Main Thesis & Background

The purpose of this article is to evaluate the Nuveen Municipal High Income Opportunity Fund (NYSE:NMZ) as an investment option at its current market price. It is a closed-end fund with an objective “to provide high current income exempt from regular federal income tax. Its secondary investment objective is to seek attractive total return consistent with its primary objective.”

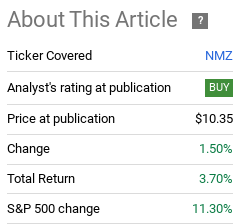

When 2023 got underway I saw a buy case for NMZ emerging. I thought that inflation would moderate and an above-average tax-free income stream would be in favor. Looking back, this was a reasonable call. The market has been in risk-on mode but NMZ has performed well along with it:

Fund Performance (Seeking Alpha)

With the end 2023 drawing closer I figured it was time to take another look at NMZ. Specifically, I wanted to decide if the “buy” rating still made sense or if a downgrade was warranted. After consideration, I continue to view this fund and the future potential positively. I think there are a few tailwinds that could push the price higher still and, as a result, will keep my bullish call in place. I will explain why in more detail below.

Discount To NAV Still Present

One of the first reasons for maintaining my rating is the fund’s valuation. NMZ has often traded at modest premiums since I started covering the fund years ago. But this has changed – along with many other CEFs – given all the macro-challenges. NMZ had moved in to discount territory as a result – and that is where I started to see value.

Fortunately, that story remains consistent today. Back in February the fund was sitting with a discount around 5%. Despite the fund seeing a positive return since that time, the discount has not narrowed much. At time of writing (8/10), NMZ still offers investors a chance to buy it on the open market at 4% less than the underlying value:

Current Metrics (Nuveen)

This is a simple takeaway but it is important nonetheless. NMZ continues to spot a price that value-oriented investors should love. That has helped it in 2023 so far and I expect it will continue to do so in Q3 and Q4.

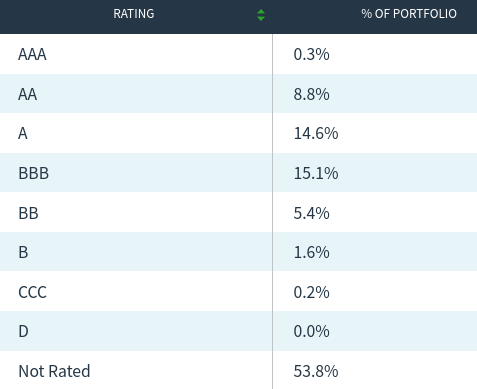

High Yield Munis Likely Safer Than Similar Corporates

I will now turn to the make-up of NMZ. This is specific to the fact that this is not the safest muni option out there. My followers know I prefer IG-rated credit for the most part, and NMZ is a CEF that pushes this risk envelope a bit. While it absolutely does hold some quality bonds, the majority of the portfolio is “not rated”, in addition to some below-IG debt. While the true credit quality of not rated bonds is not entirely known (since there are a host of reasons why an issuer would not want to pay to have a bond rated) they are generally assumed to be below-IG quality for fund purposes. Thus, readers should note NMZ’s credit backdrop very carefully before diving in to this fund:

NMZ’s Holdings (Nuveen)

With this in mind, one might ask why I would recommend a fund with so much credit uncertainty. And that is a fair question.

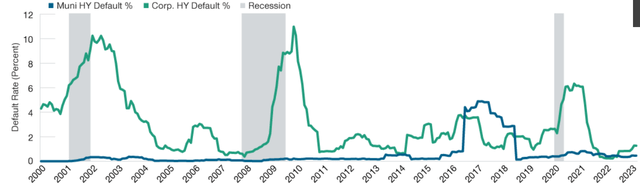

But the answer lies in the fact that I don’t really believe there is a lot of uncertainty when it pertains to results. Yes, the credit quality is a bit of a grey area, but performance suggests this is not a major problem within the muni space. For example, during periods of economic stress/recessions, corporate high yield debt tends to see a spike in defaults. Within the muni sector, by contrast, high yield or non-rated issues still generally make good on their obligations. Where there have been some default flare-ups in the past, they are very isolated within the muni space – especially compared to corporates:

Default Rates By Year (High Yield Munis and Corporates) (T.RowePrice)

What this is illustrating is that high yield munis tend to be very safe in both isolation and in relative terms. My takeaway from this is that if one does want to “reach” for yield by going down the credit ladder in quality, munis are a good place to experiment with this strategy. When I consider that NMZ is a healthy mix of both IG, high yield, and non-rated securities, this balance makes it a favorable option for those with this desire.

