Editor’s note: Seeking Alpha is proud to welcome Dividend Hiker as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

In the last couple of years, the investment in LXP Industrial Trust (NYSE:LXP) has yielded mediocre results: Over the last 10 years, the average annual return was a meager 3.5%. Also, the dividend was cut in Q1 2019 by 42.3% to “retain and reinvest as much of [its] cash flow as possible for a repositioning of [its] portfolio”.

However, upon examining LXP today, it appears to me that the management of LXP has executed its intended strategy: LXP today has a strong industrial portfolio in growing regions with high occupancy. I believe it is poised to benefit from lease rollovers and the leasing of newly developed properties, commencing at the end of this year. With a high dividend yield and a favorable price to FFO ratio relative compared to its peers, I consider LXP shares as attractively priced.

Overview

LXP is a net-lease industrial REIT with an investment grade rating of BBB-. Its portfolio consists mainly of 109 class A single-tenant warehouses/distribution facilities, covering approximately 52.7 million square feet and representing 92% of its ABR (annualized base rent). Other properties also include some office and manufacturing assets.

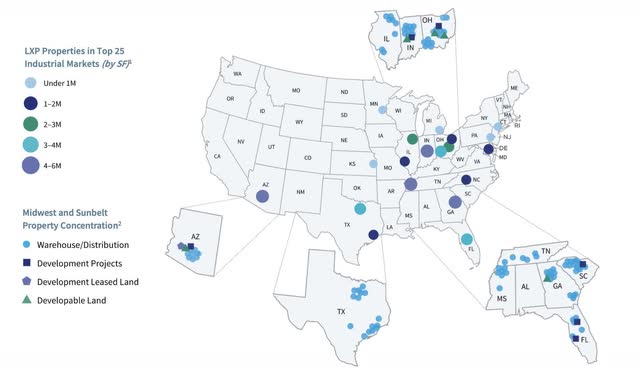

Most properties are concentrated in the Sunbelt and Lower Midwest. The Sunbelt has seen rapid demographic growth and therefore also growth in user demand, which is forecasted to accelerate in the years to come. In my estimation, this will also drive the demand for warehouses and distribution facilities in this region.

Property distribution (LXP – IR Q2 2023)

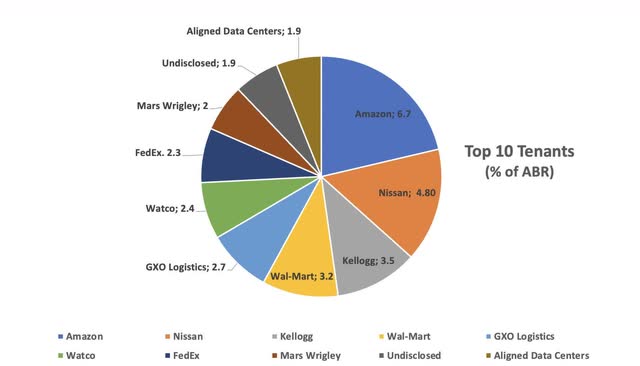

LXP’s portfolio is well diversified. Approximately half of its tenants are investment grade.

The top ten tenants contribute approximately 31.5% of ABR.

Some of its biggest tenants are Amazon accounting for 6 leases which make up about 6.7% of ABR (and 7.2% of its leased SF), Nissan contributes 4.8% to ABR, and Kellogg provides 3.5% to ABR. The well-diversified tenant base reduces LXP’s risk profile.

Top 10 Tenants (Author’s work, based on Q2 2023 investor presentation)

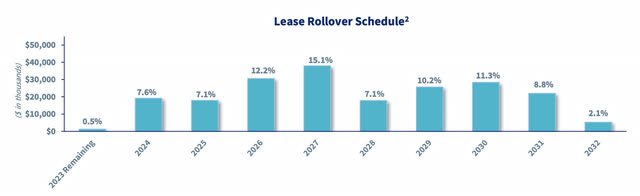

Most of the warehouses are quite new, with an average age of the industrial portfolio standing at 9.2 years. The vacancy of these assets is very low, at the end of Q2 approximately 99.5% were leased. Only a very small percentage of these leases have a flat rent, most have an annual escalation, which will drive rent 2.6% higher on average. Renewals will pick up in 2024 and are projected to have 20% to 30% higher rents and also higher average rent escalations. The lease rollover schedule can be seen in the table below, where the numbers are percent of ABR for properties owned.

