On August 3, Apple (NASDAQ:AAPL), one of the leaders in the technology sector, released its financial report for the third quarter of fiscal year 2023, which showed mixed results. Although sales of the company’s services increased compared to the previous year, demand for its key products continues to decline.

Apple’s most famous product, which continues to captivate investors and consumers year after year with its unique innovations and elegant design, is the iPhone. However, on July 20, 2023, news broke that the tech giant was having trouble making screens for more expensive devices like the iPhone 15 Pro and Pro Max. This is especially critical since sales of iPhones bring the company a little less than half of its total revenue, but also less than two months remain before its release. As a result, there is a higher probability that the volumes and rates of increasing its production in the first months after its release will be lower than initially projected. Ultimately, we expect this to hurt both revenue and Apple’s margins.

At the same time, the key Chinese macroeconomic variables indicate a slowdown in the recovery of the country’s economy. Moreover, the youth unemployment rate has already exceeded 21%, which may have a negative impact on their ability to pay. Therefore, we expect this to lead to a decrease in demand for the company’s products, including iPad and iPhone, from the end of the third quarter of 2023.

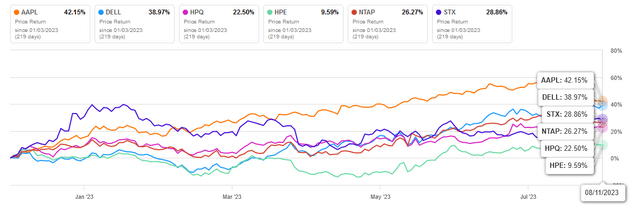

On the other hand, thanks to the expansion of the variety of services integrated into the company’s digital ecosystem, since the beginning of 2023, Apple’s share price has shown growth of more than 42%, outperforming major competitors in the sector, such as HP (HPQ), Dell Technologies (DELL), and Hewlett Packard Enterprise (HPE).

Author’s elaboration, based on Seeking Alpha

We initiate our coverage of Apple with a “hold” rating for the next 12 months.

The financial position of Apple and its prospects

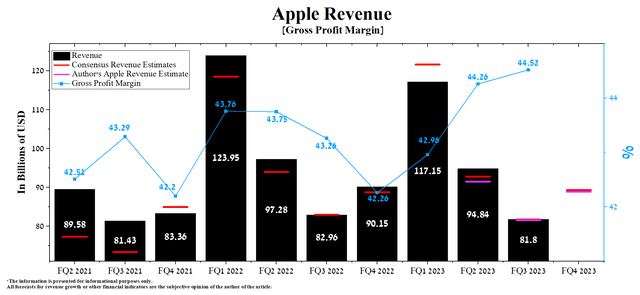

For Q3 FY 2023, Apple’s revenue was $81.8 billion, down 13.7% from the previous quarter and 1.4% from Q3 FY 2022. At the same time, the company’s actual revenue beat analysts’ consensus estimates in six of the last ten quarters, which may indicate an objective assessment of Apple by Wall Street.

We believe that due to the lack of revenue growth in recent quarters, the policy implemented by Tim Cook is becoming less effective in the current environment of stricter competition from mobile phone manufacturers and weakening global demand for electronic devices.

Author’s elaboration, based on Seeking Alpha

According to Seeking Alpha, Apple’s Q4 FY 2023 revenue is expected to be $87.31-$92.13 billion, up 9.2% from analysts’ expectations for the three months ended July 1, 2023. At the same time, under our model, the company’s total revenue will be slightly below the median value of this range and will amount to $88.9 billion.

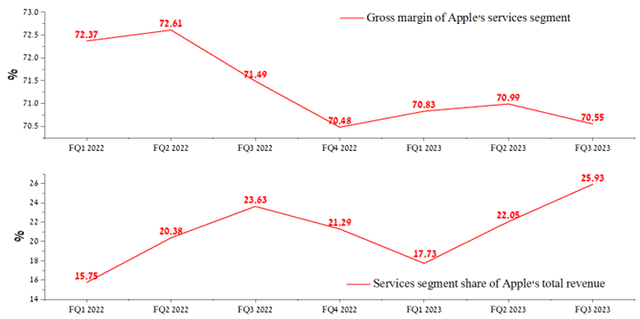

The company’s quarterly revenue growth will be driven primarily by its services segment, which shows impressive results. The share of this segment of Apple’s total revenue not only continues to grow, but its gross margin is two times higher than Products.

Author’s elaboration, based on quarterly securities reports

On the Q3 FY 2023 earnings call, the CEO of Apple stated the following:

Both our transacting accounts and paid accounts grew double digits year-over-year, each reaching a new all-time high. Third, our paid subscriptions showed strong growth. This past quarter, we reached an important milestone and passed one billion paid subscriptions across the services on our platform, up 150 million during the last 12 months and nearly double the number of paid subscriptions we had only three years ago.

On the other side, the range of Apple devices consists of a line of personal computers, iPads, and various accessories and electronics, including HomePod, AirTag, wireless headphones, smartwatches, Apple TV 4K and Apple TV HD, and more. This is especially important as the company continues its expansion into the rapidly growing market of India, whose economy is recovering at a relatively strong pace. In addition, the company’s management continues to increase the production of its devices in India, together with manufacturing partners such as Pegatron (OTCPK:PGTRF) and Foxconn (OTCPK:FXCOF), which will help strengthen Apple’s financial position. The reasons for this are reduced dependence on China due to growing geopolitical tensions between Washington and Beijing and improved logistics as demand for the company’s products in South Asia increases.

