Research Brief

Today I’ll be re-rating a stock I covered back in May but that remains an old favorite to analyze. It has been on my watchlist in the banking sector for several years now.

Morgan Stanley (NYSE:MS), which released its 2023Q2 earnings on July 18th, faced down a very challenging second quarter this year and emerged from it.

Since my last review of this stock on May 13th, when I gave it a “Buy” rating, the share price has risen 6.25%:

Morgan Stanley – last rating (Seeking Alpha)

Today, I will analyze whether to keep the same rating, upgrade, or downgrade this stock.

For those readers less familiar with this firm or industry, some key points from their company website include: diversified business segments including wealth management, investment banking, trading, research, & investment management. Acquired brokerage E-Trade a few years ago. Trades on the NYSE. Ranked #6 in Wikipedia’s largest banks in the U.S.

Rating Method

The goal is to find value-buying opportunities in these sectors: financials, insurance, tech/innovation/managed services.

My 5-step approach is to break down the overall rating into 5 categories: dividends, valuation, share price, earnings growth, & capital strength.

If I recommend this stock in at least 3 of these categories, it gets a hold rating, and if I recommend at least 4 out of 5 then it gets a buy rating.

Dividends: Recommend

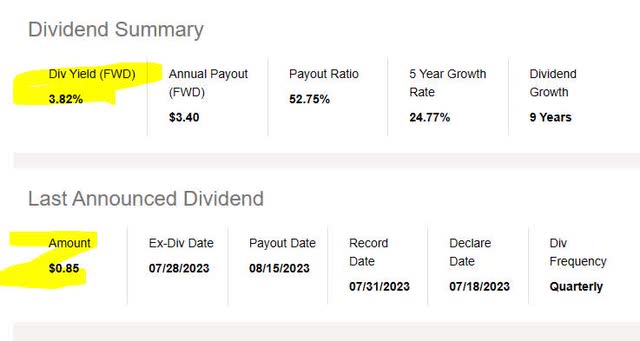

As of Aug. 8th, the MS dividend yield was at 3.82%, with a dividend of $0.85 per share, according to Seeking Alpha. I like that it is close to 4%, considering that lately I covered several bank & insurance stocks with an above 5% yield, so I believe this stock is in a competitive range for dividend-income investors to consider.

Morgan Stanley – dividend yield (Seeking Alpha)

If you compare to the sector average, Morgan is over 8% above the sector average, which is hovering around 3.5%. I am looking for a stock that is at or above average so this stock qualifies.

Morgan Stanley – div yield vs sector avg (Seeking Alpha)

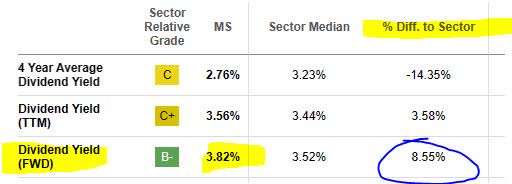

Next, I would mention that this stock has a 5-year history of dividend growth, as the chart below shows. For example, it went from an annual dividend of $1.10 in 2018 to $2.95 in 2022, a 168% growth.

Morgan Stanley – 5 year dividend growth (Seeking Alpha)

