Supply Side Platforms have managed to create a compelling narrative around how market consolidation, value-add services, CTV, commerce media and SPO will lead to growth and improved competitive dynamics going forward. Despite this, a soft digital advertising market and poor financial performance is continuing to depress PubMatic’s (NASDAQ:PUBM) share price. Consistent growth and improving margins could create strong returns for PubMatic shareholders, but at this point it is unclear if the SSP narrative is anything more than a fairy tale.

Market

While some parts of the digital advertising ecosystem are demonstrating strength, there is still a lot of weakness overall. Many advertisers remain cautious due to economic conditions, with brand advertising particularly impacted.

Weakness is largely being caused by supply growth outpacing ad spend growth, placing downward pressure on ad pricing. For example, PubMatic’s impression volumes continue to grow, but CPMs have been softer than expected, particularly in June and July. This is not homogeneous though, with the impact varying across ad verticals and by region, format and channel.

During April and May, ad spend in PubMatic’s top 10 verticals increased 9% YoY. In comparison, during June and July ad spend in the top 10 verticals only increased 1% YoY. This change was particularly pronounced in consumer-centric verticals (shopping, technology, personal finance and arts & entertainment). Video CPMs were down 10% in July relative to June, with display CPMs also softening. Given the progression of CPMs over the last 12 months, PubMatic expects video CPMS to be roughly 20% lower YoY in the third quarter and display CPMs to be down 10%.

MediaMath’s recent bankruptcy is also currently impacting the market. PubMatic estimates that it will take several months for ad spend to be redistributed across buyers that are already integrated into its platform. The transition is expected to reduce PubMatic’s second half revenue by several million USD.

Innovation

PubMatic recently introduced Activate and Convert, which significantly expands the company’s total addressable market. More important though will be the long-term impact of these types of solutions on SSP competitive dynamics.

Activate is an end-to-end SPO solution that enables buyers to execute non-bidded direct deals for CTV inventory on PubMatic’s platform. PubMatic’s estimates that Activate increases its addressable market by approximately 65 billion USD. Activate’s availability will be extended from the Americas and EMEA regions into APAC in the next few months.

Convert is a unified solution for commerce media that offers onsite and offsite monetization across a variety of ad formats, including PubMatic’s newly available sponsored listings capability. Convert targets both traditional retailers as well as high-volume transaction business like transportation, food delivery and travel. PubMatic has seen interest from a range of companies, including rideshare provider Lyft, and Wallapop, a leading European classified listings site. PubMatic believes that Convert expands its addressable market by approximately 10 billion USD. Much of this TAM expansion is from performance marketing budgets, which will help PubMatic to diversify its business beyond brand ad spend.

Connected TV

PubMatic delivered over 30% growth in CTV in the second quarter. In comparison, Magnite’s (MGNI) CTV contribution ex-TAC was only up 8% YoY. Magnite’s CTV business is around 3x times the size of PubMatic’s though, meaning growth in absolute terms was similar.

PubMatic’s pipeline of tier one streamers is growing. New and expanded partnerships include AMC Networks, DIRECTV, Fox Digital, TiVo and Warner Brothers Discovery EMEA. PubMatic believes that Activate is providing its CTV business with a tailwind, as it provides publishers with unique buyer demand. It should be noted that Magnite offers OpenPath, which is a similar solution.

Supply Path Optimization

In the second quarter, SPO made up over 40% of activity on PubMatic’s platform. PubMatic believes that in the long run SPO will eventually reach over 50% of total activity. In addition to contributing to topline growth, SPO should lead to margin expansion over time.

