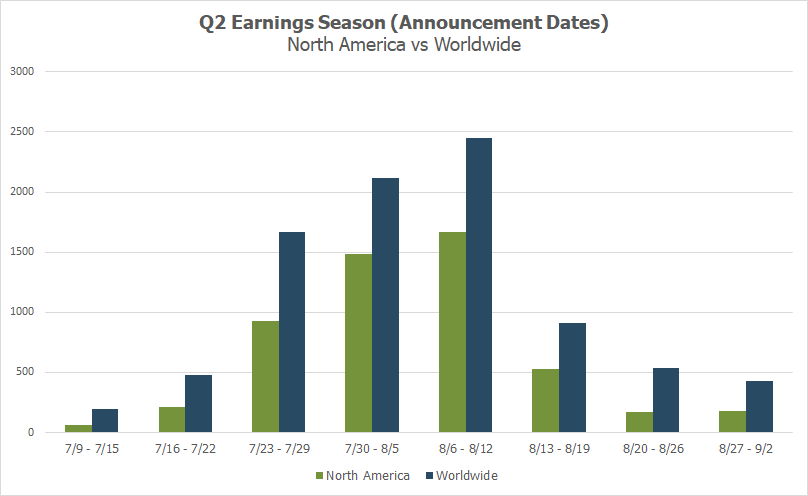

With Q2 2023 peak earnings season in the rearview, the final round of company reports to watch will mainly come from the retailers, results from which are greatly anticipated.

Certain indicators show the US consumer softening, but some retailers have reported record sales this quarter. Last week’s report from the Federal Reserve Bank of New York showed that Americans are going further into debt to make purchases, with credit card debt hitting $1 trillion for the first time ever.

While that figure may look shocking, it’s mostly unremarkable in that it puts consumer spending in-line with historic, pre-pandemic levels. As to exactly how the US consumer is currently faring, that should be made clear after these next couple of weeks of retail reports.

At this point, 91% of S&P 500 companies have reported for Q2. And while results have been okay, with roughly 80% of companies beating Wall Street EPS expectations, the main driver of positive earnings surprises has been cost-cutting, not revenue growth.

With low revenue expectations of 1.3% for Q3 (according to FactSet), companies are going to have to keep cutting their way to bottom-line growth in H2 2023 and beyond.

The Final Q2 LERI Reading Still Shows Uneasiness from US Corporations

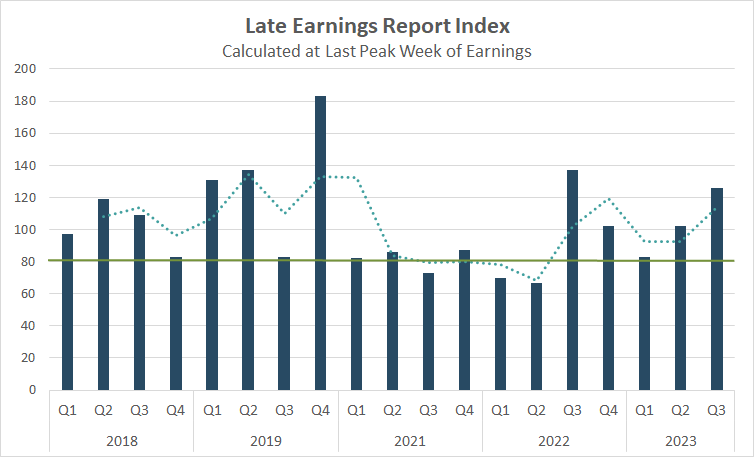

When we entered this quarter’s earnings season, our proprietary Late Earnings Report Index (LERI) was showing that CEOs were more uncertain than they had been in recent quarters.

In fact, they were about as uncertain as they’ve been since the pandemic. This reading was calculated on July 14, on the day many major banks began to report. Now that the season is over, we’ve updated the LERI again for the post-peak season, and it tells much of the same story.

The Late Earnings Report Index tracks outlier earnings date changes among publicly traded companies with market capitalizations of $250M and higher.

The LERI has a baseline reading of 100, anything above that indicates companies are feeling uncertain about their current and short-term prospects. A LERI reading under 100 suggests companies feel they have a pretty good crystal ball for the near term.

The current post-peak season LERI reading stands at 126, the second highest reading since the COVID-19 pandemic, only outdone by the Q2 2022 earnings season. As of August 11, there were 120 late outliers and 86 early outliers.