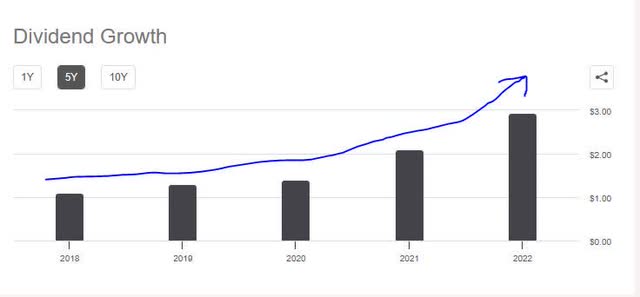

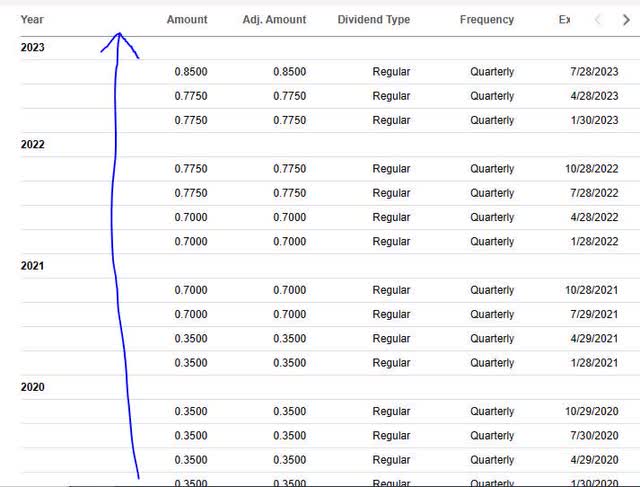

In fact, its payout history shows a steady quarterly payment over the last few years, that has grown, and without being cut. This is good news for investors depending on stable quarterly payouts.

Morgan Stanley – dividend history (Seeking Alpha)

If you compare to a peer that does many of the same things as this firm, Charles Schwab (SCHW), their dividend yield is currently 1.52%.

So, I would certainly recommend Morgan Stanley as being competitive to this sector when it comes to dividends.

Valuation: Did Not Recommend

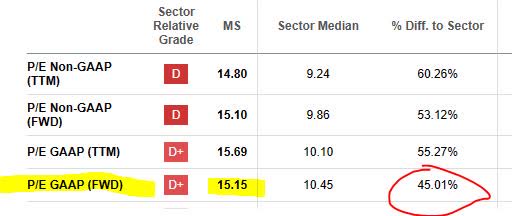

Based on official valuation data, MS stock is currently very overvalued and I will show you why.

In looking at the forward price to earnings, Morgan is over 45% above its sector average, even earning a “D+” grade from Seeking Alpha. While the sector hovers around 10.5x earnings, you would be paying over 15x earnings for this stock, which I think is unnecessary. I’d be looking for it to be around 10x earnings.

Morgan Stanley – P/E Ratio (Seeking Alpha)

In addition, the forward price to book is almost 47% above the sector average, putting Morgan at around 1.6x book value. I like it somewhere between 0.90x and 1.08x book value.

Morgan Stanley – P/B Ratio (Seeking Alpha)

Hence, I do not recommend this stock at current valuations.

Share Price: Recommend

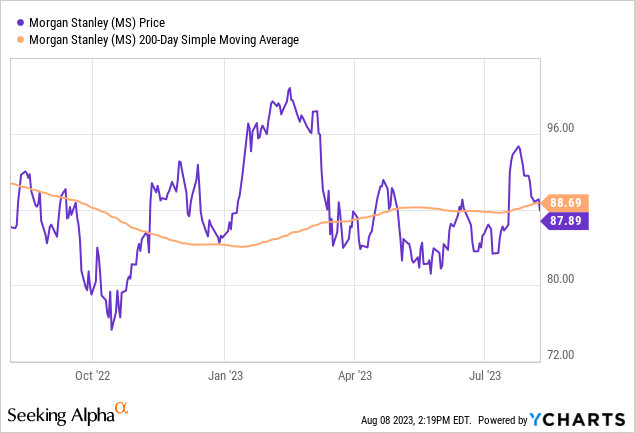

Late in the trading day on Tuesday Aug. 8th, shares were trading at $87.89. When tracking this price vs. the 200-day SMA over the last year, as the YChart below shows, this share price is just below the moving average:

My current investing idea, for simplicity’s sake, is to track the 200-day moving average over 1 year, and trade this stock within a specific range vs that average. Let’s say, for example, a 5% range below & above the average.

That would be a price range of $84.25 – $93.12. In this case, the share price above is within that range, so I would consider buying it at that price, holding it for 1 year to earn the full year dividend income, then selling when it hits $93.12.

