Introduction

For Provident Financial Services Inc (NYSE:PFS) growth has been consistent over the years and the company has for example grown its tangible book value by a CAGR of 6.51% in the last 10 years. The spotlight hasn’t been that much on the company and during the financial turmoils of the regional bank meltdowns, the valuation of PFS decreased. It hasn’t recovered that quickly and in comparison to larger financial institutions like JPMorgan Chase & Co (JPM) the YTD returns of PFS are quite disappointing. But I think as the market gets visibility and notices the solid growth of PFS the upside here is quite appealing. Trading in line with the sector at a 9x earnings multiple. If we see a more favorable market condition in the coming quarters I think PFS could transform into a buy, but for the moment it will be a hold from me.

Company Structure

The market cap of PFS isn’t too high, sitting just above $1.3 billion right now. The company operates in the regional bank industry and has like a lot of other companies in that sector seen its valuation cut as the turmoil and volatility paired with investors’ uncertainty created a poor sentiment for banks. What has me interested in the company is the solid dividend yield at 5.2% which is largely supported by the fact PFS can maintain a robust ROE of 10.2% for the last 12 months.

As for more on the company itself, its history dates back to 1839 when it was founded. It is important to note that PFS operates as a bank holding company for Provident Bank. PFS itself offers a variety of different financial and banking products like savings and checking accounts. The customer base includes individuals, families, and businesses.

The company has built up a solid loan portfolio which comprises commercial real estate loans and commercial business loans. These are then secured by properties like multifamily apartment buildings and other real estate assets.

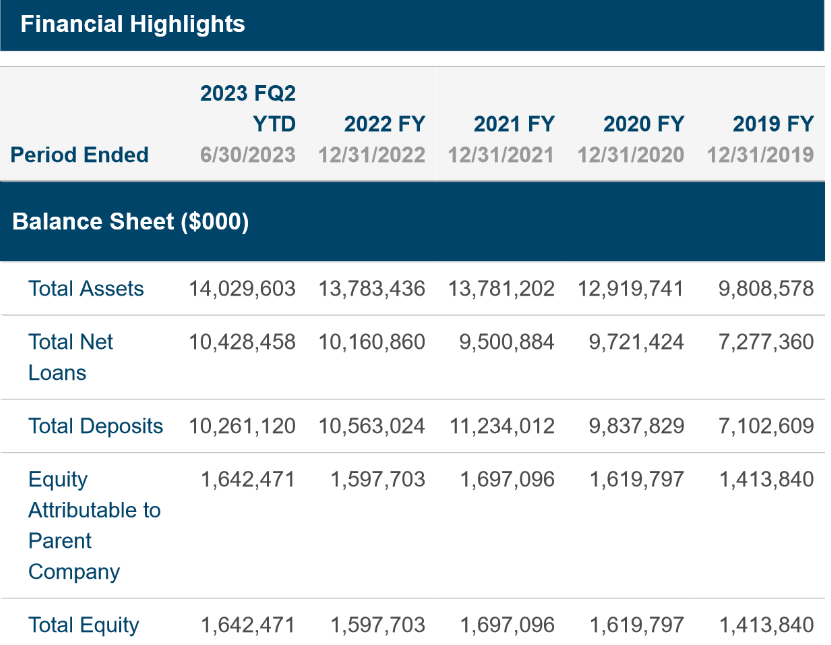

Balance Sheet (Investor Presentation)

The loans in the company have made strong strides in the last few years and right now sit at $10.4 billion. That represents an increase of around 30% from the 2019 numbers. This momentum has carried the company forward and is the reason for PFS being able to have a pretty high payout ratio without completely derailing the business otherwise.

Earnings Transcript

On July 28 we got the most recent earnings report from PFS and with that also an earnings call from the management team. The CEO Tony Labozzetta had some comments I would like to share and highlight, but also comment on.

The disruption to the banking system and resulting volatility that we all experienced in the first quarter has abated and Provident Bank fared well through the instability. These events, however, combined with more rate hikes by the Federal Reserve gave rise to new headwinds for the banking industry in the form of funding challenges as we headed into the second quarter.

Even though higher interest rates are normally a good thing for banks as they can grow their NII, it’s refreshing to see PFS highlighting some of the actual negatives about this event. With more funding challenges it seems that revenues and earnings might still be under pressure and resulted in a compression of net interest margin. The increase in deposit betas in the quarter increased the funding costs for PFS and that ultimately led to the decrease in NI margins.

Our capital is strong and comfortably exceeds well-capitalized levels. Tangible book value per share expanded 3.6% during the first six months to $15.66 on the strength of our earnings. Our tangible common equity ratio on June 30, was 8.72%. As such, our Board of Directors approved a quarterly cash dividend of $0.24 per share payable on August 25.

