Introduction

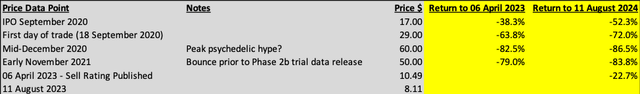

COMPASS Pathways plc (NASDAQ:CMPS) released 2Q23 results on 03 August 2023. My previous Seeking Alpha note on CMPS, published in April 2023, rated the stock a Sell at ~$10.50 based primarily on concerns regarding the company’s cash burn rate. CMPS has fallen by ~23% since that April Sell call. Exhibit 1 shows that investors who bought CMPS around the time of peak psychedelic hype (December 2020) are now down by ~87%; those who bought CMPS in November 2021 when optimism regarding the group’s initial Phase 2b trial was elevated are currently sitting on losses of 84%.

In this note, I’ll take a fresh look at the CMPS balance sheet and update my analysis of what I deem to be the key issue for investors focused on the psychedelic sector – cash burn. CMPS took significant steps to extend its cash runway in 2Q23, and I will consider whether or not these changes are sufficient to upgrade my prior Sell rating for the stock.

Exhibit 1:

Source: author’s calculations.

Cash Burn – CMPS Takes Action

I’ve previously highlighted the importance of cash burn for investors in the psychedelics sector. The potential for companies in the sector to run out of cash before psychedelic-assisted therapy (‘PAT’) becomes an FDA approved treatment for mental health conditions shouldn’t be overlooked. I discussed this issue in my previous CMPS note and I refer readers to my recent work on Numinus Wellness (NUMI:CA) and Cybin Inc (CYBN) for further examples of businesses running low on cash.

In April 2023, I wrote the following:

It therefore appears to be a question of when, not if, CMPS comes to market to raise capital. My expectation is that the company will move on this issue sooner rather than later, as further cash outflows will likely contribute to continued share price decline (as the market becomes increasingly focused on the likelihood of material dilutive share issuance).

Since my last CMPS note, the company has made two big moves to strengthen its cash position. In 2Q23, CMPS issued equity via an at-the-market equity program (‘ATM program’) that was first announced in late 2021, raising almost $27m. In early July 2023, CMPS announced a debt deal with Hercules Capital, Inc. (HTGC) for access to funding of up to $50m, with $30m drawn as at 30 June 2023 (the end of 2Q23). These moves are clearly positive in terms of propping up the group’s cash position and increasing the probability that CMPS can survive long enough to achieve FDA approval for COMP360, but there are also downsides to consider for investors, which I’ll touch on below.

ATM Program – Share Price Pressure Expected To Continue

Turning first to the ATM program. In October 2021, CMPS entered into a sales agreement with Cowen and Company, LLC, allowing the issue of up to $150m worth of stock. For readers not familiar with the term, in a typical ATM equity offering, a company will sell newly issued shares at current market prices through a broker-dealer. ATM offerings tend to be smaller than more traditional equity raises, with shares issued gradually over time. ATM programs might also be referred to as dribble-out facilities, controlled-equity offerings, or equity-distribution programs. I think the term ‘dribble-out’ sums up the ATM program nicely and intuitively points to a downside with this method of raising capital. A regular dribbling-out of new stock can add to supply of a company’s shares at a time when there is no increase in demand (or even worse, when there is a decreasing demand) for that company’s stock – with the obvious outcome being a decline in the share price.

Imagine for a moment that you are a bullish holder of CMPS, and that you see the stock as a potential ’10 bagger’. In this case, you clearly think that CMPS’s shares are currently massively undervalued. How do you then feel about the company issuing a significant chunk of new shares at low prices without inviting you to participate proportionally in the offer? Your potential ’10 bagger’ gains will be diluted, so you should probably feel pretty displeased. At the end of FY22 (before the ATM program was utilized), CMPS had 42.6m shares on issue. Let’s say that CMPS issues the full $150m worth of stock through the ATM and does so at an average price of $8 per share (slightly below the current share price) – this will involve issuing 18.75m new shares – or 44% of the pre-ATM commencement issue share count, representing a material dilution for existing holders.

