Research Brief

In today’s analysis, I cover a well-established firm in the financials sector again.

Principal Financial (NASDAQ:PFG), which had their Q2 earnings release recently in late July, operates three key business segments: retirement, asset management, benefits & protection.

Some key points to mention from their website: roots in 1879 as an insurance company, a member of the Fortune 500, $635B in assets under management, ranked 441st on the Forbes Global 2000 list.

Rating Method

The goal is to find value-buying opportunities in these sectors I focus on exclusively: financials/insurance, tech/innovation/managed services.

My 5-step approach is to break down the overall rating into 5 categories: share price, dividends, valuation, earnings growth, & capital strength.

If I recommend this stock in at least 3 of these categories, it gets a hold rating, and if I recommend at least 4 out of 5 then it gets a buy rating.

Share Price: Recommend

As I am trying a slightly different approach than in prior articles, I am starting this analysis by talking about the share price first. The question I usually get is: what is my recommended buy price for a stock, and how long should I hold it?

My answer is to first establish a target goal for a return on investment, and a target risk tolerance goal in the event of unrealized losses.

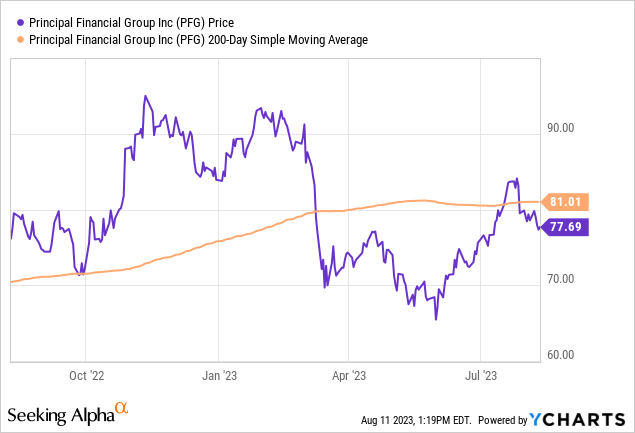

To simplify the answer, let’s first look at the current price chart for this stock as of the writing of this article. In late Friday afternoon trading on August 11th it was trending around $77.69 per share, just below the 200-day simple moving average (orange line):

Rather than pick a magic price out of a hat, throw darts at a wall, or try to “time” short-term market moves, which is not pragmatic for a long-term investor, I have created an easy-to-understand investment idea using the following spreadsheet which tracks the 200-day SMA and establishes both a goal for total return on investment as well as a risk tolerance goal for potential unrealized losses, because you have to anticipate those too:

Principal Financial – trade simulator (author spreadsheet)

The easy way to explain this investment idea is:

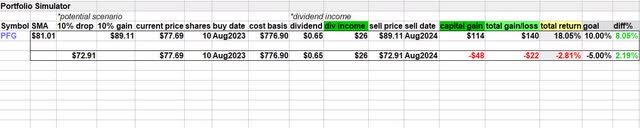

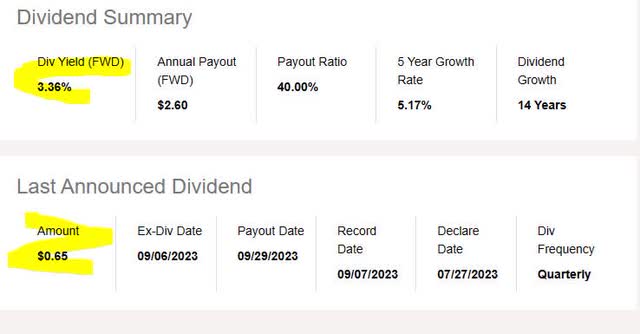

It simulates buying 10 shares at the current price of $77.69, holding for 1 year to earn the full-year dividend income, and selling at my target sell price, with a goal of achieving a total return on capital invested of 10%. In the first scenario (top row), I exceed that goal and achieve an 18% return, which is 8% above my target. This assumes the price in 1 year will be 10% higher than the current 200-day SMA.

