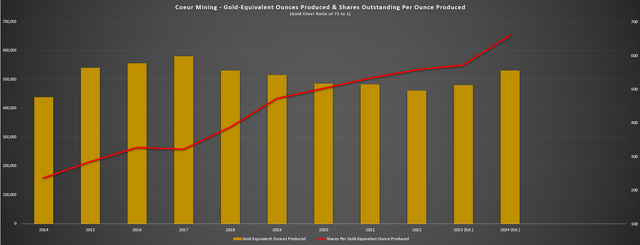

It’s been a mixed Q2 Earnings Season thus far for the Gold Juniors Index (GDXJ), and while there have been a few disappointments, Coeur Mining (NYSE:CDE) put together one of the weakest reports. Not only did production slide at three of its key assets with a sharp decline in output at Kensington, but the company reported yet another cost increase at POA 11, additional share dilution (flow-through shares sold in Q2), and reported lower revenue on a year-over-year basis despite the benefit of a record average realized gold price. Meanwhile, the company now expects to miss its annual gold production guidance due to the softer Q3 at Kensington, resulting in even further declines in its per share metrics. The result is that production has gone essentially nowhere since 2015 on a gold-equivalent basis, yet its share has increased ~100% to 350 million shares. Let’s take a look at the Q2 results below:

Rochester Mine Operations (Company Presentation)

Q2 Production & Sales

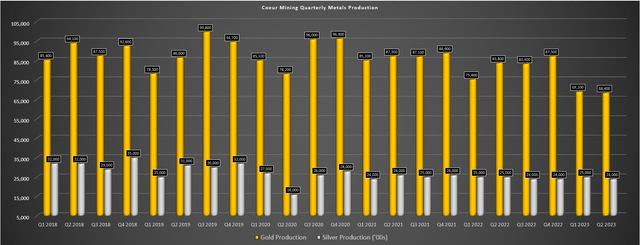

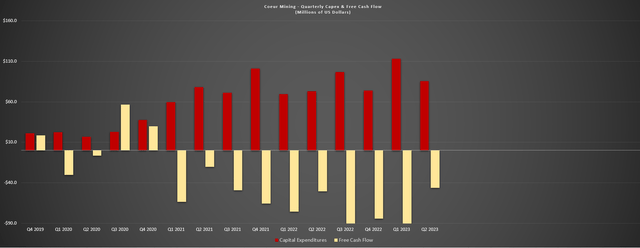

Coeur Mining (“Coeur”) released its Q2 results this week, reporting quarterly production of ~68,400 ounces of gold and ~2.4 million ounces of a silver, translating to an 18% and 4% decline, respectively, on a year-over-year basis. This was even more disappointing with the company up against easy comparisons, with Q2 2022 production down low single-digits vs. 2021 levels. And given the lower production and sales in the period combined with Coeur’s hedging, Coeur was one of the few companies that didn’t enjoy sales growth year-over-year despite the record average realized gold price. In fact, revenue slid 13% year-over-year to $177.2 million, and free cash flow came in negatively yet again at [-] $46.2 million, with trailing-twelve-month free cash flow now sitting at ~$355 million, explaining the continuous dilution to help fund its major Rochester Expansion Project (POA 11).

Coeur Mining – Quarterly Metals Production (Company Filings, Author’s Chart)

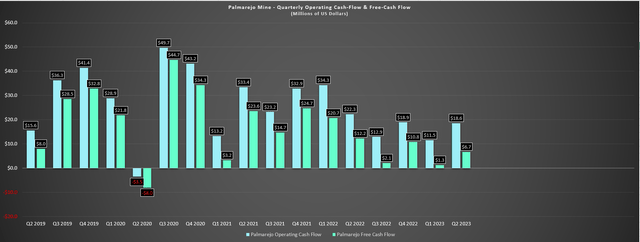

Digging into the production results a little closer, Palmarejo saw a significant decline in gold and silver production year-over-year, with an output of ~23,200 ounces of gold and ~1.62 million ounces of silver vs. ~27,100 ounces of gold and ~1.80 million ounces of silver in the year-ago period. The lower production can be attributed to a dip in throughput of ~472,600 tons in Q2 2023 and a decline in recovery rates, and while free cash flow was positive, it fell 45% year-over-year despite the benefit of higher metals prices. Meanwhile, adjusted costs applicable to sales at the asset were up significantly to $1,023/oz (Q2 2022: $855/oz), and $15.16/oz for silver (Q2 2022: $12.97/oz). This is certainly not ideal given that this is the company’s highest margin asset and one that should see declining grades in 2024, which could push costs up further when combined with the stronger Mexican Peso.

