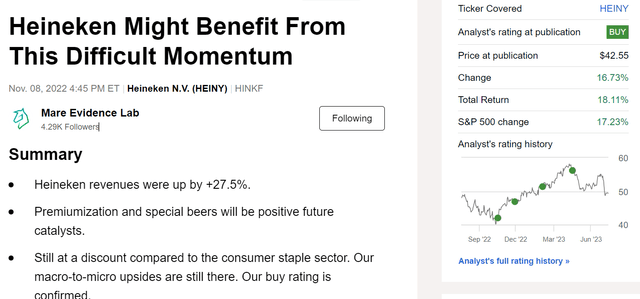

It was not a positive quarter for Heineken (OTCQX:HEINY), and today, we would like to recap our previous publication before commenting on the company’s Q2 financial results. This year, we already follow up on the beer giant twice, and we suggest our reader check our past analysis:

- Bill Gates Loves Beer, And Heineken Is Still A Buy;

- Margin Recovery Story Still In Place.

Looking back, we anticipated “incremental negative development in Nigeria and Vietnam” partially “offset by better-than-expected output in the EU and solid performance in Mexico and Brazil.” We forecasted a volume decline of minus 1.5% in Q2 with more challenges ahead. In addition, we also reported net income growth more skewed to H2 with an easing in marketing expenditure and lower raw material inflationary cost pressures. Here at the Lab, since our initiation of coverage titled ‘Heineken Might Benefit From This Difficult Momentum‘ released last year, we are still up with our investment. In numbers, the company stock price appreciated by 18% (including the dividend payment). Our buy target was based on 1) Heineken beer premiumization (at scale) with a well-balanced price MIX development, 2) higher pricing power with >10% core operating profit growth until 2025, 3) a margin recovery story combined with volume uplift (EPS > EBIT thanks also to EM exposure and higher contribution from associates), and 4) a compelling valuation vs the Consumer Staple market.

Mare Past Analysis

Q2 results

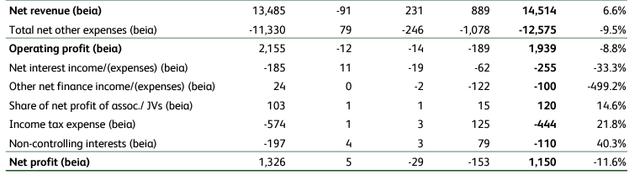

The company disappointed Wall Street with H1 financial figures and lower guidance (both below estimates). Heineken’s stock price was down by 8%, with implied consensus earnings per share cut of approximately minus 4%. Despite that, we still see risk/reward skewed on the upside here at the Lab. Looking at the numbers, Heineken’s net revenue increased by 6.6%, with volume down by 5.6%. Going down to the P&L, the company’s operating profit decreased by 22.2% with a net profit deceleration of only minus 8.6% thanks to lower tax payments and dividends from non-controlling interest. Today, we are not focusing on the numbers but looking deeper into Heineken’s business performance. Having analyzed the H1 2023 reports, we see that almost 50% of the volume decline was driven by Vietnam and Nigeria, and excluding this market performance, Heineken’s volume decline was set only at a low-single-digit. Vietnam’s inventories are now normalizing, which should support a volume recovery. More encouragingly is the UK performance; here at the Lab, we see the United Kingdom as a good indicator for other EU markets, which bodes well for the 2023 summer season. The company is the #2 global brewer (after Anheuser-Busch InBev), accounting for 10% of international beer volumes. The company has a diversified GEO portfolio, with emerging market EBIT representing 60% of the total company operating profit. In detail, Mexico, Vietnam, and Nigeria account for 14%, 10%, and 8% of the EBIT, respectively.