CMPS pushed the ATM facility hard in 2Q23 raising ~$27m. My calculations point to the company issuing shares in the quarter equal to 6.6% of the 1Q23 closing share count. All else being equal, I would expect share issuance at such a high rate to place material downward pressure on the CMPS share price. It is unclear what intentions CMPS has for further ATM issuance, but with only ~19% of the $150m capacity used, there could well be quite a lot of ‘dribble-out’ downside to come. For those interested in the detail, in Exhibit 2 I track the ATM issuance to date.

Exhibit 2:

Source: author’s calculations based on CMPS quarterly reports.

Debt Deal

CMPS issued a press release regarding the debt deal with Hercules Capital on 05 July 2023. This press release provided basic details regarding the loan facility secured, but failed to mention some key issues that ought to be of interest to investors. To obtain a fuller understanding of the deal with Hercules Capital, I direct readers to the CMPS Form 8K released on 05 July 2023.

CMPS drew down $30m of the available funding on 30 June 2023. The maturity date for the debt deal is 1 July 2027. Access to $10m of the remaining $20m of the facility is contingent upon the achievement of certain financial and performance milestones. The final $10m of funding may subsequently become available, subject to agreement from Hercules Capital. Payments under the Hercules facility are interest-only until 01 July 2025 (potentially extended to 01 July 2026 if certain milestones are achieved); the delay in repayment of capital is a positive in terms of reducing cash burn for CMPS, but it obviously comes at the cost of higher interest payments.

Talking of interest payments, I was disappointed that the CMPS press release did not disclose the interest rate payable on the debt financing secured – this is quite an important detail for investors. The facility interest rate is the greater of a) 9.75% or b) 1.50% plus the Wall Street Journal prime rate. At the time of writing, the Wall Street Journal prime rate is 8.5%, implying a debt interest rate of 10% pa. For a 4-year facility, an interest rate of 10% pa strikes me as being rather high, but perhaps not excessively so given the relatively high risk faced by the lender. There are other costs for CMPS relating to the deal, including a $0.35m upfront facility fee and an end of term charge of 4.75% of the principal amount repaid. CMPS notes that the initial $30m drawn down translated to only $28.8m of cash benefit after net issuance costs. It therefore appears to me that the effective all-in interest rate on the deal is currently north of 11% pa. I should also note that Hercules has been granted a warrant for 94,222 CMPS shares exercisable for ten years at a price of $7.96 per share.

In addition to being quite an expensive form of funding, the Hercules deal imposes various obligations and constraints on CMPS, including a covenant to maintain a minimum of $22.5m of cash during the period commencing 01 January 2024 (which may be varied subject to milestone achievements). The minimum cash covenant may be waived if the CMPS market cap is at least $750m (which is more than double the current CMPS market cap).

Updated Balance Sheet & Cash Burn Analysis

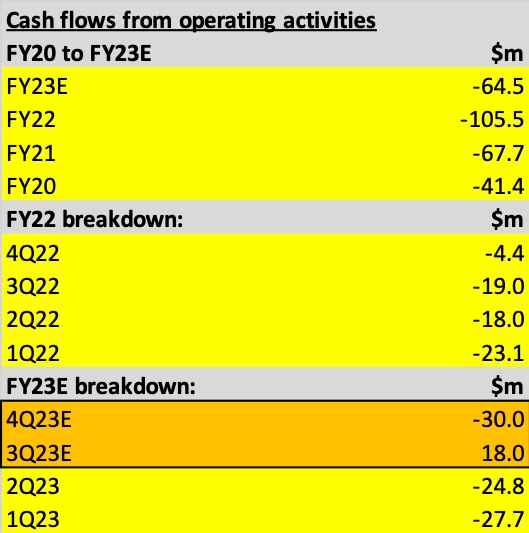

Cash received from the large 2Q23 ATM issuance and the Hercules debt deal has lifted CMPS’s balance sheet cash and equivalents from $117.1m at 1Q23 to $143.2m as at 2Q23 (30 June 2023). In the 2Q23 management speech, CFO Mike Falvey explained that net cash used in operating activities for 3Q23E will be a substantially better outcome than we have been used to seeing. Falvey guided to 3Q23E net operating cash flow of -$2m to +$18m, thanks to an adjustment to prepaid costs associated with the Phase 3 trial and the expected receipt of a $14m UK R&D tax credit. In Exhibit 3, I track operating cash flow back to FY20 and provide an estimate for FY23E operating cash flow (which assumes +$18m for 3Q23E, being the top end of management guidance).

