In what has been a fast-moving news cycle in the cryptocurrency market over the last several months, the recent launch of PayPal’s (PYPL) new ERC-20 token stablecoin might be one of the biggest signals we’ve received pertaining to TradFi adoption of public blockchain rails yet. As good as I think this is for Ethereum (ETH-USD) more broadly, I’m not actually as convinced PYUSD will provide an earnings tailwind PayPal’s actual business. I detailed my thinking on that in a previous article for Seeking Alpha that you can read here.

What I didn’t focus on in that piece is what the PYUSD development could mean for the broader regulatory environment in the United States. By my count, PayPal’s stablecoin is the third major action since mid-June that seemingly undermines previous policy positions from the US Securities and Exchange Commission.

- In June, Wall Street behemoth BlackRock (BLK) applied for a spot Bitcoin (BTC-USD) ETF with the backdrop of an SEC that has denied every previous application to this point.

- In July, a US district judge ruled secondary sales of Ripple (XRP-USD) do not constitute unregistered securities sales in a lawsuit between Ripple Labs and the SEC. Though the agency is reportedly appealing that decision.

- And August has now brought the launch of a notable fintech branded USD-backed stablecoin that is being issued by the exact same firm that was given a Wells Notice earlier this year for what seems to be a fundamentally identical product.

If we’re reading the tea leaves on this, we now have two major traditional financial firms seemingly rejecting the SEC’s positions on crypto-related policies. I don’t think this is a small deal and I believe it strengthens the viewpoint that Grayscale’s lawsuit with the SEC will result in a positive outcome for GBTC shareholders.

Of course, this is all nothing more than pure speculation on my part and should be treated as such for whatever value that is worth to the reader. But there are other signs that I believe give credence to the bull thesis today.

What We Know

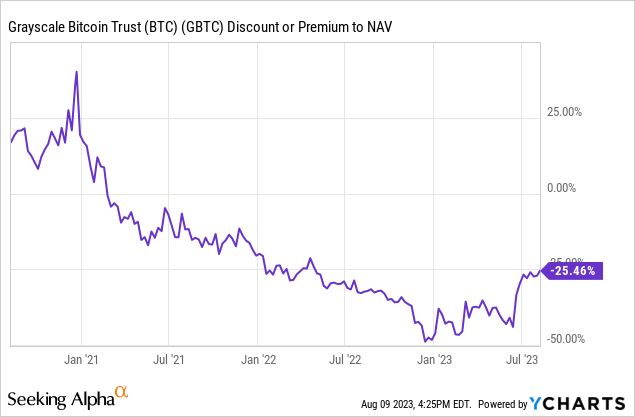

The enormous discount to net asset value for Grayscale’s Bitcoin Trust (OTC:GBTC) shares has been a well-documented problem both here and through other outlets. In recent months, that NAV discount has started to close and the progress has been more stable in recent weeks. As of Tuesday August 8th, that discount is just 25.5% – this is up from a NAV discount of roughly 50% at the end of 2022:

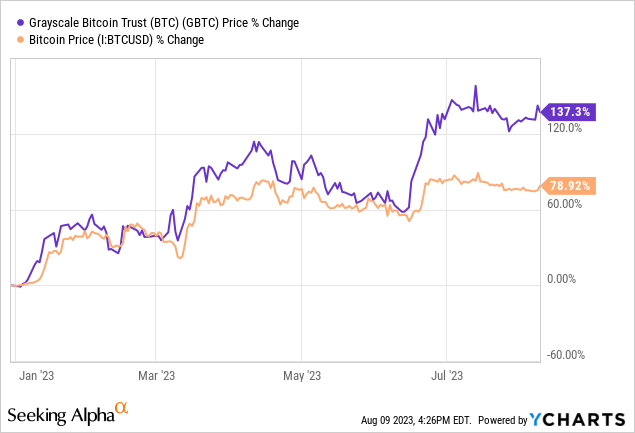

Because of the discount closing, holding GBTC year to date has resulted in outperformance of over 5,800 basis points versus the underlying asset.

Bitcoin is up 79% year to date while GBTC is up over 137%. What’s additionally encouraging is that related party holdings of GBTC are actually slightly higher than they were at the beginning of the year:

| Related Party Share Holdings | As of 12/31/22 | Current 10-Q | Change |

|---|---|---|---|

| GBTC | 36,065,470 | 36,069,847 | 0.01% |

| Ethereum Trust (OTCQX:ETHE) | 11,811,797 | 8,728,797 | -26.10% |

| Ethereum Classic Trust (ETCG) | 3,258,770 | 3,002,894 | -7.85% |

| Litecoin Trust (OTCQX:LTCN) | 1,296,956 | 1,126,498 | -13.14% |

| Bitcoin Cash Trust (OTCQX:BCHG) | 1,786,273 | 1,443,441 | -19.19% |

Source: Grayscale

This means the Grayscale Bitcoin Investment Trust is one of the few funds that Grayscale’s related parties have not been selling in recent quarters per the company’s recent 10-Q filings. In the table above, I’m showing Grayscale’s top five single asset funds by AUM. GBTC, ETHE, and ETCG 10-Qs are all as of Q2-23 while LTCN and BCHG are as of Q1-23. Of the top five funds, only GBTC has actually been acquired by related parties since the end of December rather than distributed.

