By Sam Korus, Director of Research, Autonomous Technology & Robotics

Electric air taxi companies have made significant strides since ARK estimated the industry’s progress five years ago.[1] The Federal Aviation Administration (FAA) has collaborated closely with the electric aviation community as it has prepared to certify electric air taxis,[2] so much so that three or more companies are likely to launch commercially in 2025.

To help investors understand this business, we are featuring our recent open-source research on the cost declines likely to propel the industry forward during the next two years and beyond.

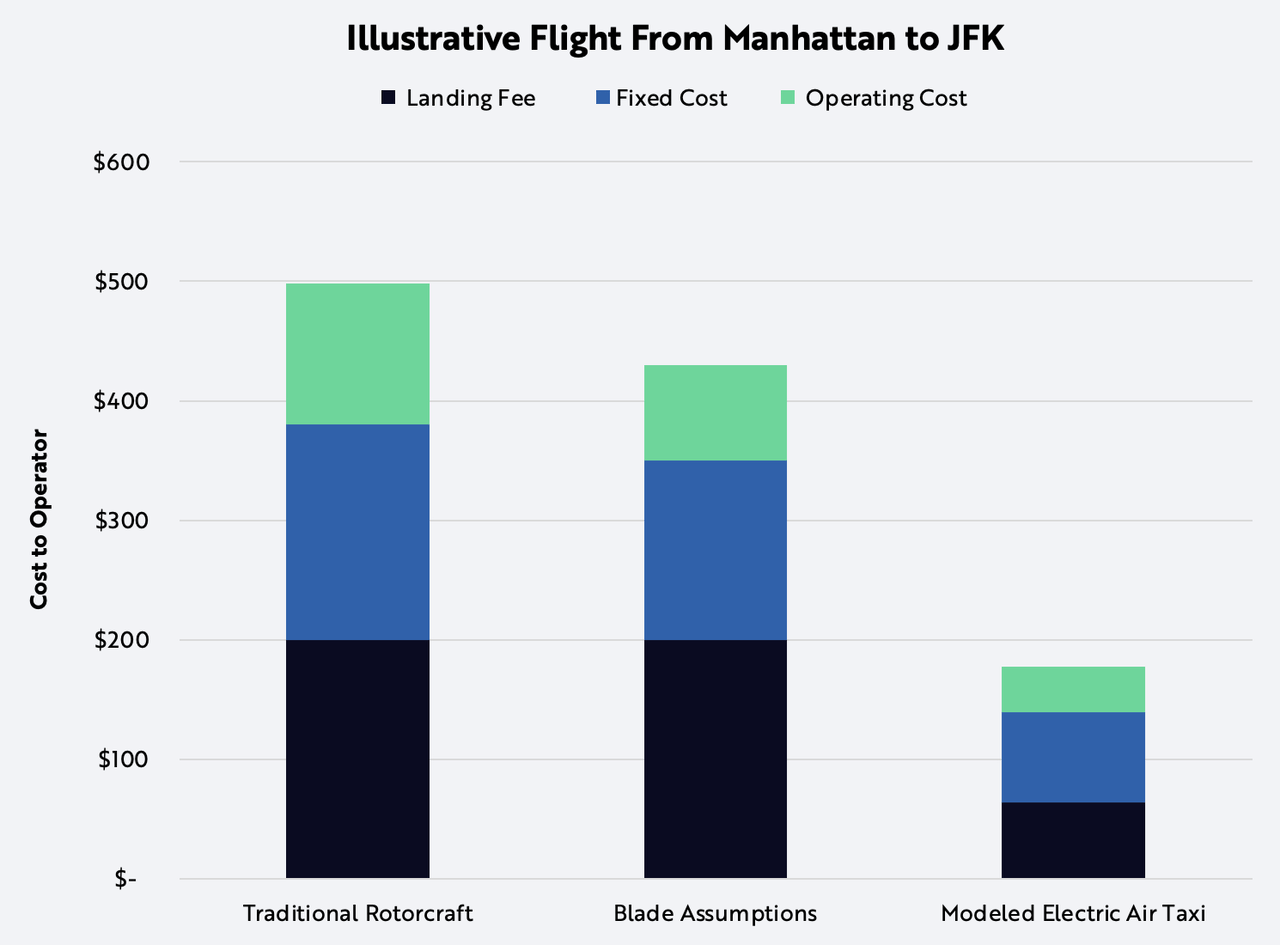

Our initial reference point was Blade Urban Air Mobility (BLDE), a company with deep expertise in helicopter operations that estimates electric air taxis initially will lower the cost of a trip from Manhattan to JFK by 14%, from $500 in a traditional helicopter to $430.

