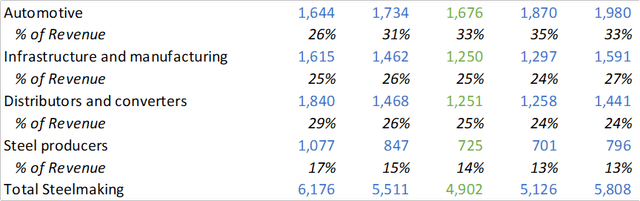

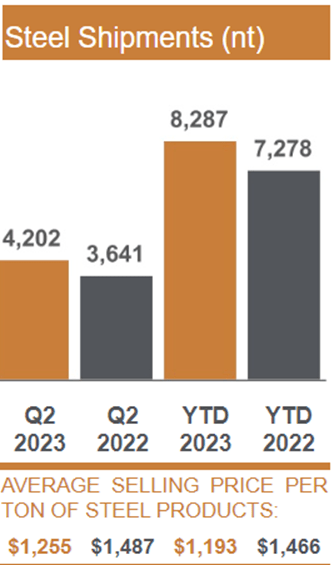

Cleveland-Cliffs (NYSE:CLF) reported a phenomenal second quarter on the back of a banner year for steel pricing. Despite the 5.5% contraction in revenue, volumes remained elevated at 4.2mm tons for the quarter as their automotive demand inched closer to pre-C19 levels. Despite the near-term hurdles in steel pricing, Cleveland-Cliffs successfully paid down $550mm of debt and returned $100mm to shareholders through buybacks on the back of their $756mm free cash flow generation for the quarter. Given their ability to rightsize operations and their balance sheet, I believe Cleveland-Cliffs is well-positioned to continue moving forward with their debt reduction plan and maximize shareholder value no matter the economic climate. With this, I provide CLF a buy rating with a price target of $21.16/share based on the market’s 9x EV/EBITDA.

Cleveland-Cliffs is heavily pushing forward towards decarbonizing the steel production process by utilizing their hot briquetted iron, or HBI, and transitioning into hydrogen as a fuel source, allowing them to include a $40 per net ton surcharge for Cliffs H. Through their successful trial of injecting hydrogen gas into their 20 tuyeres at the Middletown #3 blast furnace, Cleveland-Cliffs will be producing Cliffs H for broader sales with Linde (LIN) as their supplier of hydrogen.

Given the necessity to lower carbon intensity in the automotive space, which accounted for 33% of sales in Q2’23, automotive manufacturers purchasing Cliffs H steel will reduce their Scope 2 emissions and better align them with their carbon-neutral goals. This process will be trialed at their largest blast furnace, Indiana Harbor #7, and can potentially bleed through the rest of Cliffs’ blast furnaces as hydrogen capacity picks up. There are a handful of companies that are actively building out the supply chain for hydrogen fuel cells, including FuelCell Energy (FCEL) in collaboration with Exxon (XOM), Plug Power (PLUG), Air Products and Chemicals (APD), amongst others. At this point, as Lourenco put it, it’s a chicken and egg dilemma. Lourenco made it clear on their Q2’23 earnings call that he will take the initiative and make the first move towards replacing coke with hydrogen fuel.

10-Q

I believe Cliffs’ initiative to decarbonize the steel-making process is a major value add that can improve profitability with a clean steel surcharge and give Cliffs a competitive edge over the competition. It’s clear that Cliffs has some flex in their pricing negotiations given that they’ve increased the base price for steel sold. At the end of Q4’22, Cleveland-Cliffs announced price increases for their fixed-price contracts across the automotive industry, with an average selling price of $1,400/net ton in 2023, which should represent roughly 40-45% of their volumes.

10-Q

In total, Cleveland-Cliffs has increased their minimum selling price for hot rolled steel (“HRC”) a total of 7 times in 2023, starting the year off at $800/net ton and incrementally increasing the price to $1,300/net ton on April 3rd. HRC accounted for roughly 20% of revenue for the last two years. Their most recent pricing for HRC has settled at $950/net ton as of June 20th, a $40 premium above the date’s spot price.

Trading Economics

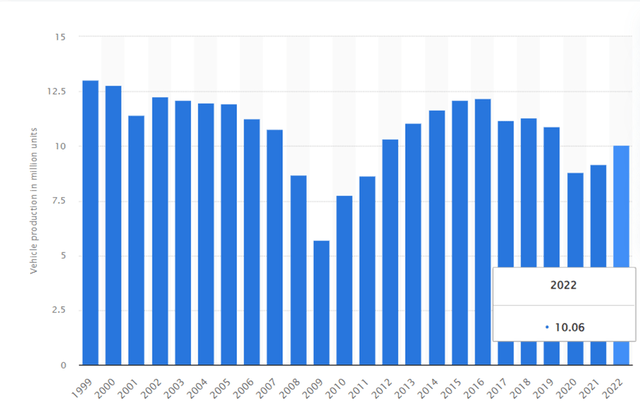

Given the economic landscape Cleveland-Cliffs is expected to perform in, there is a lot of opportunity to be had. The automotive industry still remains suppressed compared to pre-C19 figures. Vehicle production in 2022 was a mere 10mm units, as compared to a recent high of 12.18mm in 2016.

Statista

As the automotive industry returns to a more normalized state, Cleveland-Cliffs should be positioned to take full advantage of the upswing. To speculate on the automotive market, there is the potential for a stronger demand given that the average age of vehicles on the road is 12.5 years and the consumers’ challenges in securing a vehicle over the last three years.