Source: Wall Street Horizon

On Deck for the Remainder of the Q2 Season

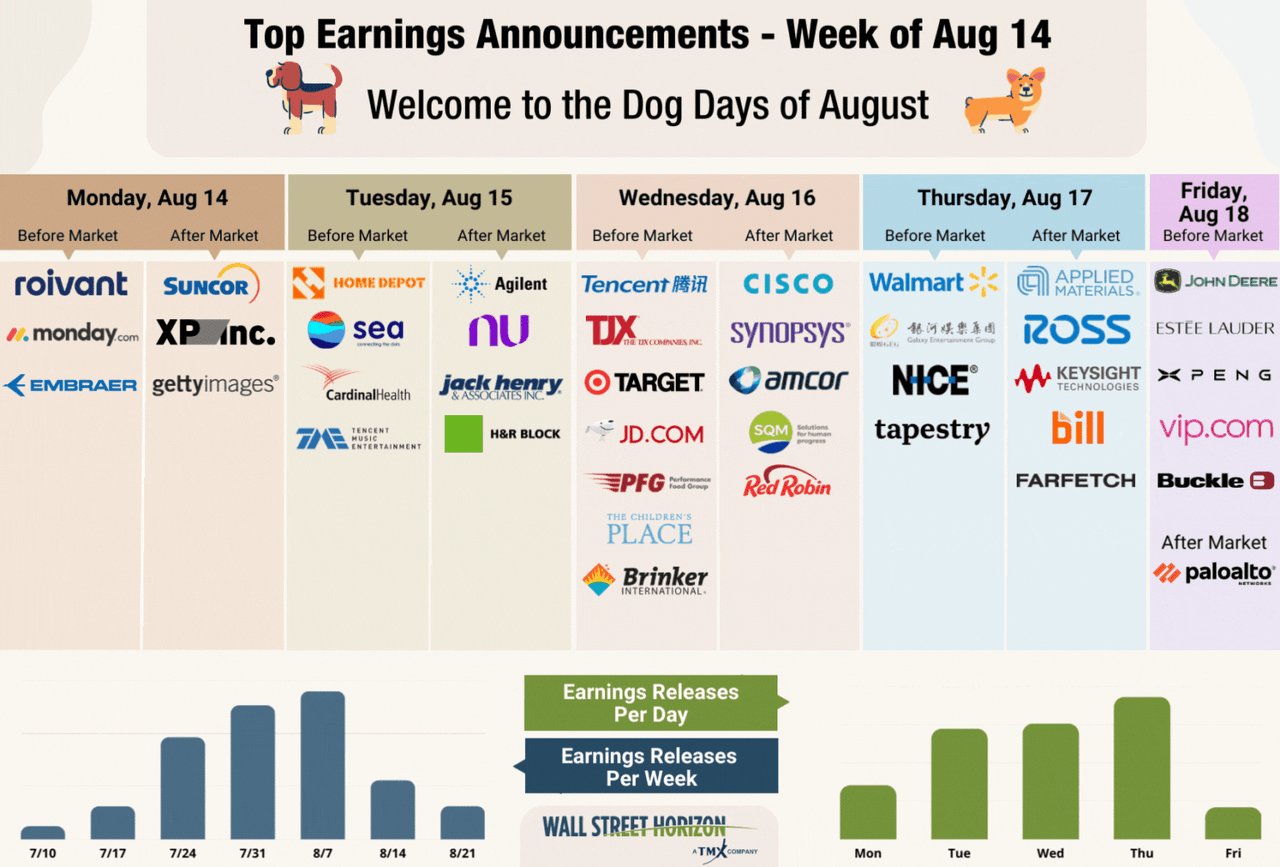

In addition to the usual headliners of retail earnings season – Home Depot (HD), Target (TGT), TJX Companies (TJX), Walmart (WMT), Ross Stores (ROST) and others – we’ll also get plenty of results from companies with Barbie licensing deals.

The movie has already crossed the $1B box office mark in just three weeks and is on track to be the highest grossing movie of the year. That track record could offer retailers with licensing rights the pop they need in the second half of the year.

Mattel (MAT), owner of the Barbie brand, reported second quarter earnings on July 26. While they beat expectations on both the top and the bottom line, the Barbie brand actually declined 6% year-over-year.

While discretionary items such as toys remain at risk as consumers tighten up their budgets, the success of the “Barbie” movie release in Q3 should set the second half of the year up to healthy top-line growth.

But will companies licensing the Barbie brand meet the same fate? Crocs (CROX) already reported for the second quarter. Their Barbie shoe collab didn’t launch until July 11 and therefore wasn’t reflected in results, but it should give a boost to Q3’s bottom line as it sold out that very same day.

AMC Entertainment (AMC) reported the highest July revenue in their 103-year history thanks to box office smashes that included Barbie, as well as “Oppenheimer”, “Mission: Impossible – Dead Reckoning” and “Sound of Freedom”. In the next couple of weeks, we will get results from Macy’s (M) owned Bloomingdales (August 16), Kohl’s (KSS) (August 22) and Gap (GPS) (Aug 24) who all have similar licensing deals.

Investors will also be looking for commentary regarding how the all-important back-to-school shopping season is faring. According to the National Retail Federation, this year is expected to show record spending across all categories, despite worries about a cautious consumer.

Source: Wall Street Horizon

Potential Earnings Surprises Later this Season – CRM

For the final few weeks of the second quarter earnings season, we only see two S&P 500 companies with outlier earnings dates. Both Cardinal Health (CAH) and Salesforce (CRM) have confirmed Q2 2023 earnings dates that are significantly later than expected. According to academic research, the later than usual earnings dates suggest these companies will report “bad news” on their upcoming calls.

Salesforce

Company Confirmed Report Date: Wednesday, August 30, AMC

Projected Report Date (based on historical data): Wednesday, August 23, BMODateBreaks Factor: -2*

Salesforce is set to report Q2 2023 results on Wednesday, August 30. This is one week later than expected, which may suggest less than stellar news will be shared.

While this is the latest that Salesforce has reported in the last seven years, it still conforms with their Wednesday report day in the 35th week of the year, a pattern they just started following since the pandemic.

Academic research shows when a corporation reports earnings later than they have historically, it typically signals bad news to come on the conference call. We also see date changes as a sign of uncertainty, a company is seeking clarity on some item and therefore wants more time before sharing information with the public.

This might not be surprising considering the competitive product from Microsoft (MSFT) Dynamics, continues to chip away at Salesforce’s domination of the CRM market.

There is also worry that Salesforce’s recent announcement regarding a roughly 9% price hike across their entire product line could force client churn, as companies look to stay lean amidst economic uncertainty.

Q2 Earnings Wind Down

Last week marked the final peak week of the Q2 2023 earnings season, with 90% of our universe now having reported. This week we will see 1,190 companies release results, mostly from the consumer discretionary and tech sectors.

Source: Wall Street Horizon

* Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company’s 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

Original Post

Read the full article here