As the technology scales in the coming decade, according to our research, the total cost of an air taxi ride may drop as low as ~$180, as shown below, which – when split among three or more passengers – would translate to a price of ~$70 per passenger.[3]

Source: ARK Investment Management LLC, 2023, based on data from Blade Urban Air Mobility as of June 27, 2023.[4]

For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Forecasts are inherently limited and may not be realized.

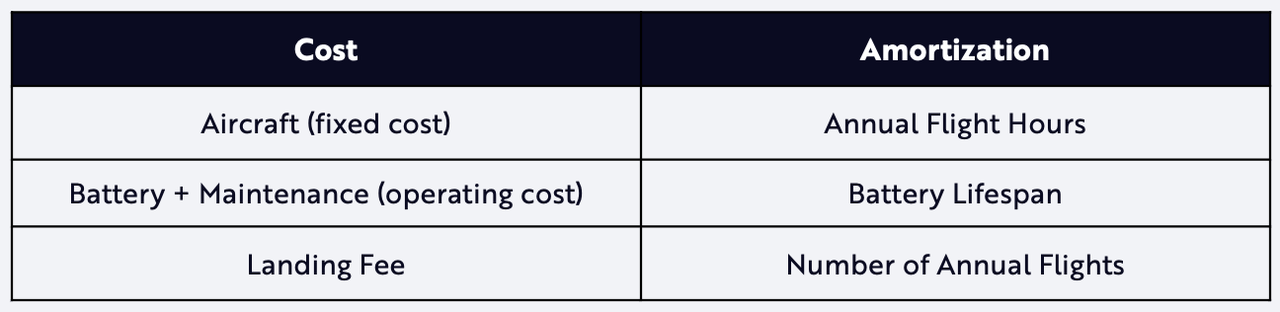

Driving our model are three costs and amortization schedules, as shown below.

According to our research, the primary variables impacting the hourly fixed cost of an electric air taxi are upfront aircraft costs and the number of flight hours per year, as shown in the chart below.

Our model assumes that, although high initially, costs will decline as production scales. Joby Aviation (JOBY) has estimated that the upfront manufacturing cost of an electric air taxi averages $1.3 million, while Blade notes that a Part 135[5] rotorcraft typically operates ~1,000 hours per year.[6]

In our view, however, those estimates do not represent the upper limits for electric air taxis, as 2,000 hours would equate to an aircraft utilization rate of ~23% if operating 24 hours a day 7 days a week.[7]

Source: ARK Investment Management LLC, 2023.

This ARK analysis is based on underlying data from external sources, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Forecasts are inherently limited and may not be realized.

