Introduction

Tango Therapeutics (NASDAQ:TNGX) focuses on the discovery and development of next-generation precision medicines to target cancer, specifically aiming at tumor suppressor gene loss. Their innovative approach centers on selectively killing cancer cells while sparing normal ones. A major aspect of their work is in the development of PRMT5 inhibitors. Their lead program, TNG908, a selective inhibitor for MTAP-deleted cancer cells, is in Phase 1/2 clinical trials. They have also developed a next-generation PRMT5 inhibitor, TNG462, which is 45 times more potent with MTAP deletion and is now recruiting patients for a Phase 1/2 clinical trial for the treatment of MTAP-deleted solid tumors.

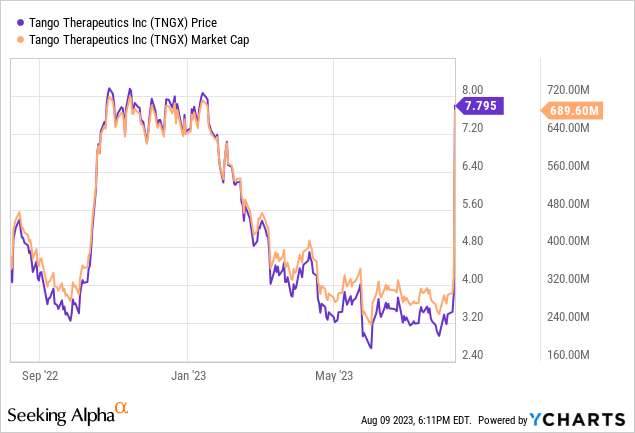

Recent Developments: The stock of Tango skyrocketed by over 100%, on unusually strong volume (74 million shares), following Mirati Therapeutics’ (MRTX) announcement of preclinical and Phase 1 data for their unique PRMT5 inhibitor.

The following article examines Tango Therapeutics’ recent financial results, clinical developments in cancer treatment (including PRMT5 inhibitors), stock surge in response to Mirati’s developments, and a comprehensive analysis leading to a “Hold” investment recommendation.

Tango Therapeutics Q2 2023 Earnings

As of June 30, 2023, Tango Therapeutics held $310.7 million in financial assets, believed to be adequate until 2026. Collaboration revenue increased to $9.6 million in Q2 2023 from $5.8 million in Q2 2022, and license revenue rose to $5 million due to a new program out-licensing to Gilead (GILD). Research and development expenses grew to $28.7 million for Q2 2023, primarily due to increased staff costs, as did general and administrative expenses, reaching $9.2 million. The net loss for Q2 2023 was $20.7 million, down from $24.9 million in Q2 2022.

Balance Sheet Checkup

Tango’s financials for the six months ending June 30, 2023, show a net loss of $48.72 million, slightly improved from the previous year’s loss of $50.07 million. The company’s total current assets stand at $320.54 million, including cash and cash equivalents of $66.05 million and marketable securities of $244.60 million. By converting marketable securities, the total available liquidity becomes $310.65 million. Considering the total operating expenses of $73.90 million for the past six months, my estimated cash runway for the company, assuming no change in expenses and without additional financing, is roughly 25 months. Tango’s financial position indicates the potential need to explore additional financing or reduce cash burn to ensure longer-term sustainability.

Clinical Progress

Tango has been actively progressing in its clinical developments, focusing on different therapies for various types of cancer. Their TNG908 phase 1 trial is currently in the dose escalation stage, having treated 16 patients with MTAP-deleted solid tumors. The proof-of-mechanism for TNG908 as an MTA-cooperative PRMT5 inhibitor was demonstrated, showing marked reduction in specific cancer cells and favorable pharmacokinetics.

Additionally, Tango has initiated the TNG462 phase 1/2 clinical trial, aiming to evaluate its effects on MTAP-deleted solid tumors, except glioblastoma, since TNG462 doesn’t cross the blood-brain barrier in preclinical models. This drug has shown enhanced potency and selectivity compared to TNG908 in preclinical studies.

A notable development in Tango’s pipeline is the TNG260 phase 1/2 clinical trial. This is a first-in-class, highly selective CoREST complex inhibitor, evaluated for use with pembrolizumab in patients with specific mutations in solid tumors. The importance of TNG260 was highlighted by the FDA’s grant of Fast Track Designation for its combination with an anti-PD-1 antibody for the treatment of previously treated advanced NSCLC with STK11-mutations in April 2023. In preclinical studies, TNG260 has shown promising results in reversing immune evasion effects and preventing tumor regrowth, indicating potential for significant advancements in cancer treatment.

TNGX Stock Skyrockets in Response to Mirati’s PRMT5 Inhibitor Development

Mirati has unveiled data from an initial clinical trial of their compound MRTX1719, targeting cancers with MTAP deletion. The compound acts as an inhibitor of the PRMT5-MTA complex, turning a unique feature of MTAP-deleted cancers into a potential therapeutic target.

The study has demonstrated marked anti-tumor effects in various solid tumor models. The treatment trial, involving 18 patients, resulted in six confirmed objective responses, and the compound was found to be well-tolerated at different dose levels. Furthermore, some patients’ tumors continued to shrink over the course of treatment, emphasizing the need to observe tumor response over an extended period.

According to Mirati, MRTX1719’s unique targeting strategy is different from first-generation PRMT5 inhibitors and has shown promising early results. The company believes this could point to a new therapeutic approach for a significant subset of cancer patients with MTAP deletions, an area with a substantial unmet medical need.

The information has caused excitement around Tango’s stock due to the similar mechanism of action with their own PRMT5 inhibitors. However, it’s essential to approach this with caution as directly comparing the two this early in the process could be premature.

My Analysis & Recommendation

In evaluating Tango Therapeutics’ prospects and current valuation near $700 million, several factors must be considered. The recent surge in stock price, following Mirati’s data on their PRMT5 inhibitor, emphasizes the potential and optimism around Tango’s innovative approach in targeting MTAP-deleted cancers. Their robust clinical pipeline, featuring TNG908, TNG462, and TNG260, illustrates Tango’s commitment to developing next-generation precision medicines that aim to selectively kill cancer cells. The favorable financials, with $310.7 million in financial assets projected to last until 2026, and the promising preclinical and clinical results all paint a picture of potential success.

However, as an investor, I must also be aware of certain risks and concerns. Tango’s drugs are still in the early stages of development, with some trials in phase 1/2. While the initial results are promising, the subsequent stages could present unforeseen challenges, especially given the dearth of real-world data regarding PRMT5 inhibition in cancer patients. Tango’s financial position, although strong, requires careful scrutiny in terms of their cash runway, which may necessitate additional financing or cost-saving measures to ensure long-term sustainability. I suspect it may be wise for them to opportunistically bolster their liquidity position in light of their stock’s massive jump.

Given these factors, I would recommend a “Hold” investment stance on Tango Therapeutics at this time. I am optimistic about Tango’s clinical prospects, particularly their work in PRMT5 inhibitors, and the Fast Track Designation for TNG260 indicates recognition of the company’s innovative approach. Yet, caution must be exercised due to the early stages of the trials and the potential need for additional financial support. Investors should also be prepared for continued volatility in Tango’s share price, given the early stage of development and the market’s sensitivity to news related to Tango’s peers and their products. Furthermore, in my view, the trading volume associated with TNGX’s move is a signal that warrants careful monitoring. Balancing this optimism with an awareness of the inherent uncertainties at this stage of development provides a cautious but hopeful outlook on Tango Therapeutics’ future.

Read the full article here