from me.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best AI Ideas investment competition, which runs through August 15. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Read the full article here