Gentherm Incorporated (NASDAQ:THRM) delivered beneficial guidance for 2023, and received beneficial expectations from most analysts. I believe that the acquisitions of Jiangmen Dacheng Medical Equipment Co and Alfmeier Präzision SE could bring FCF growth in the coming quarters. Besides, more inorganic growth, expansion in the medical industry, and thermal control markets may bring further FCF growth in the coming years. If restructuring efforts are successful, and failed product development or goodwill impairments do not lower future FCF generation, I believe that Gentherm appears undervalued.

Gentherm

With its activities oriented almost exclusively towards the automotive industry, Gentherm Incorporated is a global manufacturer and market leader in thermal and tire comfort products. These products include seats with heating and conditioning control systems, internal heating systems, battery performance solutions, cable systems, seat massage comfort, and other electronic devices that serve the user experience.

In addition to its developments for the automotive sector, the company is a provider of temperature control systems for patients used in the medical field. At present, Gentherm is developing new products and technologies for the application on its existing lines with the objective of positioning itself in markets where it has not yet achieved significant expansion.

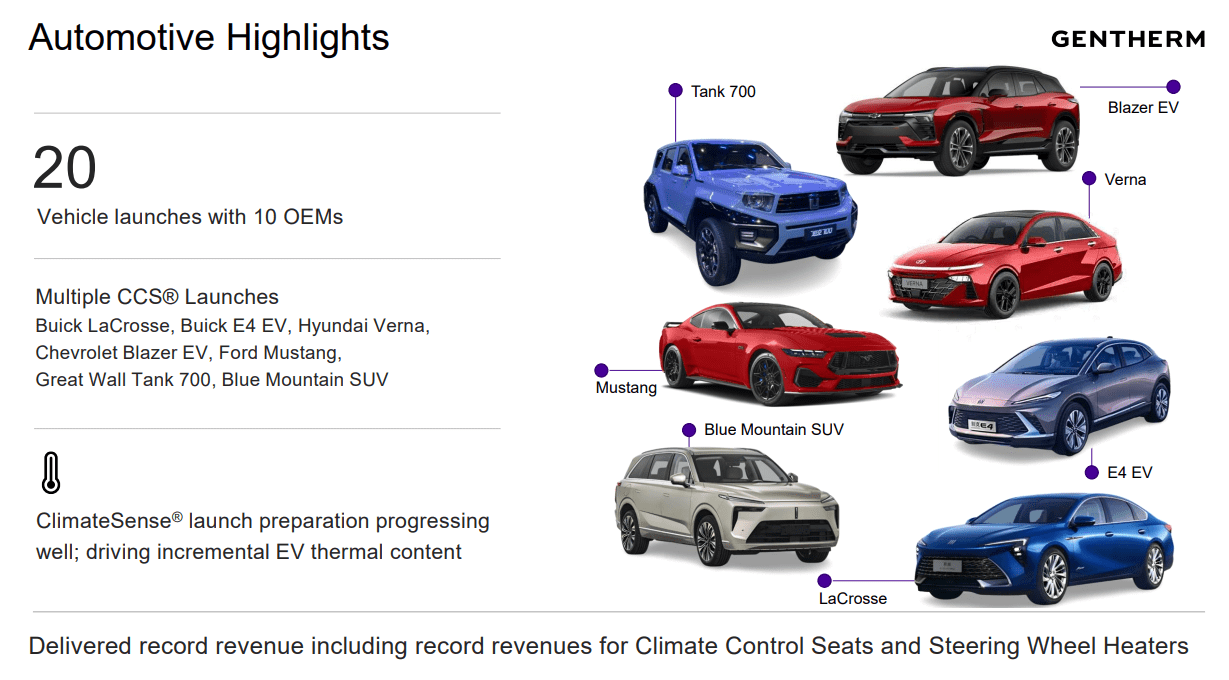

The company’s automotive products are often part of cars from the world’s most recognized original manufacturers, and its facilities are located close to the production areas of these manufacturers to maintain a direct dialogue and speed in the movement of products. The following slide from a recent quarterly presentation mentioned some brands that work with Gentherm. I believe that new clients and partners will most likely show up as soon as they recall the type of original manufacturers working with Gentherm.

