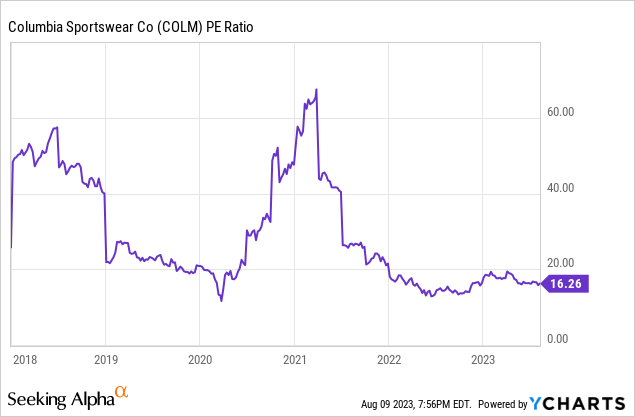

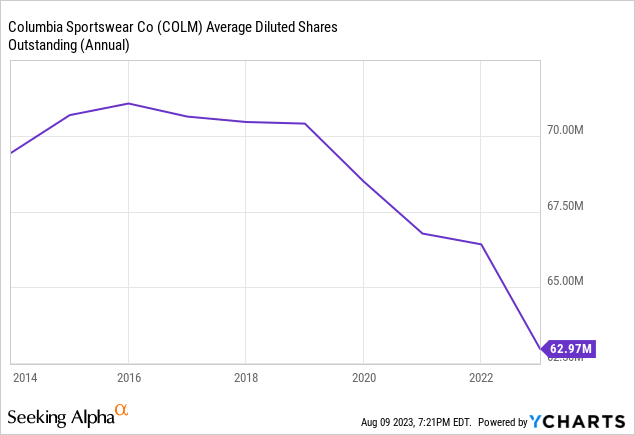

Columbia Sportswear Company (NASDAQ:COLM) investors have endured poor returns over the past 5 years, as the stock is down 15% in that time. This is despite the fact that, in that same time, sales are up about 25%, earnings per share are up about 30%, capital intensity is down, and the capital structure is the same. This points to the stock being down due to multiple compression.

In 2018, Columbia’s stock consistently traded with a trailing twelve month P/E ratio above 40. The current trailing twelve month P/E ratio is around 16.

Earnings multiples are determined by growth and ROIC and in 2018, both of these metrics were well above average and trending up relative to Columbia’s history. Currently, growth and ROIC are below average and trending down. I will go into more detail of what is driving these metrics later in this report, but in general, I believe the market was a bit overzealous in 2018 and is currently too negative on the company’s prospects.

While H2 2023 results may be poor, I think the stock is undervalued when considering future cash flows. The upcoming earnings results could cause some volatility in the near term, especially as economic weakness weighs on the market, but this is also what is creating opportunity for patient investors with long-term holding periods.

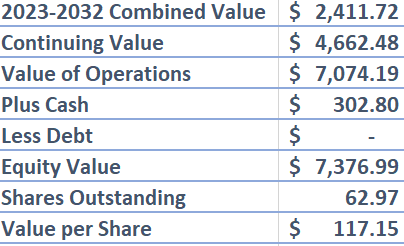

Based on what I believe are reasonable assumptions, my intrinsic value estimate for Columbia’s equity is about $117 per share, or 50%+ above the current stock price. This happens to be about 25x the high point of recently lowered FY2023 EPS guidance, which is in-line with the average multiple of the past 10 years. Once the current inventory issues are resolved, and when margins and growth begin to reaccelerate in 2024, I believe the stock will trade closer to my price target.

