Investment thesis

Our current investment thesis is:

- ONON is a high-growth athletics business, attracting consumers through an innovative product offering and quality marketing. In the most recent quarter, the business grew by over 70%, illustrating the strength of this momentum.

- Margins will likely land in excess of its peers, as the commercial strength of the business allows it to price at a premium.

- Reviews of its footwear are glowing, suggesting its CloudTec is a superior technology in the industry.

- ONON looks expensive but if the business can maintain its momentum in the coming years, this will quickly look cheap.

Company description

On Holding (NYSE:ONON) is a Swiss athletic footwear company founded in 2010 by Olivier Bernhard, David Allemann, and Caspar Coppetti. Headquartered in Zurich, Switzerland, the company is renowned for its innovative running shoes and performance-oriented footwear. On Holding’s mission is to revolutionize the running experience by creating lightweight and technologically advanced footwear for athletes and running enthusiasts worldwide.

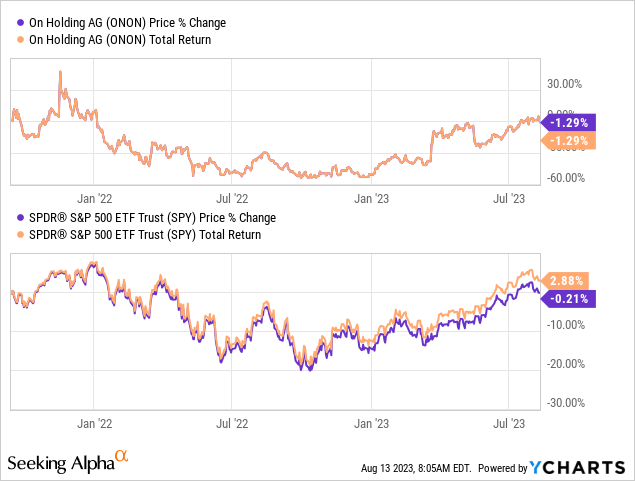

Share price

ONON’s shares have only been listed for a short period of time, performing relatively well considering the current bear market and economic uncertainty. During this period, the business has performed well and continues to progress.

Financial analysis

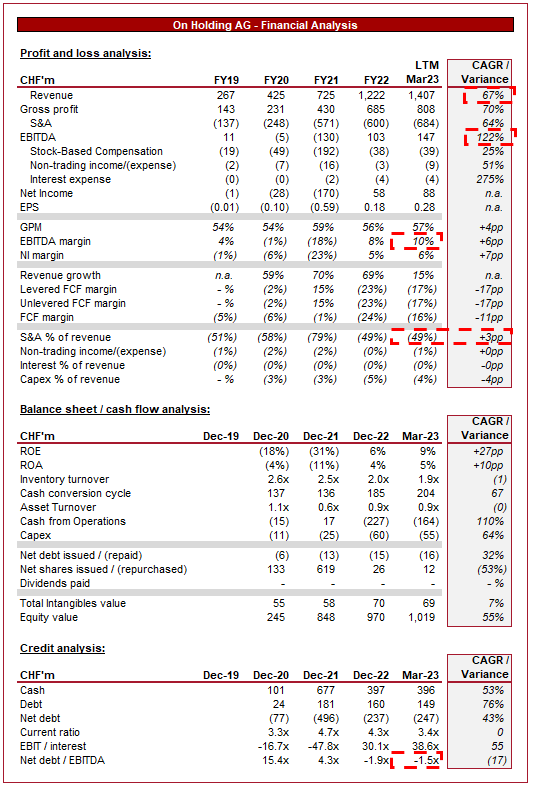

On Holding Financials (Capital IQ)

Presented above is ONON’s financial performance.

Revenue & Commercial Factors

Revenue has grown at a CAGR of 67% since FY19, as the business continues its tremendous trajectory since gaining traction in the industry. In the most recent quarter, growth was 78%, implying this momentum is far from slowing, and potentially improving.

Business Model

ONON’s business model revolves around innovation, high-quality craftsmanship, and performance-driven products. The company designs, manufactures, and markets athletic footwear tailored for various running styles, including road running, trail running, and outdoor activities.

The company’s rise to prominence is built on its innovation, gaining the attention of the market through its innovative CloudTec cushioning system, which provides an impressive level of energy absorption and transfer. Management takes the technology underpinning its product seriously, continuing to seek areas for improvement to ensure they remain a market-leading offering.

Consumers are not just interested in function but also in design from a fashion perspective. ONON products are generally designed extremely well, blending sleek silhouettes and elegance with its minimalist design philosophy. This allows the business to also target the casual segment while ensuring it is aligned with current industry tastes.

