Dear readers/followers,

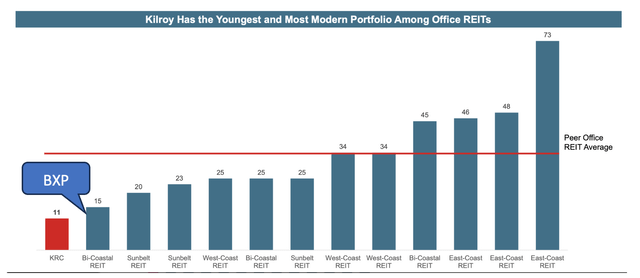

Boston Properties (NYSE:BXP) is an office REIT with some of the highest quality buildings in the US in terms of quality, location and age.

BXP Presentation

The company focuses exclusively on established legacy markets such as Boston, NYC and San Francisco. What’s important is that their buildings are almost exclusively A-Class (CBRE classifies 94% of their properties as premier) and located in the best locations (with 80% of properties in the CBD within each city). Moreover, the REIT has some of the youngest buildings on average.

KRC Presentation

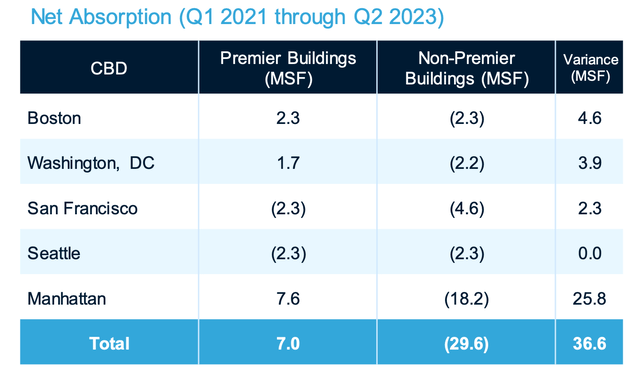

I’ve been really trying to emphasize the fact that the quality of buildings is crucial these days, because as demand drops due to WFH and recession fears, we’re likely going to see the strong (offices) getting stronger and the weak (offices) getting weaker.

In fact, according to a study done by CBRE, premier space in CBD markets where BXP operates has seen positive net absorption of 7 Million sft between 2021 and today, while non-premier space has seen negative net absorption of almost 30 Million sft. The delta is quite big and confirms that premier buildings have been able to keep their occupancy stable, while non-premier ones saw their occupancy decline meaningfully.

BXP Presentation

The quality of BXP’s buildings, alongside a very depressed valuation, were the primary reasons, why I issued a BUY rating on the stock back in March at $54 per share with a price target of at least $75 per share.

Since then, the stock has climbed to $67 per share, returning around 30%. With a large part of upside to my price target already realized and following the newly released Q2 2023 earnings which have been quite strong, it’s time to update our thesis.

Recent Earnings

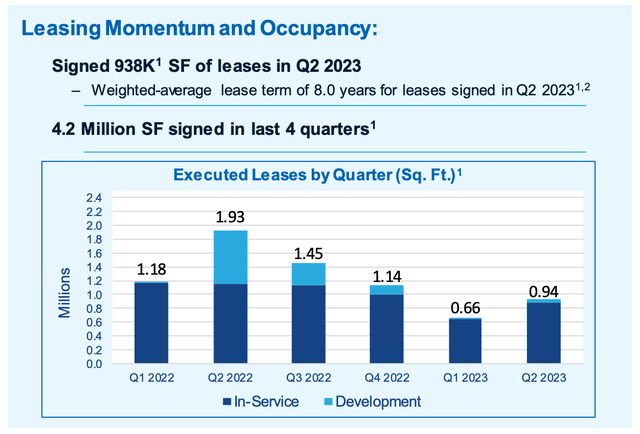

Let’s start with leasing, which is probably the most important indicator of performance right now. Management has been guiding towards leasing 3 Million sft of space in 2023, that’s 750,000 sft per quarter, on average.

In Q1, they executed 660 ths. sft of leases and in Q2 leasing accelerated to 940 ths. sft. That puts their mid-year leasing at 1.56 Million sft, which is right on target (actually a bit above target).

BXP Presentation

Occupancy of their in-service portfolio has dropped slightly compared to last quarter (88.3% vs 88.6%) as a result of adding 2100 Pennsylvania Avenue to the in-service portfolio.

Note that the newly added building is 91% leased, but only 61% physically occupied (because tenants haven’t moved in). Consequently, the building causes a slight drag on reported occupancy. Excluding this effect, occupancy remained flat QoQ.