Business Overview

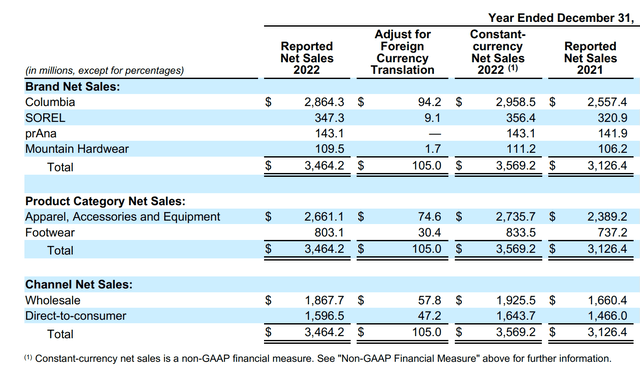

Columbia operates 4 business segments, the most recent of which was acquired in 2014. These segments are the main Columbia brand, SOREL, Mountain Hardware, and prAna. These segments sell a variety of products and are sold both wholesale and direct to consumer. The Columbia brand segment is by far the largest in terms of sales, so it is the most important for the value of the business.

Columbia Sales by Category in 2022 (Columbia 2022 10-K)

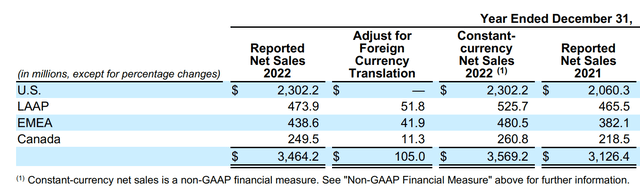

These products are sold internationally, but most sales can be attributed to the U.S.

Columbia Sales by Region in 2022 (Columbia 2022 10-K)

With the most recent acquisition occurring in 2014, the business and general business goals have not changed much in the past decade. These goals consist of capturing more of the large apparel and footwear market through brand awareness, and working to drive margins higher with economies of scale and general efficiencies.

Much of Columbia’s most recent investor presentation focuses on improving their brand, as they understand that a positive association with their brand is the best way to drive long term growth.

Columbia Brand Priorities (Columbia 2022 Investor Presentation)

Despite the stock’s poor recent performance, Columbia has historically been able to accomplish this brand goal. I don’t see any reason to believe that this won’t continue to some extent going forward as consumer preferences for outdoor activities continue to grow and as the business has been and will continue to be largely owned and run by the same family that founded it. This will lead to a continuity in culture.

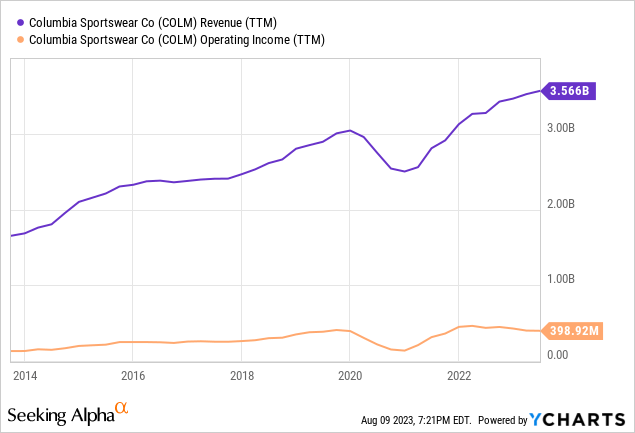

Past Financial Results

Columbia has been a consistent and well-run company over the past decade. Since 2013, revenue has increased at an 8.3% CAGR and earnings per share have increased at a 15.3% CAGR. Along with this, ROIC has averaged 13%, or 14% if not including 2020. This average would likely be higher if Columbia used some leverage, but they seem committed to carrying no debt and maintaining a large net cash position.

In 2018, ROIC reached its peak of 17.8% as earnings were high due to above average revenue growth, an above average operating margin, and as working capital that was managed very efficiently. This top line growth and high ROIC led the market to assign the stock with a P/E ratio of around 40 throughout 2018.

Columbia’s decision to spend $200mm+ on share repurchases in 2018 also likely contributed to this high multiple. In hindsight, this was a poor capital allocation decision, but along with Columbia’s consistent dividend payments, it shows that management is committed to returning capital to shareholders.

