Introduction

NextEra Energy (NYSE:NEE) is a leading company in the production of electric power and energy infrastructure in the United States and Canada. NEE’s business structure is a combination of regulated utilities and renewables that provide capacity for higher long-term growth in the future. The company’s business mainly includes FPL, one of the largest electric utilities in the U.S. that serves approximately 5.8 million customers, and NEER. NEER represents the world’s largest renewable energy generation capacity consisting of wind, solar, and battery storage. In this analysis, I have investigated NEE’s second quarter results and its profitability condition. As a result, I updated my previous rating for NextEra Energy and believe that a buy rating is appropriate.

NEE business outlook

As the fastest-growing state in the United States, Florida is experiencing both population and economic growth. Thus, it is of great importance to provide appropriate investments based on the state’s needs. The management in the FPL segment has always had the strategy of keeping bills affordable while offering a reliable grid. During the recent quarter, FPL increased its regulatory capital employed by 12% year over year compared with the same time last year. This capital was devoted to new solar, transmission, and distribution infrastructures. Furthermore, FPL could reach $1.152 billion of net income in 2Q 2023, which was slightly higher than 2Q 2022.

Additionally, recent investments in Energy Resources led to 14% of growth in adjusted earnings versus the prior-year quarter. The demand for renewables and battery storage is increasing, and NEE’s infrastructural investments will assist the company in meeting the demand and thus keep affordable bills for customers. Looking outside the box, NEE is on track to meet its predictions through 2026. For example, during the second quarter of 2023, Energy Resources added 1800 megawatts into operations while adding 1665 megawatts of new renewable and storage projects to their backlog. As a result, they have settled approximately 20 gigatons of renewables and battery storage.

During the last two years, macroeconomic issues like inflation caused by the COVID-19 outbreak and thus, high interest rates to combat the inflation brought economic challenges for most people and businesses. However, NextEra Energy could leverage its competitive advantages and cater to strong financial statements. I believe that NEE’s established capital plan will lead to higher strength and growth by 2025.

Renewables market outlook

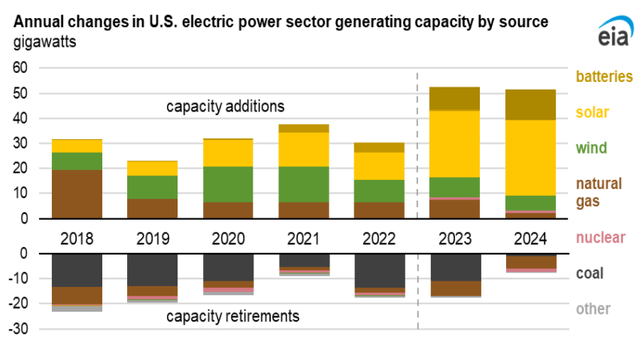

Renewable energy capacity is growing at a fast pace, and the growth is permanent in the following year as the electric power sector has planned to add 27 GW of new solar generating capacity by the end of 2023 while adding another 31 GW by the end of 2024. As a result, it is forecasted that renewables will account for a 25% share of U.S. electricity generation by 2024, up from 22% in 2023. As indicated in Figure 1, solar energy has boosted its share in U.S. electricity generation in 2023 and 2024. It is a good indicator that NEE’s capital projects are progressing well. Solar is the lowest-cost alternative for customers, and NEE executed approximately 225 megawatts of solar in the recent quarter. Since the start of 2023, the company has placed circa 1200 megawatts of solar services.

Figure 1

EIA

Furthermore, it is worth noting that overall energy consumption is going to decrease by slightly 1% by the end of 2023. However, the share of renewable energy in U.S. energy consumption will improve from 13% in 2022 to circa 14% at the end of 2023. Thankfully, the U.S. carbon intensity, which refers to total CO2 emissions relative to total energy consumption, is going to decrease more as economic activities will boost more than emissions in 2024. The total renewable energy share of total energy consumption will reach 15% by 2024. As a result, NEE’s capital expenditures in renewables in Florida, the fastest-growing state, will reach long-term growth and profitability for investors.

NEE’s financial outlook

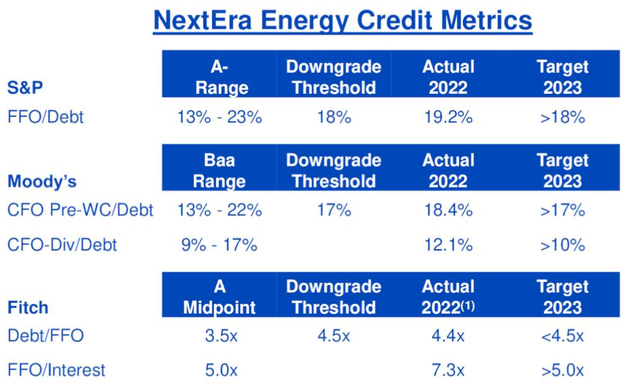

In my last article about NextEra Energy, I mentioned that the company has a large level of debt, with the past six years of free cash outflow. However, we should consider that high leverage is normal in the utility industry, and based on different credit metrics, NEE is on track. As you can see in Figure 2, S&P and Fitch rates for NextEra Energy’s credits are A- and A, respectively, while Moody’s rate is Baa.