ONON is quickly increasing the number of athletes it partners with, the ultimate stamp of approval in the athletic apparel industry. This is critical to boosting widespread interest in the brand, especially with Olympic Games in 2024. Teaming up with elite runners has not only enhanced the brand’s reputation but also fostered trust among consumers. As the business continues to grow, we expect the roster to increase, especially if the business branches out into other sports. We see no reason why ONON couldn’t partner with Football (Soccer) players, advertised as an exercise essential.

The business has also done well in its wider marketing efforts. Management clearly understands the current market landscape, developing a strong online presence and engaging directly with consumers to create a valuable relationship. The business has a magazine, posts several articles and videos, and encourages and leverages user-generated content to improve visibility.

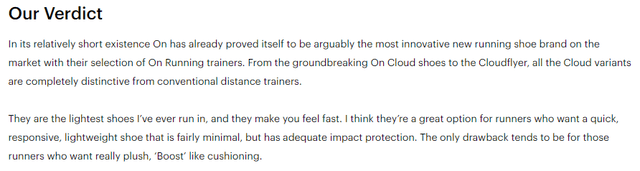

An analysis of a new business such as this is not complete without considering what the customers are saying. The following are a few excerpts from reviews online.

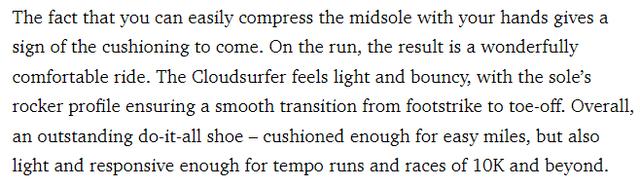

The Sports Edit

Thing Testing

Trail & Kale

Runner’s World

Given who important the product is to the future of ONON, I decided to buy one its trainers. I am not a runner but I exercise and go for a walk daily. The product is the real deal. The cushioning is incredibly, making it a joy to walk, run, or even jump.

The consensus is unanimously positive. The business scores extremely well in almost every metric. Reviews conceded that the price was higher than its peers but this was completely justified. The only “issue” we identified was that several reviews had seemingly not considered the business in their lists, focusing on the market-leading brands. This implies that continued marketing efforts have the potential to propel this brand into the mainstream, as it is winning the hearts of users.

The rising popularity of ONON’s products can be attributed to several key factors, none of which are unique to the industry in approach. The company is innovating impressively, it is designing fundamentally attractive products, its marketing efforts are successfully growing the reach of the business, and its customers are extremely happy. This approach, underpinned by innovation, has been seen countless times in this exact industry, such as by Nike (NKE). This does leave the business somewhat exposed to future innovators, which feels inevitable given the number of times it has already occurred. Further, its peers will seek to find ways of replicating its technology / close the gap in performance, neutralizing any material advantage it can develop. For this reason, we must approach ONON’s commercial attractiveness with caution when looking ahead.

The key to offsetting this risk is to create a truly global brand, reducing its reliance on product superiority. ONON is succeeding with this in our view, developing trust with the community. The natural step from here is to expand its product offering and interest in these products, as footwear currently comprises 95% of sales.

Footwear/Athletics Industry

ONON operates in a competitive landscape, competing with established brands such as Nike, adidas (OTCQX:ADDYY), ASICS (OTCPK:ASCCF), New Balance, Hoka (DECK), Puma (OTCPK:PMMAF), and Under Armour (UA).

We are currently seeing a trend of wearing athletic apparel beyond sports activities, with consumers interested in flexible clothing which can maintain the comfort of high performance while also being fashionable. As previously discussed, this is a core focus for the business and is positioned well. Its products vary in the degree to which they focus on performance vs. fashion, giving consumers the ultimate level of choice while still receiving its proprietary CloudTec.

Running has grown in popularity across the West, as people recognize the health and wellness benefits of the activity. This does not just apply to running, but all forms of exercise, even if it’s as simple as walking. We expect this to remain a sustained trend in the industry.

Finally, many of its peers such as Nike, have been focusing heavily on direct-to-consumer sales (D2C). The reason for this is to achieve improved sales economics, with reduced reliance on retailers. This is a logical step following the popularity of e-commerce, allowing brands to easily interact directly with customers. This only works once loyalty is developed, however, which ONON has done well through its marketing efforts. The business is already generating 33% of its revenue through DTC, allowing it to have an impressive GPM despite the small scale.

Economic & External Consideration

The current economic conditions of high inflation and elevated interest rates are impacting ONON in the following ways:

- Input Costs. High inflation has led to increased production costs, contributing to near-term weakness in GPM. We expect ONON to win back some of this margin in the coming 12-24 months, as inflationary pressures subside and pricing action yields top-line improvement.

