Intro

Much like the entire banking sector, Sandy Spring (NASDAQ:SASR) is experiencing various difficulties in this 2023 due to the Fed’s tightening of monetary policy. In recent months, there seems to be more optimism, and this has caused a rally in the price per share of almost every bank. In any case, there is still a long way to go for Sandy Spring to recover.

Seeking Alpha

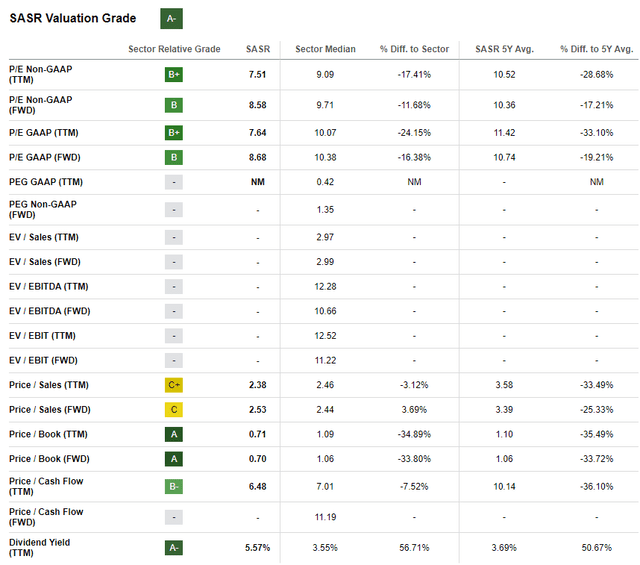

On Seeking Alpha this bank has a valuation grade of A- signaling a strong undervaluation. In addition, with a dividend yield of 5.57 percent, it also manages to provide excellent shareholder returns.

Based on this information, at first glance Sandy Spring may seem like a bargain, but in my opinion it is not. There are a number of reasons why this bank has such low multiples, and in this article I will show you the ones I think are most relevant.

The cost of funds is rising too much

For a bank to be able to raise funds at low interest rates is critical. If funds cost too much, the bank will probably not be able to maintain high profitability unless it lends at higher interest rates. As long as the yield on assets increases more than the cost of funds the situation is stable, but according to Q2 2023, this is not the case for Sandy Spring.

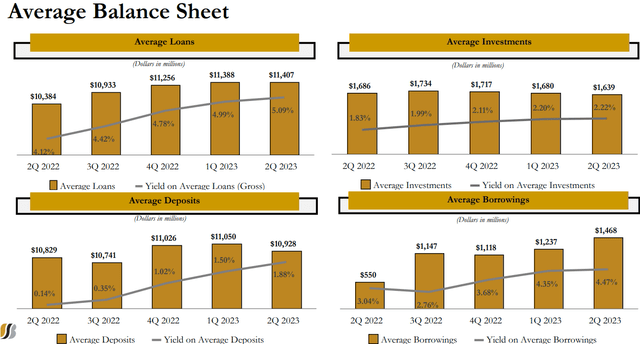

Sandy Spring Q2 2023

Compared with Q2 2022, the yield on average loans increased by 97 basis points, while the yield on average deposits increased by 174 basis points. In addition, the yield on average borrowings also increased a lot, 143 basis points.

The fact that the cost of funds increased over the past 12 months was inevitable since the current Fed Funds Rate is 5.25 to 5.50 percent, the worrying aspect is the speed with which this cost is increasing. What is more, it is unlikely that this trend will be reversed anytime soon, since the Fed may raise rates again and keep them high for a long time.

The money market offers interest rates that are too attractive to pass up, and as a result, businesses and households are shifting their funds to more profitable financial instruments. This phenomenon is evident in the Sandy Spring balance sheet.

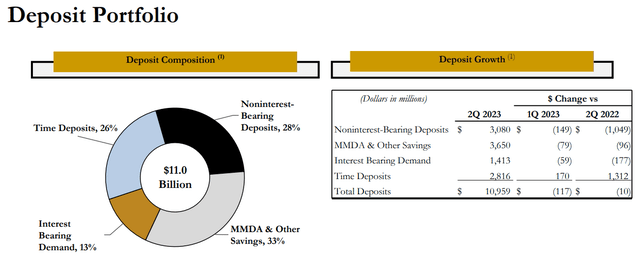

Sandy Spring Q2 2023

As we can see, compared to Q2 2022, except for time deposits, all of them show a decrease, especially noninterest-bearing deposits, – $1.04 billion. These fluctuations in deposits are not random, in fact, they perfectly reflect the macroeconomic scenario we are in now. Time deposits are the ones that offer the highest yield and therefore have increased, while noninterest-bearing deposits are the most convenient for the bank and have plummeted.

In other words, over the past year, the quality of Sandy Spring funds has deteriorated significantly, not only in terms of increased cost but also in terms of absolute growth.

