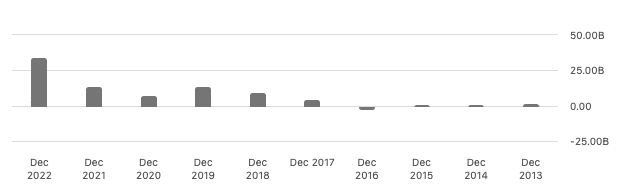

Late last year, I wrote about French energy giant TotalEnergies SE (NYSE:TTE), positioning it as a stock with upside potential due to its diverse and growing energy portfolio, its serious ability to generate cash and its focus on rewarding shareholders. It recently released its Q2 2023 earnings report. Although the earnings missed EPS expectations, TotalEnergies remains steadfast in its commitment to shareholder value. The company increased its dividend and announced a $2 billion buyback, even amidst short-term setbacks brought forward by the fall in oil prices. Furthermore, TotalEnergies’ stock has rewarded investors with returns of 18.49% over the last year and 4.41% since my previous article.

One year stock return (Seeking Alpha)

Although TotalEnergies experienced a weaker financial performance in Q2 of 2023, I am still optimistic about its potential due to its dedication to expanding its energy portfolio, consistent past performance, prioritisation of investor returns, and commitment to progress and innovation. Therefore I maintain a bullish position on the stock.

Compelling compared to peers

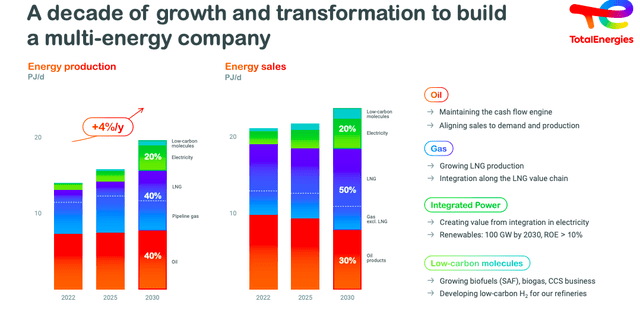

TotalEnergies ranks as one of the top six energy companies globally regarding market cap. The company’s diversified portfolio includes oil and biofuels, natural gas and green gas, renewables, and electricity. Its diversified portfolio demonstrates a forward-looking strategy that aligns with global energy trends.

Balanced energy portfolio (Investor presentation 2023)

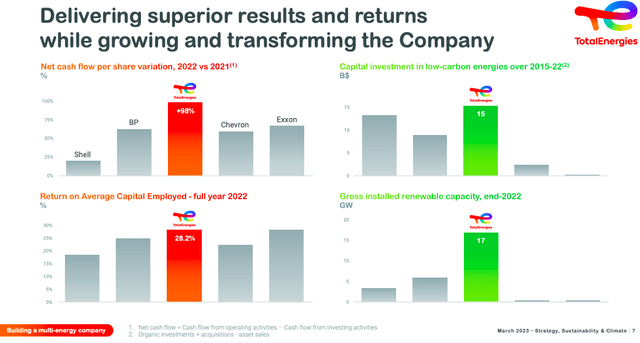

This forward-thinking approach positions TotalEnergies as a key player in the transition to cleaner and more sustainable energy solutions. If we compare TotalEnergies to BP p.l.c (BP), Shell Plc (SHEL), Chevron Corporation (CVX) and Exxon Mobil Corporation (XOM) we can see that it has performed above its peers across a number of key factors.

TotalEnergies versus peers (Investor presentation 2023)

Q2 2023 Earnings update

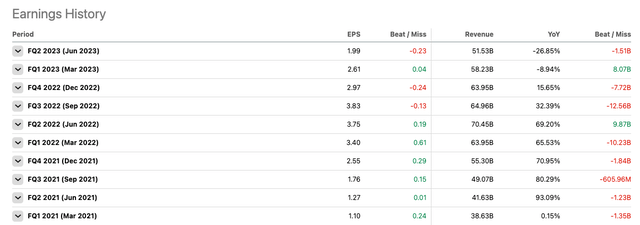

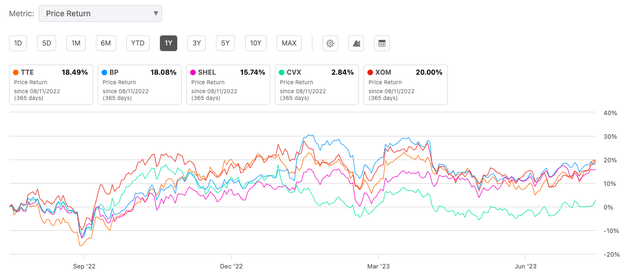

In line with industry trends, TotalEnergies has seen a consecutive decline in revenue compared to FY 2022, which was elevated due to high oil prices. However, if we compare the revenue and earnings to two years prior, we can see that there has been an upward growth trend. Furthermore, TotalEnergies has a long history of resilience in an industry characterised by market volatility.

Earnings and revenue per quarter (Seeking Alpha)

The company reported an adjusted net income of $5 billion, reflecting its ability to navigate challenges and maintain stable financial performance. Moreover, TotalEnergies’ oil and gas production witnessed a commendable 2% year-on-year increase, a testament to the efficacy of its strategic projects.

