Transcat (NASDAQ:TRNS) offers laboratory instrument services worldwide. It works in two segments: Distribution and Service. TRNS recently announced its Q1 FY24 results. I will analyze its financial result in this report. Although its revenue has increased, I think the company is currently overvalued. Hence, I assign a hold rating on TRNS.

Financial Analysis

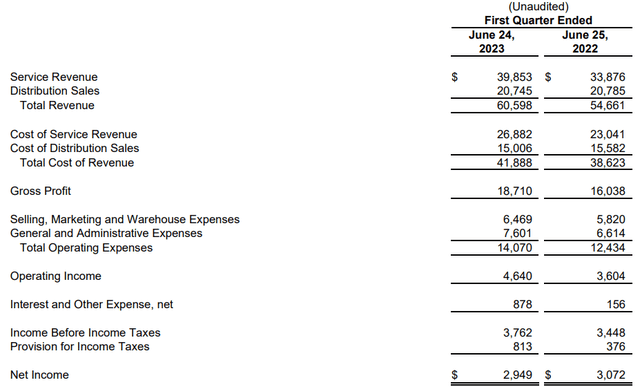

TRNS recently posted its Q1 FY24 results. The total revenue for Q1 FY24 was $60.5 million, a rise of 10.8% compared to Q1 FY23. Its service segment performed well, and its acquisitions benefitted them, which I believe led to an increase in its revenue. The revenue from the service segment grew by 17.6% in Q1 FY24 compared to Q1 FY23. I believe strong demand in the life sciences market boosted its revenue in the service segment. Its gross profit margin also improved to 30.8%, which was 29.3% in Q1 FY23. I believe higher productivity in its lab operations was the main reason behind the margin improvement.

TRNS’s Investor Relations

However, its net income declined by 4% in Q1 FY24 compared to Q1 FY23 due to higher interest expense. In my view its performance was decent in this quarter improvement in the margins and higher revenues was an optimistic sign. In addition to improving financials, its balance sheet also improved. It had $2.1 million in cash at the end of June 2023, a rise of 40.3% compared to March 2023, and its debt also declined. TRNS appears to be financially and fundamentally sound and talking about future expectations. I believe its FY24 revenue might exceed its FY23 revenues. I am saying this because they have adopted an acquisition strategy to expand its business and boost its revenues; acquisitions played a vital role in growing its revenues in Q1 FY24, and recently it acquired SteriQual, which provides services to the life sciences and TIC-MS. If they are able to successfully integrate these acquisitions into their business, then I think their revenues and margins might improve in the coming quarters.

Technical Analysis

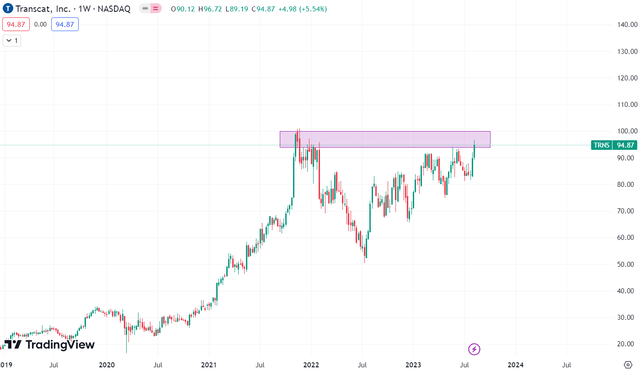

TradingView

TRNS is trading at the $94.8 level. Since July 2022, the stock price has risen over 85%, and it is now near the all-time high of $100, which it created in November 2021. As I have marked in the chart, there is a strong resistance zone at $94-$100, and the stock price is currently in the resistance zone. I would advise investors to stay cautious at the current level because when the stock touched the resistance zone in 2021, the price fell down by 45%, and if we look at the most recent candle, we can see that there is a wick in the candle which shows that selling pressure is high at the resistance zone. So I would wait until the stock breaks the $100 level in the weekly time frame before buying it because there is a high chance that the stock might reverse or might correct from this level.

Should One Invest In TRNS?

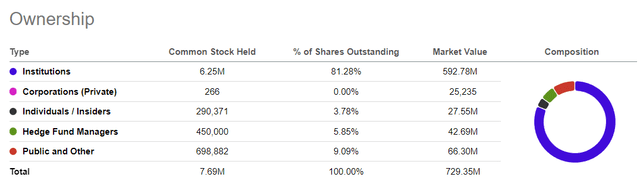

Seeking Alpha

TRNS has a solid shareholding pattern. The institutions own 81.2% of the shares in the company, which is a positive sign. Because in companies where institutions own the majority of the stake, we see less volatility in stock price fluctuations. TRNS has shown strong growth in the past three years; they have grown their revenues consistently, and their balance sheet has also improved in Q1 FY24. But despite all these positives, I would not advise investing in it at the current level because I think it is now overvalued.

If we look at TRNS’s valuation, we can see that it is way overvalued. TRNS has a P/E [TTM] ratio of 51.28x which is way above the sector median of 17.26x, and it is not only above the sector median but also above its five-year average of 38.79x. TRNS has an EV / EBITDA [FWD] ratio of 21.58x compared to the sector median of 11.19x. It shows that it is overvalued. I know their revenues have grown consistently over the years, and high-growth companies generally trade at a higher premium, but their growth is not that significant to justify their high valuation. The company’s revenue increased by 12.5% in FY23, and the management anticipates high single-digit organic revenue growth in the services segment in FY24, which is not significant. So looking at the current growth and future growth expectations, I don’t think it deserves to trade at a higher premium. Its five-year average P/E is 38.8x, and its forward EPS is around $1.65. This gives us a share price of $64, and it is currently trading at $94.8, which shows that it is overvalued. Hence despite the positive growth, I think TRNS is overvalued, so I assign a hold rating on TRNS.

Risk

The majority of their costs for their service segment, such as those for premises, equipment, and employees, are set. As a result, companies might not be able to minimize expenses in a given quarter if revenues drop or do not increase as expected. Their operating results and quarterly revenues have fluctuated in the past and will probably continue to do so. Due to industrial operating cycles, historically, their third and fourth fiscal quarters have performed better than the first and second quarters. Their revenues and operating results may fluctuate because of changes in the industry demand for the goods and services they supply. Their stock price could drop if their operating results in some quarters fall short of what analysts and investors had anticipated.

Bottom Line

TRNS has been able to grow its revenues in the past three years, but I think the growth rate isn’t significant to justify its high valuation. In addition, its stock price is at a key level and might face rejection from the current level. Hence, I assign a hold rating on TRNS.

Read the full article here