Struggling lending and declining margins

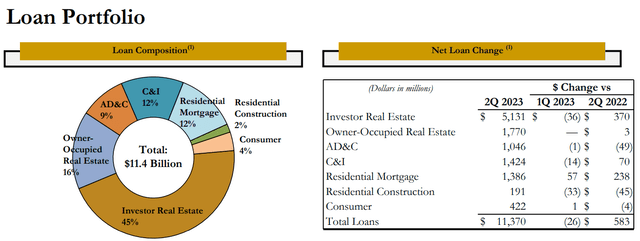

Sandy Spring Q2 2023

The loan portfolio achieved an increase of $583 million over Q2 2022, but is down $26 million from the previous quarter. With interest rates so high, demand for loans from businesses and households is definitely lower, which is a crucial factor to consider for growth in the coming quarters.

The loan to deposit ratio is 103.75 percent, so the value of loans granted exceeds the deposits on the balance sheet, making the financial structure rather rigid and little in line with the dynamic nature of the current macroeconomic environment. Historically, this ratio has always been very high and close to 100 percent, but the current environment is much more complex than in past years where the Fed has kept interest rates low. Also, as we saw earlier, deposits are falling and are more expensive, which could lead to a further increase in this ratio.

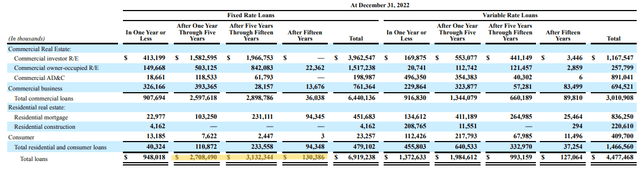

Sandy Spring annual report 2022

Finally, making the financial structure even more rigid are the many fixed-rate loans that the company has originated in the past at rates that are significantly less favorable than those of today. On this aspect, the last available data I found were from 10-K, and about 29 percent of the loans were fixed-rate with a maturity of more than 5 years. Moreover, if we also considered those with maturities between 1–5 years, this figure rises to 52%.

In my opinion, I think the timing for increasing the fixed-rate loan portfolio was wrong. Fewer long-term fixed-rate loans should have been made in previous years in order to make the most of new opportunities once rates would inevitably rise again. Instead, today, the bank faces fewer resources available to exploit and a loan-to-deposit ratio at the limit. In any case, I realize that it is easy to talk in retrospect.

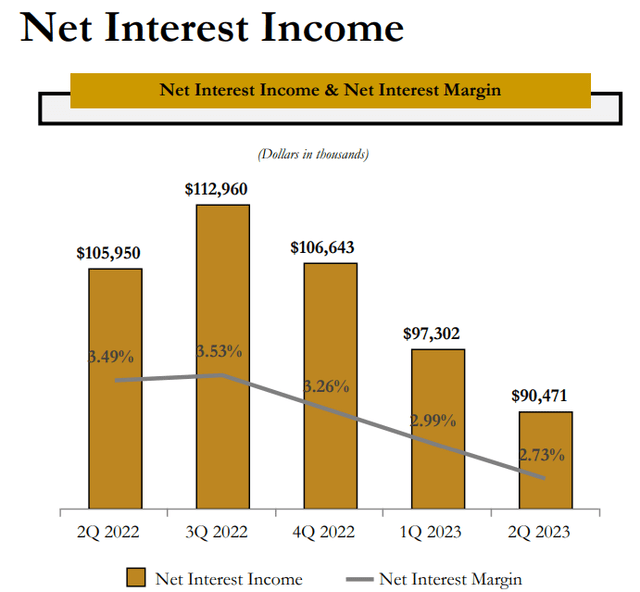

In light of these considerations, it will not be easy for Sandy Spring to originate new loans and consequently improve the now steadily declining net interest margin.

Sandy Spring Q2 2023

For CFO Philip Mantua, the bottom of the net interest margin could be around 260 basis points, but I personally would not be surprised if it collapses even further. His statements during the conference call about a possible improvement in the NIM outline a rather complicated scenario:

I think we need rates to go down in order for us to really get any legitimate lift. I mean it could be a one basis point or two here or there when things kind of level out. But I think for us to get a true lift into the margin, we’re going to need some rate cuts at some point. And right now, in addition to the prediction of the two rate increases in our current forecast, we don’t see a rate cut at this point until potentially the second half of next year. Hopefully, we’re wrong about that piece and that comes a little sooner, but that’s the way we’re viewing it for the time being.

In other words, for the NIM to return to growth it will be necessary for the Fed to start cutting interest rates, but this is an unlikely scenario at least for this year. Potentially, reversal of monetary policy could happen even a year from now if interest rates remain high for a long time, which would hurt Sandy Spring even more.

