We wonder why the economy continues to grow. We wonder why the stock market continues to rise. And, we wonder what the Federal Reserve is going to do next.

Well, one major reason why we are not getting the recession, getting the downturn that most investors wanted, is because the economy has lots and lots of money “hanging around.”

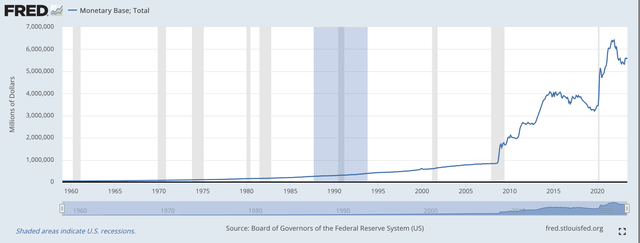

Let’s take a look at the monetary base… the base money that serves as the foundation for the money stock. The monetary base is a combination of currency in circulation and bank reserves.

Monetary Base (Federal Reserve)

This chart goes back to 1960, just to lets us get a little perspective on the situation.

I argue that three periods make up this chart.

First, there is the period from 1960 to 2008.

Second, there is the period from 2008 to somewhere in 2019.

Third, we go from 2019 to the current date.

The “old” thinking on monetary policy dominated the first period.

The second period I define as the “Bernanke” period.

And, the third period can be called the “Covid-19 period.”

The growth of the monetary base went bonkers in the second period and then took off again in the third period.

These two periods stand out as the foundation for the position of the current banking system, a banking system “flush” with liquidity.

The “Bernanke” Period, 2008 to 2019

Ben Bernanke, as the chairman of the Board of Governors of the Federal Reserve System, faced the worst U.S. recession, the Great Recession, since the Great Depression.

Mr. Bernanke created a monetary program aimed at stimulating the rise in the stock market to create a wealth effect that would result in more and more consumption spending, spending that would drive the next period of economic growth.

The foundation of this plan was the program to steadily increase the Fed’s portfolio of securities held outright. This program was given the title, “Quantitative Easing.”

Mr. Bernanke led the Federal Reserve through three rounds of quantitative easing during his tenure as the Fed Chair. His successor, Janet Yellen, did not engage in any efforts of quantitative easing.

But, as you can see from the chart, the monetary base “took off” between 2008 and 2016. And, as you can see, the financial system had never seen such an explosion of reserves in the banking system before.

Truly, Mr. Bernanke had produced something new.

Very little took place on this approach during the tenure of Ms. Yellen.

Jerome Powell became the Federal Reserve chairman in February 2018.

The Covid-19 pandemic hit in 2019 and Mr. Powell moved the Federal Reserve into a fourth round of quantitative easing.

The growth of the monetary base took off once again.

The banking system was rich with cash.

Note that from December 2019 through June 2023, even with the decline in the monetary base in recent times, the monetary base has risen from $3.427 trillion to $5.608 trillion.

In June 2023, the monetary base had risen by 63.7 percent since December 2019. And, this includes the decreases in recent months.

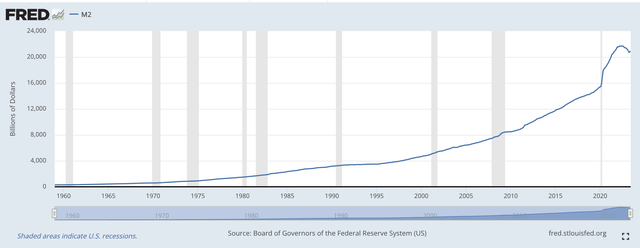

M2 Money Stock

The performance of the M2 money stock over this whole time period can be seen in the next chart.

M2 Money Stock (Federal Reserve)

Note that in the period between 1960 and 2008, the chart traces out the increase of the M2 money stock, and it is not much different from the rise in the monetary base over this time.

In the second period discussed above, 2008 to 2019, the behavior of the two charts is quite different. Whereas the monetary base increased rapidly in the period, the performance of the M2 money stock was pretty much the same as it was in the earlier period.

The “Bernanke” program resulted in a major increase in the monetary base, but there was very little impact on the rate of growth of the M2 money stock.

The commercial banking system was storing up all the reserves generated by the Federal Reserve in “excess reserves.” The banking system was just not doing much more than it had done before, even with all of the reserves being pumped into the financial system.

In the third period, M2 money stock growth took off along with the expansion of the monetary base.

Still, “excess reserves” grew in the banking system.

During this time period, as I have documented over and over in my posts over this time period, the flood of money into the financial system flowed into all sorts of “new” outlets as banks and others tried to find outlets to place all the “cash” that was on balance sheets.

In March 2022, the Federal Reserve went into a period of quantitative tightening as it moved to reduce the size of its securities portfolio, in the steady, persistent way that it pursued quantitative easing.

And, that quantitative tightening is now in its 16th month.

The M2 money stock hit its peak in July 2022, and has been declining ever since.

Still, the point is that the M2 money stock is up 36.3 percent from its number in December 2019.

Record (using these dates):

The monetary base is up 63.7 percent from the earlier date;

M2 money stock is up 36.3 percent from the earlier date.

The question: is the Fed doing all it should to bring the banking system… and the economy… back under some kind of policy control?

Still A Lot Of Money Around

There still is a lot of money around.

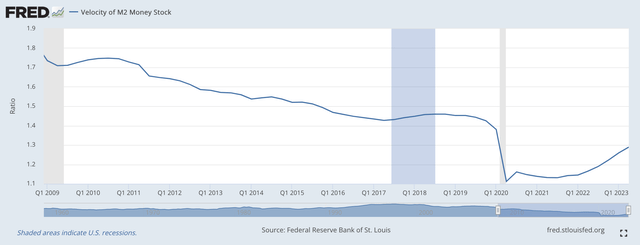

One thing that “hides” all these funds is that people aren’t spending as they did.

The velocity of circulation of the M2 money stock has been going down and down since Mr. Bernanke began the Fed’s quantitative easing. Note this chart.

Velocity of M2 Money Stock (Federal Reserve)

Note particularly the drop in velocity that took place in early 2020 when the Federal Reserve… and the federal government… were reacting so dramatically to the spread of the Covid-19 pandemic.

So, in truth, the massive amount of money the Federal Reserve created in the banking system, has not been used as much as it has been in previous times.

There is money all over the place.

And, this is what the Federal Reserve is fighting… among other things.

What problems this will bring in the future is anyone’s guess.

For now, it is hard to call the Fed’s monetary position “tight.”

Read the full article here