In early February 2023, I wrote Bitcoin: A New War is Beginning. In that article, I theorized that Ordinals inscriptions on the Bitcoin (BTC-USD) blockchain could result in another block space war. I’d encourage anyone who hasn’t read that full piece to read it and consider some of the implications of my takeaways at that time. Since publishing, we did indeed see a spike in fees manifest on the Bitcoin blockchain in early May; though fees have since normalized.

But the part of that piece that I feel is applicable to understanding Bitcoin SV (BSV-USD) is from the section that detailed the result of Bitcoin’s last “civil war:”

BCH is the product of the last Bitcoin civil war several years ago that consisted of two camps; “big blockers” and “small blockers.” When BTC was originally constructed, there was a 1 megabyte block size limit at launch. This is very small and only allows about 7 transactions per second on the base layer chain.

The block space war directly led to the Bitcoin Cash (BCH-USD) fork back in 2017. For better or worse, BCH has failed to gain adoption to the degree that BTC has since the fork and I suspect at least some of that failure can be attributed to the emergence of BSV. In 2018, yet another internal war about block space size within the BCH community led to the Bitcoin Satoshi’s Vision fork.

BSV is a bit of a third rail within the broader crypto community as there has been some debate about one of the network’s primary proponents. Craig Wright, an Australian computer scientist, claims to be Satoshi Nakamoto – the pseudonymous author of the original Bitcoin white paper. Outside of the BSV community, there is little belief in the claim. Ethereum (ETH-USD) founder Vitalik Buterin famously referred to BSV as a “complete scam” shortly after the fork. While former BTC developer Gavin Andresen, who Satoshi Nakamoto allegedly endorsed before stepping aside from the project, stated he believed Craig Wright is actually Nakamoto.

While I’m not going to speculate on the validity of the claim or comment on Andresen or Wright any further in this article, I don’t think it’s a stretch to say the claim that Wright is Nakamoto has likely had a negative impact on adoption of the Bitcoin SV network overall. Despite that, like other altcoins BSV has caught a bid in recent weeks. As of article submission, BSV has benefited from a significant 50% rally in price from a June low of $23 per coin to current $35 dollar levels. In this article we’ll explore some of the key network metrics of the Bitcoin SV blockchain, and I’ll assess what I believe is causing the increase in the native coin’s price since mid-June.

Network Metrics

The critical difference between BSV and BCH or BTC is the block size limit of the blockchains where they live. Bitcoin has a block size limit of 4 megabytes (or MB). The block size limit on Bitcoin Cash is 32 MB and the Bitcoin SV block size can often exceed a full gigabyte. This means Bitcoin SV can handle substantially more data transaction throughput per block but that block size potentially comes at the expense of being able to run a node.

The major critique of large blocks is that it can lead to centralization which theoretically puts the network at greater risk of a DDOS attack. And this is arguably already a major concern for Bitcoin SV as the total blockchain size is now over 9 million gigabytes. This drastically diminishes the ability to run a node at the individual level, and it has contributed to the centralization of BSV hash rate:

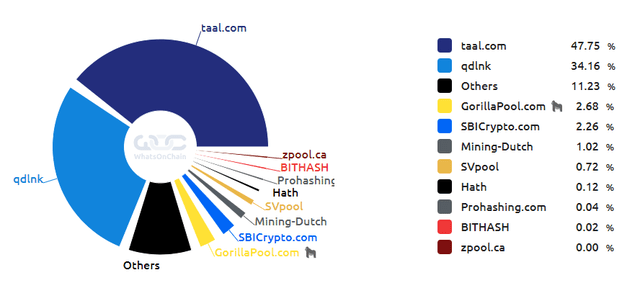

BSV Miner Pool Blocks, 1yr (WhatsOnChain)

For Bitcoin SV specifically, we can see that mining pool operators has become centralized with just 2 entities accounting for over 81% of the blocks. One of the other potential reasons for this centralization issue in the BSV mining pool is the decline in overall network hash rate:

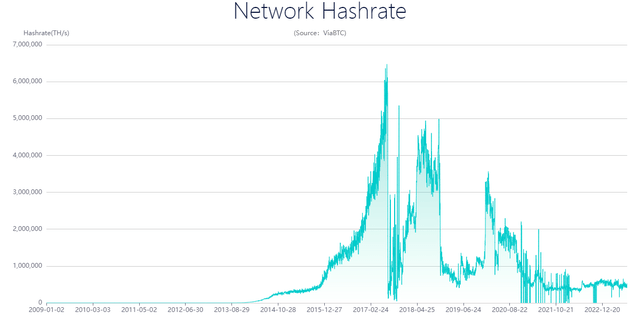

BSV Hash Rate (Viawallet)