Bitcoin Supply Crunch

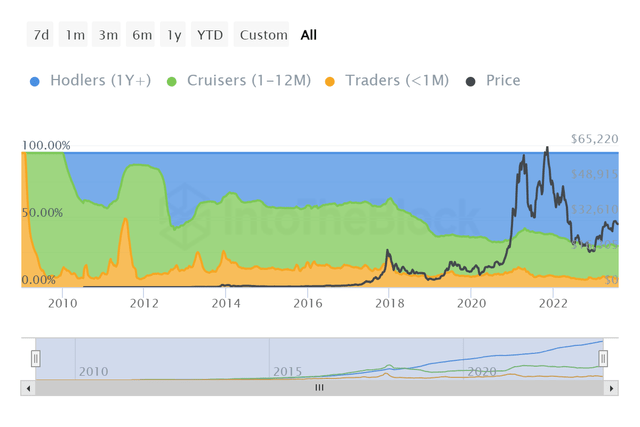

Even if the NAV discount remains exactly where it is, there is a compelling argument to be made that GBTC will still move up with the underlying asset from here given the current supply setup for BTC. The level of Bitcoin “hodling” has reached unprecedented levels. As of August 7th, over 13.3 million BTC was held by long-term holders. Nearly 70% of the circulating supply is being hoarded according to data from IntoTheBlock:

IntoTheBlock

IntoTheBlock defines “Hodlers” as wallet addresses that have held bitcoin for more than a year and counts 33.3 million addresses as qualifying for that distinction. We can also see supply coming out of exchanges to a significant degree.

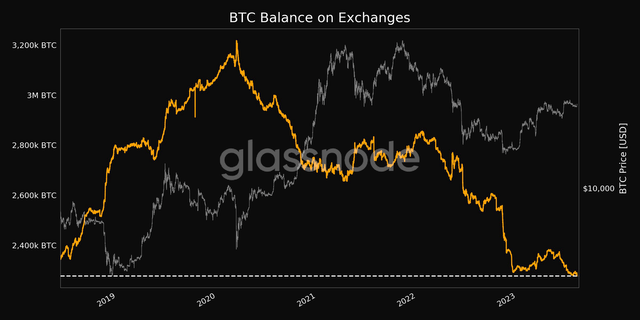

Glassnode

Per data from Glassnode, just under 2.3 million BTC is held on exchanges globally. This would be the lowest level of exchange BTC holdings in 5 years. It is generally interpreted as bullish for Bitcoin’s short to medium term price when supply comes out of exchange addresses as it’s an indication that speculators are committing to holding the asset rather than swapping it for fiat or other cryptos.

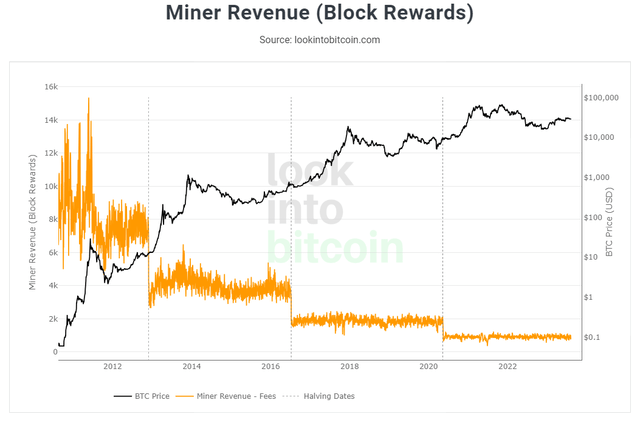

LookIntoBitcoin

And this is all with the next Bitcoin halving just 8 months away. When this happens, it means the block reward for mining BTC will be cut from 6.25 BTC per block to just 3.125 BTC per block. The point is, market participants appear to be loading up BTC in anticipation of this event. With less than a year before the halving and with traditional financial firms preparing to offer spot ETFs, it’s difficult for me to see much more downside from here barring something catastrophic.

Risks

From where I sit, the biggest risk to GBTC at this juncture is the possibility that Grayscale could lose its lawsuit with the SEC. If that were to happen, I suspect traders who have been playing the NAV arbitrage will throw in the towel and that could depress the price of the fund shares further against the underlying asset.

There is also risk in the related party holders. Digital Currency Group, Grayscale’s parent company, is one of those related parties and that company has reportedly missed a $630 million dollar payment to one of its creditors. DCG could potentially become a forced seller of assets and that could also harm the GBTC share price even with a flat BTC.

Finally, there is also underlying asset risk. If the price of BTC goes down significantly, it would be detrimental to the share price of Grayscale Bitcoin Trust.

Summary

There has been a noticeable shift in sentiment toward the regulatory environment in the United States. Traditional financial firms like BlackRock and PayPal are now doing things that the SEC has previously indicated were problematic from more crypto-native businesses just a few months ago. The crypto industry has been lamenting what has been viewed as a policy of regulation by enforcement under Gary Gensler’s SEC. But recent developments in markets and in court seem to indicate the law may be on the side of the innovators after all. I think this is very bullish for Bitcoin and for GBTC shareholders as well. And I believe the on-chain metrics are screaming a supply crunch is upon us.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here