Columbia also strives to maintain a clean balance sheet, so the business can be relatively profitable even in unusual times. From the most recent earnings call, CEO Tim Boyle touched on this when he said, “We’re finding great strength and comfort in the fact that we have the balance sheet that can help us to hang on to this inventory and sell it profitably during a period like this. “

While growth and ROIC grew into and peaked in 2018, it is currently declining. Management is currently guiding for revenue to grow 2-3.5% and for earnings to decline by a high single digit percentage, which, along with a glut of inventory, will lead to a low ROIC in 2023. The stock dropped on this news, and it is currently trading at 16x trailing twelve months EPS. I believe this creates an opportunity for long-term investors to invest in a well-run and high quality company at a trough multiple, and at a discount to its intrinsic value based on my estimates of future cash flows.

The recent decline in earnings is due to softness in demand as wholesalers have built up inventory, and also due to higher costs associated with storage of elevated inventory levels. Inventory levels are high due to supply chain delays, which led to delayed shipments of inventory in 2021, which in turn led to the current glut. As this normalizes, earnings and ROIC will inflect upwards.

Valuation

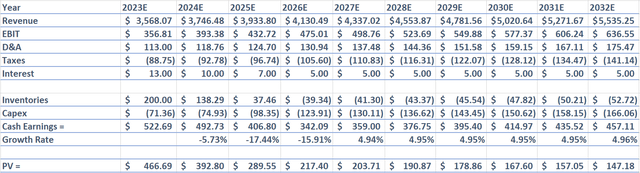

In my estimate of Columbia’s intrinsic value, I am assuming 3% topline growth in 2023, followed by 5% through 2032 thereafter. Along with this, I am assuming that Columbia’s operating margin is 10% in 2023, and that it increases to 11.5% in 2026 and remains there through 2032. I am assuming that net interest income is $13mm in 2023 and that it declines to $5mm by 2026 and remains there through 2032. I am also assuming the tax rate is 24% in 2023 and that it declines to 22% by 2025 and remains there through 2032.

I am assuming D&A from 2023 through 2032 is equal to 3.17% of revenue, which is its 10-year average. While I have inventories being accretive to cash flow from 2023 to 2025, I am modeling a 20% rise in inventory per year after 2025. I am also assuming capital expenditures are 2% of revenue in 2023 and that they rise to 3% of revenue from 2026 to 2032.

Finally, I am assuming that Columbia’s WACC is 12% and that the terminal growth rate is 2%.

These assumptions bring me to an intrinsic value estimate of $117 per share. This happens to be just about 25x the high point of management’s 2023 EPS guidance, which is also just under the 10 average trailing twelve month P/E ratio.

Columbia DCF (Created by Author) Columbia DCF Continued (Created by Author)

I believe that these assumptions are reasonable because they are generally in line or below the trends of the past decade and because, despite lumpiness in recent earnings, Columbia’s story and position in the industry has not changed.

This leaves investors with a margin of safety, as I believe there is a greater than not chance that true results going forward will be better than my estimates. Columbia is also repurchasing shares and when cash flow rises as inventory normalizes, they will be able to repurchase a large number of shares at a cheap multiple. This will also provide some level of protection against further multiple compression and sustained demand softness.

Risks

The main risk in this model is if financial results continue to decline rather than inflect up in 2024. However, even if long term revenue growth stalls at 3% and operating margins stall at 10%, my model still indicates that Columbia’s intrinsic value is $95 per share. Something catastrophic must happen to Columbia’s competitive positioning in the industry which would cause them to lose massive market share in order for there to be true downside risk in a long term investment today.

There is short term risk to be aware of, though. If there is a global recession which causes earnings to fall below the already lowered guidance, the stock will drop on both a decline in earnings and multiple compression. A long term holding period and Columbia’s clean balance sheet can help bail long term investors out of this scenario, but it is something to be aware of.

Final Thoughts

Columbia is trading at a trough earnings multiple on reduced earnings as there has recently been some demand softness, higher costs associated with higher levels of inventory, and less investor enthusiasm due to these disappointing results.

This is providing investors with a great opportunity to build a position as it is trading at a 50% discount to my estimate of intrinsic value using what I believe are reasonable assumptions. As earnings inflect upwards in 2024, I believe the multiple will expand and the stock will trade closer to my intrinsic value estimate of $117 per share. This price target also happens to be about 25x the high point of EPS guidance, which is in-line with the average multiple of the past decade.

Read the full article here