Investment action

Based on my outlook and analysis of Tradeweb Markets Inc. (NASDAQ:TW), I recommend a buy rating. I expect TW to continue reaping the benefits of this high rate environment and gain share in the credit market as the secular trend of electronification drives large trading volumes. As TW grows as I expect, valuation should revert back to its historical average of 40x forward PE.

Basic info

TW builds and operates electronic marketplaces for rates, credit, equities, ETFs, and money markets. The company serves institutional, wholesale, and retail clients in multiple countries. The business has four key segments: Institutional, Wholesale, Retail, and Market data. Each of these segments represents 60.5%, 23%, 9.3%, and 7.2% of FY22 revenue.

Review

TW recently announced its 2Q23 results, and its revenue was largely in line with analyst forecasts. Better than expected expense management contributed to an adjusted EBITDA margin of 52.5%, which surpassed analyst forecasts. AS a result, TW saw an EPS beat of $0.52 vs consensus estimate of $0.50. To some extent, the EPS beat was driven by non-operating income of $15.1 million.

I am optimistic about TW after reviewing the 2Q23 results because I anticipate revenue growth will inflect higher in the near future before returning to its historical growth rate (msd-hsd range). Rates derivatives, in particular, have seen strong volume growth of around 17% y/y, which is a major factor. In addition, there have been enough hints from management that 3Q23 is off to a good start. Since July 2022, global government bonds, global interest rates, swaps, and corporate credit have all seen strong volume growth, and management has noted that both revenue and volumes have increased by double digits. Here, I’ll zero in on U.S. corporate credit, which saw 10% y/y increase in revenue, driven by all three client channels. TW’s performance this quarter is further evidence of their market position, as they set a new fully electronic market share record in investment grade [IG] of 16% at the peak during the quarter (ended at 14.9%). This is in contrast with TW US HY market share of 6.2%, which I believe should be able to continue in the same direction as IG as management continues to invest in it. For the credit market as a whole, I believe that the accelerated entry of Citadel into credit, announced at the beginning of July, will serve as a growth driver in the near term, resulting in widespread adoption of electronic trading. I think this says a lot about the significance of trading electronically and anticipate more new entrants, which will lead to larger trades quoted online and faster trading in the credit market.

Elsewhere, as for the swap market, I also see a long runway ahead for TW to continue capturing share. Management mentioned that the market is still only 30% electronic and, as such, sees significant growth potential for long-term swap revenue. I believe the path to electronification is an inevitable one, just as the stock market shifted from bucket shops to electronic trading. The process is just a lot more scalable and safer. Hence, I anticipate a reacceleration in revenue as macroeconomic conditions return to normal.

“With the market still less than 30% electronified, we believe there remains a lot that we can do to help digitize our clients’ manual workflows while the global fixed income markets and broader swaps market grow.” 2Q23 earnings

Looking ahead, I believe there is a good chance for margin to further expand in 2H23, given the strong total volume growth of double digits in July. The silver lining is that management has stuck to their guns and said that they expect expenses for FY23 to be between $669 and $714 million, and that so far, total expenses have been on the low end of that range. Thus, margin growth may exceed what was implicitly guided for if management does not increase spending in 2H23.

Valuation

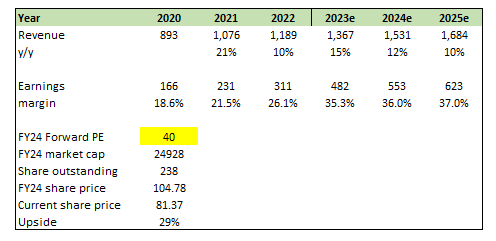

Author’s work

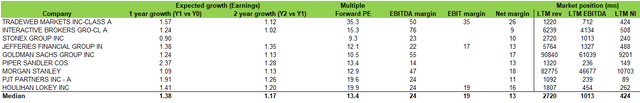

I expect that TW will experience a growth inflection in FY23 and then a normalization of growth rates over the following two years. As growth is driven by volume, they carry very high incremental margins as the fixed cost of facilitating the entire platform does not increase at the same magnitude. For FY23, I expect to see a surge compared to FY22, given that rates remain resilient. On valuation, my expectation is that TW should see its forward PE revert back to 40x, its historical average, as it continues to capture share and grow as expected. This premium in multiples is plausible when we compare it to peers in the industry. TW’s net income is expected to grow at a much faster pace over the next 12 months compared to peers, and its margin profile is way better (almost double). While TW’s market position in terms of revenue is much smaller, it also means that it has more room to continue growing at this pace since the base is small.

Author’s work

Risk and final thoughts

Tradeweb is in an industry with plenty of rivals, including other electronic trading platforms, traditional financial institutions, and securities and futures exchanges. Incumbents tend to be large players in the industry with a relatively strong balance sheet (on an absolute dollar basis), which they can use to subsidize attractive terms. In conclusion, TW appears poised for continued growth and market share expansion in the evolving landscape of electronic trading. The tailwinds of electronification and favorable interest rates are expected to drive TW’s revenue growth, especially in rates derivatives and credit markets. The company’s strong performance in 2Q23, including record electronic market share and expense management, underscores its market position and potential. TW’s margin expansion prospects in 2H23 add to my positive outlook. Thus, considering these factors, a buy recommendation is supported by the anticipation of TW’s growth trajectory and potential valuation reversion.

Read the full article here