Palmarejo – Operating Cash Flow & Free Cash Flow (Company Filings, Author’s Chart)

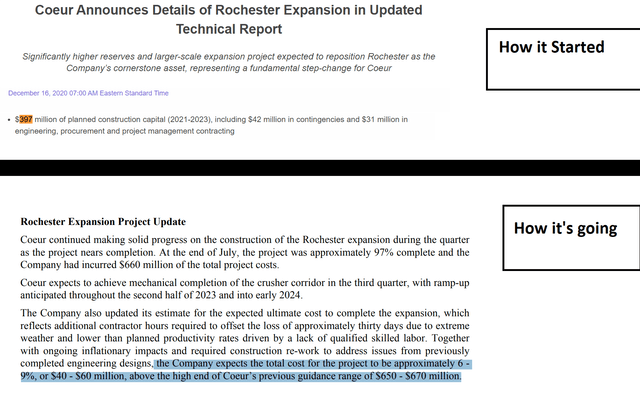

As for the company’s Rochester Mine, production came in at ~6,300 ounces of gold and ~673,000 ounces of silver, with gold production down over 23% from the year-ago period. Meanwhile, costs remained at some of the highest levels sector-wide at $20.39/oz (adjusted CAS for silver) and $1,646/oz (adjusted CAS for gold), and we saw a $65.3 million free cash outflow with a slight step up in capital expenditures sequentially. The other negative development was that Coeur has had to revise capital expenditures for its cost to complete higher yet again at Rochester, with the project now expect to cost ~$720 million at the mid-point, an 82% increase from the ~$397 million expected in 2020. This is a massive capex blowout and certainly puts a dent in the company’s expected 31% IRR at the time of its Q4 2020 study. Some investors might point there’s an offset because of higher metals prices, but I would expect inflationary pressures to claw back much of this benefit.

Rochester Capex Blowout (Company Filings)

Finally, it wasn’t a much better quarter at the company’s Kensington Mine either. In fact, Q2 production came in 52% below Q2 2022 levels at ~13,200 ounces, impacted by lower throughput at substantially lower grades of 0.09 ounces per ton gold. The result was that adjusted CAS per gold ounce soared to $2,927/oz, up from $1,399/oz in the year-ago period, and free cash flow came in at [-] $15.4 million. Coeur Mining noted that significant water inflows from spring runoff and paste backfill challenges resulted in a disruption to extracting stopes and this meant that the team had to rely on some lower grade development ore for mill feed in the quarter. Given the shortfall, the company’s gold production has been revised lower at Kensington and on a company-wide basis to 89,500 ounces at the mid-point and 328,000 ounces (mid-point), respectively, a 5% decline for Coeur’s total gold production vs. previous estimates.

Overall, the Q2 results were an enormous disappointment, and with the company’s most consistent asset having a significant gold stream that reduces its average realized sales price ($1,589/oz gold in Q2) and coming up against a stronger Mexican Peso, there wasn’t much to write home about either. The result was that sales were down materially year-over-year, operating cash flow came in at a paltry $39.4 million, and free cash flow outflows have continued, which isn’t surprising given the higher capex spend related to Rochester POA 11, but there are several producers also pursuing growth projects like Alamos Gold (AGI) that continue to generate free cash flow during their major growth projects because of strong operational execution and much higher quality assets. Fortunately, after what’s been a rough two years, the Rochester Expansion is at least 97% complete as of the end of July, setting Coeur up for free cash flow generation in FY2024 if metals prices can cooperate.