An example of the possible growth in rental income, which may result from lease rollovers, can be seen in recently released properties. In Q2 of this year, the 408,000-square-foot facility in Duncan, South Carolina, was renewed with a five-year lease; raising base rent by 26.3%.

Year-to-date, more than 2.7 million square feet have been released with a 41% increase in cash-based rent.

Lease Rollover (LXP – IR Q2 2023)

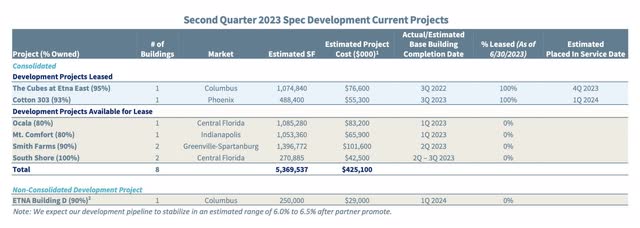

LXP uses not only acquisitions and Sale/Lease Backs to grow, but it has also experienced in constructing its warehouses. Through its development program, seven industrial facilities have been leased in the past few years. The current development pipeline consists of 8 warehouses totaling 5,400,000 square feet, among which some are already pre-leased and most are completed or will be completed soon.

On a square foot basis, this would increase the portfolio size by 10.2%, when all warehouses are completed.

Development Projects (LXP – IR Q2 2023)

About the pre-leased facilities in Columbus and Phoenix, Brendan Mullinix, CIO, shared in the last earnings call:

“Reviewing the second quarter leasing outcomes in our development program, at our 488,000 square foot Phoenix facility, we executed a seven-year lease with a starting rent of $9.60 per square foot and attractive annual rental bumps averaging approximately 4%. We also secured a 10-year lease with a starting rent of $4.85 per square foot and 3.5% annual escalations at our 1.1 million square foot project in Columbus. Both facilities require some additional build-out requested by the tenants. The tenants are expected to take occupancy when the build-outs are complete, which should be early November for the Columbus asset and early January for the Phoenix facility.”

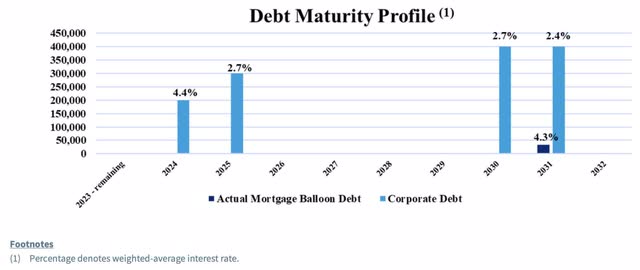

Although the FED’s rate hikes may be coming to an end soon, due to the high funds rate, it’s also important to take a look at the debt of LXP. Net debt to adjusted EBITDA is in my judgment quite high at 6.3 times. It’s above their target of five times to six times net debt to adjusted EBITDA. But if the pre-leased development projects would be included, then net debt/EBITDA would decrease to 6 times, as mentioned in the latest earning call.

Most of the debt comprises fixed-rate long-term debt with a weighted-average interest rate of 3.3%. Additionally, no amounts are outstanding on LXP’s $600 million unsecured credit facility. So in my view, the credit risk is quite low, even if the FED rate should stay higher for longer.

Debt maturities (LXP – Quarterly Supplemental Q2 2023)

Valuation

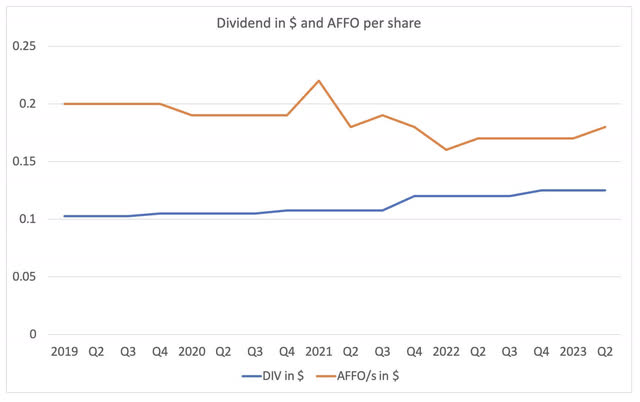

As noted in the introduction, LXP cut its dividend in Q1 2019 to reposition itself as an industrial REIT. To assess the progress in this reorganization, it seems sensible not only to look at the latest valuation but also at its progression.

