By Fawad Razaqzada

US Dollar Rally Stalls Ahead of US Data

The strength of the dollar is nonetheless going to hurt US exports and thus weigh on inflation further in the coming months, meaning that our longer-term outlook remains bearish on the dollar.

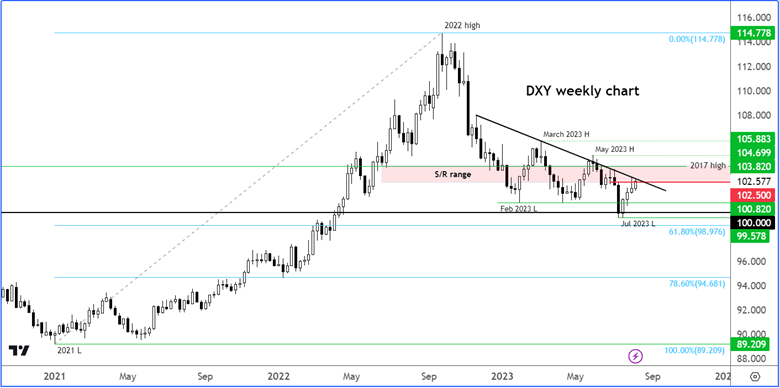

Before discuss the US dollar analysis further, here’s a weekly chart of the Dollar Index, highlighting the fact it is testing a major resistance zone circa 102.50 to 103.00 area:

Until the Fed’s next meeting in September, we will have one more jobs and inflation report. Any further weakening of CPI could cement expectations of a policy hold. But the Fed will also monitor other macro indicators, including consumer confidence.

Later on, at 15:00 BST, we will have the latest readings on the University of Michigan’s Consumer Sentiment and Inflation Expectations surveys to look forward to. But first up is more inflation data with the release of PPI at 13:30 BST.

Why Hasn’t the Greenback Sold off Yet?

Clearly, the fact that the dollar hasn’t started to trend lower again has a lot to do with a lack of risk appetite given concerns over China (where the CSI 300 Index fell by a sharp 3.2% overnight on concerns over local government debt) and a mild risk-off tone in global equities.

In addition, economic struggles around the world are discouraging investors from building long positions in foreign currencies – although we are starting to see signs of resilience in some economies, for example the UK.

Perhaps investors are waiting to see more evidence that the US economy is on a clear downward trajectory, before shunning the dollar again. So, it is important to look for signs of a slowing economy, and not just inflation figures, if you are a dollar bear. This puts today’s UoM surveys into focus (as well as PPI).

The Fed itself needs more conviction that it is winning the fight against inflation. For example, San Francisco Reserve Bank President Mary Daly said yesterday that despite CPI falling in recent months, the Fed still has “more work to do” on inflation.

Core inflation eased a tad further to 4.7% while the headline rate edged higher because of base effects to 3.2%, albeit this was better than expected. Price pressures abated nearly across all components, except the housing market.

With interest rates being high, this isn’t going to last very long – we think. And the market agrees, as the probability of another rate hike fell even further.

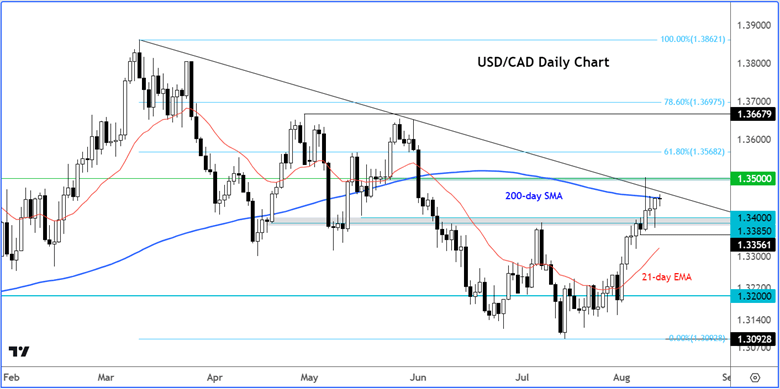

USD/CAD: Bears Wait for Reversal Signal Continues as Loonie Hits Resistance

As soon as risk sentiment improves, we think many high-beta currencies will start to shine – not least the Canadian dollar, given the recent sharp gains in crude oil prices with WTI nearing $85 per barrel.