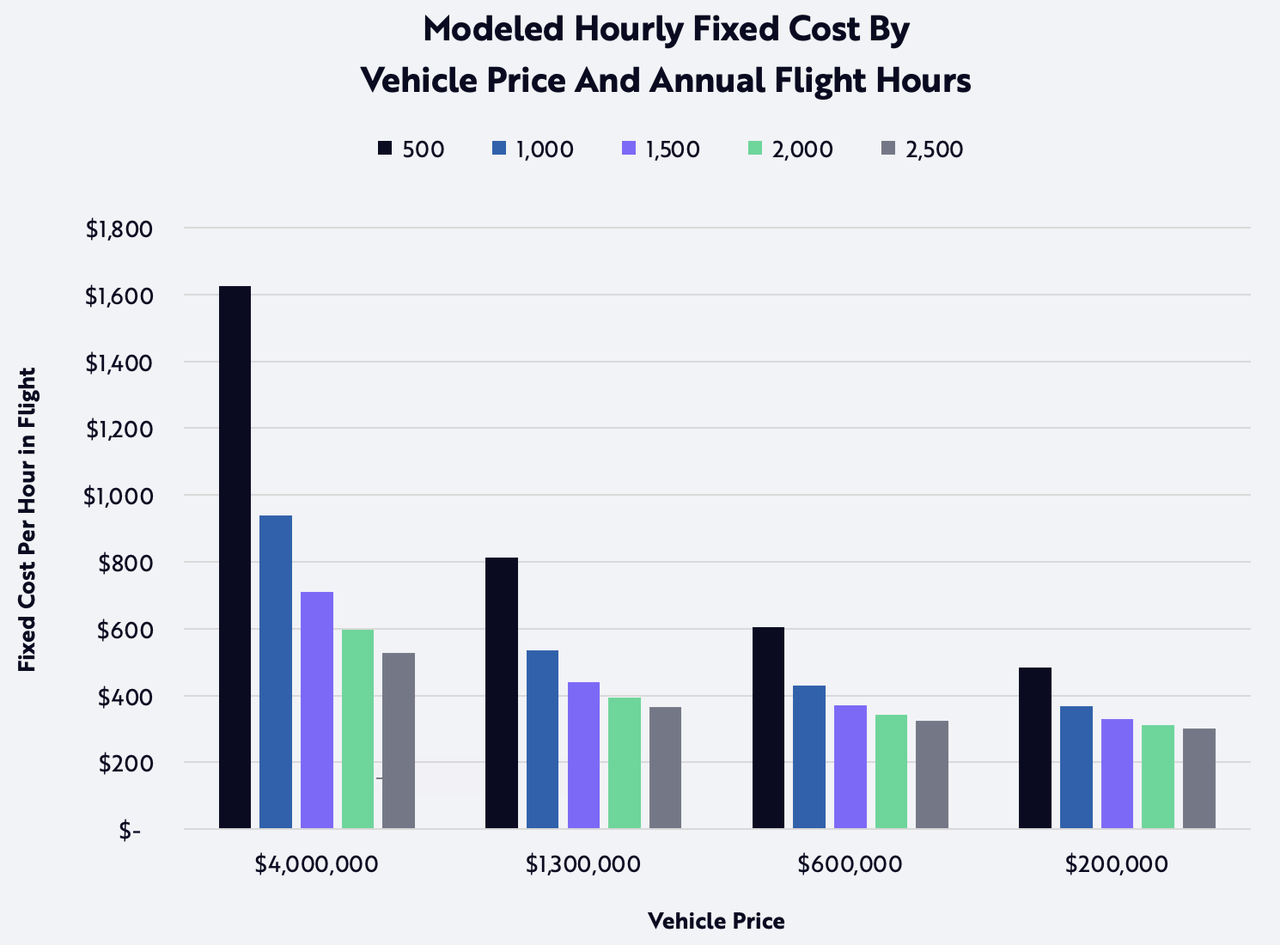

Impacting the hourly cost of operating an electric air taxi are three variables that, combined, are estimated to be lower than that of traditional helicopters: electricity costs, maintenance reserves, and battery replacements.

For perspective, Robinson Helicopter Company estimates that it costs more than $300 per hour to operate its R66 helicopter, as shown on the left below: ~$89 per hour for periodic maintenance, ~$94 per hour for the overhaul parts kit, and ~$123 per hour for fuel.

According to our research, the cost per hour to operate an electric air taxi may be more than 30% lower, thanks to the lower cost of electricity compared to fuel oil and batteries/electric motors relative to their internal combustion engine counterparts, as shown on the right below.

Source: ARK Investment Management LLC, 2023. Based on data from Robinson Helicopter Company as of 2021.[8]

For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Forecasts are inherently limited and may not be realized.

