SFL Corporation Ltd. (NYSE:SFL) is a diversified ship leasing firm with 36 containerships, 13 tankers (after the recent sale of four older tankers), seven car carriers, two drilling rigs, and 15 dry bulk ships.

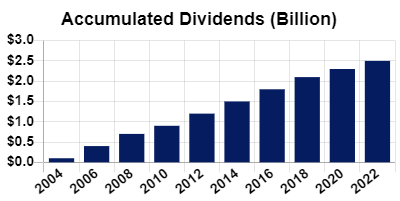

The company is controlled by John Frederiksen, who also has significant ownership in several other related firms, including Frontline (FRO), Golden Ocean (GOGL), Seadrill (SDRL), International Seaways (INSW) and Euronav (EURN). This is important because it shows oversight by a very experienced owner, potential for deals with his other firms, and because Mr. Frederiksen has a history of preferring high dividend payouts (Mr. Frederiksen, as a Cyprus citizen, doesn’t pay taxes on dividends). In fact, SFL has paid a dividend every quarter since its initial listing on the New York Stock Exchange in 2004.

sflcorp.com

Source: Company Website

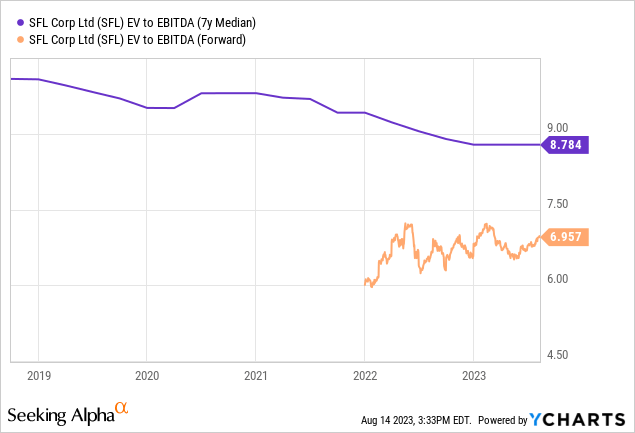

Cash Flow and Valuation

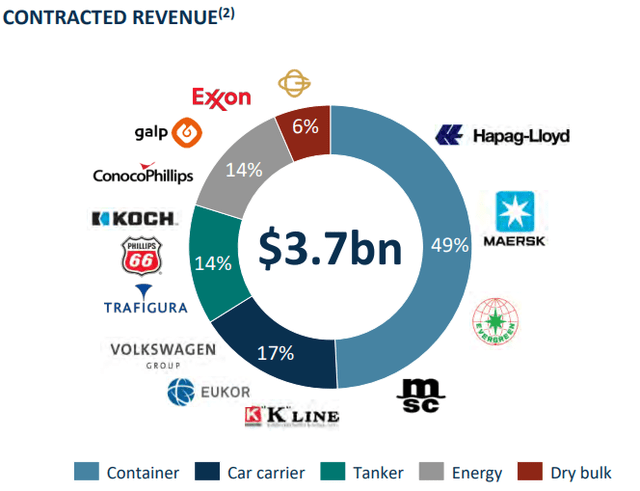

SFL’s cash flow stream is mostly being generated from long-term ship leasing contracts (93% of revenue, $3.7 billion in backlog). These contracts are with some of the bluest of blue chip names in the business, and have an average duration of over six years.

globenewswire.com/Resource/Download/3eeb2ec7-47b1-4083-83e6-b3a5083e65b6

Source: Company Presentation

SFL brought in $182.4 million in Q1 charter revenue, approximately 60% of which dropped to EBITDA and Operating Cash Flow ($110.3 and $108.5 million respectively). This obviously covers the $29.2 million they pay out in dividends per quarter many times over. Or if you prefer, one can look at the last years EPS of $1.60 and see that it covers their 96¢ annual dividend well. Despite this predictable cash flow, SFL is currently trading at an attractive 9.3% dividend yield (covered 1.7x last year, representing a 15.8% earnings yield). It is also currently trading at a lower than typical valuation.

The firm, however, does have debt that is currently convertible at $11.76 per share; so resistance as the convertibles become “in the money” should be expected. At that price SFL would still be offering a well covered 8.2% dividend before any dividend increases.

Risk

In the last three months, SFL was priced under $9 per share because investors were worried about containership firms in general, as well as the re-lease prospects for the drill rig, “West Hercules”.

The containership worries however have always been unfounded as current spot rates for SFL are mostly immaterial. The average containership in SFL’s fleet remains on contract for the next 6.7 years.

