Target Corporation (NYSE:TGT) is scheduled to report its second fiscal quarter earnings in the pre-market session on Wednesday. Here’s what investors need to know.

Target Stock Key Metrics

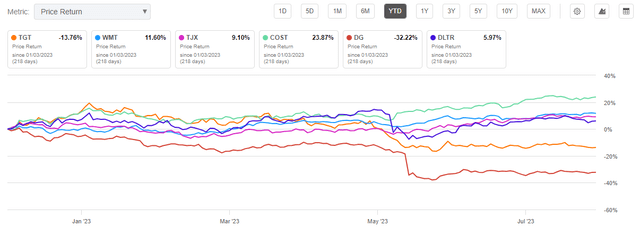

Shares in TGT have lagged over the past year. YTD, the stock is down nearly 15%. The broader S&P 500 Index (SP500, SPY), in stark contrast, is up the same in the other direction. And most in the peer group are in the positive as well. Walmart (WMT), for example, is up about 12%.

Seeking Alpha – YTD Returns Of TGT Compared To Peers

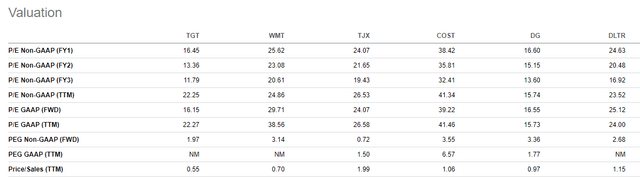

Perhaps surprisingly, the weakness hasn’t materially affected their forward valuation. The stock carries a forward earnings multiple of 16x, just shy of their five-year average of 18x. Shares, however, are priced at a significant discount to WMT, which commands nearly 30x.

Seeking Alpha – Valuation Metrics Of TGT Compared To Peers

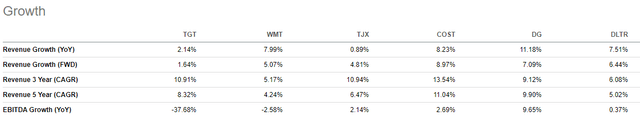

The disparity isn’t unreasonable, given that WMT’s YOY revenue growth is nearly 4x that of TGT.

Seeking Alpha – Revenue And EBITDA Growth Of TGT Compared To Peers

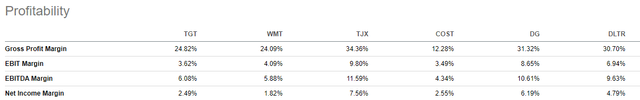

Yet despite this, gross margins remain comparable between the two companies.

Seeking Alpha – Profitability Metrics Of TGT Compared To Peers

TGT Guidance and Estimates

In Q1, Target reported total quarterly sales of +$25.3B and non-GAAP EPS of $2.05/share. Both beat expectations by +$40M and $0.29/share, respectively. The stock, nevertheless, dipped following the release due to soft guidance.

The softness was attributable in large part to expectations for increased retail theft (“shrink”). CEO Brian Cornell noted on the conference call that worsening shrink rates were putting significant pressure on their financial results. From a dollar standpoint, the impact was estimated to be +$500M. In Q1, that represented 100 basis points (“bps”) off gross margins.

Aside from shrink, CFO, Michael Fiddelke, pointed to softer comparable trends as they exited the first quarter. Resultingly, he provided a wide range for sales in-line with a low single-digit decline. The range for expected profit was similarly wide.

Altogether, Fiddelke guided for a higher YOY margin rate in Q2 but lower sequentially. This translated to an expected EPS midpoint of $1.50/share for the quarter and $8.25/share for the full year. Both were well below the consensus of $1.93/share and $8.47/share, respectively.

At present, estimates for the quarter stand at EPS of $1.50/share and revenues of +$25.36B.

What To Watch In Target’s Q2 Earnings

Discretionary Spending: One aspect of the bearish view on TGT is the greater weighting of discretionary categories in their sales mix. At present, it’s about a 51/49 split between their discretionary and consumable categories. For some Wall Street analysts, that’s enough to warrant a downgrade in the stock.

Their greater reliance on younger customers is also viewed as a risk due to the pending restart in student loan repayments. This could further amplify any fallout from a significant pullback in overall discretionary spending.

Research conducted by analysts at UBS also found that apparel is the category consumers defer the most during inflationary periods. And the trend was found to be even more pronounced with consumers with student loans. This could have significant implications for TGT. While the repayments haven’t kicked in just yet, observers should expect analysts to raise the topic during the post-release conference call.

Heading into earnings, expectations are low since management had already guided for a softer discretionary sales environment. There have been numerous downgrades since their Q1 release as well. This places TGT in a favorable position to surprise to the upside in the discretionary sales category.

For one, overall inflation is on the mend. And real wages are on the rise. On top of that, consumer confidence is at the highest level in more than two years, according to recent data from the Conference Board. On their Q1 release, deteriorating confidence was cited as one reason for the softening in their discretionary categories. The reversal in confidence could translate to stronger-than-expected sales.

With the improving macro data in mind, I expect a beat on top line sales followed with more favorable commentary on their discretionary categories.

Shrinkage: Retail theft isn’t an issue unique to TGT. In fact, it was one of the primary themes across all retailers throughout the Q1 earnings season. But what investors found striking was the sheer impact TGT expects out of it for the year; half a billion dollars. Analysts, no doubt, will be asking about updates during the conference call. I expect Cornell to also elaborate on the overall environment in his opening remarks.