Costs & Margins

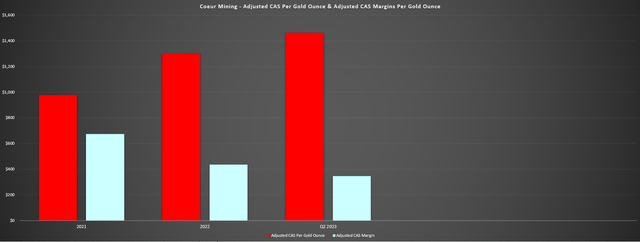

Moving over to costs and margins, there wasn’t much to write home about either, with adjusted CAS per gold ounce coming in at $1,464 (Q2 2022: $1,207/oz) and adjusted CAS per silver ounce coming in at $16.77 (Q2 2022: $15.09/oz). These costs remain above the industry average and continue to climb from FY2021 and FY2022 levels, as the below chart highlights. And given the strength we’ve seen in the Mexican Peso (Palmarejo), I wouldn’t expect Q3 to be much better at the company’s largest asset, suggesting we’ll see another high-cost quarter and year overall. Worse, unlike some silver producers such as Hecla (HL) that benefit from long mine lives, Coeur’s Kensington Mine is running short on mine life, suggesting that some of the production expected from the Rochester Expansion may simply be offset by sidelining Kensington if the company can’t successfully grow reserves at this asset.

Coeur Mining – Adjusted CAS Per Gold Ounce & CAS Margins (Company Filings, Author’s Chart) Coeur Mining – Quarterly Capex & Free Cash Flow (Company Filings, Author’s Chart)

Given the continued free cash outflows (highlighted above), Rochester ended the quarter with one of the weaker balance sheets sector-wide, with $60 million in cash and ~$470 million in debt. Fortunately, the company might be able to avoid further share dilution while it works to bring the Rochester Expansion into commercial production, which was accomplished by modifying the financial covenants on its revolving credit facility. During the quarter, Coeur’s total interest expense was $6.9 million (Q2 2022: $5.2 million), and the company has reduced its upside to gold and silver prices relative to peers with ~111,000 gold forward contracts at $1,977/oz and ~2.49 million ounces of silver at $25.40/oz. And it wouldn’t be a normal quarter for Coeur without additional share dilution and the company delivered in this respect in Q2, Coeur raising ~$29 million from flow-through shares, which is on top of the $98 million raised in the March 2023 Equity Offering by selling ~32.8 million shares at US$3.04.

Valuation

Based on ~370 million fully diluted shares and a share price of US$2.56, Coeur Mining trades at a market cap of ~$950 million, and an enterprise value of ~$1.40 billion, which at first glance might seem quite cheap for a company set to produce ~350,000 ounces of gold and over 12 million ounces of silver next year. However, as I’ve noted, while the stock may increase in value as it delivers on the Rochester Expansion, holding the stock has been a fool’s errand, given consistent share dilution offsets that any increase in the market cap. The over 20% share dilution in the past 18 months alone despite asset sales and selling off equity investments is evidence of this, and it’s why I’ve warned against investing in the stock because there’s no way to make a case for an attractive valuation if the share count is a moving target that can’t be counted on. And as of the most recent filing, its outstanding shares are above 350 million (~370 million fully diluted) vs. 278 million weighted average shares just a year ago in Q2 2022. The good news is that the worst of the share dilution appears to be in the rear-view mirror, but the track record alone makes the stock un-investable and the per share declines are among the worst sector-wide. This is an important point to pay attention to:

If you are investing in precious metals it is likely because you wish to preserve the purchasing power of your wealth and avoid the erosion caused by constant inflation of the money supply over time. Holding physical gold and silver bullion can help provide that long-term protection. If one wants additional leverage on that same thesis, the logical extension is to own the mining companies finding and extracting that gold and silver. However, this latter strategy only works if those gold & silver producers are at least holding the line or preferably growing their per-share metrics, meaning that production, reserves (resources), net asset value and ideally cash flow per share (though this is more dependent on metals prices) are growing.