Other areas Cliffs can benefit from include the electrification of the grid. I have written about this topic extensively through my published articles for Argan (AGX) and Quanta Services (PWR), so I won’t go into too much depth (you can reach out to me in the comments or messages for a further discussion). In short, there is a tremendous amount of coal capacity being retired and replaced by natural gas-fired power plants, wind, and solar, which all require steel to manufacture. Cleveland-Cliffs is also the sole domestic producer of electrical steel, which is required for producing electric vehicles and grid modernization as intermittent loads enter the grid. In addition to this, windmills and solar panels add some additional demand for steel plates and galvanized steel. Lastly, there are roughly 19 semiconductor foundries being built across the US that will require steel structures, as can be read about in my article covering KLA Corp. (KLAC). On top of this heightened demand, there are also multiple supporting public policies in place that will benefit the growth of Cleveland-Cliffs’ operations, including the CHIPS Act, the Infrastructure Bill, and the Inflation Reduction Act.

Financials

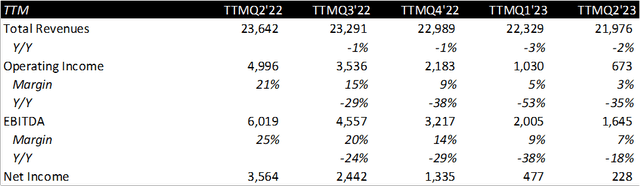

10-Q

2023 is going to appear to be a tough year for Cleveland-Cliffs coming off of a banner year for steel pricing. On a trailing basis, Q2’23 experienced a 2% decline in revenue, with severe margin contraction following. To add some figures to it, EBITDA margin for FY21 came in at 24% and is currently sitting at 7% using TTM Q2’23 numbers. Despite this slowdown, management is actively rightsizing operations, managing costs, increasing prices, and eliminating debt, which currently stands at 2.39x net debt/EBITDA.

10-Q

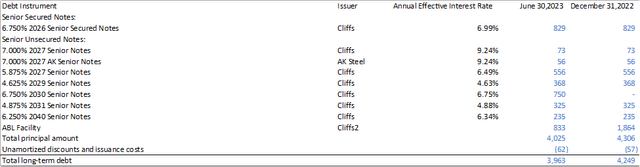

Cliffs has been in the process of restructuring their debt to benefit the firm for the long run. During the first 6 months of 2023, Cliffs issued $750mm of 6.750% 2030 senior notes to pay down and extend out their ABL facility to 2028 and to include their recent acquisition of Ferrous Processing and Trading Company, bolstering their liquidity by an additional $250mm. This pushed out their maturity date with the nearest maturity being their 6.750% 2026 senior secured notes.

10-Q

Looking forward, growth for Cleveland-Cliffs is going to highly depend on the state of the economy and whether the US experiences a soft/hard landing. Many economists, specifically Mike Feroli of JPMorgan (JPM) have switched fields into a no-landing mindset in which no recession will occur. Many others that focus on the debt markets fall in the opposite end of the spectrum. It’s hard to tell at this point in time given inflation growth falling to 3.2% growth; however, key interest rates remain at 5-5.25%. On the opposite end of the spectrum, the ISM Manufacturing PMI reading for July came in at 46.6%, remaining in contractionary territory for the last 9 months, the longest period since the Great Recession.

“I think that we’re probably in the trough” or the bottoming out has occurred, Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® Manufacturing Business Survey Committee, told a conference call of reporters on Tuesday.

The bottom line is that the market for steel producers remains in good condition. Reviewing Cliffs’ economic outlook as per their recent 10-Q, HRC averaged 19% lower for Q2’23 at $1,065/net ton; however, this price remains well above the 10-year average of approx. $750/net ton. Accordingly, service center inventories remain severely low at 1.5 months of inventory on hand and can lead to potential operating challenges if there were a production disruption or a drastic upswing in steel demand. I believe this positions Cleveland-Cliffs well, among other integrated steel producers like U.S. Steel (X) in regard to pricing power. To prove the strength of their volumes, Cliffs idled Indiana Harbor #4 in Q1’22 while maintaining similar production across their 7 other blast furnaces and has the ability to rightsize operations to maintain the elevated price for their steel.

Valuation

Cleveland-Cliffs is currently valued at 7.36x EV/EBITDA, a slight discount to the materials index of 9x. There are some value-creation initiatives taking place, including debt reduction, opportunistic share buybacks, and a hint at a future dividend.

“Why we are allocating money to buybacks? Because every now and then our stock price goes on sale. Then we go ahead and buy. There’s one way for us to expedite the dividend, stock price needs to follow the results. As soon as the stock price start reflecting, the reality of what Cleveland-Cliffs has been delivering quarter after quarter, year after year, we will be more excited about the dividend.” – Lourenco Goncalves

Given Cleveland-Cliffs’ competitive edge in the automotive industry, their drive for carbon reduction, their competitive advantage in electrical steel in the US, and the volume of new infrastructure projects on the horizon, I give CLF a buy rating with a market price multiple of 9x EV/EBITDA for a price target of $21.16.

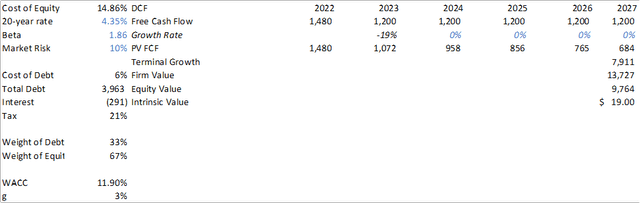

To add justification to the price target, using a basic DCF model with no growth in free cash flow for future years, the present equity value still leaves room for ~19% upside in today’s equity price.

Michael Del Monte

Read the full article here