Investment Thesis

Peloton Interactive, Inc. (NASDAQ:PTON) seeks to position its brand on delivering high-end fitness experiences through connected equipment and digital content, enabling users to engage in immersive workouts at home.

Peloton is about to report its fiscal Q4 2023 results on Wednesday, 23rd August, premarket. I make the argument that this stock could positively impress the investment with a turnaround story.

Nevertheless, I note that the bear case points to Peloton’s perilous balance sheet, something we discuss in more detail below.

Essentially, Peloton will need to use its earnings results to proactively discuss its balance sheet and how it can reposition its balance sheet to be less restrictive and to support its turnaround effort.

In sum, there’s still a lot of wood to chop here, but Peloton seems determined to pedal their way to fitness success. Presently, I remain neutral but am actively watching this stock.

Rapid Recap

In my previous analysis, I said,

[…] outlook from here is more uncertain and that there are some potential scenarios where there’s an upside in the stock.Further, it’s important that we all acknowledge the following conjecture. Just because the stock is down +90% from its highs, does not mean that the stock is undervalued.

But within the gray area that Peloton presently trades at, there are different scenarios that Peloton can take. Personally, if I held the stock, I wouldn’t be a seller at this point.

I stand by those comments today. The fact that the stock is down doesn’t make it undervalued. Meaning that where the share price was last week or last year has no bearing on where it will be next year.

Revenue Growth Rates Will Stabilize. So, What’s Next?

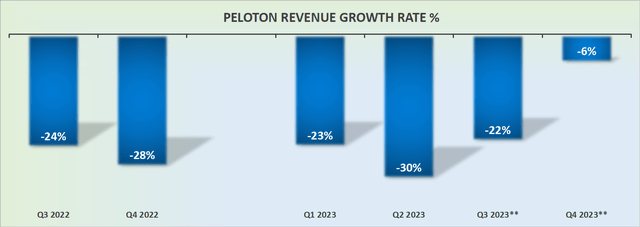

PTON revenue growth rates

In my previous analysis, I said,

This is my key contention; if one were to build a bull case, this would be it.

Peloton has one more quarter of challenging comparables, and then, once we get to fiscal Q4 2024, the quarter ending June 2023, its quarterly revenue growth rates are unlikely to be posting such negative y/y revenue growth rates.

That means that the business will reach stability. And within that stability, the business can attempt to better monetize its user base.

We’ve now started Peloton’s make-or-break year, fiscal 2024 (starting July 2023).

Indeed, any shred of positive sentiment for this stock that shareholders held has now washed out. Those shareholders that still hold the stock today are not going to be selling at this point.

For whatever reason they may have, be it endowment effect or denial, or any other bias or belief, the end result is the same, they are not selling out of PTON.

That means that the investors that are now left are only net buyers. Furthermore, Peloton’s comparables for fiscal 2024 will be really easy, particularly H1 2024.

That means that Peloton can easily reshape its narrative as a turnaround and how its underlying business has stabilized. That is a very positive setup for when Peloton delivers its results next week.

Peloton Must Take Charge To Discuss Its Balance Sheet

Peloton holds $1 billion of convertibles notes. These convertible notes equal about 35% of Peloton’s market cap. This means that when these notes are converted, there would be around 35% shareholder dilution. Clearly, that’s less than optimal as it would significantly dampen the bull case. Why?

Not only are there still questions outstanding over whether or not Peloton can stabilize its operations. But there’s also the fact that Peloton is hemorrhaging free cash flows.

Even if its free cash flow profile dramatically improves in fiscal 2024 (already started), I can’t see a path to where Peloton’s cash flows after capex in fiscal 2024, can be in positive territory.

This means that Peloton will continue to rely on creditors to support its business. And by extension, creditors will only be willing to extend Peloton credit, if they believe they’ll make a suitable return.

And therefore, we return full circle. Peloton has to convince the investment community that it can turn around its operations.

But all the while, the business is running against time, because not only are there $1 billion of convertibles that are eligible for early conversion in August 2025, less than two years from now, but there’s also about $740 million of debt outstanding with an effective interest rate of 10% outstanding. Meaning that asides from any opportunity for Peloton’s operations to be free cash flow positive, there are approximately $70 million in interest payments due next year.

The Bottom Line

As Peloton Interactive, Inc. prepares to unveil its fiscal Q4 2023 results, my attention is drawn to its potential effort to turn around its operations.

The company’s potential turnaround story seems plausible, although massive concerns linger over its balance sheet, highlighted by a hefty load of convertible notes.

Peloton’s forthcoming earnings call is pivotal, requiring a comprehensive strategy to alleviate balance sheet pressures and boost operational prospects.

As Peloton’s journey unfolds, the financial landscape resembles a challenging workout – full of twists, turns, and endurance tests. Just like those grueling last few reps, Peloton faces its own set of hurdles. So, reader, are you exhausted yet? Keep your water bottle handy, as this ride is far from over.

Read the full article here