Source: Investor Presentation

Due to this new arrangement in its business model, Gentherm works with two reportable segments: the automotive and the medical products. Due to the historical activity in the first of these segments, the flow of capital and work is considerably higher. The automotive segment brings together the company’s activities at a global level, in the design, development, and manufacturing.

On the other hand, the segment of medical instruments is recent, and the only line of products on which the company works is that of devices for managing the temperature of patients. These instruments are used in different types of therapies and for the control of various treatments. Gentherm has projected future growth in these markets.

Beneficial Product Revenue Growth And Market Expectations

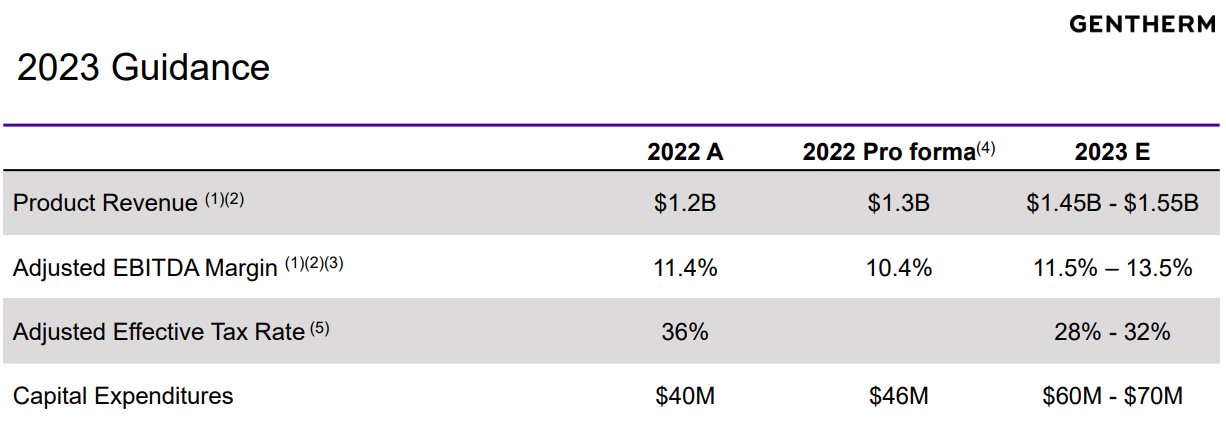

Considering the most recent guidance given for the year 2023, I believe that it is a great moment for having a look at Gentherm. Management expects product revenue close to $1.45-$1.55 billion with an adjusted EBITDA margin of 11.5%-13.5%, capital expenditures of $60-$70 million, and adjusted effective tax rate close to 28%-32%. I used some of these beneficial figures in my discounted cash flow model.

Source: Investor Presentation

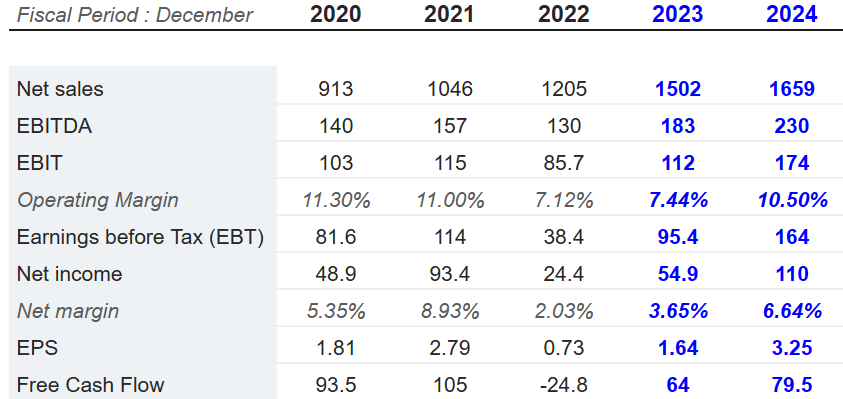

Market participants expect 2024 net sales close to $1.659 billion, with 2024 EBITDA of $230 million, EBIT close to $174 million, and an operating margin of 10.5%. Besides, 2024 net income would be around $110 million with 2024 free cash flow of $79.5 million. It is worth noting that investors are expecting FCF growth as well as EPS growth in 2023 and 2024.

