Instead of an investment thesis

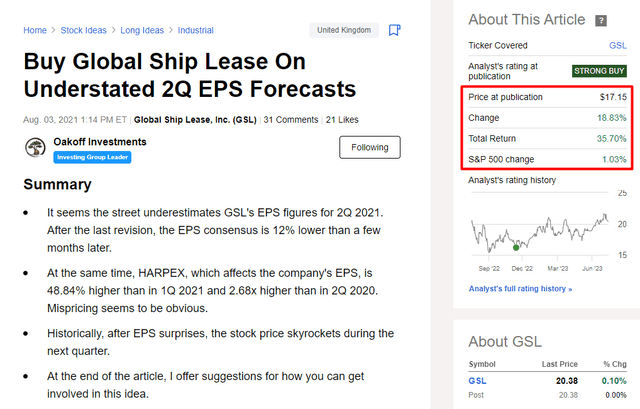

Writing about cyclical companies is a dubious pleasure if you don’t update your thesis regularly. Because of my full-time day job, I rarely write on Seeking Alpha, and so my calls on cyclical companies usually don’t do as well as I’d like, but in the case of Global Ship Lease, Inc. (NYSE:GSL), it’s completely different. I first published a “Strong Buy” article on this company in August 2021, when one share was trading at $17.15. Since then, thanks to generous dividends and a persistently cheap valuation, the stock hasn’t only risen in nominal terms but has also outperformed the broad market index, the S&P 500 (SP500) (SPX), in total return many times over:

Seeking Alpha, my first take on GSL stock

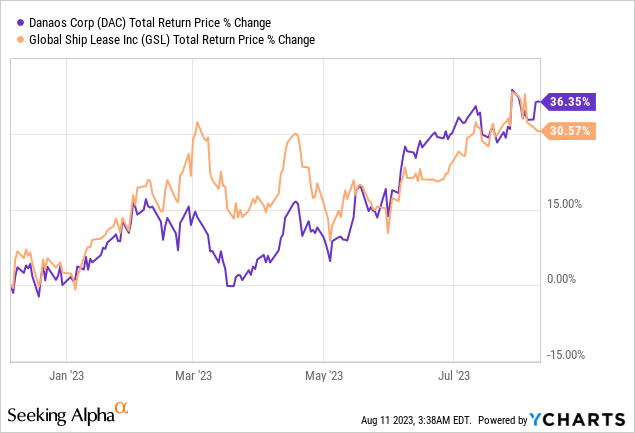

In December 2022, I decided to compare GSL to its direct competitor Danaos Corp (DAC) – at the time I concluded that GSL was still a Buy stock, but DAC looked better at the time. Since then, DAC has actually beaten GSL, albeit marginally:

Today, I decided to update my thesis solely on GSL and assess buyers’ current positioning on the market [Does it still make sense to buy and hold the stock?].

Recent financials

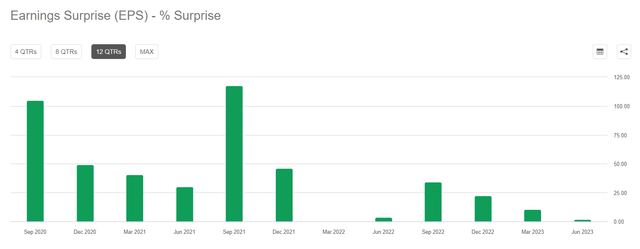

Over the past 3 years, GSL has consistently exceeded analysts’ EPS forecasts, even though revenues in this type of business are contractual (analysts can estimate them in advance and therefore have a better chance of being more accurate in EPS calculations).

Seeking Alpha, GSL, Earnings Surprises

Why is this the case with GSL? I suspect it’s because of the small number of analysts whose opinions are used as consensus: The company is too small (<$1 billion market cap) so its quarterly sales and EPS forecasts are coming from only 2 banks, according to Seeking Alpha.

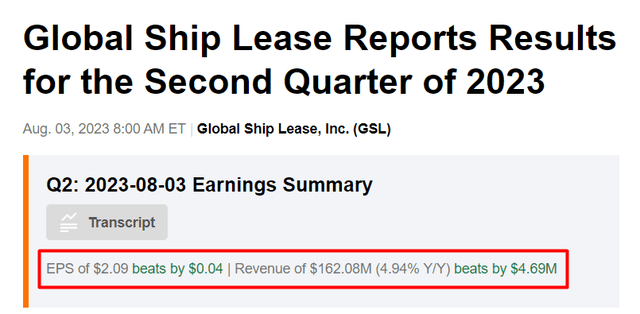

As you can see above, the mispricing was also observed in Q2 FY2023, albeit with a relatively small magnitude of ~2%.

Seeking Alpha, author’s notes

GSL’s revenue increased to $321.4 million in Q2 FY2023 from $308.1 million in the same period of the previous year. Adjusted EBITDA rose to $213.1 million (+14%), showcasing improved operational efficiency. Normalized net income adjusted for one-off items saw growth, reaching $149.5 million compared to $133.5 million in 1H FY2022.

