Technical Analysis

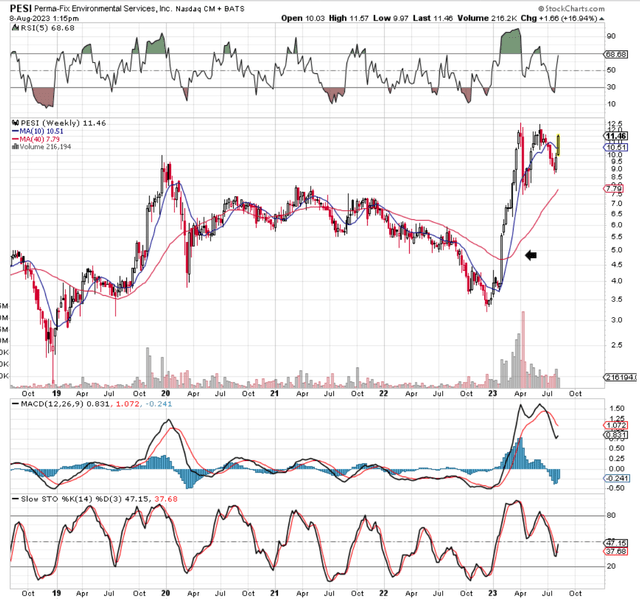

If we pull up a short-term chart of Perma-Fix Environmental Services, Inc. (NASDAQ:PESI), we see that we have a potential ascending triangle (bullish pattern) in play in the waste management company. Although some analysts may deem that PESI may be undergoing a topping pattern (Due to the stock not being able to take out resistance in June of this year), we have a few short-term technical results in play which are pointing towards rising prices in PESI over the near-term.

PESI Daily Technicals (Stockcharts.com)

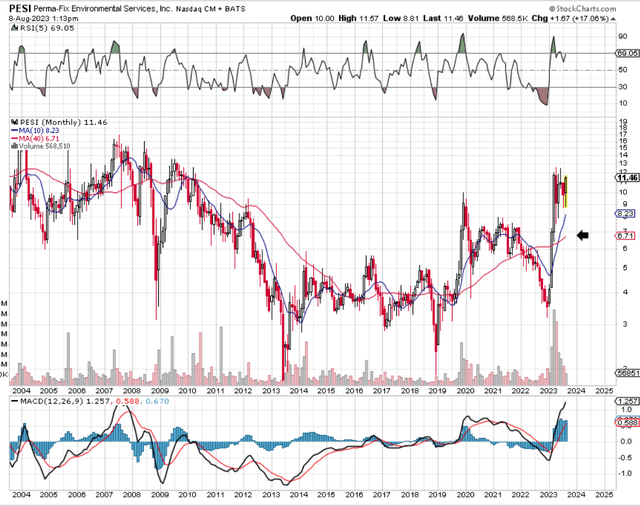

The company’s recent second-quarter numbers provided further momentum to the upside where we now have a bullish ADX trend reading, a crossover of the 4-day moving average above the corresponding 9-day & 18-day plus also a bullish MACD crossover. These indicators all play into the bullish argument here. A further reason for our short-term bullishness is the fact that the long-term trends in PESI are bullish on both the stock’s long-term 20-year monthly chart as well as the intermediate weekly 5-year chart. In both charts below, shares have witnessed recent bullish moving average crossovers which means PESI has returned to a bull market.

PSE Long-Term 20-Year Technicals (Stockcharts.com) PESI Intermediate 5-Year Weekly Chart (Stockcharts.com)

Q2 Earnings

Although PESI missed the consensus earnings estimate in the second quarter (GAAP earnings of $0.03 per share announced), the revenue estimate was surpassed ($25.03 million announced) due to top-line gains in both the ‘Treatment’ & ‘Service’ segments. Furthermore, it is important to remember that despite the bottom-line miss, PESI’s Q2 net profit of just under $0.5 million was well up from the negative $1.4 million bottom-line number in the same period 12 months prior. Moreover, sales in the quarter grew by an impressive 29% as a result of gains in both segments alluded to above.

The market though as we know is also heavily clued into other parts of the financial statements to see if near-term growth can be sustained over the long term. To this effect, there were numerous encouraging trends in PESI’s Q2 earnings report which point to sustained growth going forward.