Source: MarketScreener

Balance Sheet

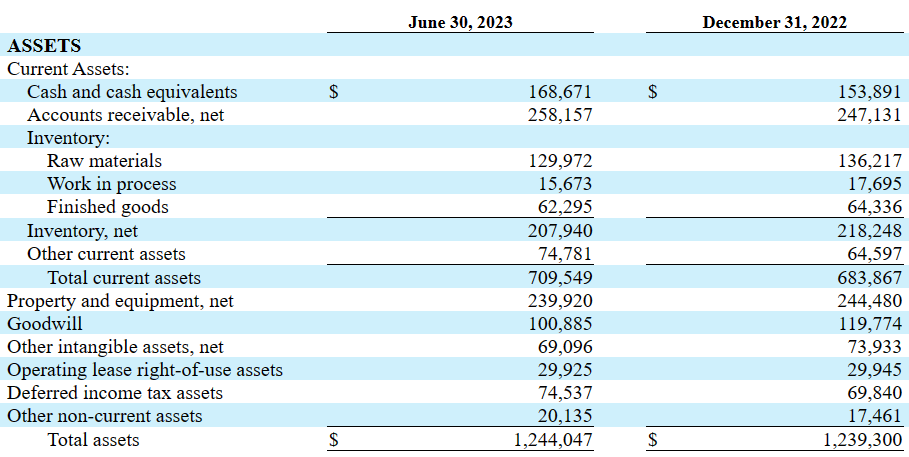

As of June 30, 2023, the company reported cash and cash equivalents close to $168 million, accounts receivable worth $258 million, and inventory close to $207 million. Total current assets are equal to $709 million, more than 2x the total amount of current liabilities. With this in mind, I would say that the company may not suffer a liquidity crisis any time soon.

Long-term assets include property and equipment worth $239 million, goodwill of about $100 million, operating lease right-of-use assets worth $29 million, deferred income tax assets of $74 million, and total assets of $1.244 billion. The asset/liability ratio stands at close to 2x, so I believe that the balance sheet looks quite solid.

Source: 10-Q

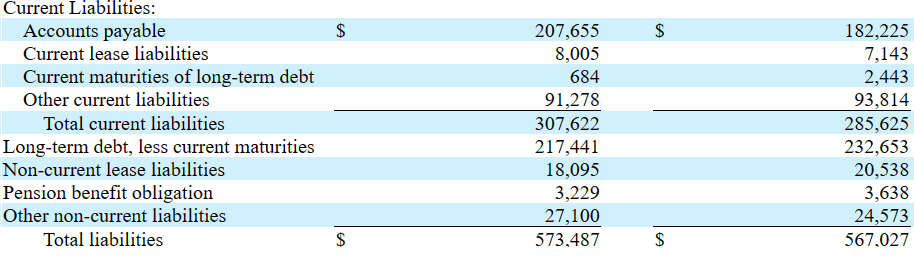

The company also reported accounts payable worth $207 million, with current lease liabilities of $8 million and total current liabilities close to $307 million. Besides, management also reported long-term debt of $217 million, non-current lease liabilities close to $18 million, pension benefit obligation worth $3 million, and total liabilities worth $573 million.

Source: 10-Q

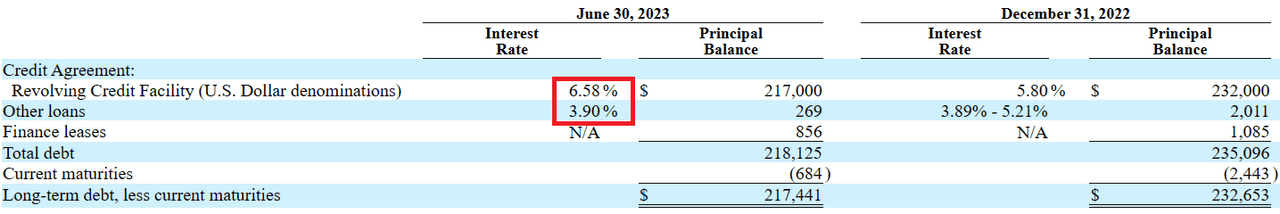

I am not really concerned about the total amount of debt, however, investors may want to have more details about the debt outstanding. Gentherm is paying an interest of close to 6.58%. I used a WACC of about 9%, which I believe is quite conservative.

Source: 10-Q

DCF

Under my DCF model, I assumed that the company would successfully deliver FCF margin growth from the infrastructure of professionals and business values that it has achieved in recent years.