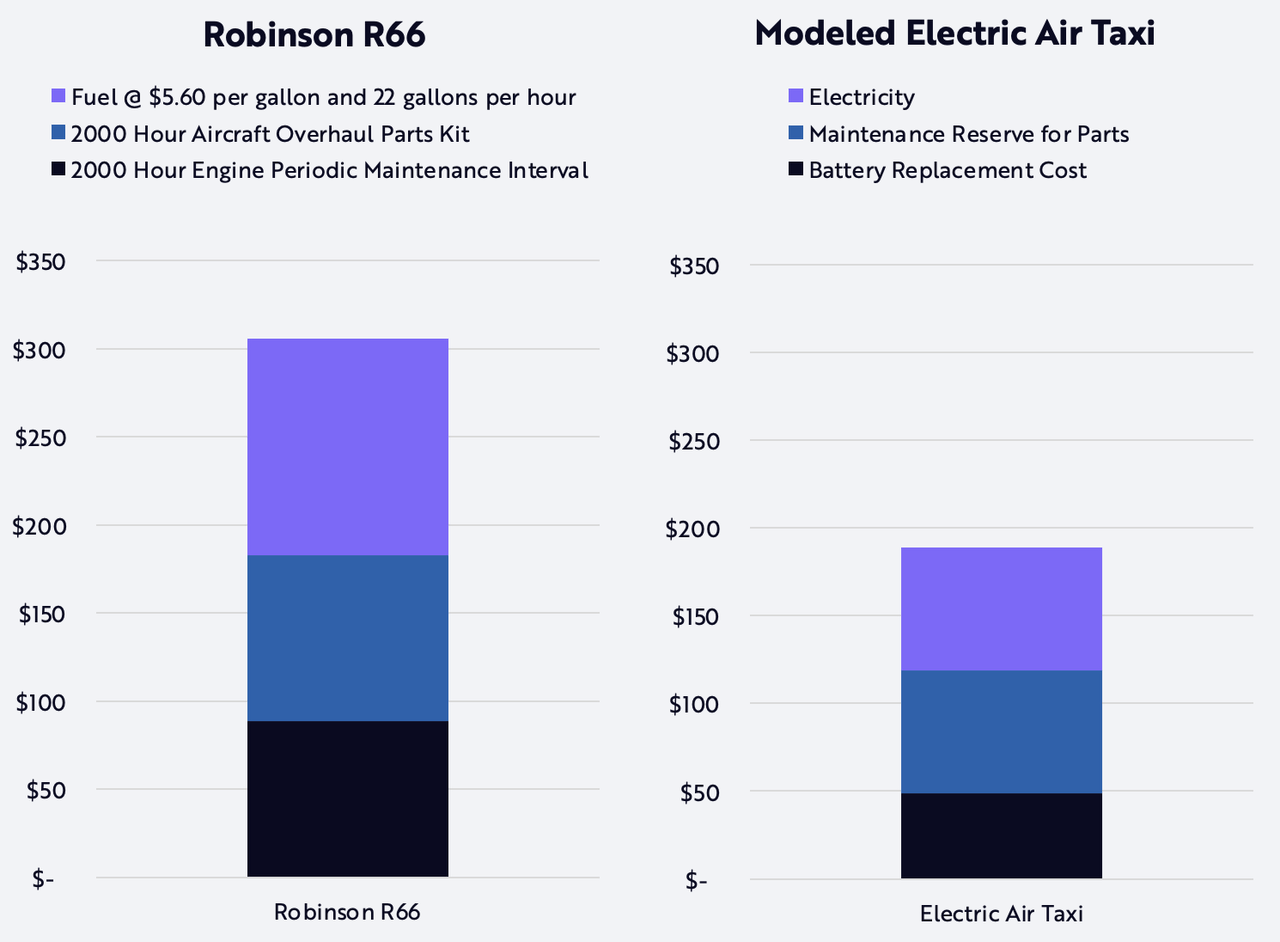

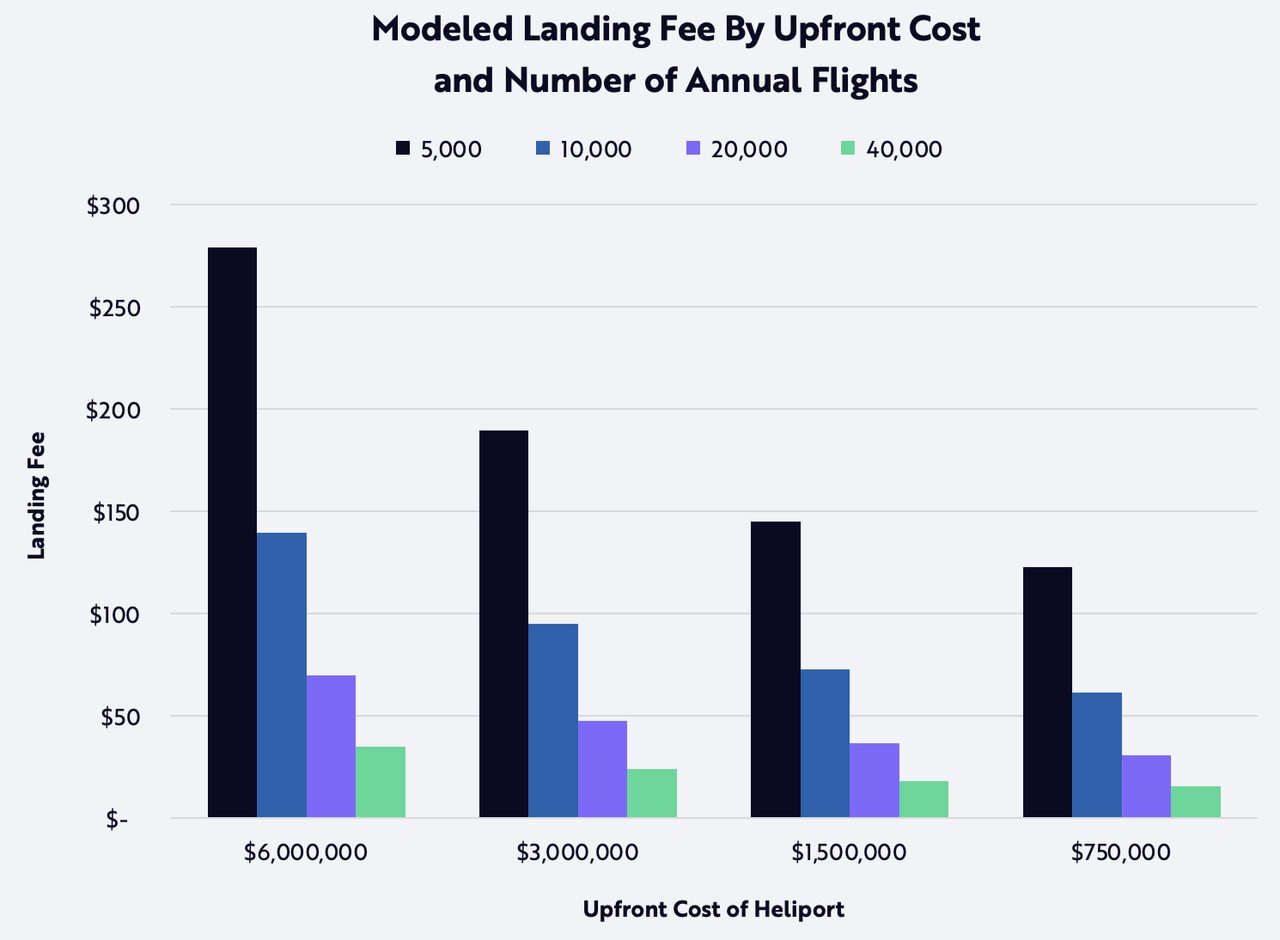

Moreover, our research indicates that landing fees – which currently account for ~40% of a helicopter trip cost from Manhattan to JFK – are likely to decline over time for two reasons: an increase in helipad utilization and lower upfront costs, as shown below.

For perspective, roughly ten years ago, the downtown Manhattan heliport accommodated ~40,000 flights per year at an estimated annual lease cost of $1.3 million.[9]

In our view, the price elasticity of demand for electric air taxis will create a positive feedback loop as lower costs stimulate demand, increasing helipad utilization. In addition, the infrastructure supporting electric aircraft should cost less than that required for aircraft using liquid fuel.

Source: ARK Investment Management LLC, 2023.

This ARK analysis is based on underlying data from external sources, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Forecasts are inherently limited and may not be realized.