The USD/CAD has found some resistance around the 1.35 handle, where a bearish trend line and the 200-day average have held firm so far. We will be on the lookout for a bearish reversal here. A move below key support in the 1.3350 to 1.3400 region would be a welcome sign for the USD/CAD bears.

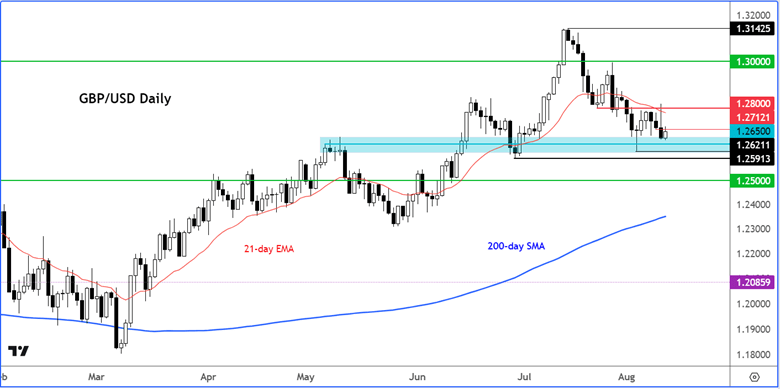

GBP/USD Forecast Boosted by UK Growth Figures

The big, inverted hammer candle from Thursday has so far failed to bring out fresh sellers in the cable. Instead, the bulls have bought the dip again, defending key support in the 1.2680-1.2700 range once more.

A close north of 1.28 handle would probably provide the bulls the signal that the GBP/USD is going higher again. And there is good reason why the GBP might be able to outperform the USD.

We already discussed the USD above. Insofar as the pound is concerned, well, the UK economy proved to be more resilient than expected, as the latest GDP figures revealed this morning.

In case you missed it, UK GDP rose 0.5% month-on-month in June, coming in ahead of the 0.2% forecast, and primarily driven by production output and growth in construction.

On a quarter over quarter basis, growth was up 0.2% in Q2 versus a flat reading expected. The Bank of England, meanwhile, remains firmly focused on services inflation and wage growth.

We will have data on both fronts in the week ahead, which should impact the GBP/USD in the direction of the surprise. One key risk facing GBP investors is the UK housing market, which has been slowing more rapidly than expected of late thanks to high mortgage rates.

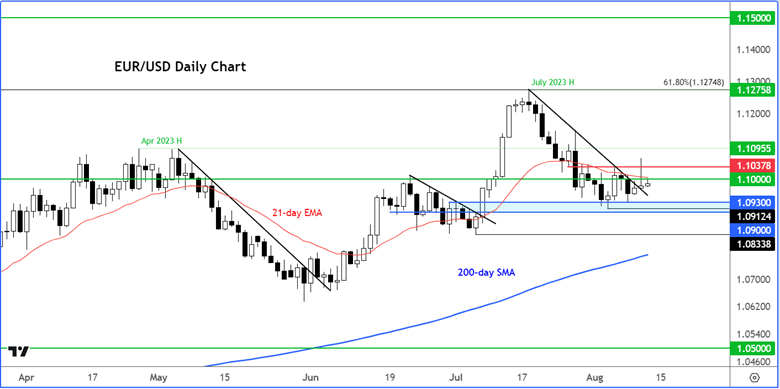

EUR/USD: Has the Euro Bottomed?

The EUR/USD forecast has not changed much since our last update, but given my bearish dollar view, I think this pair will soon bottom out, if it hasn’t already.

Although the EUR/USD relinquished much of its earlier gains on Thursday, it still managed to close in the positive territory, providing the bulls with hope that it may have bottomed out.

The EUR/USD outlook brightened slightly after breaking above its bearish trend line that had been in place since around mid-July, earlier this week. This is a positive technical indication about the trend.

But while this may appease the bulls, they will now want to see some upside follow through after the EUR/USD held onto key support around the 1.0900-1.0920 area it tested earlier this week.

So, a more decisive close above the trend line is what the bulls will be eyeing today. Key resistance to watch remains around that 1.1030-1.1050 area. If it manages to climb above here again, this will be another positive technical development.

Source for all charts used in this article: TradingView.com

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here