Financial Analysis

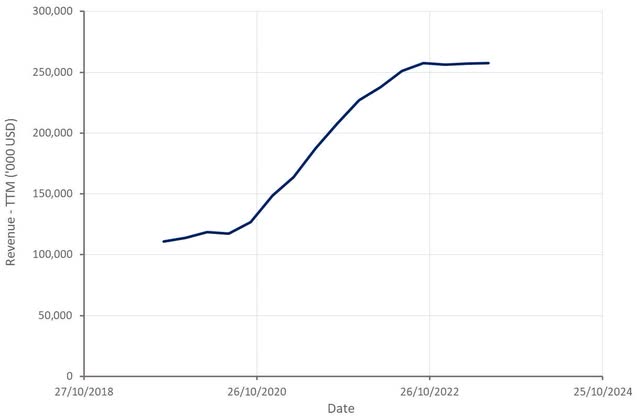

Revenue in the second quarter was approximately 63.3 million USD, which was roughly flat YoY. CTV revenues increased more than 30% YoY, driven by an increase in monetized impressions, partially offset by lower CPMs. PubMatic’s online video revenues were down more than 10% YoY, as CPM declines more than offset impression increases. Total omnichannel video revenues declined 4% YoY and represented approximately 31% of total revenues. Display revenues were down 1% YoY and were responsible for 69% of total revenues.

Online video impressions increased over 20% YoY in July. CTV impressions increased in the single-digit percentage range YoY in July. Display impressions increased 5% over last year.

PubMatic is currently guiding to roughly an 8% YoY decline in revenue in the third quarter. Display revenues are expected to decline in the single digit percentage range, online video revenues are expected to decline by roughly 10% YoY and CTV revenue is expected to decline YoY. PubMatic is not anticipating any material revenue contribution from its commerce media solution this year.

Figure 1: PubMatic Revenue (source: Created by author using data from PubMatic)

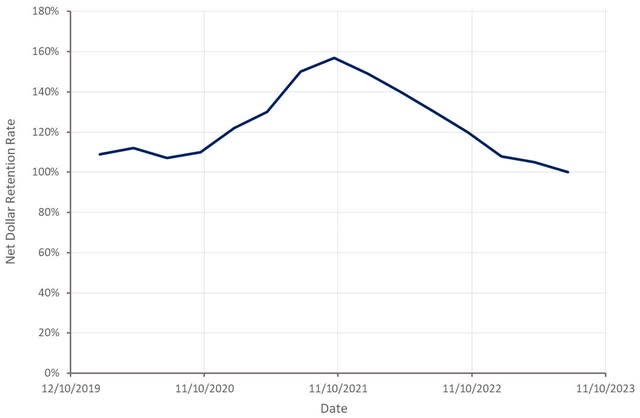

The total number of active customers on PubMatic’s platform increased 13% YoY in the second quarter. PubMatic is now monetizing inventory from over 1,750 publishers and the number of advertisers on the platform has increased by almost 30% over the past year.

While PubMatic’s customer count is increasing, its net dollar retention rate continues to soften. Given expectations for the second half of the year, NDR probably hasn’t bottomed yet.

Figure 2: PubMatic Net Dollar Retention Rate (source: Created by author using data from PubMatic)

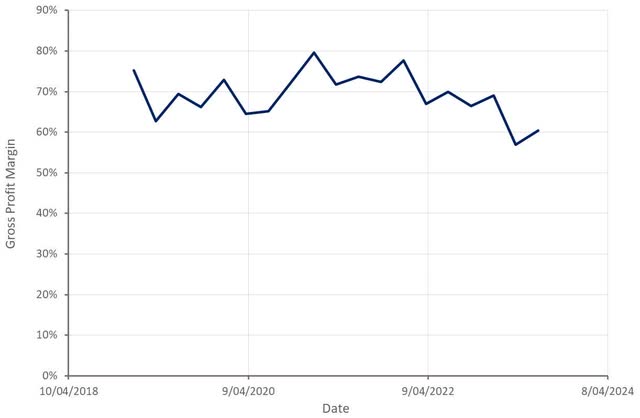

Declining CPMs are pressuring PubMatic’s margins, although the company is offsetting this to some extent with efficiency gains. By the end of the second quarter, PubMatic had added approximately 30% incremental processing capacity, without a corresponding increase in CapEx. On a trailing twelve-month basis PubMatic’s cost of revenue per million impressions processed declined by 12%. As a result, PubMatic expects its cost of revenue to be fairly flat in the second half of 2023, despite growth in impressions. This is expected to result in a significant improvement in gross profit margins when CPMs begin to rebound. This is illustrated by the fact that approximately 85% of every incremental revenue dollar above Q1’s level, converted to gross profit in Q2.