With a current quarterly dividend of $0.1250 per share, the forward yield is 5.04% as of the time of writing, and the CAGR since the dividend cut in 2019 is 5.09%. The yield is quite high when comparing it to LXPs peers (see below).

With a payout ratio of 71.74%, there seems to be room for further modest dividend hikes.

In the last couple of years, AFFO has remained quite flat, also the earnings guidance for 2023 from the press release for the second quarter shows little room for improvement in the remainder of the year. With the provided range of $0.66 to $0.70 per diluted common share and the generated AFFO in H1, LXP expects to generate between $0.31 and $0.35 in H2.

AFFO has been dragged down by the development costs for the new warehouses. Last quarter, for example, $23.4 million was invested in the six ongoing development projects, whereas $87.1 million of gross revenue were generated. In total, the eight ongoing development projects are estimated to cost $425 million, at the end of Q2 2023, already $332.4 million of these costs have been paid.

Author’s work, based on data retrieved from the company’s quarterly reports

Through the reduction of the development costs for the eight warehouses of the development program in the coming quarters and the rental income for the finished projects, as well as through the release of existing properties, I estimate an increase in AFFO in the coming years. As mentioned above, with the 1.1 million-square-foot property in Columbus, the first property of the development projects is expected to be occupied by November 2023.

My price target with a very quick comparison to peers

LXP already appears cheap today when compared to other industrial REITs. Most of the peers have a higher price to FFO ratio and a lower dividend yield.

| LXP | EGP | FR | PLYM | REXR | STAG | TRNO | |

| Div yield (FWD) | 5.04% | 2.87% | 2.50% | 2.98% | 2.83% | 4.09% | 3.03% |

| Price/FFO (FWD) | 14.34 | 22.96 | 21.2 | 12.19 | 24.67 | 15.91 | 27.39 |

Of course, one reason for the discount may be that income-oriented investors are still cautious here due to the dividend cut in 2019.

But generally, I see no reason for this large discount and assume the repositioning as an industrial REIT with properties in growing markets has not been recognized by the broad market. With a change in the perception due to the presented growth with nearly finished development projects, I expect P/FFO to shift at least approximately 15% higher in the next twelve months.

To arrive at a proper price target, I’m also considering projected growth in FFO through releasing and the leasing of newly occupied facilities. As approximately 1.5 million-square-foot of these development projects are already pre-leased with known conditions and most of the other projects have achieved core and shell building completion, I think there is a high probability, that at least half of them will be occupied in the next twelve months. Therefore, I expect FFO (forward) to grow by at least 5%.

With these assumptions, I anticipate a one-year price target of $12 per share or higher.

Risks

Of course, there are also certain risks inherent in my assessments. Notably, a recession has been looming for quite some time. If one occurs towards the end of this year or at the beginning of 2024, then LXP could encounter difficulties in leasing the newly developed properties. LXP might have to set rents at or below prevailing market rates.

Moreover, negotiations for lease renewals could potentially become more challenging, especially with financially distressed tenants, which might not result in the projected outcomes.

Given the diversified tenant base, the risk associated with tenants going bankrupt is somewhat diminished. However, in the event of a tenant’s possible bankruptcy, one or more warehouses/distribution facilities could end up vacant with no rent for some time. Additionally, costly build-outs could be required before these properties can be released.

In my view, management has done a good job in repositioning LXP. Nonetheless, there’s still a way to go. If it takes significantly longer than anticipated for the newly developed facilities to be occupied, and if the achieved rent is lower than expected, I might reconsider my bullish sentiment.

Investor takeaway

LXP has positioned itself as an industrial REIT in the attractive, growing Sunbelt and Lower Midwest regions. Although the dividend yield may already appear attractive for income-seeking investors, due to rent escalators, the releasing of warehouses/distribution facilities, and, to a large extent, the development of new properties, which are mainly finished and will become operational.

Read the full article here