I also expect benefits from accelerating technological developments on temperature management systems and the company’s climate sense product line. In particular, I believe that achieving growth in the area of tires, gaining margin in the position of thermal control markets, and the relationship with existing customers will most likely bring further FCF growth.

Besides, if the company continues to conduct optimization of the performance of car batteries, targeting mainly the cellular connections market, in parallel to respond to the needs raised by its clients in their own developments, demand from clients will most likely grow.

I also believe that further expansion of thermal control solutions for patients in the medical field and further experience in customer responses could enhance net sales growth. If management also delivers disciplined financial results, in line with the restructuring of recent years to reduce administrative costs, we could expect beneficial financial figures. In this regard, I believe that having a look at the recent information provided about restructuring appears interesting for investors.

During the three and six months ended June 30, 2022, the Company recognized restructuring expense of $0 and $50, respectively, for employee separation costs and $97 and $198, respectively, for other costs. Source: 10-Q

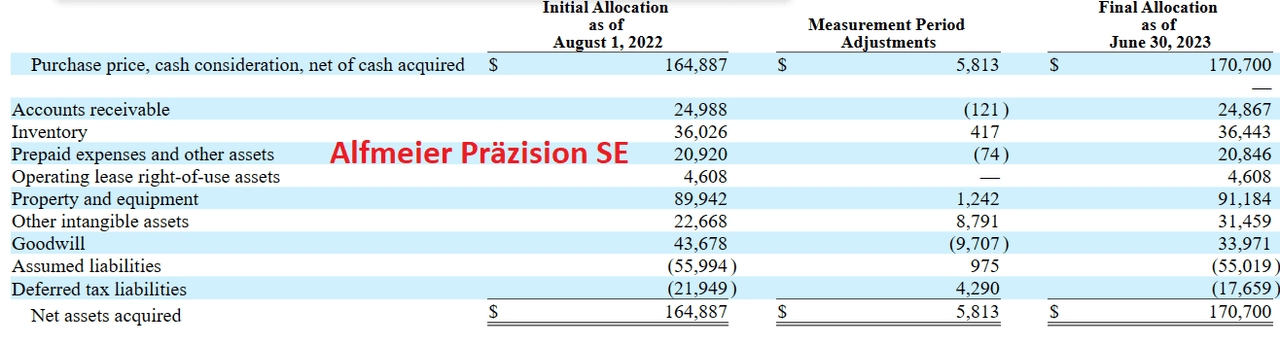

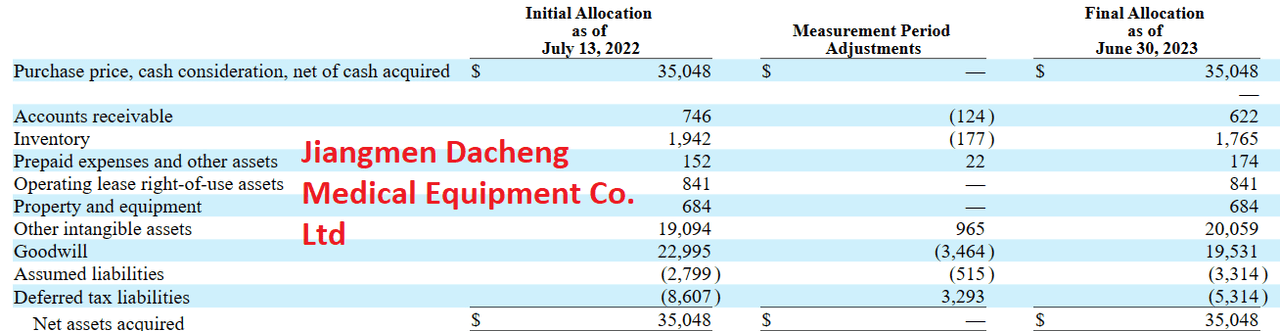

During 2022, the company made important acquisitions of Jiangmen Dacheng Medical Equipment Co, which serves to expand its position in the medical industry, and Alfmeier Präzision SE, a global leader in lumbar massage solutions as well as integrated systems and software. In both acquisitions, management included a significant amount of goodwill. More information about the assets acquired and liabilities assumed is given below, which was not significant.

Source: 10-Q Source: 10-Q

Under my financial model, I assumed that the M&A integration will be successful, so I am not expecting large goodwill impairments. With this being said, I believe that investors may want to have a look at the impairments reported in the Company’s Medical reporting unit.