Coeur Mining – Annual GEO Production, Forward Estimates & Shares Per Gold-Equivalent Ounce Produced (Company Filings, Author’s Chart & Estimates)

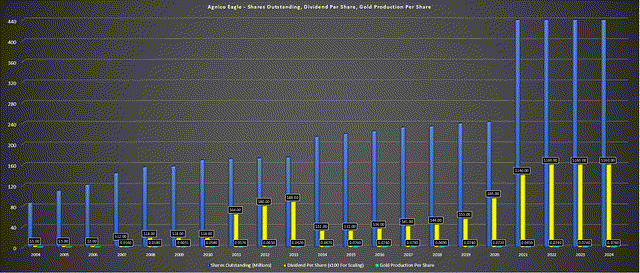

With industry leaders like Agnico Eagle (AEM) and Alamos Gold, they excel in this department and continuously grow their per share metrics, but this is not the case for Coeur Mining – and it’s not even close. In fact, as the chart above highlights, Coeur has seen limited production growth on a gold-equivalent ounce basis since 2014, and will see barely 20% production growth from 2012 to 2024 based on estimates of ~530,000 GEOs. Meanwhile, the amount of shares an investor has needed to hold to get the same ounce of gold-equivalent production has roughly tripled, with the share increasing from ~100 million shares to ~350 million shares. Hence, one’s exposure to precious metals has steadily declined at a rapid pace. So, unless one enjoys having to continue throwing more money at a stock each year simply to maintain the same exposure to precious metals production, there is absolutely no reason to own Coeur from an investment standpoint.

Agnico Eagle Mines – Shares Outstanding, Dividends & Production Per Share (Company Filings, Author’s Chart)

Back to the stock’s valuation, Coeur may trade at a discount to some peers of a similar size, but I believe this discount is more than justified given the company’s poor track record of creating shareholder value. Plus, even if we assume Coeur generates $65 million in free cash flow next year, the stock is trading at over 22x forward free cash flow, a multiple reserved for a low-risk business such as a franchisor with iconic brands like McDonald’s (MCD) or a large-cap software company with high margins and recurring revenue like Paycom (PAYC), not a cyclical stock with industry-lagging margins like Coeur Mining. And if we compare this to what’s available elsewhere in the GDX, an investor can buy Sandstorm Gold Royalties (SAND) for a lower multiple (15x EV/FCF) and a much lower-risk business model.

Therefore, on both an absolute and relative value basis, Coeur still isn’t cheap enough, and using what I believe to be a more conservative multiple of 10x free cash flow estimates, I continue to see the stock as fully valued despite its violent correction.

Summary

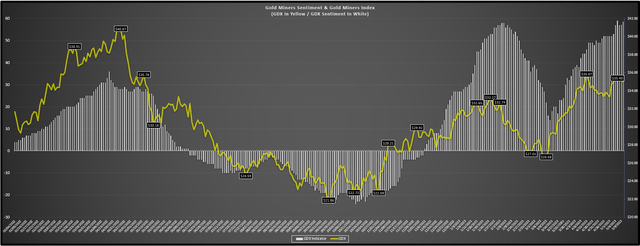

The Gold Miners Index (GDX) has suffered a deeper correction than some might have expected, though the depth of this correction shouldn’t be overly surprising given that we saw sentiment get too over-heated in April which often portends 15% plus corrections in the GDX. And while this has left some stocks sitting in the sale rack, I believe it’s important to separate the wheat from the chaff because the names that are cheap for a reason typically just get cheaper. Plus, in a sector that can be full of negative surprises (excess mining dilution, pit-wall failures, metallurgical issues, capex blowouts, strikes, proposed royalty increases, negative permitting surprises) I believe it’s best to focus on quality names with management teams that know how to navigate this difficult environment and that focus on the best assets so that they can deliver consistent shareholder value even in flat metals price environments.

Gold Miners Sentiment – February 2022 to May 2023 (Author’s Data & Chart)

In Coeur Mining’s case, the company has had multiple opportunities to turn the ship around and all we’ve seen is consistent share dilution and even worse, the company still has the mediocre portfolio that it did several years ago. And while the Rochester Expansion is an upgrade to production, it’s come at a cost on a per share basis, with the capex blowout resulting in having to sell off development assets, in addition to massive dilution for shareholders. In summary, I continue to see Coeur Mining as an inferior way to buy the dip in the gold sector and it remains un-investable. Hence, if we see any rallies above US$2.85 before year-end, I would view this as an opportunity to take profits and substitute for a higher-quality miner where investors can have confidence in per share growth.

Read the full article here