For one, gross profit hit $4.5 million in the quarter which resulted in a gross margin of 18%. Maintaining an elevated gross margin is crucial to protect the income statement and bottom-line earnings over time. Furthermore, the 18% Q2 gross margin number came in well ahead of the 15.7% trailing 12-month number as well as the company’s 17% 5-year average gross margin number.

Another key trend on the income statement which should act as a tailwind for bottom-line earnings growth over time is the company’s reducing SG&A costs. Although SG&A only came down by roughly $0.1 million in Q2 over a rolling quarter basis, investors should remember that sales grew by almost 29% in the quarter. Therefore, SG&A costs in Q2 only made up 14%+ of the company’s revenues compared to almost 19% in the same period of 12 months prior.

It is also worth noting how the company’s return to profitability significantly improved the cash-flow statement in the second quarter. Generated operating cash flow amounted to $2.9 million from which only $0.4 million was used for investing & financing activities. This meant $2.5 million was added to balance sheet cash in the quarter which brought the company’s cash & ST investments to $4.8 million at the end of Q2. Suffice it to say, PESI’s income statement trends along with the company’s ability to generate positive operating cash flow are bullish from a growth standpoint going forward.

Bullish Growth Expected

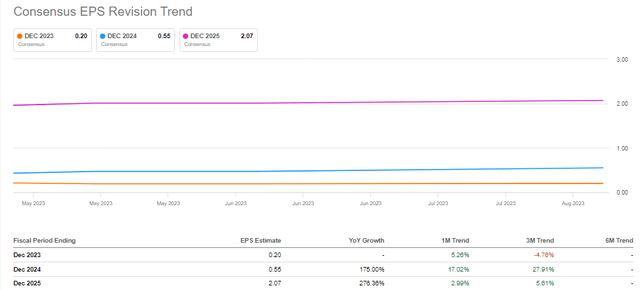

In fact, if we look at what consensus is expecting from Perma-Fix over the next couple of years, we see a bottom-line estimate of $0.20 per share this year followed by expected earnings of $0.55 per share & $2.07 per share in fiscal 2024 & fiscal 2025 alike. To make matters better, look at how all of PESI’s yearly estimates have changed for the better in recent months. Suffice it to say, if PESI’s EPS revisions continue to get dialed up, it will only be a matter of time before shares break out of that overhead resistance alluded to earlier.

These numbers stem from the significant number of catalysts open to PESI only a few ‘wins’ would significantly move the share price over time. To name but a few, you have the multi-million service opportunity with the Environmental Protection Agency and the significant runway for growth on the treatment side with respect to nuclear waste treatment in Europe for example. Then you have ‘Hanford’ where PESI has already been chosen by the DOE to perform the secondary waste treatment there over time. Suffice it to say, the speed at which these growth catalysts can be realized over time will dictate how fast share-price gains can take place going forward.

Perma-Fix EPS Revisions Trends (Consensus) (Seeking Alpha)

Risks

Given how Perma-Fix’s trailing GAAP earnings are not in positive territory at present, it can be difficult to value this stock due to the absence of a trailing price-to-earnings ratio. However, the consensus fiscal 2024 estimate equates to a 2024 price-to-earnings multiple of 20.22 which incidentally is right in line with what this sector is trading at presently. Therefore, if Perma-Fix’s forward-looking EPS estimates continue to gain traction, this stock will continue to get cheaper all things remaining equal.

As alluded to earlier though, the trajectory of PESI’s share price will be determined by how fast the company can literally do the work. Government projects for example many times can lead to delays or on the other hand call for significant capex spending from PESI when least expected. Then you have the fact that PESI being a microcap stock can experience significant price swings on selling days due to inherent below-average trading volume. The technical charts though are aware of all the risks posed to PESI at any given time which is why we recommend ‘trend following’ this play.

Conclusion

To sum up, Perma-Fix recently posted a solid set of earnings results where we saw improvements in revenues, gross margin, SG&A costs as well as bottom-line earnings. In saying this, investors should not put capital to work here until a confirmed breakout above overhead resistance is confirmed. We look forward to continued coverage here.

Read the full article here