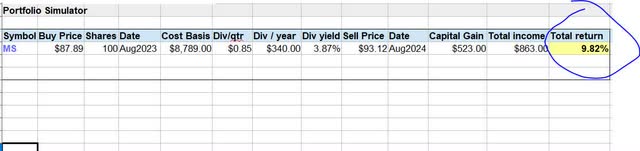

Below is a simulation of this idea:

Morgan Stanley – trade simulation (Author spreadsheet)

In the above simulation, my portfolio would be nailing a 3.87% dividend yield, achieving a capital gain, and a total return on capital invested of 9.82%.

What the moving average, or share price, will look like in 1 year is impossible to predict with certainty, however this simulation provides a framework to go by. There is also the risk of unrealized capital losses in that time as well.

If you are an options trader, you can take advantage of selling covered call options in that time period and earn additional premiums. For example if you bought 100 shares at $87.89, and you sell 1 covered call with a strike of $89, that is an easy $57 in premiums instantly, using the example chart below from August 11th calls. If the option gets called at $89, you still earn a capital gain as well. If it does not, you keep your shares and do it again. I personally have held a stock for many months and sold covered calls each month, earning a nice premium each time. *Note: Further research on your part, and brokerage approval, is best before getting into options trading, due to risk involved.

Morgan Stanley – call options (Seeking Alpha)

Earnings Growth: Did Not Recommend

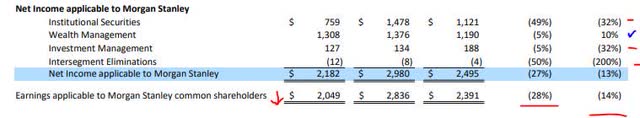

This firm showed a disappointing drop in YoY net income and earnings per share, after the last quarterly results and income statement:

Morgan Stanley – earnings growth YoY (Seeking Alpha)

Further, if you drill down into their quarterly results supplement, two of their business segments saw significant (over 30%) YoY decrease in net income, as did the overall earnings applicable to common shareholders:

Morgan Stanley – net income applicable to shareholders (Morgan Stanley – quarterly supplement)

According to the Q2 earnings press release, the company stated “the second quarter of 2023 was impacted by severance costs of $308MM associated with an employee action.”

Since once of my rating categories is YoY earnings growth, this stock is not recommended in this category right now as it has not shown YoY positive net income growth.

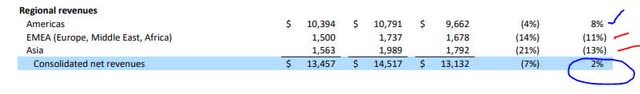

On a positive note, however, net revenues overall have grown 2% YoY, helped by the Americas region but were impacted by negative YoY net revenue growth in EMEA and Asia.

Morgan Stanley – regional revenues (Morgan Stanley – quarterly supplement)

Capital Strength: Recommend

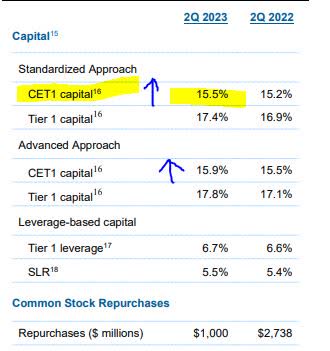

There is no question that this firm has capital strength. In taking a look at the table below, you can see that their CET1 ratio is above 15% and actually has gone up YoY, both the standardized and advanced approach.

I think this is another good sign of this firm exceeding regulatory capital requirements by a lot. In addition, their continuing to repurchase shares also is a sign of strong capital deployment ability.

Morgan Stanley – capital (Morgan Stanley – Q2 supplementals)

In remarking on their capital ratios, here is what they had to say:

Standardized Common Equity Tier 1 capital ratio was 15.5%, 220 basis points above the aggregate standardized approach CET1 requirement inclusive of buffers as of June 30 and 260 basis points above the estimated aggregate standardized approach CET1 requirement that will take effect as of October 1, 2023.