Offshore rig lease volatility has been a bigger challenge for SFL and especially Fredrickson’s other holding, SDRL, in the past. Thus, Mr. Market may have some holdover memory and fear from that previous negative event. Currently, however, offshore exposure is clearly more a benefit than a risk. Drilling rig lease rates and thus the ongoing outlook for recently refurbished SFL’s “West Hercules” (and eventually the “West Linus”) have improved materially since the invasion of Ukraine. According to Woods Mackenzie drill rig rates are up 40% in the last year and expected to grow another 20% by 2025.

SFL, however, did have to invest $100 million in the “West Hercules” to modernize it and thus make it more marketable. This capex is already factored into management plans and guidance with a lot of it showing up in Q1 and Q2. Now that the dry dock is completed, “West Hercules” will start a short 4.5-month, $50 million dollar contract with Exxon. Following that it will be offshore Namibia for another $50 million contract with Galp Energia. Then offshore Canada for a $100 million contract with Equinor. All told this will generate $200 million dollars and keep the rig employed into early 2025. The $100 million looks well spent.

Car carrier rates have also been rising significantly. Two of SFL’s car ships were just released to Volkswagen for three years at rates that will generate 6x the cash flow they used to (6¢/share to 36¢). Additionally, SFL has been benefiting not just from higher drill rig, car carrier and tanker lease rates caused by the Russia-Ukraine war, but also the ability to sell older tanker ships at premium prices. In Q4 2022 the company sold four older tankers (raising over $100 million in cash), then some more in Q1. Hence, with the delivery of the SFL Elbe in June, SFL will now have no tanker vessels trading on spot and a fleet with a lower average ship age.

SFL had $185 million ($1.46 per share) in cash on the books at the end of Q1. Thus even after factoring in remaining Q2 Hercules refurbishment expense, SFL is going to be swimming in cash.

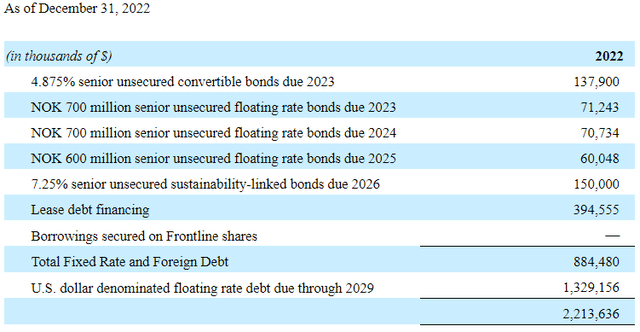

Debt

As a shipping firm with a lot of long-term contracts, SFL can afford to carry a lot of debt (expected to be about 72% of assets following a recent car carrier refinance).

sec.gov/ix?doc=/Archives/edgar/data/0001289877/000128987723000010/sfl-20221231.htm

Source: SFL 2022 10K, page 81

The rates, however, are reasonable with nothing due in 2023 (a refinance completed in Q1 eliminated all 2023 debt listed above). A fair amount, 40% of the total debt, is fixed. Hence, an additional 100-bps increase in interest rates is estimated to cost the firm about $9.8 million in additional annual interest, or roughly 5% of their earnings run rate. A 100-bps decline in rates on the other hand would increase their earnings by about 5%. Neither is particularly material compared to the effect of changes in current ship lease rates.

Our estimated Debt / Adj. run rate EBITDA is 2.4x. This is admittedly off a historically high EBITDA; however, that EBITDA is expected to be pretty secure and growing through at least 2024.

Alignment and Trading Considerations

It doesn’t really matter how well management is aligned. John Fredrickson owns over 20% of the firm so from a capital allocation point of view, whatever he says goes. Mr. Fredrickson has a long history of maximizing dividends with the firms he controls. So, if dividends are something you find appealing, the firm should be well aligned with your wishes.

SFL broke solidly above $10 today (August 14) on at least double the normal volume. The latest Hercules contract and recent $1 billion+ in refinancing’s make their 9.3% dividend not only solid, but likely to increase over the next couple years.

The board also recently approved a potential $100 million stock buyback (the first I’m aware of them ever doing). They may be starting to execute on this buyback approval. If so that would create ongoing demand which should be supportive of the stock’s price.

Conclusion

“This is our 77th quarterly dividend. And over the years, we have paid [out] … more than $29 per share. And we have a robust charter backlog [ $3.7 billion or $29.18 in revenue per share] supporting continued dividend capacity going forward.“

– Ole Hjertaker – CEO of SFL Corp

SFL’s charter book insures significant ongoing cash flows that should continue to cover the dividend well for the next couple years at least. Only 7% of their ships are on spot, with those on time charters having a greater than 6-year average backlog duration totaling more than $3.7 billion. If you are happy with a 9.3% and growing dividend, you should be happy owning SFL Corp.

Read the full article here