Tapestry deal signals a positive sentiment

Tapestry (TPR) has agreed to acquire Capri Holdings (CPRI) for $57 per share in an all-cash deal valuing Capri at approximately $8.5 billion enterprise value. In May, we published a paper and took a position on Capri because we thought the value was favorable.

We view this deal as a signal of a positive shift in sentiment for the struggling retail/apparel sector amid the 2023 downturn. With valuations depressed, major strategic M&A indicates some industry leaders now see attractive opportunities to consolidate.

Investment Thesis

We are upgrading VF Corp to Buy based on new CEO Bracken Darrell’s strong track record and progress getting VF back on track strategically, combined with an attractive upside to our $30 price target.

New CEO in place

V.F. Corporation (NYSE:VFC) is a business that we are keeping an eye on in our watch list. VF recently appointed Bracken Darrell as incoming President and CEO, effective July 17, 2023. Darrell joins VF after an impressive 10-year run as President and CEO of Logitech, where he led a successful turnaround driven by category expansion and market share gains. Under his leadership, Logitech delivered a 9% revenue CAGR and a 17% diluted EPS CAGR from 2014-2023.

We believe that Darrell’s proven track record of revitalizing Logitech should instill confidence in VF investors amid current headwinds. His experience spearheading strategic transformations and delivering solid growth even in challenging conditions makes him well-suited to guide VF forward. The CEO change should provide a fresh perspective and strong leadership to catalyze VF’s next chapter.

Getting back on track

Previously, we voiced concerns about VF losing market share due to over-diversifying into non-core innovation pre-inflation. The subsequent economic pressures further highlighted those issues.

However, VF seems to recognize the need to sharpen its focus. In their press release, they highlighted new CEO Bracken Darrell’s track record of launching 20 new successful categories at Logitech. This demonstrates his ability to expand strategically.

We continue to improve the Vans go-to-market activities. Our initiatives to sharpen our focus around fewer key products and story are well underway and are benefiting the quality and productivity of our store assortments with our in-store SKU reduction actions expected to be fully completed in August.

Additionally, on the recent Q1 2024 earnings call, VF stated they are concentrating on fewer key products and stories to improve quality and productivity.

Overall, VF appears to have acknowledged earlier missteps and is taking sensible remedial actions. The renewed focus on excellence in core categories while prudently expanding addresses our prior worries. We will monitor for effective execution but believe VF is moving in the right direction strategically under new leadership. With disciplined growth and brand revitalization efforts, VF can get back on track toward long-term success.

Company performance stabilizing

Despite Q1 revenue declining 8%, key metrics show signs of stability amid macro headwinds. DTC sales, a leading indicator, fell only 2% compared to wholesale’s steeper drop as e-commerce disrupts traditional channels. DTC now represents 46% of sales, approaching 50%, which could spur investor confidence.

For Q1 2024, The North Face delivered 9% growth in North America. This stands in stark contrast to LVMH and Kering, which reported North America declines of 1% and 23% respectively for the same period.

The North Face’s ability to grow sales while major luxury groups like LVMH (OTCPK:LVMHF) and Kering (OTCPK:PPRUY) retreat demonstrates its brand strength with consumers. Even as inflationary pressures mount, The North Face is weathering the storm and gaining a share in its home market.

While more work remains, DTC traction, inventory normalization, and The North Face’s outperformance demonstrated its core strength.

Inventory composition remains primarily core, carryover and replenishment, which has a higher likelihood of being sold at full price or with a minimal markdown.

We see as VF pivots towards a direct, digital-first model, performance should strengthen. Continued DTC gains coupled with maintaining brand momentum in tough conditions would demonstrate VF’s strategy taking hold. We’re seeing green shoots but staying vigilant as VF navigates through challenges.

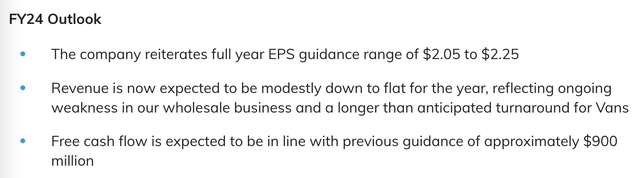

The guidance reflects company is in control

The company lowered its FY2024 revenue guidance to project a decline, reflecting wholesale weakness. However, VF maintained its EPS and free cash flow targets through measures like supply chain optimization and cost discipline.

Outlook (VFC)

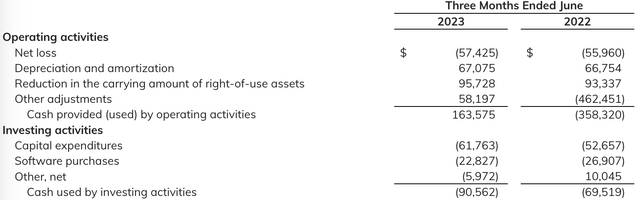

This shows VF’s ability to manage bottom-line performance amid top-line pressure. Despite headwinds, VF is stabilizing profitability and cash generation. The company showed in Q1 FY2024 that it could turn its inventory into operating cash and improved its operating cash flow from outflow the previous year.

Cash flow (VFC)

The valuation upside is more convincing

Previously, we used FY2024 free cash flow guidance as the basis for a $30 price target, representing a 50% upside from the current price. But we were cautious about valuation without clarity on strategy and leadership.

With VF now appearing on track under new CEO Bracken Darrell, the valuation upside seems more credible. VF’s guidance demonstrates its potential to navigate challenges while protecting shareholder value. We have increasing conviction in significant stock appreciation as the turnaround initiatives gain traction.

Risk remains in the wholesale business

VF’s sizable wholesale exposure remains a risk factor to monitor. With over 50% of sales still coming from struggling wholesale accounts, further declines could restrict near-term upside.

However, VF is taking steps to right-size inventory, especially in the Americas, to reduce wholesale reliance. As the company pivots toward a more DTC-driven model and refocuses on core, wholesale’s drag should moderate over time.

So our focus really is to your point on stabilization, is just that stabilize our classics business, brings style iterations to the market around classics, which is where we’re seeing success with our wholesale partners and our consumers who want newness

Signs of stabilization are also emerging, with VF guiding to improved wholesale performance in the back half of the year. While uncertainty persists, disciplined inventory actions and a demand recovery could ease wholesale pressures.

Overall, investors should keep a close eye on the wholesale channel’s trajectory as a swing factor for VF’s results.

Conclusion

New seasoned leadership, a return to strategic focus, and compelling valuation upside collectively warrant an upgrade to Buy. While risks remain in the tough wholesale retail climate, we believe VF has the strengths to navigate challenges and unlock significant shareholder value. The turnaround initiatives appear well underway, making now an opportune time to reconsider this transformed investment case.

Read the full article here