Equity Market Looking Too Calm

I now want to step back and take a broader look at the market as a whole. This is relevant for munis – and NMZ by extension – but could be useful to understand the backdrop for just about any investment.

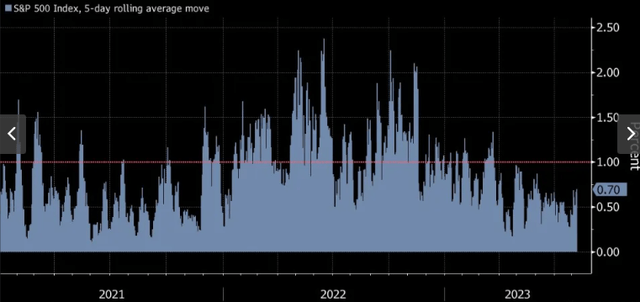

What I am referring to is the general sense of calm in the equity market. This is something that has been rewarding to me as an equity-heavy investor through 2023. Markets have risen and the rise has been very consistent. But perhaps it has been too consistent. What I mean is, volatility is way down, and that sometimes suggests difficult times could be ahead. For example, the number of times the S&P 500 has been moving in 1% or more (in either direction) has come down significantly in 2023 compared to last year:

Days When S&P 500 Moves 1% (or more) (Yahoo Finance)

Of course, this is generally a “good” thing. Who doesn’t want steady markets that consistently trend up? Everybody, except for short sellers, that is.

But the challenge is that we should all know by now that good times don’t last forever. When volatility and big market moves are down, it is easy to get complacent. And that is when investors can be caught unprepared. That is the scenario I am trying to avoid and I want to get prepared now for a more difficult end of the year.

To do so, I am looking to increase my positions in both cash and fixed-income, and munis are a good way to do the latter. NMZ in particular is on my watch list to accomplish this objective.

Leverage A Big Hurdle, Inflation Coming Down Helps

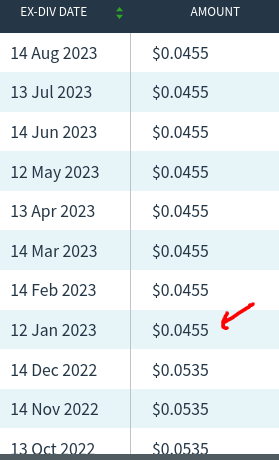

A topic I have been discussing about for all of 2023 has been CEFs and their use of leverage in a rising inflationary environment. Due to having covered this so often, I will keep it relatively short here. Suffice to say that the inflationary environment is keeping pressure on the Fed to push up short-term borrowing rates. This is increasing expense for leveraged CEFs – such as NMZ – while simultaneously limiting how the fund can earn higher income at the longer-dated end of the curve. The net result has been income pressure as expenses have risen faster than income can grow. This was evident back in the start of the year when NMZ suffered a distribution cut:

NMZ’s Distribution History (Nuveen)

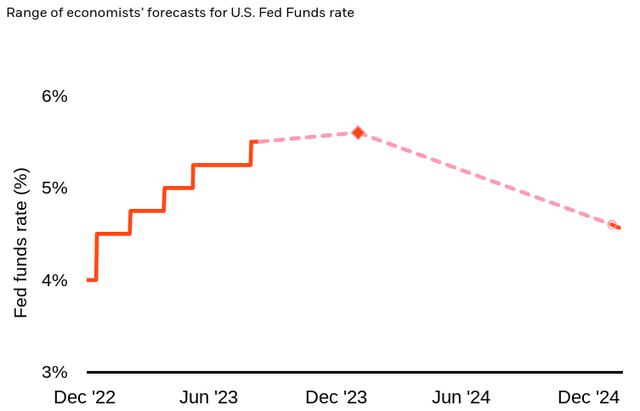

This is certainly part of the reason for why NMZ has not performed better than it has this calendar year. And the challenge going forward is this fund is still susceptible to another cut because its use of leverage is quite extreme. At almost 40%, this makes me a bit uneasy to say the least:

Quick Stats (Nuveen)

As you can see, this immediate hurdle is still relevant. NMZ continues to borrow heavily and the yield curve remains inverted. This has left the fund with a negative income balance in reserves and a pressured forward outlook. For me this suggests readers need to approach this cautiously and think holistically about how much their overall portfolio is leveraged. If one already owns a lot of similar CEFs, this could be a pass for now. If, for example, one is like me and has generally avoided leverage thus far in 2023, then buying in here now could offer a reasonable risk-reward balance despite the risk.

