2023 has been dire for Arbor Realty (NYSE:ABR) whose common shares now sport a 14.5% year-to-date decline. The commercial real estate lender has essentially been under siege from the spillover of the fear-induced banking crisis, back-to-back hikes to the Fed funds rates, recession fears, and an out-of-the-blue short report. Everything that could go wrong went wrong, as continued fears around the health of US commercial real estate continues to highly define the direction of publicly listed REITs.

Against this backdrop, I believe Arbor Realty now represents a buy and should become an accretive long-term hold in the REIT space. The internally managed mortgage REIT offers a strong dividend history that is now aggregated, with common shares trading at a marked discount to stockholders’ equity. These factors have contributed to a decision to liquidate my position in Arbor Realty’s 6.375% Series D Cumulative Preferred Stock (NYSE:ABR.PD) to use the proceeds to go all in on the commons. I’m excited about the upside potential here.

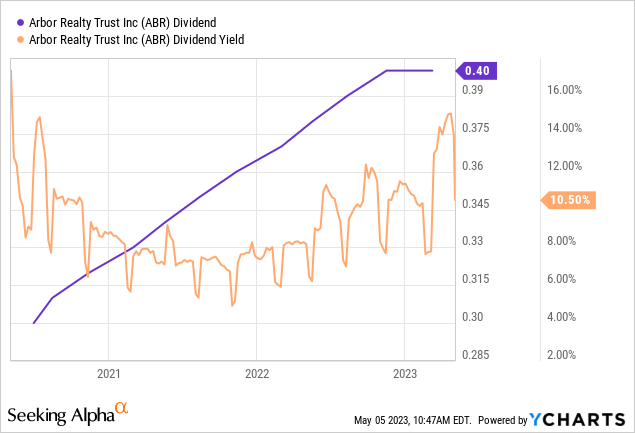

Management recently hiked its quarterly dividend payment by 5% to $0.42 per share for a roughly 14.5% forward yield. The mREIT had previously paused its dividend after 11 consecutive hikes. This decision was taken against what management stated was less market enthusiasm for high dividend distributions against a payout ratio that management also flagged as the lowest in the industry. That the company has become a casualty of the fear-induced banking crisis has come as a relative shock. Arbor Realty has always been a relatively non-controversial pick and now forms a recovery play.

Trading At A 27.5% Discount To Stockholders’ Equity

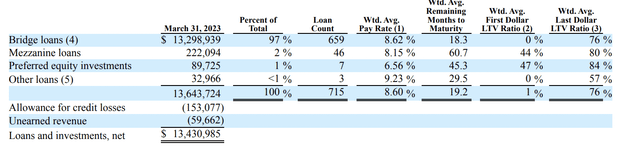

Arbor Realty just reported its fiscal 2023 first-quarter earnings that saw revenue come in at $108.57 million, an increase of 29% over the year-ago quarter and a beat by $7.79 million on consensus estimates. This growth was driven by a loan and investment portfolio with an unpaid principal balance minus loan loss reserves of $13.44 billion. The mREIT’s weighted average current interest pay rate of 8.60% was also a sequential increase of 43 basis points from the prior fourth quarter. Critically, Arbor Realty only had four non-performing loans with a $7.7 million carrying value. This was before related loan loss reserves of $5.1 million. The REIT’s total allowance for loan losses as of the end of the quarter stood at $153.1 million, with a $20 million CECL recorded during the first quarter.

Arbor Realty Trust

Net income for the quarter came in at $84.3 million, around $0.46 per share, and was year-over-year growth of 31.5%. Distributable earnings were $122.2 million, around $0.62 per share, and up by around $0.07 over $0.55 in the year-ago comp. Hence, Arbor Realty is currently paying out around 68% of distributable EPS to shareholders as a quarterly dividend. The mREIT also launched a $50 million share buyback program last month in response to short-selling pressure.

A Mixed Outlook For 2023

The mREIT continues to maintain a strong liquidity position, previously described by management as a war chest. Cash, cash equivalents and restricted cash at the end of the first quarter stood at $1.48 billion with $560 million of restricted cash held in CLOs with a weighted average cost of 1.64% over benchmark rates. This liquidity position amounts to nearly 70% of its market cap. Crucial for longs, this position has rendered the balance sheet highly conservative and sets the backdrop for its hedge against the expected macroeconomic reverberations of a Fed funds rate that’s been hiked to a 5% to 5.25% range.

The May hike is likely the final for this year, and a pause should allow more certainty to return to a highly disrupted capital market. There are two more inflation readings before the start of summer and the next one on the 10th of May should confirm whether the dovish pivot is finally here. Arbor Realty could be set for a more intense upswing in the quarters ahead if the core economic metrics trickling in signal a soft landing. Indeed, unemployment remains low, and job availability is still robust. Bears, who form the huge 13.7% short interest in the mREIT, would of course flag that inflation could remain sticky and that hopes for a dovish pivot are premature. Further, the mREIT recently suffered a default on a multi-family development loan.

Overall defaults remain low. This might change if the US slips into a recession. I’m bullish on the prospects of Arbor Realty against its 14.5% yield at its discount to stockholders’ equity. The blockbuster dividend raise expected towards the latter part of 2023 has come early, and there could be more hikes in the coming quarters as the company’s portfolio remains resilient. I’m rating the common shares as a buy against this.

Read the full article here