After a post-fork high of 4 million TH/s, the hash rate on Bitcoin SV has since fallen to about 400k TH/s over the last 2 years. Interestingly, of the “Bitcoin blockchains,” the overwhelming majority of total raw transactions happen on Bitcoin SV according to data from Coin Dance:

| Share of Total | Bitcoin | Bitcoin Cash | Bitcoin SV |

|---|---|---|---|

| Hash Rate | 99.26% | 0.56% | 0.11% |

| Network Nodes | 97.32% | 2.42% | 0.25% |

| Transactions | 15.06% | 7.93% | 76.88% |

| Block Sizes | 9.68% | 3.27% | 86.98% |

Source: Coin Dance

However, in my estimation it is highly likely that these are almost entirely bot transactions that don’t result in real value transfer. Per data from BitInfoCharts, the median transaction value in USD is generally a penny or less on the Bitcoin SV blockchain. In the past, as much as 98% of the transactions on Bitcoin SV were from a single data harvesting weather app. More recently, it appears that activity is coming from a Swedish website which claims to offer “student discounts and awesome promotions:”

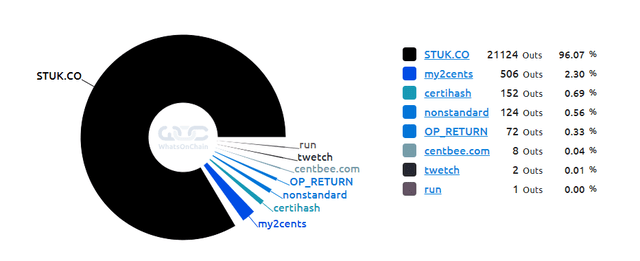

BSV Block 804664 (WhatsOnChain)

I went back several blocks and even sampled various blocks from previous days, and they all generally look the same. Stuk accounts for anywhere between 70-90% of recent BSV transactions in a given block. One of the other apparent BSV transaction contributors is a social payments site called “centbee:”

Homepage (Centbee)

However, when visiting that domain, one is greeted with a virtually unreadable website with graphics and words crashing into each other in an indecipherable manner. In my view, it’s unlikely either of these websites are adding much real value to Bitcoin SV or the BSV token.

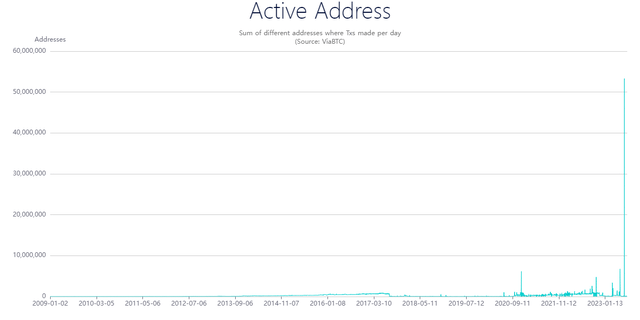

Active Addresses (ViaWallet)

Turning to the active addresses on the network, it’s difficult to ascertain a real trend given the recent spike on July 10th. For most of July and August, active addresses on Bitcoin SV have typically fallen between 40k and 80k. However, on July 10th, that figure somehow mooned to over 53 million for the day before returning to previous levels on July 11th.

Risks

For me, the risks with BSV are fairly straightforward. Like all cryptocurrencies, BSV is battling potential regulatory headwinds both in the United States and elsewhere. But beyond the industry-wide risks, Bitcoin SV is struggling from a hash rate centralization problem and a real user problem. The sentiment with the coin is bad in the broader cryptocurrency community and that is unlikely to change in my opinion given how the coin was created and who the primary backers are.

Investor Takeaways

From where I sit, the most logical explanation for the recent increase in the price of BSV is simply good old fashioned speculation. For me, there are way too many problems with the real adoption of the network to justify going long BSV even as a small speculation. I think there are too many other coins that have better fundamental setups than BSV to justify the opportunity cost of parking capital in a coin that has a lot of obvious red flags.

Ultimately, whether one views the tradeoffs that come with any blockchain’s technological differences as problematic or not, if said blockchain lacks real adoption, the native coin is going to lack a real economic value through utility. And that’s the problem with BSV in a nutshell. It’s an avoid for me.

Read the full article here