Exhibit 3:

Source: author’s calculations based on CMPS quarterly reports.

Looking forward, I estimate that CMPS will have operating cash outflow of at least -$30m per quarter from 4Q23 onwards. Assuming balance sheet cash of ~$160m as at 3Q23E, and allowing for a minimum cash covenant (under the Hercules debt facility) of $22.5m, I conclude that CMPS has sufficient cash to fund ongoing operating cash outflows until late 2024. Relative to my previous analysis back in April 2023, it appears that the ATM and debt financing actions taken by CMPS have extended the group’s cash runway by around four to five months.

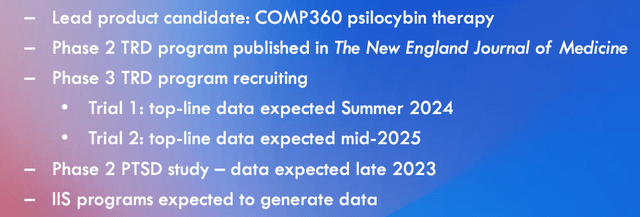

Exhibit 4:

Source: CMPS Investor Presentation, August 2023, slide

As set out in Exhibit 4, with results from the Phase 3 Pivotal 1 trial not expected before summer 2024 and the more important Phase 3 Pivotal 2 trial not expected to report results until mid-2025, it is extremely likely that CMPS will run out of cash before being able to advise the market of its Phase 3 results for the use of COMP360 psilocybin therapy for treatment resistant depression (‘TRD’). I am struggling to see how CMPS can raise another tranche of debt funding, and so the most likely outcome is that CMPS will rely upon further issuance under the ATM program to extend the group’s cash runway.

Conclusion & Rating

In this note I have very deliberately focused on the CMPS balance sheet and cash runway – these are key issues for CMPS and peers in the psychedelics sector that are all too often glossed over and overshadowed by discussion regarding clinical trials and the path to regulatory approval for psychedelic-assisted therapy.

I have previously written that I consider CMPS to be a market leader in the listed psychedelics space and I continue to hold that view. Since I last published on CMPS in April 2023, the company has made solid progress in terms of cash runway extension. Whilst not unexpected, the news in June 2023 that two legal challenges of CMPS patents have been dismissed is a further positive. I also note that the company continues to develop and refine its strategy for generating value in a post FDA approval environment (should that ever occur). The collaboration between CMPS and MAPS (Multidisciplinary Association for Psychedelic Studies) to secure a regulatory health coding that could be used to facilitate insurance payments for psychedelic-assisted therapy is an example of CMPS’s leadership in the sector.

It is possible that the anticipated US FDA approval for the use of MDMA to treat PTSD (driven by MAPS) will occur before CMPS runs out of cash, and that the positive sentiment regarding MDMA-assisted therapy will provide a boost to the CMPS share price, such that it can then raise capital without massively diluting the interests of existing shareholders. The timeline for MDMA-assisted therapy is still highly uncertain, and even if/when such approval is granted, given the very high cost-to-serve for MDMA/psychedelic-assisted therapy, there are many question marks regarding the commercial viability of operators in the sector.

My conviction that psychedelic-assisted therapy can be a game-changer in terms of the treatment of mental health conditions and improved wellness has not diminished from when I first published on this broad topic back in January 2022. However, as things stand today, CMPS and other stocks in the psychedelics sector sit in deeply speculative territory from an investment perspective. I therefore maintain my Sell rating on CMPS.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here