During the second quarter of 2023, the Company’s Medical reporting unit did not perform in line with forecasted results primarily driven by slower than anticipated revenue growth. As a result, an indicator of impairment was identified and the Company performed an interim quantitative assessment as of June 30, 2023. The results of this quantitative analysis indicated the carrying value of the reporting unit exceeded the fair value of the reporting unit by $17.1 million, and accordingly, an impairment expense was recorded for $19.5 million that includes the associated deferred tax effect. Source: 10-Q

I hope that more impairments are not reported. In my view, if management successfully shows to market participants that it knows how to acquire and integrate targets, we may see further support for new acquisitions. Further inorganic growth would lead to net sales growth and FCF growth.

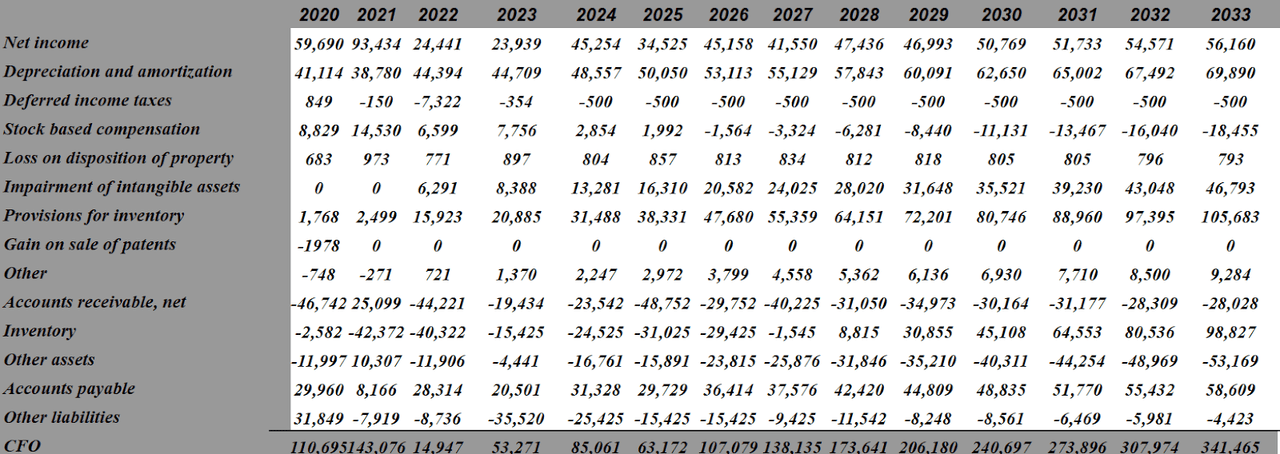

My DCF model includes 2033 net income close to $56 million, depreciation and amortization worth $69 million, deferred income taxes of around -$1 million, and stock-based compensation of -$19 million.

Besides, with impairment of intangible assets of about $46 million, provisions for inventory worth $105 million, changes in accounts receivable worth $-29 million, and changes in inventory worth $98 million, 2033 CFO would be about $341 million. If we also include capex worth -$17 million, 2033 FCF would be close to $324 million.

Source: My DCF Model

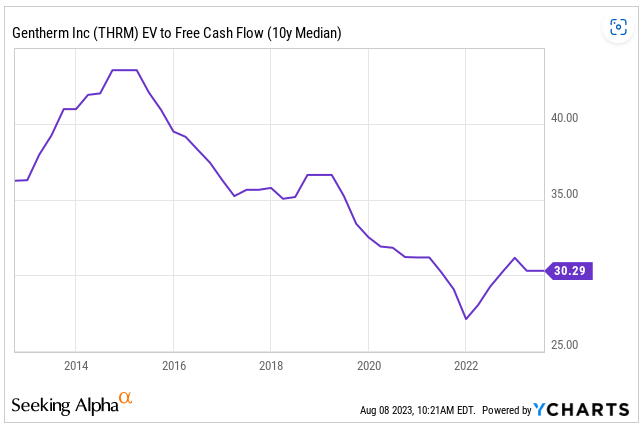

In the past, the EV/ 10 years Median FCF ranged from 40x to 30x. With these figures in mind, I believe that the EV/ 2033 FCF could be around 21x, which I believe is conservative.