Heineken H1 Financials in a Snap

Changes to estimates

Following the H1 results, we apply these changes:

- We believe that volume recovery will sequentially accelerate in H2 (we forecast a plus 0.5%) compared to a minus 5.4% achieved in H1;

- We cut our earnings per share estimates by 2.5% due to weak performance in the Americas and APAC region. We still believe Heineken’s lower-end EBIT guidance is achievable (Fig 1). In numbers, we anticipate a 3% organic core operating profit growth (and we are now beyond Wall Street guidance set at a plus 4.7%)

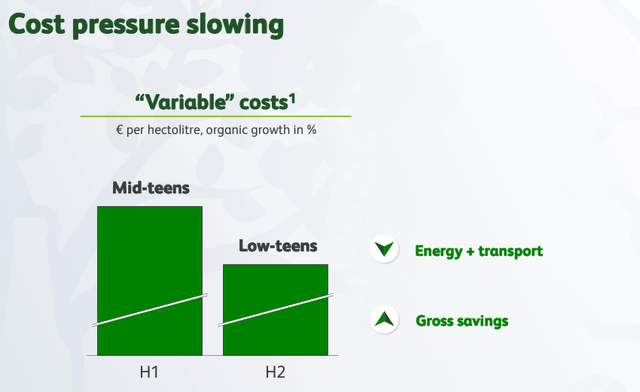

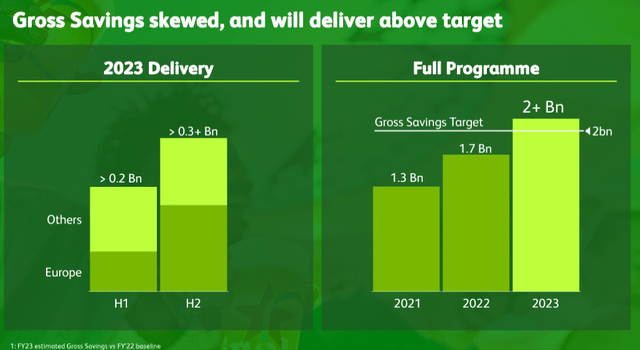

- As mentioned, Heineken also reported a sequential slowdown in COGS per hl (the CEO reported H1 COGS/h grew mid-teens, and he expects H2 to grow low-teens). In addition, aside from the uplift from the 45 ERP system renewal, the company now forecasts a “significant acceleration” in the cost savings target in H2 (Fig 2). In our numbers, we see saving measures up to €550 million in 2023;

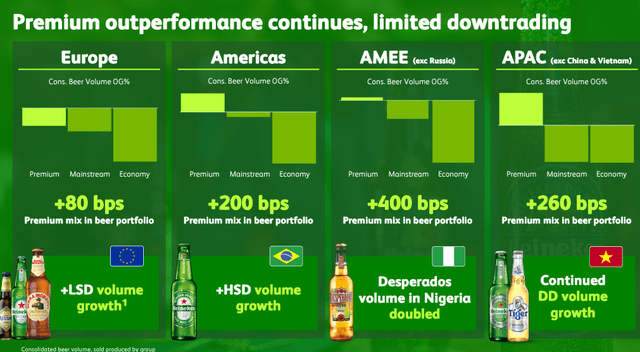

- Solid performance in beer premiumization with higher market share penetration across its GEO MIX (Fig 3).

Heineken variable cost savings

Fig 1

Heineken saving targets

Fig 2

Heineken volume performance

Fig 3

Conclusion and valuation

Heineken’s Q2 differed from the expected financial release, and the company postponed a few targets. Here at the Lab, we reduced our EBIT margin to 14.9% for 2023 and cut our EPS by 2.5%. Thus, applying the company’s historical EV/EBITDA of 10x, we derive a target price of €115 per share from our previous buy at €120 per share. Despite that, given the recent decline in the stock price, Heineken trades at a 15.1 P/E multiple on a 12-month forward estimates with -24% discount to Staples, excluding Tobacco. Here at the Lab, we believe this discount is not justified. In addition, China’s recent development, now the #2 most significant market for the beer giant brand, supports our buy case. Downside risks include 1) a slowdown in consumer expenditure levels, 2) higher regulatory risk of excise duty, 3) industry restrictions on consumptions, 4) adverse weather conditions, 5) consumer trends in products substitution, 6) higher competition, and 7) (again) raw materials inflationary pressure (packaging, distribution, aluminum, sugar, etc).

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here