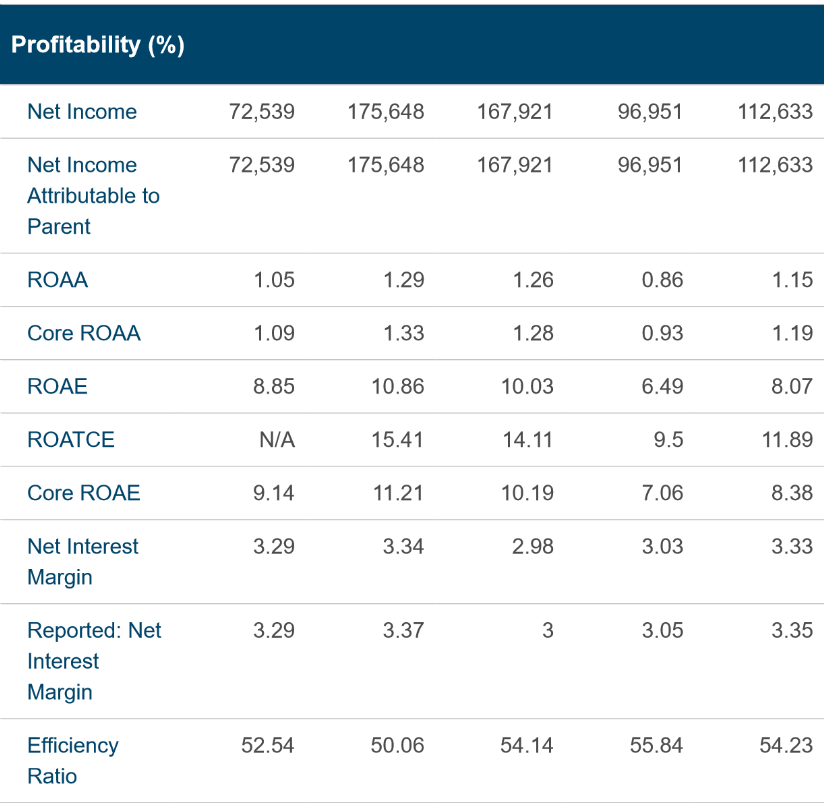

Despite the challenges that the quarter presented, PFS is still looking to be in a strong position as they remain well capitalized and tier book value per share also grew during the quarter. Looking closer at the estimates previously for the earnings, the bottom line did beat but the top line missed instead by $25 million. A worrying trend was the increase in the provision of credit losses of $10.4 million, an increase of 40% YoY. I wouldn’t want to see this continue in coming quarters but will more looking out for growth in the ROE instead. The TTM ROE is 10.2%. A positive sign would be a clear move to reach a level higher than the sectors of 11.25%.

Valuation & Comparison

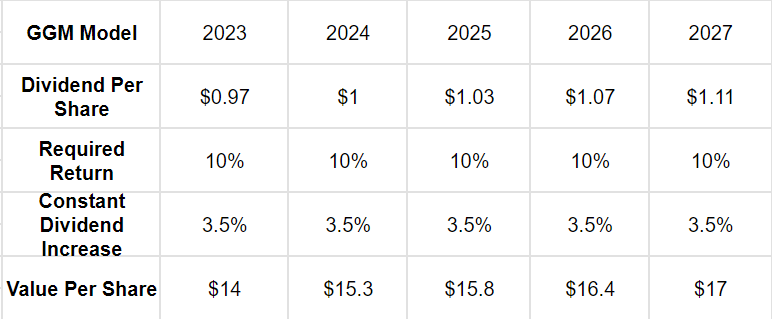

GGM Model (Author)

Looking at the model above here I have concluded that besides the market environment not being where I want it for an intense, the share price of PFS is also slightly too high for my liking. The company does offer a nice dividend, but given the quite small dividend growth rate it doesn’t make it a strong buy yet. We aren’t far off though from where I have my price targets set here, and keeping a tab on or having PFS in your watchlist seems like the best way to go. Looking at the dividend a bit closer we see that the payout ratio is quite high at 43%. I don’t think PFS will have any trouble raising it going forward, but the high ratio does leave less room for growth than perhaps other smaller banks or companies in the sector.

In comparison to the sector, PFS does trade at a discount of about 3 – 4% based on earnings, but that isn’t a sufficient margin of safety for me, I would rather have something closer to 10%. That would mean PFS needs to drop another 7% in share price before I would consider it a buy. What does make me confident in the hold rating is the discount in p/b we have of about 22% in comparison to the sector. That tells me we are still holding shares in an undervalued company based on quality assets.

Risk Associated

Financial institutions such as banks, thrifts, and mortgage companies often find themselves exposed to a range of risks closely tied to the unpredictability of economic conditions. The intricate interplay between market dynamics and their operations necessitates a vigilant approach to risk management.

In this context, these entities must remain attuned to the potential repercussions of economic volatility. As economic conditions fluctuate, banks and similar institutions can face challenges in maintaining stable financial performance. These challenges stem from factors such as shifts in consumer behavior, alterations in lending demand, and changes in interest rate environments.

Profitability (Investor Presentation)

One key concern that arises as interest rates approach their upper limits is the anticipation of a potential economic slowdown. This can have cascading effects on loan growth, which is a pivotal driver of interest income for these institutions. The inherent relationship between interest rates and borrowing decisions often results in a decline in loan demand as rates rise. This, in turn, can impact the revenue generated through interest income streams.

Investor Takeaway

PFS has done a decent job at growing with the tailwinds in the industry, unfortunately, the market conditions aren’t necessarily where I would like them to be, and the management team of PFS also commented on this. The pressure that interest rates have put on the market seems to have for PFS resulted in higher funding costs which made margins compress.

I am waiting for a better price target to get in at or for the company to signal that better times seem to be coming. For the moment though I am rating PFS a hold.

Read the full article here