In the loss scenario (2nd row), I am testing a 10% drop in the current moving average in 1 year’s time, and my risk tolerance is a 5% unrealized loss on capital invested. In this scenario, my potential paper loss of 2.81% is within my risk tolerance range of a negative -5% return, so it is tolerable.

This tells me that the current share price can be recommended as a buying opportunity. In this model, the upper buy limit would be $79.49, because buying above that would exceed my risk tolerance in the event of a 10% drop in the SMA in a year’s time, as it would cause a negative return of -5.01%.

Here is a closer look, which shows what happens if I buy at the current price and decide to sell in 1 year’s time at 10% above or below the current 200 day SMA. The total gain/loss includes dividend income earned:

trade simulator (author spreadsheet)

This investing idea essentially requires using the YCharts, 200-day SMA, and current share price. All simulations shown may not be suitable for all readers’ portfolio goals and risk tolerance, and is simply a “framework” to go by. Capital gains & dividend income may also be taxable events, so readers should use caution & consult with sources outside the scope of this article on such topics. The goal of this section of the article was to establish if the current share price vs the SMA presents a buying opportunity, and in my opinion it does, within the targets mentioned.

Dividends: Recommend

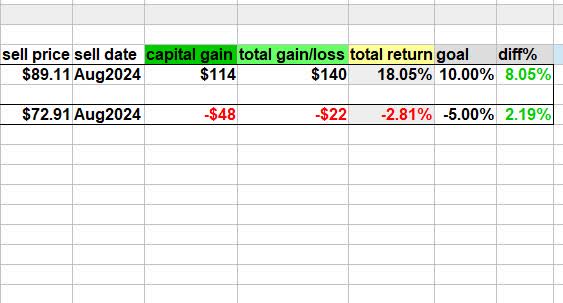

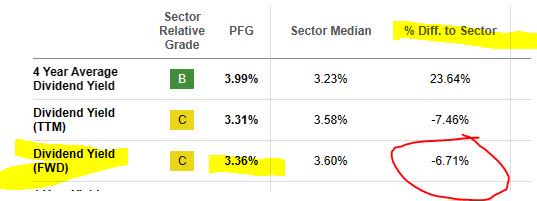

As an analyst, I am looking for dividend-income opportunities among stocks. In the case of Principal, as of Aug. 11th it is offering a dividend yield of 3.36% which is modest.

Notable to mention is that its dividend of $0.65 per share has an upcoming ex-date on September 6th, which could be an opportunity.

Principal – dividend yield (Seeking Alpha)

In comparison with its sector, however, it is a little lower than the average, however not terribly lower. My target is for it to be in a range of -10% to +30% vs its sector average, so I think it is still within an acceptable range.

Principal – dividend yield vs sector (Seeking Alpha)

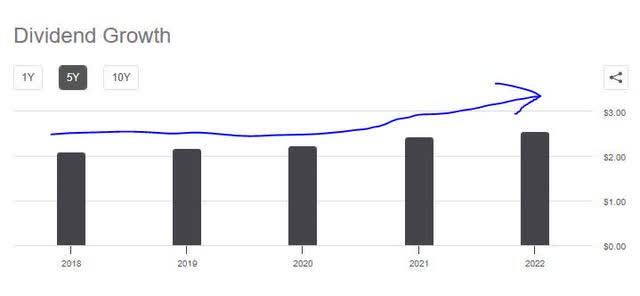

On another positive note, when looking at the 5 year dividend growth rate there has been a steady growth since 2018:

Principal – dividend 5 year growth (Seeking Alpha)

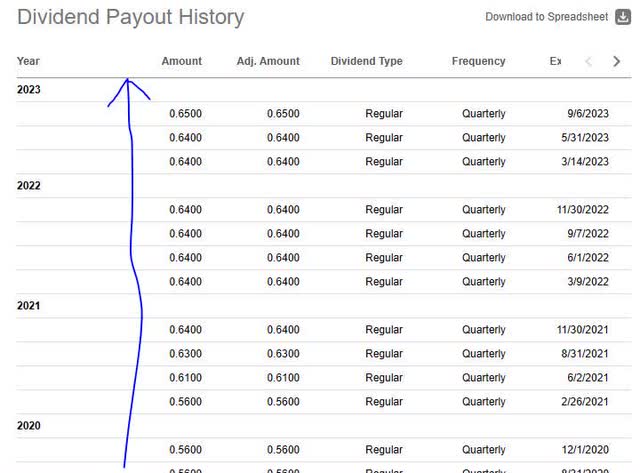

Further, since 2020 there have been steady dividend payouts without any cuts, and payouts have successively been higher.