Also notable to mention is that Morgan was part of the 2023 Fed Stress test, and according to a June article in CNBC this stress test not only showed the resilience of the sector but also individual firms:

U.S banks including JPMorgan Chase (JPM), Wells Fargo (WFC), and Morgan Stanley said Friday they plan to raise their quarterly dividends after clearing the Federal Reserve’s annual stress test.

That is evidence enough for me to be convinced that this stock can be recommended on the basis of its company’s capital strength, and I think looking forward this will continue to be the trend, especially since Morgan is on the Financial Stability Board’s list of global systematically important banks.

Rating: Hold / Neutral

As it has won in 3 of my rating categories, today I am rating this stock “hold/neutral” which is a slight downgrade from my prior “buy” rating in May. Today’s rating is in line with the “hold” rating from the Seeking Alpha quant system, as shown below, but is less bullish than the consensus from analysts.

ratings consensus (Seeking Alpha)

Risk to my Outlook: Earnings Beats

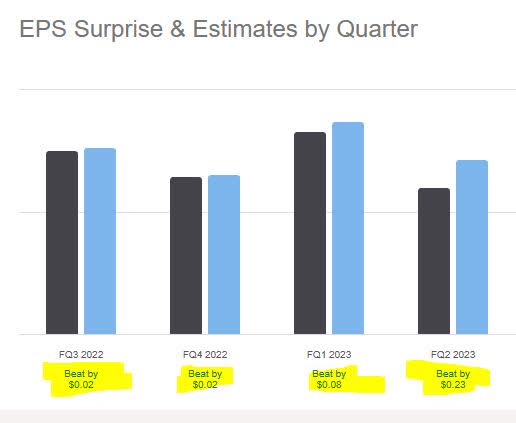

A risk to my lukewarm outlook of hold is that this stock continues to beat analyst earnings estimates in the next Q3 earnings call, thereby potentially giving the share price bullish momentum and making my rating too cautious.

Consider that this stock has been beating analyst estimates for all of the last 4 quarters.

Morgan Stanley – earnings beats (Seeking Alpha)

The July earnings beat, for example, seems to correlate with a jump in share price in mid-July, as the YChart shows:

Morgan Stanley – July price boost (Seeking Alpha YCharts)

However, my counterargument is that future Morgan Stanley bullishness is likely to be dampened by investors who see the valuation metrics and consider this stock too overvalued, as I have already shown previously. We are also past the point of those opportunistic March dip buyers in the banking sector, so I would caution against assuming too much more bullishness just yet.

Investors, however, who bought during my May rating at the share price of around $82.67, are currently already seeing realized gains, and if continue holding I think they can see a positive return at least.

Analysis Wrap-up

Here are the key points we went over today.

Today, I am downgrading Morgan Stanley stock from my prior rating of buy to a rating of hold, in line with the consensus from the Seeking Alpha quant system.

Positives: dividends vs sector average, share price vs 200-day SMA, capital strength.

Headwinds: valuation vs sector average, earnings YoY growth.

Concluding thoughts: Morgan Stanley is one of those top 10 banks I like to keep in my watchlist as well as occasionally in a portfolio of other bank stocks, particularly as it is a market leader and systemically critical, and has a nicely diversified business mix that includes the E-Trade retail brokerage unit who competes with Schwab, TD Ameritrade, and Bank of America (BAC) Merrill Edge platform.

We saw during the remote-work era how much renewed interest there has been in online & home-based trading, so being in that space too I think gives this firm a competitive edge, along with the money flows from the E-Trade brokerage clients that it provides. The former E-Trade bank is now rebranded into FDIC-insured Morgan Stanley Private Bank, for example, and the ecosystem is highly integrated.

As an online trader myself who has used all of these platforms, that is one segment I recommend keeping an eye on, especially when the trading platform is owned by a big player like Morgan Stanley.

Read the full article here