Figure 2 –

Earnings conference call presentation

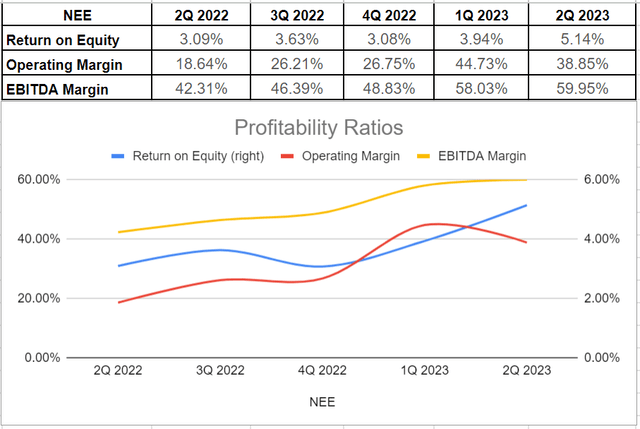

Due to the higher interest rates during the last few years, most utility companies have experienced challenges as they largely rely on debt financing. However, as the inflation rates decreasing back, there is no need for the Fed to insist on high-interest rates. Thus, there will be a better outlook for utility financials. Analyzing NextEra Energy’s financial condition indicates that the company has been able to provide benefits for its shareholders during the last year. In doing so, I have analyzed their profitability condition across the board of return on equity and margin ratios. As you can see in Figure 3, the company has improved its ROE considerably from 3% and 3.9% in 2Q 2022 and the end of 2022, respectively, to 5.14% at the end of 2Q 2023. This development was mainly due to the strength of net income that surged from $1380 million in 2Q 2022 to $2795 million at the end of 2Q 2023. The growth of NEE’s ROE indicates that the company is capable of returning its equity investments into profits. Furthermore, NextEra has been provided an encouraging level of margin ratios in the recent quarter. After surging to over 44% in the first quarter of 2023 from 26% at the end of 2022, NEE’s operating margin declined by 588 bps to 38.8% in 2Q 2023. However, it is worth mentioning that their operating margin was far higher year over year compared with 18.6% in the prior-year quarter. As a result, NEE’s operating margin or return on sale ratio shows positive signs for growth investors. Additionally, an astonishing boost in EBITDA generation of $4406 million in the recent quarter versus $2193 million in 2Q 2022 led their EBITDA margin to surge to approximately 60% as compared to 42% year over year in the second quarter of 2022.

Figure 3 – NEE’s profitability ratios

Author

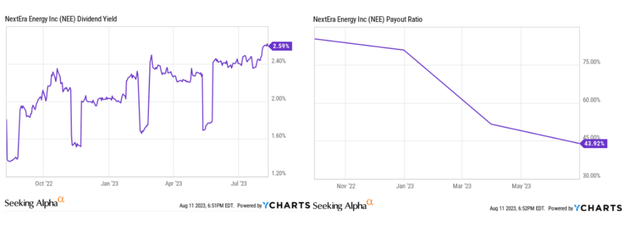

Apart from the company’s encouraging profitability condition, its long-term performance is heartening in terms of its dividend yield. NextEra Energy has grown its dividend yield during the last year and reached 2.59% of the yield. The company has shown consistency in growing its dividend payment, and the management expects to have annual 10% dividend growth by at least 2024, which represents NEE’s well-growth in the future. Moreover, the payout ratio sat at approximately 44%, which indicates that the management is willing to share their income among shareholders. It is notable that in the utility industry, with its high volatility, NEE’s payout ratio is ideal and shows its financial health (see Figure 4)

Figure 4 – NEE’s dividend yield and payout ratio

YCharts

Risks

Notwithstanding growth capacity and positive profitability outlook, NextEra Energy is facing some risks that can adversely affect its financial conditions. Although NEE’s business construction is a mix of regulated utility and clean energy operations, and this combination provides growth opportunities for it, NEE and FPL’s large portion of operations are subject to several federal, state, and other regulations. For instance, their rates and cost structures, operations, licensing of nuclear power facilities, and construction of electric generation are highly-regulated, and these regulations may have a material adverse effect on the business. NEE uses derivative instruments continuously to manage its risks. If the authorities find these instruments imprudent, they can deny cost recovery for such use by NEE, thereby adversely affecting their results of operations and financial condition. Ultimately, NEE’s and FPL’s operations are highly subject to operational risks including lost revenues due to prolonged outages, higher expenses due to monetary penalties, liability to third parties, and so on.

Conclusion

Throughout the analysis, I have investigated NextEra Energy’s results for the second quarter of 2023. The company’s investments in renewables provide a bright future for growth investors. Moreover, analyzing NEE’s profitability condition in terms of return on equity and margin ratios indicates that the company could increase its profitability, which was to the strength of its wise investments. Ultimately, NEE’s high dividend yield and payout ratio are good indicators to show the company’s capacity to remain on expected annual dividend growth of 10% by at least 2024. As a result, notwithstanding the existence of operational and market risks that NEE is facing, the company has performed well, and I recommend a buy rating for NEE stock.

As always, I welcome your thought and comments.

Read the full article here