Principal – dividend history (Seeking Alpha)

All of this is a sign of strong capital deployment by this firm, and a commitment to return capital back to shareholders.

I would recommend this stock in the category of dividends, based on this evidence. One idea is to add this stock to an existing portfolio of other insurance-focused firms as well as asset managers.

Valuation: Not Recommended

Next, I often ask what is a good valuation for a stock. Is it overvalued or an undervalued opportunity?

To analyze this, I have simplified the process down to looking at two ratios: the forward P/E ratio and forward P/B ratio, from official data.

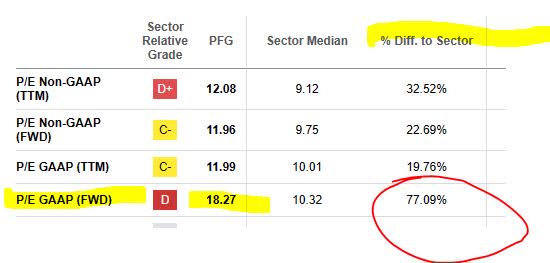

For starters, this stock is over 18x price to earnings, while its sector average is closer to 10x earnings, making it over 77% higher than the sector it’s in.

Principal – PE Ratio (Seeking Alpha)

My target is for this stock to be at or below 10x earnings, so with a P/E of 18.27 I consider this overvalued vs its sector and therefore not a great opportunity right now.

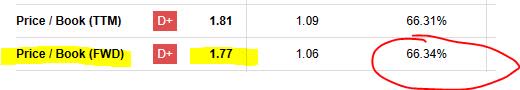

It’s P/B ratio is also quite inflated it seems. At almost 2x book value, it is over 66% higher than its sector average which is a little over 1x book value. My target for this stock is a P/B of around 1x book value or less. So, right now it is overvalued and not a great opportunity on this metric either.

Principal – PB ratio (Seeking Alpha)

In comparison to a peer, I will use Sun Life Financial (SLF), a stock I covered recently. Its valuation is more reasonable though still high, with around 12x forward price to earnings.

I would certainly also mention Prudential Financial (PRU) which has an attractive valuation of just 7.8x price to earnings and 1.15x price to book. It also deals in the insurance, annuities / retirement solutions space as well and is a major whale in that space.

So, I will not be recommending Principal Financial on the basis of valuation, as there are better opportunities in this category.

Earnings Growth: Not Recommended

At first glance, the top line numbers for this company in Q2 look ambitious, with YoY growth in both of its key revenue segments: premiums/annuities and interest/dividend income:

Principal – revenue YoY growth (Seeking Alpha)

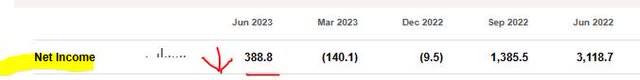

However, the bottom line could use improvement, as it has seen a YoY disappointingly negative trend:

Principal – net income YoY growth (Seeking Alpha)

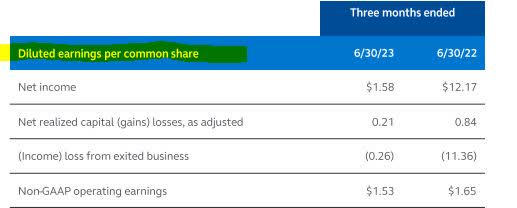

The firm also took a major YoY hit on earnings per share:

Principal – EPS YoY drop (Principal – Q2 presentation)

So while the top line is getting a lot of tailwind, especially with the interest rate environment being favorable, I think the bottom line results are in need of improvement for the next quarter and so for that reason I do not recommend in this category right now.

Capital Strength: Recommend

From its Q2 presentation, we can see why this company says it has a “strong capital position.. focused on deploying capital to attractive organic opportunities and to shareholders.”