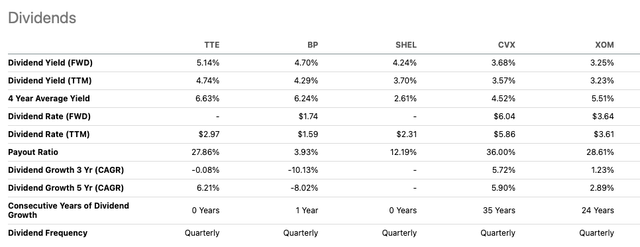

Dividend increase and buyback

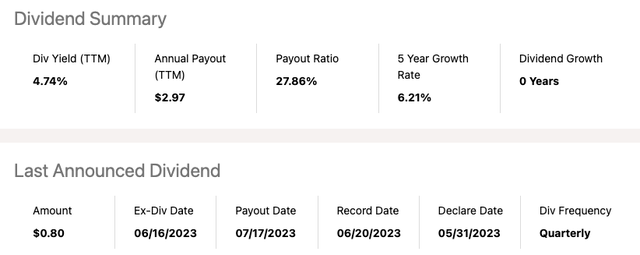

Despite a disappointing earnings report, TotalEnergies remains committed to its efforts to reward shareholders. It was one of the few companies not to decrease its dividend in FY2020 and has a 5-year CAGR of 6.21%. The company’s decision to increase its interim dividend by 7.25% year-on-year showcases its confidence in its prospects. Furthermore, announcing a $2 billion share buyback program in the upcoming quarter echoes TotalEnergies’ dedication to enhancing shareholder value and optimising its capital structure. We can also see that the dividend is supported by generous cash flow generation and a payout ratio of 27.86%. In the first half of 2023, the company completed $4 billion in share buybacks.

Dividend overview (Seeking Alpha)

Cash flow and balance sheet strength

The levered free cash flow of TotalEnergies over the last twelve months is $24.53 billion. While there has been a decline in this figure recently, it has generally been on the rise over the past five years. Upon examining the company’s balance sheet, we see they are in a robust financial position, with a total cash, cash equivalents, and short-term investments balance of $32.3 billion and a Grade A credit rating. Its current ratio of 1.17 indicates they have enough liquidity to cover short-term liabilities. TotalEnergies has set a goal to achieve an AA credit rating.

Annual levered free cash flow (Seeking Alpha)

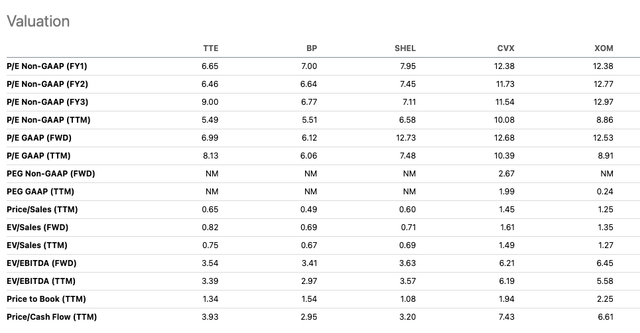

Valuation

Since my previous article, TotalEnergies remains attractive on several key valuation factors using Seeking Alpha’s Quant rating and comparing it to its oil peer giants. Comparing TotalEnergies across various valuation ratios, it appears to be an undervalued opportunity with a compelling FWD price-to-earnings ratio of 6.99, lower than its American peers. While it may not have outperformed all its peers, its resilience against market challenges and substantial total return growth is worth considering. Furthermore, it is taking on a proactive approach to renewable energy with significant global investments.

Relative peer valuation (Seeking Alpha)

Furthermore, TotalEnergies is trading well below its average price target of $72.68. However, investors should be cautious of the volatility within the energy market. Comparing TotalEnergies to its peers, we can see it has been one of the most rewarding stocks to hold over the last year, with a return of 18.49%, only surpassed by Exxon Mobil with 20% in returns.

One year price return versus peers (Seeking Alpha)

The company’s dividend program is highly attractive, boasting a TTM yield of 4.74%. The dividend alone and the company’s focus on rewarding shareholders could be a reason to consider this stock.

Dividend versus peers (Seeking Alpha)

Risks

When investing in energy stocks, it’s important to consider the potential risks involved. Various factors can impact the financial performance of these stocks, such as the supply and demand of different energy sources and geopolitical factors like changing regulations that could affect the company’s operations and profitability. With the global shift towards sustainable practices, governments worldwide are implementing stricter environmental regulations and emissions targets to combat climate change. Many of these changes are still under discussion, such as the EU’s effort to tax polluting aviation fuels. This could lead to higher compliance costs and operational challenges for companies like TotalEnergies. Companies must stay up-to-date with evolving regulations to maintain a competitive position in the market. While the company is investing in renewable energies, a large portion of its business can be impacted by ongoing changes.

Final thoughts

Although TotalEnergies missed earnings and revenue expectations in its most recent financial report, it remains dedicated to rewarding shareholders, making forward-thinking energy investments, and being resilient against market challenges. The company has substantial cash flow and a healthy balance sheet to continue navigating the changing energy environment in the long run. Therefore I maintain a bullish stance on this stock.

Read the full article here