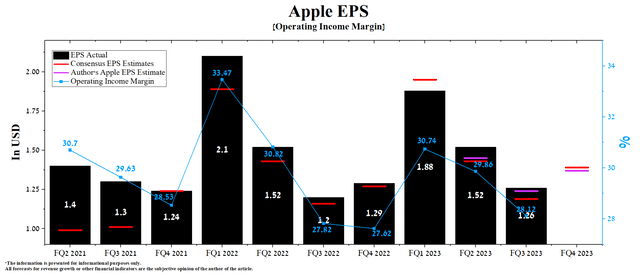

Apple’s Q3 FY 2023 operating income margin was 28.12%, up slightly from the previous year but still below its median of 29.73% between January 1, 2021, and July 1, 2023. At the same time, we forecast that in 2023 the operating income margin of the company will remain stable and reach 28.7%, and by 2024 this value will increase to 29.4%, thanks to lower inflation and higher revenue from the services segment.

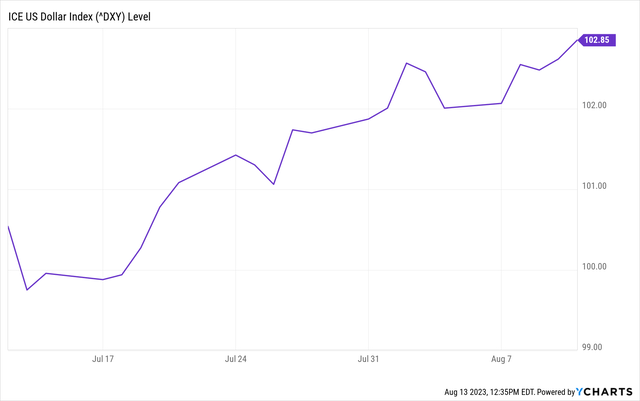

In addition, we expect the upward trend in the number of paid subscribers to continue, including through the transfer of Lionel Messi to Inter Miami, which will significantly draw the attention of football fans to MLS. Apple TV currently has the exclusive rights to broadcast MLS matches in the United States. In our assessment, we considered the impact of the strengthening US dollar against foreign exchange rates, which negatively affects Apple’s margins.

YCharts

The company’s earnings per share (EPS) for the three months ended July 1 was $1.26, down 17.1% quarter-on-quarter and, just as importantly, beating analyst consensus estimates in nine of the last ten quarters.

According to Seeking Alpha, Apple’s Q4 FY23 EPS is expected to be in the $1.35-$1.45 range, down 16.8% from the Q3 FY23 consensus estimate. While we believe this is slightly underestimated, our model puts Apple’s EPS at $1.37.

Meanwhile, the company’s Non-GAAP P/E [TTM] of 29.88x, 53.40% more than the average for the sector, and 15.94% more than the average over the past five years. In addition, the Non-GAAP P/E [FWD] of 29.35x is one of the factors indicating that the company is slightly overvalued during the current period of slowdown in consumer spending in China, which is one of the key markets for the company.

Author’s elaboration, based on Seeking Alpha

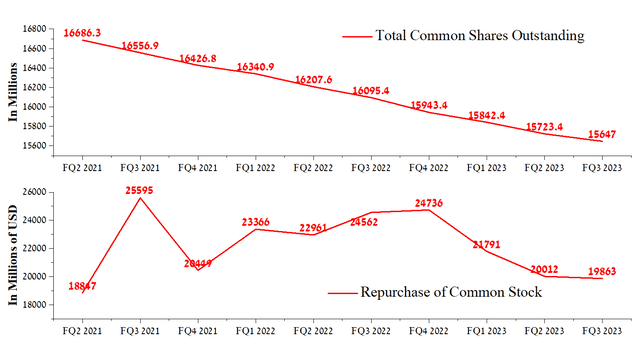

But at the same time, we believe that one of the key factors contributing to Apple’s beating the consensus EPS is related to its management’s active use of the share buyback program. For the third quarter of fiscal year 2023, the company repurchased $19.86 billion of its shares, slightly less than the previous quarter. At the same time, Tim Cook has the authorization to buy back Apple shares for a total amount of over $90 billion, which is an impressive amount that will have a positive impact on the fight against short sellers.

Author’s elaboration, based on Seeking Alpha

Conclusion

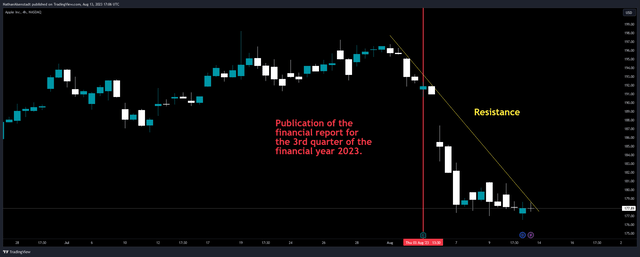

On August 3, Apple, one of the leaders in the technology sector, released its financial report for the third quarter of fiscal year 2023, which showed mixed results, which eventually led to the start of a corrective movement in its share price.

TradingView

Demand for most of the company’s products is falling, reflected in the decline in its total revenue relative to the previous year and the previous quarter. In contrast, the services segment continues to thrive despite the Federal Reserve’s elevated interest rates and the slowdown in China’s economic recovery.

On the other hand, Apple has stable cash flow, and the total debt/EBITDA ratio remains below 1x, indicating that there will be no significant debt servicing and repayment difficulties in the future. However, it is important to note that the company’s margins are declining, and there have been reports of challenges in producing screens for more expensive devices such as the iPhone 15 Pro and Pro Max. Given these considerations, we believe the $167-$168 range presents an attractive risk-reward ratio for long-term investors.

We initiate our coverage of Apple with a “hold” rating for the next 12 months.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here