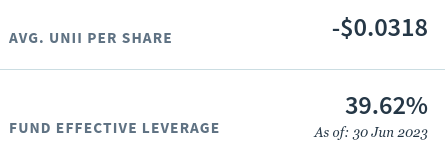

The reason why there is some opportunity is we are finally starting to see inflation come down. As that happens, so too does the Fed’s hawkish mandate, which could alleviate part of the problem I am discussing here:

Inflation (USA) (Bureau of Labor Statistics)

This is central to my “buy” rating call on NMZ. I recognize the leverage hurdle and want to emphasize that – as a result – this may not be for everyone. It amplifies the risk and could lead to over-concentration in leverage if one already has too much exposure to this theme. But for me, I see inflation’s decline as a reason to step back in to this tactic through NMZ.

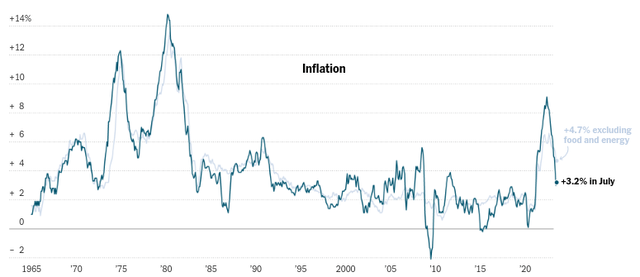

The fund has managed some positive returns even with a challenging backdrop in the first half of the year and, if inflation continues its decline, the second half of the year should be easier for the fund to navigate. While rates may still be high – they are estimated to have peaked based on market participants opinions. If that is correct, then the future should be brighter for leveraged options:

Fed Funds Rate (Current and Forecasts) (BlackRock)

In sum, I see this environment as a time to begin to build on to my income positions, both leveraged and unleveraged. This supports my continued bullishness on NMZ and other muni funds.

Limited Obligation Bonds Have Some Drawbacks

My final thought goes back to NMZ in isolation. One of the reasons why this is a “high” income fund is due to its holdings that are non-rated. But why are they non-rated? Part of the reason is the fund is heavily exposed to limited obligation bonds, as opposed to broader general obligation (GO) bonds – which are more common in the IG-realm. This difference is that a limited tax bond is a specific type of GO bond that only has access to a predetermined or specific tax line. This is distinct from GO bonds that are backed by the full credit quality and tax raising ability of the issuer, such as a state or local government. Limited GO bonds don’t have that full support, and come with additional risk to owners of the securities because the issuer can’t increase taxes to make up any shortfall if they incur financial difficulties.

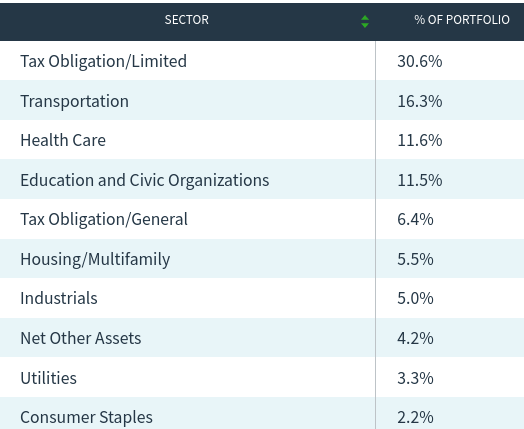

The relevance here is NMZ very long this type of security, as shown below:

Holdings Breakdown (NMZ) (Nuveen)

I personally don’t see this as a major risk right now but it is important enough to highlight it. States, cities and local governments have seen a nice uptick in tax collections over the past couple of years and are in a good position to weather the storm of any economic distress. While GO bonds are generally preferable in terms of credit quality, limited GO bonds are still quite face given the position states and cities are in (on average) right now. If economic conditions deteriorate quickly, that could change, so this is something to remain aware of. But for now, I don’t see this as an excessive risky vehicle.

Bottom-Line

NMZ has pumped out some gains in 2023 and I believe that could continue going forward. The fund still has a discount to NAV, its holdings – while a little bit riskier than my normal recommended funds – are still pretty safe, and fixed-income more broadly will benefit from inflation’s decline. The fund’s extensive use of leverage and non-rated securities do pose headwinds, so weigh this option carefully before taking the plunge. But I personally see value here and think the “buy” rating remains justified at this time.

Read the full article here