Source: YCharts

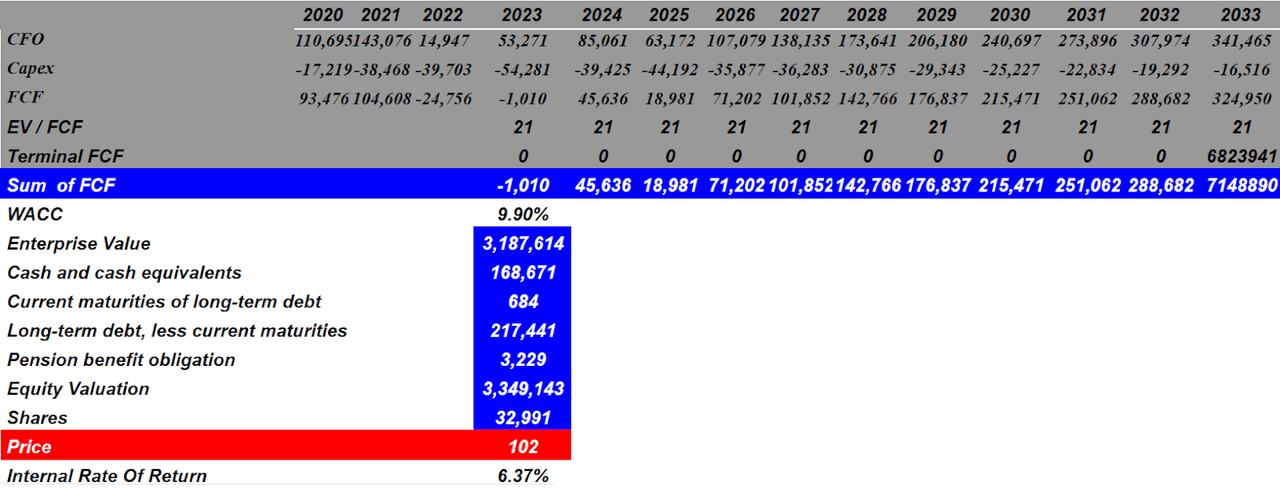

With a WACC of 9.9%, I obtained an enterprise value of close to $3.187 billion. If we add cash and cash equivalents of about $168 million, and subtract long-term debt of $217 million and pension benefit obligation worth $3 million, the implied equity valuation would be about $3.349 billion. The implied stock price would be $101 per share, and the implied internal return would be 6.37%.

Source: My DCF Model

Competitors

The competition is given mainly by other manufacturers and suppliers of the automotive industry. In some cases, the competition is given by the own productive capacity of the original manufacturers of this industry to meet their needs in the solution of thermal and pneumatic systems. With the consolidation of the market in recent years, the number of competitors decreased, leading to greater competition between companies that have concentrated larger portions of it. In this framework, Gentherm is confident that its experience in the development of thermal management products, tire comfort, and electronic systems will allow it to gain market shares against traditional manufacturers and those with historical recognition.

Risks

The automotive industry is driven by variable sales cycles, highly conditioned by global economic conditions, and technological innovation in the dispute over product positioning. At this point, the most severe risk that I see for this company is the lack of diversification of its clients, since the three main clients account for more than 30% of the company’s sales. Although it is difficult to imagine a drop or serious complications in the activities of these clients, any breakdown or rupture of commercial relations, the appearance of competitors that offer better price and sales conditions can mean serious alterations in the net income structure of the company.

In other words, the record of recent years indicates that more than 60% of revenue occurs outside the local sphere in the United States, which not only exposes the company to a number of risks in this regard. This can certainly be a problem for supply chain compliance among other complications.

Going forward, with the increasing trend towards developments for electric cars, it is essential for Gentherm to develop and adapt its products in this regard to be able to stay competitive in the market and not lose out to the advance of new entrants who have higher performing know-how.

Conclusion

There are many well-known original manufacturers working with Gentherm, which would most likely bring new manufactures and clients. If we assume successful M&A integration of the recent acquisitions, more inorganic growth, expansion in the medical industry, and thermal control markets, FCF growth would most likely continue. Besides, successful restructuring efforts and cost control that the company conducted in 2022 may have a beneficial impact from 2023. Yes, even taking into consideration risks from failed product development, I think that Gentherm appears undervalued.

Read the full article here