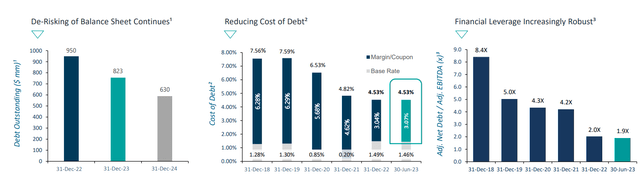

Despite securing a new debt facility for 4 ships financed in Q2, GSL managed to reduce its gross debt to $925 million, down by ~$200 million since Q2 FY2022. Total cash, including restricted funds and liquidity for operational needs, amounted to $259 million – that’s >36% of the firm’s market cap. The financial leverage is now looking even better than what I saw a few quarters back:

GSL’s IR presentation, August 2023

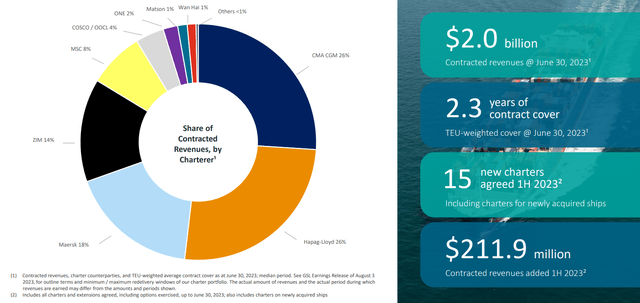

During the earnings call, the CEO noted that the company experienced a relatively modest chartering activity, with a limited increase in available capacity and idle capacity reaching around 1% at quarter end. The macroeconomic uncertainty and limited liquidity in the charter market make predicting future developments challenging. Despite this, GSL benefits from its strong contract cover and forward visibility due to its contract signings and extensions:

GSL’s IR presentation, August 2023

GSL is essentially fully booked for FY2023, and >80% of ownership days in FY2024 are already covered. This forward charter cover provides significant cash flow and earnings visibility, which is especially valuable in uncertain market conditions.

I like the way the company is allocating its capital: it pays a $1.50/year dividend and makes buybacks, that totaled $17 million in the current year. To further support buybacks, GSL’s board approved a new $40 million buyback authorization. At the same time, the firm tries to acquire new vessels focusing on timing that avoids periods of overpriced assets.

GSL, like others in the industry, faces challenging times as the overall business activity is still under severe pressure at present, and the growing orderbook is expected to continue to be a barrier to rising freight rates (read revenues). But at the same time, I think the contract revenues are already sufficient to pay dividends until the end of 2024, which makes the current 7.2% per year very attractive if we consider that we have to add the positive effect of buybacks to it.

GSL’s valuation is still quite cheap

Take a look at earnings forecasts: one analyst is projecting a decline in earnings per share of >11% in FY 2025, and on that assumption, GSL stock would still trade at ~2.6 times earnings:

Seeking Alpha, author’s notes

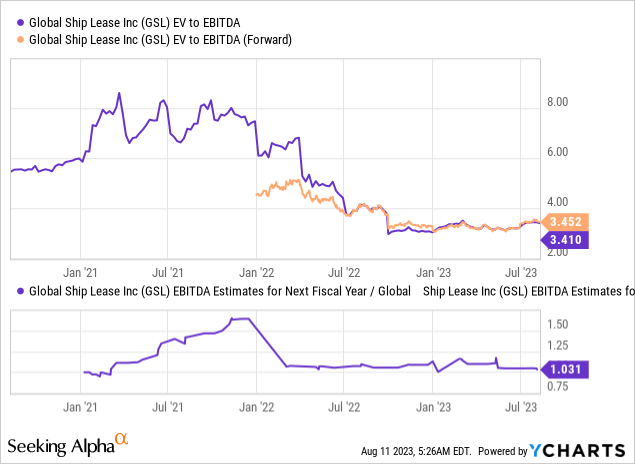

In my opinion, the stock is too cheap even with meager projected EBITDA growth with a next-year EV/EBITDA multiple of only ~3.4x:

Risk factors to consider

First off, GSL faces the risk of market instability, with uncertainties in charter rates and shipping demand driven by global economic conditions and supply-demand imbalances. The rising orderbook won’t make you sleep well even if GSL’s vessels are fully booked by the end of FY2023, no matter how big the dividend payout is.

GSL’s growth and operations rely on secure liquidity and financing access; challenges in obtaining financing due to credit market fluctuations could hinder the company’s expansion.

Also keep in mind that changing vessel values resulting from technological advancements, shifts in regulations, or market preferences could affect GSL’s financial performance, coupled with challenges in accurately estimating residual values.

Quick summary thesis

Certainly, GSL operates in a volatile cyclical industry. But it’s worth noting that the company maintains strong financials despite all the headwinds. Also, GSL’s dividend appears secure until the end of 2024, reflecting sound capital allocation and commitment to shareholders.

Moreover, despite a growing order book, GSL’s valuation seems to provide a safety cushion, suggesting that potential risks are already factored into the stock price.

That’s why I still view GSL stock as a “Buy.”

Read the full article here