It boats $1.2B in excess capital, while just having a 22% debt to capital ratio, and has returned $255MM back to shareholders:

Principal – capital & liquidity (Principal – Q2 presentation)

For us dividend investors, looks like it also has boosted its dividend in Q3, which is good news.

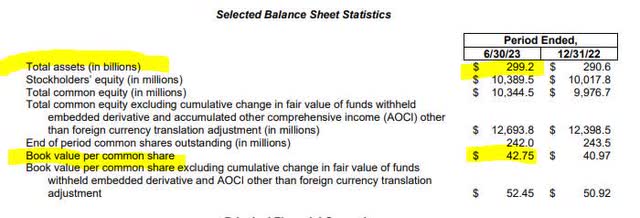

In looking at the balance sheet, the company can boast $299B in total assets, positive equity, and a book value around $43.

Principal – balance sheet (Principal – Q2 earnings release)

Here is what CEO Dan Houston had to say in his quarterly remarks:

We returned over $250 million to our shareholders during the quarter and remain confident in our full-year guidance.

In looking at this firm more closely now, I am agreeing with his confidence level about this firm’s financial strength and would recommend it on that basis.

Rating: Neutral / Hold

Today this stock won 3 of my 5 categories, earning a hold rating, which is in line with the consensus from both the Seeking Alpha quant system and analysts, however more bullish than the Wall Street consensus, as seen below:

Principal – ratings consensus (Seeking Alpha)

A hold rating is not considered a negative, in my opinion, as it could be an opportunity for those who got in at a much lower price to see some realized or unrealized gains by now, or to continue earning the dividends quarterly rather than sell out. It just is not so great I think right now for a new buyer perhaps.

Risk to my Outlook: Exposure to CRE

A risk to my neutral/hold outlook is it is too ambitious, as investors get increasingly concerned about risk exposure of firms like this to commercial real estate and office properties, which have not gotten great press lately.

Consider the late July article in Reuters that highlighted this risk:

second quarter earnings show that a number of big banks have prepared for potential defaults, primarily on office loans.

As you may know, firms like Principal Financial invest a lot of their extra cash into a portfolio of income-producing assets.

Here is what Principal’s looks like:

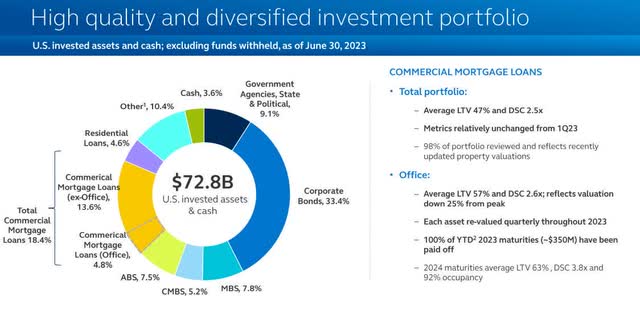

Principal – CRE exposure (Principal – Q2 presentation)

What I gather from this chart is a highly diversified portfolio with a majority of assets not tied to CRE but actually corporate bonds, in fact over 33%. The black sheep of CRE lately, office property, is just 4.8% of the portfolio. This is hardly a number that will bring the house down, in my opinion, even if it does face problems let’s say.

The firm also mentioned that “year to date, 100% of 2023 office commercial mortgage loan maturities have been paid off.”

So, I am of the opinion that this risk is not a major one, although it should be considered for sure as a risk.

Analysis Wrapup

Key points we went over today include:

Positives: share price vs moving average, dividends, capital strength.

Headwinds: valuation, earnings growth YoY.

Risks: exposure to CRE and office loans have been addressed.

Concluding thoughts:

I remain neutral about this stock, as is the consensus it seems, as it is not quite one I am ready to be bullish on or overly bearish either. It is otherwise a well-established name in its space and looks after billions in assets under management.

They missed two of the last 4 quarterly earnings estimates, so I predict a 50% chance they beat on the next one, with a $0.06 earnings beat for Q3.

Principal – earnings beats (Seeking Alpha)

Read the full article here