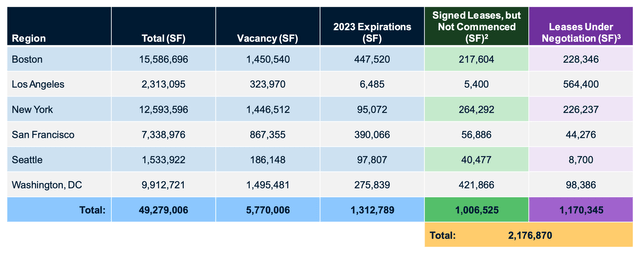

Currently, the REIT also has about 1 Million sft of signed leases that haven’t started, about 80% of which are scheduled to start before the end of the year. Moreover, there are 1.17 Million sft of space currently under negotiations, up from 900 ths. sft same time last quarter – again indicative of an acceleration in leasing overall.

With remaining 2023 expirations of about 1.3 Million sft, the company seems to be on track to deliver on their guidance of over 3 Million sft leased. I expect them to report positive net absorption for the year and therefore slightly increase their occupancy at year-end.

BXP Presentation

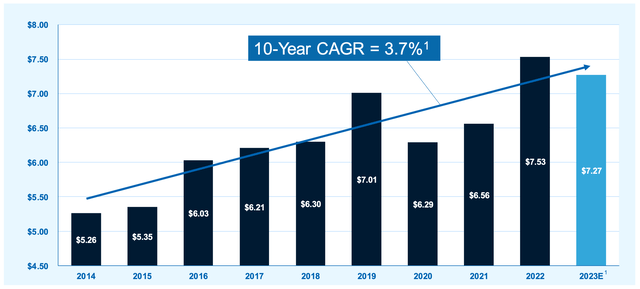

In terms of guidance, following a solid quarter, management has raised full year per share FFO forecast by $0.10 at midpoint to $7.27 (-3.5% YoY). Half of this increase ($0.05 per share) comes from a higher same-store property NOI growth assumption which has been increased by 100bps to 2.5%. The other half, comes from lower expected net interest expense as a result of newly issued bonds at a lower than assumed rate and higher deposit rates on higher cash balances.

BXP Presentation

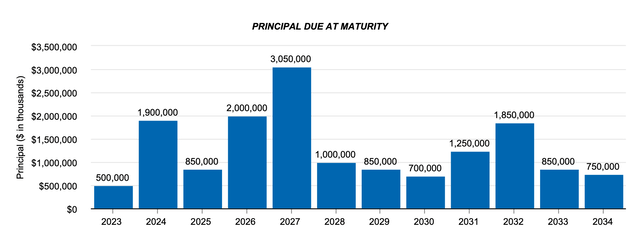

Going forward, high interest rates will obviously continue to be a headwind for BXP as low interest debt maturities come due. The company has sufficient liquidity with $1.6 Billion in cash and $1.5 Billion available on their revolver. So debt maturities don’t really threaten the REIT’s survival, but will increase their interest expense.

In particular, the $500 Million note due in September of this year currently costs just 3.13%, but is expected to get refinanced at 6.5%. Next year, there’s another $700 Million note due in February and a $1.2 Billion term loan due in May.

BXP Presentation

Overall, the REIT remains in good shape financially with a BBB+ rating, though I would like to see their net debt/EBITDA come down slightly from 7.3x.

Valuation

Going forward I expect BXP’s FFO to be flat for the foreseeable future, as:

- they refinance the $1.9 Billion of debt due next year, their annual interest expense will rise by at least $30 Million.

- and this gets roughly offset by 2% same-store NOI growth

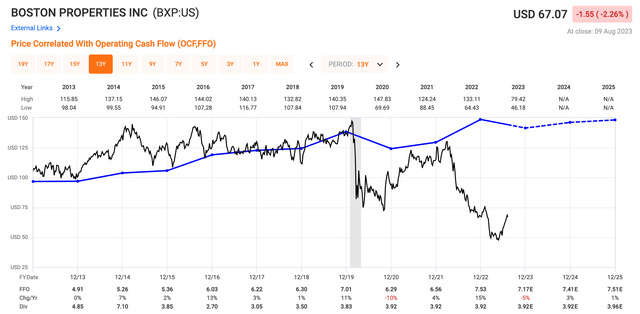

In terms of multiples, since my last article, the stock has increased from 7.4x FFO to 9.2x which continues to be deeply below the historical average of 19x.

In reality, though, we all know that a return to the historical average is highly unlikely at this point. Still I see 10-12x FFO for a company of this quality as reasonable, which would indicate a price target of $75-85 per share.

FAST Graphs

From a cap rate perspective, the REIT trades at an implied cap rate of 7.2% which is still relatively cheap, considering the quality and location of its buildings.

There have been very few office transactions lately. Management has highlighted the two comparable deals – a sale of three buildings in the Boston area at a 5.8% cap and a sale of a development site in Santa Clara at a 6.1% cap. This too suggests that there’s still some room in the valuation.

Bottom Line

All things considered, BXP has had a good quarter and I see no reason to move my $75 per share price target. A lot of the upside potential has already been realized, but if you’re looking for a long term play on offices, BXP is likely your best bet. I reiterate my BUY rating for the stock here at $67 per share.

Read the full article here