- Consumer Spending. The combination of rates and inflation is causing reduced discretionary spending, as consumers protect their finances. As a premium market offering, ONON could be more heavily hit by this. For us, this illustrates how strong the demand for its products is. The business is growing at >50% Y/Y and yet is facing headwinds.

Margins

ONON margins have gradually improved, as the business achieves scale and operating cost leverage. The key area to consider is GPM, with the business already boasting an impressive level, illustrating the financial gains from its marketing and innovation.

In the coming decade, we expect S&A spending to continue to decline relative to revenue, falling to c.40%, while GPM will rise with economies of scale, likely exceeding 60%. This should mean an EBITDA-M of 17.5-22.5% is achievable. This would place the business well above its comparable peers. For this reason, brand development is key to the perception of its product, allowing the company to maintain its premium pricing.

Balance sheet & Cash Flows

ONON continues to burn cash, as the business invests heavily in inventory to sustain its current growth trajectory. The business has CHF396m in cash on hand, with a transition to profitability likely ahead in the coming 9-18 months.

Outlook

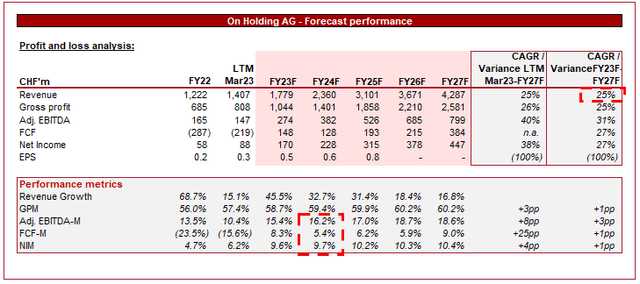

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming 5 years.

Analysts are forecasting an impressive growth rate of 25% in the coming 5 years, likely pricing in a conservative estimate given how well the business is doing. It will be incredibly difficult to judge where the business will land but strong double-digits are reasonable.

Margins are also expected to improve, for the reasons discussed above. Analysts believe the business will land at 19% by FY27F, a reasonable view based on the current trajectory.

Valuation

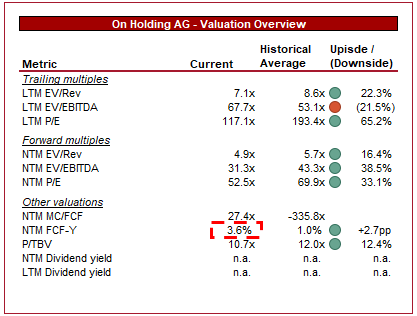

Valuation (Capital IQ)

ONON is currently trading at 68x LTM EBITDA and 31x NTM EBITDA. This is a premium/discount to its (short) historical average.

The current valuation is clearly daunting but investors must remember that with high-growth businesses, the multiple will rapidly contract as margin improvement and growth combine to quickly contract the multiple.

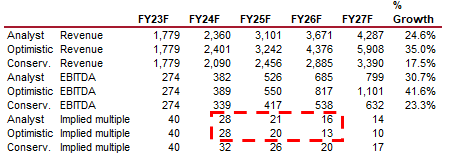

In order to assess ONON’s valuation, we have conducted a back-of-the-napkin calculation of how the company’s valuation may develop in the coming years. We have taken analysts’ margin projections as they look reasonable. We have flexed revenue based on an improved rate (35%) and a conservative rate (17.5%). Based on this, ONON’s valuation is below 20x in every multiple by FY26F and around 20x by FY25F

Growth (Author’s calculations)

With an EBITDA-M of close to 20% and a healthy growth trajectory remaining come 2025-2027, we believe the business will still be worth in excess of 20x its EBITDA. This implies upside at the current share price, although not materially so when factoring in execution risk.

Key risks with our thesis

The risks to our current thesis are:

- Execution. The biggest risk to this business is the execution of its growth trajectory. Hype is high and the business is selling every product it makes very quickly. Management must not become complacent, continuing to develop its marketing approach to ensure it is adapting to its changing size.

- FX. The business reports in CHF but is already a global business. The business will face some issues with fluctuations in FX contributing to variations in reported results.

Final thoughts

ONON looks to be a good business. Its fundamental competitive position is built on innovation and product superiority, reassuring investors that this is not built on shaky foundations. The transition should now be on the brand, through partnerships and collaborations, as well as product development beyond footwear.

Financially, we like the business. Growth is of course amazing, but margins are also developing well. Strong DTC sales and a compelling product offering should allow for outsized returns.

ONON is expensive but as the growth we expect continues, the business will quickly see its trading multiples contract.

Read the full article here