Vehicle noise is a potential risk to the acceptance of electric air taxis, and the “not in my backyard” phenomenon could pose challenges to establishing the necessary landing infrastructure for a successful buildout.

Community resistance to air taxis could slow price declines and limit demand in urban areas. That said, electric air taxi companies are achieving significant success in lowering noise levels. At a recent air taxi demo, for example, the vehicle was so quiet that participants did not notice it.[10]

In ARK’s view, the benefits of affordable, low-emission, alternative air-born transportation will become an imperative for communities, especially if low-cost electric vehicle autonomous taxi networks increase traffic congestion by three-fold during the next five to ten years, as our research suggests!

1. Korus, S. 2018. “Air Taxis Are On The Way.” ARK Investment Management LLC.

2. Federal Aviation Administration. 2023. “Advanced Air Mobility | Air Taxis”. Zukowkis, D. 2023. “Federal guidelines for eVTOL operations encourage cities to plan for infrastructure.” Smart Cities Dive.

3. This ticket price reflects the same ratio of ticket price to total cost as assumed in Blade’s estimates.

4. Blade. 2023. “Blade Investor Presentation, May 2023.”

5. The Federal Aviation Administration (FAA) grants the authority to operate on-demand, unscheduled air service in the form of a Part 135 certificate. See Department of Federal Aviation Administration. 1978. “Part 135—Operating Requirements: Commuter And on Demand Operations And Rules Governing Persons On Board Such Aircraft.” Special Federal Aviation Regulation No. 50-2.

6. Blade. 2023. “Blade Investor Presentation, May 2023.”

7. For context, a study suggests taxi utilization rates are roughly 40%. See Li, T. et al. 2021. “Taxi Utilization Rate Maximization by Dynamic Demand Prediction: A Case Study in the City of Chicago.” Taxi Utilization Rate Maximization by Dynamic Demand Prediction: A Case Study in the City of Chicago. Transportation Research Record.

8. Robinson Helicopter Company. 2021. “R66 Turbine Estimated Operating Costs.”

9. Moss, M.L. 2012. “Helicopters And Their Importance For New York City.” Eastern Region Helicopter Council.

10. Tangel, A. and Downs, G. 2023. “This Flying Taxi at the Paris Air Show Is Quiet. Too Quiet.” The Wall Street Journal.

©2021-2026, ARK Investment Management LLC (“ARK” ® ”ARK Invest”). All content is original and has been researched and produced by ARK unless otherwise stated. No part of ARK’s original content may be reproduced in any form, or referred to in any other publication, without the express written permission of ARK. The content is for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation in respect to any products or services for any persons who are prohibited from receiving such information under the laws applicable to their place of citizenship, domicile or residence.

Certain of the statements contained on this website may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All content is subject to change without notice. All statements made regarding companies or securities or other financial information on this site or any sites relating to ARK are strictly beliefs and points of view held by ARK or the third party making such statement and are not endorsements by ARK of any company or security or recommendations by ARK to buy, sell or hold any security. The content presented does not constitute investment advice, should not be used as the basis for any investment decision, and does not purport to provide any legal, tax or accounting advice. Please remember that there are inherent risks involved with investing in the markets, and your investments may be worth more or less than your initial investment upon redemption. There is no guarantee that ARK’s objectives will be achieved. Further, there is no assurance that any strategies, methods, sectors, or any investment programs herein were or will prove to be profitable, or that any investment recommendations or decisions we make in the future will be profitable for any investor or client. Professional money management is not suitable for all investors. For full disclosures, please go to our Terms & Conditions page.

The Adviser did not pay a fee to be considered for or granted the awards. The Adviser did not pay any fee to the grantor of the awards for the right to promote the Adviser’s receipt of the awards nor was the Adviser required to be a member of an organization to be eligible for the awards. For full Award Disclosure please go to our Terms & Conditions page. Past performance is not indicative of future performance.

Disclosure:

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. For a list of all purchases and sales made by ARK for client accounts during the past year that could be considered by the SEC as recommendations, click here. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities in this list. For full disclosures, click here.

Original Post

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange.

Read the full article here