In short, the fact that this bank’s profitability is so dependent on the Fed’s choices is something to consider. Monetary policy affects all banks, but it should not be a justification for sharply declining profit margins. Many banks of the same size have maintained historical NIM; others have even increased it. Personally, these are the banks I keep in mind to include within my portfolio.

But my doubts about Sandy Spring do not end there.

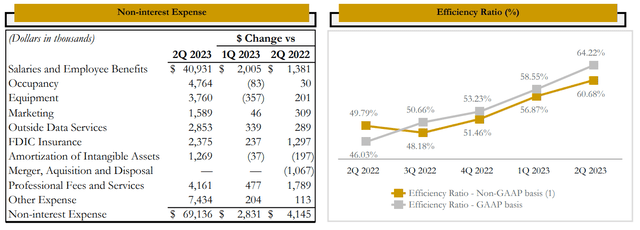

Sandy Spring Q2 2023

Non-interest expenses are increasing more than revenues, and the efficiency ratio is worsening quarter by quarter. The main reasons for the increase in these expenses include higher salaries and employee benefits, as well as professional fees for investments in technology projects. All of this has a negative impact on profitability.

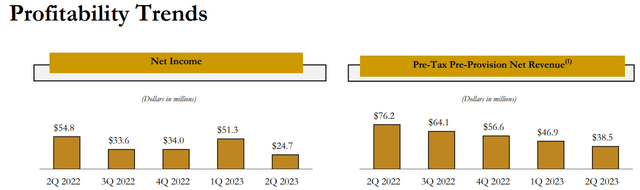

Sandy Spring Q2 2023

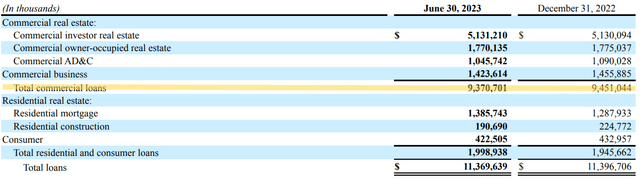

Last but not least, Sandy Spring is almost totally dependent on commercial loans as they account for 82 percent of total loans.

Sandy Spring Q2 2023

This strong concentration may partly explain why Sandy Spring is currently trading at such low multiples. In the event of a recession, commercial loans do not have the same resilience as residential mortgages, making this bank very dependent on business cycle trends.

Looking on the bright side, for the time being, NPLs remain low and in line with the trend of recent years.

Conclusion

I personally prefer to invest in banks with a stable NIM and low cost deposits, which leads me to exclude Sandy Spring regardless.

If we were relying on valuation multiples, this bank would seem like a bargain, but as I showed you in this article, there are more than a few doubts about its future. The fact that it is at a discount does not necessarily make it a buy, in fact the reasons behind the current Price/Book Value of only 0.71x I think are justified.

Profitability has deteriorated a lot and is expected to decline, deposits are increasingly expensive, and loans are struggling to grow given the rigidity of the financial structure. In addition, NIM improvements are too dependent on monetary policy.

Seeking Alpha

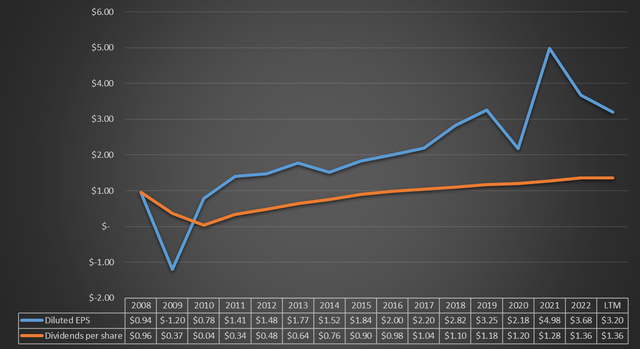

The dividend at least for the time being seems sustainable, but as happened in 2008, it is unlikely to be maintained in the event of a recession. At that time, the problem was not only the dividend cut, but also the time it took thereafter to return to 2008 levels. Given the heavy reliance on commercial loans, I expect something similar to occur again in the future.

Finally, in the last picture, EPS is growing over the long term, but it is good to look at the situation under a different lens to avoid drawing misleading conclusions.

TradingView

EPS growth occurred in the post-recession period, and this was the main growth driver for the price per share. However, expanding the time horizon even further, we can see that the current price per share is the same as it was 25 years ago, a signal that Sandy Spring never completely overcame past recessions. Increasing EPS after a recession when interest rates are close to 0% is definitely easier than increasing it over the decades facing less expansive periods as well. In other words, the high dividend is important, but it is even more important that it is increasing over the decades and that there is also capital gain. But this is not the case.

In conclusion, I would like to point out that Sandy Bancorp may exceed my expectations and turn out to be a good investment: so, I could be wrong. Anyway, the current situation should not be underestimated.

Read the full article here