Summary

Remitly Global (NASDAQ:RELY) provides financial services. The Company offers online money transfer and payment solutions for immigrants and their families by providing financial services. I am recommending a buy rating as the 2Q23 results have convinced me that RELY can continue growing at 40% for the foreseeable future, driven by multiple growth trends.

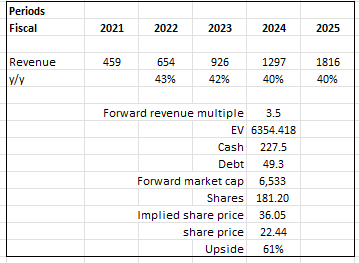

Financials/Valuation

Strong net adds drove quarterly active customers to around 5 million, up 47%, driving RELY’s 2Q23 revenue of $234 million, which beat consensus estimate by 8%. Strong net additions helped push total send volume to $9.6 billion, despite a 6% drop in send volume per customer to $1,907. This led to an adjusted EBITDA of $20 million, or a margin of 8.7%, as the positive top-line results trickled down to the bottom line.

Based on author’s own math

Based on my view of the business, RELY should be able to continue growing at a very strong pace, mirroring its growth so far and well supported by the key drivers I mentioned below. I expect RELY’s valuation to continue staying at a premium vs. peers like PayPal and Western Union, given that it is growing much faster (PayPal is expected to grow 10% while Western Union’s growth is flattish). Most importantly, RELY is growing from a much smaller revenue base, with EBITDA margin at its inflection point. As RELY shows accelerating EBITDA growth, I expect the market to continue supporting the current valuation of 3.5x forward revenue. Net-net, I have a price target of $36.

Comments

The RELY 2Q23 result is telling of how strong the business fundamentals are. RELY exceeded expectations across the board, from growth and profitability to customer acquisition unit economics, and as a result, the stock price spiked by 15% at one point (in my opinion). In essence, I have become more bullish about RELY after reviewing 2Q23 results, as I see enduring trends that should continue to support strong growth in the foreseeable future. To begin, RELY is evolving from a growth-focused company to one that is both rapidly expanding and profitable. Given the high cost of capital due to the current interest rate environment, this shift is of critical importance as it does not need to tap into additional financing. The bright spot is that margins have been expanding at healthy rates, with growth not showing signs of a major slowdown. Total revenue grew 48.8%, transaction profit grew 60%, and adj. EBITDA reached an 8.7% margin. If we extrapolate this performance to the next few quarters, EBITDA is expected to grow at an insane pace. Importantly, RELY’s unit economics continue to improve, with LTV/CAC now trending above the 6x it saw close to its IPO. This means that RELY’s long-term margin potential is increasing as the company expands and becomes more profitable.

Second, I think RELY’s growth could speed up because its monetization efforts are paying off and its take rates are increasing as it expands into new markets. My optimistic perspective on growth extends beyond just revenue and includes earnings as well. This is because RELY’s investments in its network, increased scale, and greater utilization of digital payout methods are leading to higher take rates and reduced transaction costs. In addition to these, the international expansion momentum that RELY has been experiencing should also aid in overall growth. Outside of North America, growth has been accelerating rapidly, with management highlighting more than 120% y/y growth in 2Q23, driven by new corridors and increased penetration in existing corridors. Given such performance, I expect international expansion to continue at this high rate going forward, contributing to RELY’s top-line growth in the not-too-distant future.

All in all, looking ahead, I expect management to continue investing in customer acquisition as the unit economics are relatively better today. I see no reason for growth to significantly slow down any time soon, given that they are able to sustain growth at 40+% while being profitable and are gaining substantial share from incumbents. In particular, a long-term secular tailwind is provided by the ongoing transition in the remittance markets away from cash and toward digital channels.

Risk & conclusion

Traditional money transfer companies like Western Union are also making the jump to the digital space. Given that these incumbents have an advantage in terms of brand recognition, reach, and balance sheet in absolute terms, they have the ability to undercut RELY prices.

In conclusion, I anticipate strong and sustained growth for RELY based on its robust 2Q23 performance and compelling growth drivers. The company’s expanding customer base, increased scale, and efficient digital payout methods are bolstering take rates and reducing costs, positioning RELY for continued strong growth. The positive trajectory is supported by improved unit economics and international expansion momentum, particularly outside North America. While competition from traditional incumbents exists, RELY’s profitability, market share gains, and the ongoing shift to digital channels underpin my bullish outlook.

Read the full article here