Figure 3: PubMatic Gross Profit Margin (source: Created by author using data from PubMatic)

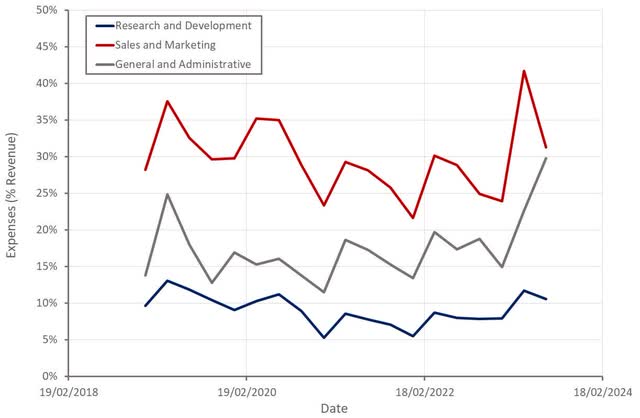

PubMatic’s operating expenses are also elevated due to growth investments and the soft demand environment. In addition, MediaMath’s bankruptcy resulted in a 5.7 million USD unexpected bad debt expense which fell under general and administrative expenses.

PubMatic’s pace of hiring remains fairly modest, which should help to limit further increases in operating expenses. Despite this, a potential fall in revenue in the third quarter will further pressure margins.

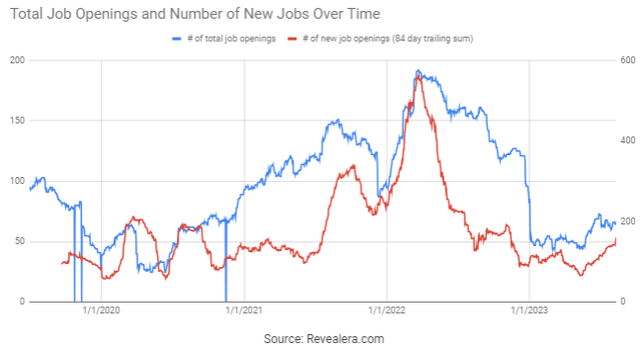

Figure 4: PubMatic Operating Expenses (source: Created by author using data from PubMatic) Figure 5: PubMatic Job Openings (source: Created by author using data from PubMatic)

Valuation

While PubMatic’s operating profit margin has been negative in the last two quarters, the company continues to generate strong free cash flows, and has been using these to repurchase shares. As of July 31, PubMatic had repurchased 1.8 million shares of its Class A common stock for 27.5 million USD. PubMatic still has 47.5 million USD remaining in the repurchase program. Given the company’s current valuation, this is potentially a smart use of cash.

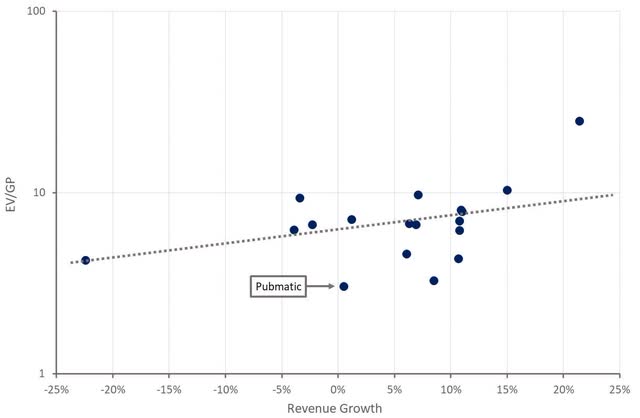

PubMatic’s valuation is low relative to comparable companies, particularly given PubMatic’s ability to generate free cash flow and growth potential. This is a reflection of the headwinds still facing digital advertising, and the fact that SSPs have generally had a tenuous competitive position in the past. There are forces in the market that could change this, but at this stage, investing in SSPs remains a speculative endeavor.

Figure 6: PubMatic Relative Valuation (source: Created by author using data from Seeking Alpha)

Read the full article here