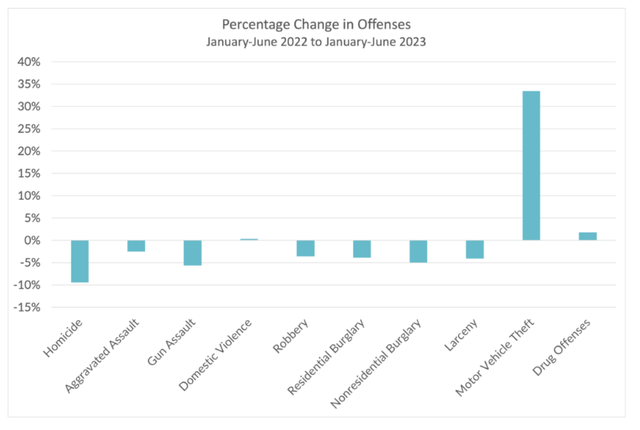

Recently released data from the Council on Criminal Justice (“CCJ”) show a positive trend in overall crime rates. In most categories, crime is down in the single-digit percentage range. It appears perpetrators have moved on from residential/non-residential burglaries to vehicle theft.

Council On Criminal Justice – 2023 Crime Trends

Given the pullback in overall crime rates, I expect shrinkage to be less of a factor than it was last quarter. It may even result in a positive revision in full-year guidance. If this is in fact the case, expect TGT to highlight any internal efforts made to combat the issue, such as enhanced security measures.

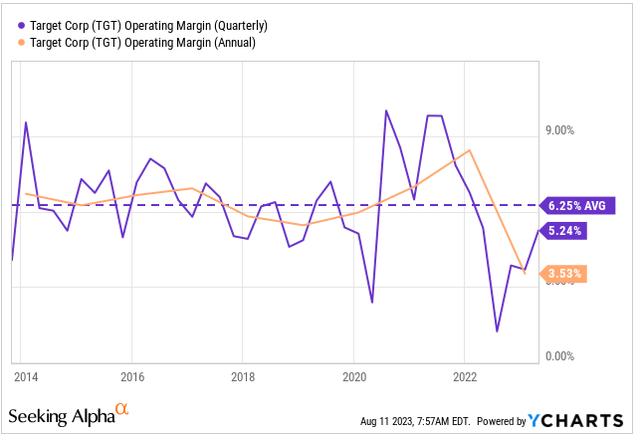

Recovery In Profits: Any improvement in the outlook for shrink would have a positive impact on TGT’s margins. This would be a welcome relief to investors who have grown impatient with the pace of recovery. At 5.2%, Q1 margins were improved from last year but still a full percentage point below their long-term average. They are also still trying to climb out of the hole on a twelve-month basis, with reported TTM operating margins at just 3.5%.

YCharts – Trend In TGT Operating Margins

Analysts at Raymond James recently downgraded TGT due to their expectations of a higher promotional environment resulting from TGT’s greater reliance on discretionary product offerings. And in their note, they mentioned that the higher promotions would delay their margin recovery.

I am less pessimistic about the selling environment. As such, I expect TGT to report an operating margin rate of about 5%. It would be lower than in Q1, but not significantly so. I also expect more favorable commentary on the full-year outlook on their recovery efforts.

Seasonal/One-Time Uplifts: Target has made significant strides in working through excess inventory. At the end of Q1, inventory was 16% less than a year ago. The more favorable position likely enabled the company to capitalize on ordering new and in-demand product offerings.

Examples of the types of products that would have been in demand include those relating to major Hollywood films. On their Q1 conference call, TGT’s Chief Growth Officer, Christina Hennington, highlighted major theatrical releases through the date of their release, such as Super Mario Brothers and The Little Mermaid, as significant tailwinds in their discretionary categories.

The release of Barbie, then, could have proved especially beneficial for TGT. The company hasn’t had a problem with foot traffic in their stores. In fact, TGT reported their 12th consecutive quarter of YOY growth in traffic in Q1. That’s a milestone not even Walmart or Costco (COST) has achieved.

Provided that traffic growth was still positive, I expect TGT to have benefitted through sales of their Barbie collections. I also expect them to have benefitted from sales of other move-related toy offerings, such as the Teenage Mutant Ninja Turtles.

Is TGT Stock A Buy, Sell, Or Hold?

Inflation is on the mend, real wages are rising, and consumer confidence is high. This could swing the pendulum back in favor of discretionary products, TGT’s majority offerings. There is also the added tailwind from the box office hit, Barbie. If these demand drivers were in place, TGT likely would not have had to discount to move product, especially when factoring in their stronger inventory position heading into the quarter.

At present, TGT is currently trading near their 52-week lows. This follows the issuance of soft guidance in their Q1 release earlier in the year and a series of downgrades more recently. The underperformance has even raised speculation of possible activist activity. Despite the bearish sentiment, the consensus price target on the stock sits at around $160/share. This represents about 25% upside from current trading levels.

I believe TGT can get there on the dual catalysts of a milder promotional environment and reduced expectations relating to shrink. Together, this would raise the full-year margin and profit expectations, key sticking points for some investors who have shunned the stock.

With expectations low and positive data on their side, TGT makes for a solid addition ahead of Q2 earnings, as well as on share price weakness in the event of any disappointment in quarterly results.

Read the full article here